Market Size

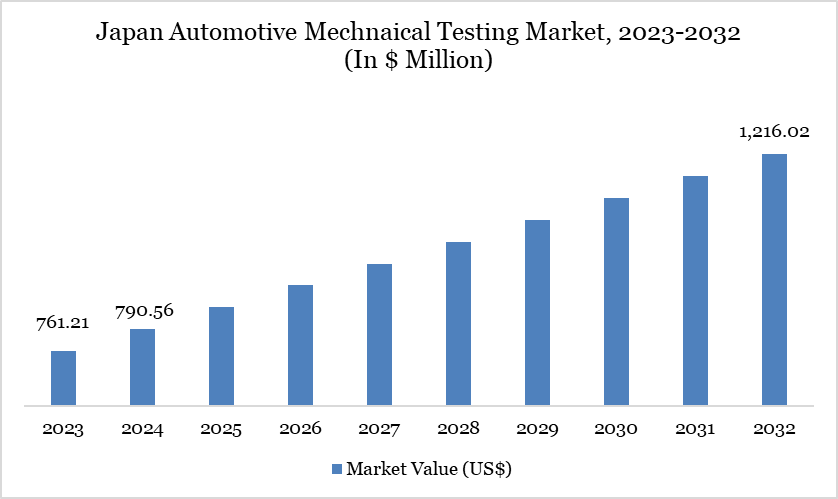

The Japan automotive mechanical testing market reached US$ 790.56 million in 2024 and is expected to reach US$ 1,216.02 million by 2032, growing at a CAGR of 5.53% during the forecast period 2025-2032.

Japan’s automotive mechanical equipment market is anchored by the country’s role as the world’s third-largest automobile producer, with over 7.84 million cars manufactured in 2023 according to the Japan Automobile Manufacturers Association (JAMA).

The market is shaped by rising demand for precision testing and validation systems, as Japan enforces stringent safety and emission standards aligned with the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) regulations. Equipment such as dynamometers, durability rigs, and engine analyzers are increasingly deployed in R&D and compliance facilities across key hubs like Aichi, Shizuoka, and Kanagawa. The sector also benefits from continuous collaboration between OEMs and universities under NEDO-funded projects that focus on enhancing testing efficiency and automation.

The Japanese government’s Green Growth Strategy has further accelerated demand for advanced mechanical testing equipment, as manufacturers are required to validate hybrid and electric propulsion systems under strict carbon reduction targets. With a focus on exporting reliable vehicles, mechanical testing remains critical to Japan’s position in global markets, ensuring compliance with UN Regulation frameworks. Increasing investments in automated and robotics-driven testing platforms are gradually transforming traditional test benches, enabling higher throughput and real-time monitoring while reducing operational inefficiencies.

Automotive Mechanical Testing Market Trend

A unique trend in the Japanese market is the integration of robotics-driven precision testing to address the dual challenge of labor shortages and advanced vehicle complexity. The Statistics Bureau of Japan highlighted that the working-age population declined to 74.2 million in 2023, intensifying automation needs. Major R&D centers now employ robotic-assisted dynamometers and AI-based fault detection to accelerate validation cycles for hybrid and EV components.

The Japan Patent Office (JPO) has recorded rising patents in automotive testing automation, signaling a domestic innovation push. Additionally, government-backed pilot programs under Society 5.0 promote smart testing ecosystems combining IoT, robotics, and digital twins, making automation a defining trend for the sector.

Market Scope

Metrics | Details |

By Test Type | Crash Testing, Emission Testing, Safety Testing, Durability/Endurance Testing, Dynamic/Performance Testing, E-Mobility & Battery Testing, ADAS & Autonomous Vehicle Testing, Others |

By Vehicle Type | Passenger Vehicles, Commercial Vehicles |

By Propulsion | Internal Combustion Engine (ICE) Vehicles, Electric Vehicles (EVs) |

By Equipment | Chassis Dynamometers, Engine Dynamometers, Transmission Dynamometers, Vehicle Emission Test Systems, Wheel Alignment Testers, Fuel Injection Pump Testers, Diagnostic Scan Tools, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More detailed information Request free sample

Market Dynamics

Integration of Advanced Robotics and Automation in Japanese Automotive Testing Facilities

The integration of advanced robotics and automation is significantly strengthening Japan’s automotive mechanical equipment market, as automakers and testing facilities prioritize efficiency and precision. According to the Ministry of Economy, Trade and Industry (METI), Japan maintained over 373,000 installed industrial robots in 2022, the highest in the world, with the automotive sector accounting for nearly 40% of deployments.

Testing facilities have increasingly adopted robotic arms, automated inspection systems, and AI-driven testing platforms to enhance consistency in performance validation for engines, transmissions, and safety systems. This transition supports Japan’s broader Society 5.0 initiative, which emphasizes digital transformation and smart manufacturing to remain globally competitive in advanced automotive technologies.

Automation also addresses the country’s critical labor shortage. The Statistics Bureau of Japan recorded that Japan’s working-age population declined to 74.2 million in 2023, down from 87 million in 1995, creating rising pressure on industries requiring skilled technicians. In response, automotive OEMs and testing labs are accelerating the deployment of automated equipment that reduces human error and lowers dependence on manual processes.

For instance, robotic-driven dynamometer testing and AI-enabled fault detection systems are increasingly deployed in major R&D hubs across Aichi and Kanagawa prefectures. This integration not only reduces testing time but also ensures compliance with strict Japanese Industrial Standards (JIS) for vehicle safety and emissions, making robotics and automation a crucial driver for the Japanese automotive mechanical equipment market.

High Operational Costs Associated with Precision Testing Equipment Maintenance in Japan

Japan’s automotive mechanical equipment market faces a significant restraint due to the high operational and maintenance costs of precision testing systems. According to data from the Japan External Trade Organization (JETRO), Japan ranks among the top five countries globally for industrial machinery maintenance expenses, with operating costs often 25–30% higher than in competing Asian markets.

Precision instruments such as dynamometers, scanning electron microscopes, and emissions analyzers require frequent calibration and part replacements, which are mandated under the Japanese Industrial Standards (JIS) for safety and reliability. These compliance-driven costs weigh heavily on testing laboratories and OEMs, particularly smaller suppliers who must align with the rigorous quality assurance frameworks set by the Ministry of Economy, Trade and Industry (METI).

The challenge is further amplified by Japan’s labor cost structure. The Statistics Bureau of Japan reported in 2023 that average annual labor costs in the manufacturing sector exceeded ¥5.3 million (US$36,000), significantly increasing the expense of skilled technician hours required for maintaining advanced testing equipment.

Additionally, the import dependency for specialized spare parts and calibration tools, often sourced from Europe and the US, adds to the financial burden, given Japan’s rising machinery import bill as noted by Ministry of Finance (MOF) trade data. These cumulative factors make the upkeep of precision testing systems a cost-intensive challenge, limiting adoption among mid-sized automotive firms and slowing modernization efforts within Japan’s mechanical equipment testing ecosystem.

Segmentation Analysis

The Japan automotive mechanical testing market is segmented by test type, vehicle type, propulsion, equipment.

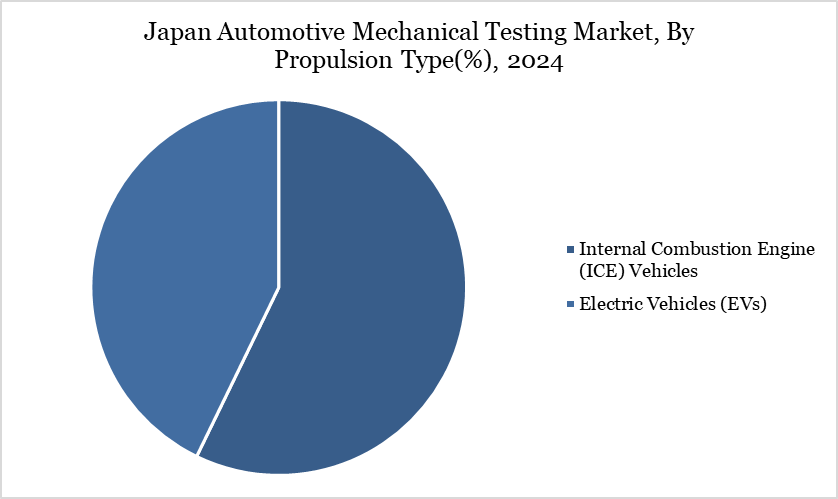

Internal Combustion Engine (ICE) Vehicles Segment Holds a Significant Share

Despite Japan’s strong commitment to electrification, Internal Combustion Engine (ICE) vehicles continue to play a critical role in sustaining demand for automotive mechanical equipment. According to Japan Automobile Manufacturers Association (JAMA), ICE-powered vehicles, including hybrids, accounted for over 87% of new vehicle sales in Japan in 2023, highlighting the enduring market presence of combustion technology. Mechanical testing equipment such as dynamometers, emissions analyzers, and endurance rigs remain vital for compliance with Japan’s increasingly stringent fuel efficiency and emissions regulations under the Post-2020 Fuel Efficiency Standards introduced by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT). These standards mandate a 32.4% improvement in average fuel economy for passenger vehicles by 2030, compared to 2016 levels, driving automakers to heavily invest in advanced testing equipment for ICE optimization.

Leading OEMs such as Toyota and Honda have reinforced this demand through hybrid-heavy production strategies. Toyota reported in its 2024 sustainability update that hybrids, reliant on ICE components alongside electrified systems, make up more than 40% of its domestic sales. This hybrid reliance extends the lifecycle of ICE-focused mechanical testing infrastructure, as both powertrain durability and fuel economy testing remain indispensable. As a result, while Japan accelerates towards carbon neutrality, ICE vehicles and their hybrid counterparts continue to anchor investment in automotive mechanical equipment, ensuring ongoing demand for precision testing systems and regulatory compliance solutions.

Sustainability Analysis

Japan’s automotive mechanical equipment market is increasingly aligned with the country’s decarbonization and circular economy goals under the Green Growth Strategy Through Achieving Carbon Neutrality by 2050, announced by the Government of Japan in 2020. According to the Ministry of Economy, Trade and Industry (METI), Japan aims to reduce greenhouse gas emissions by 46% from 2013 levels by 2030, with the transport sector a critical focus.

Automotive equipment makers such as Toyota and Nissan have committed to carbon-neutral production lines, integrating energy-efficient testing machinery and low-emission material processing systems. For example, Toyota’s 2023 sustainability report highlights a 20% reduction in CO₂ emissions per vehicle during production compared to 2013, achieved through energy-optimized mechanical testing and automation. These initiatives demonstrate how sustainability is shaping equipment design and testing processes, ensuring compliance with both domestic climate targets and global environmental standards.

Competitive Landscape

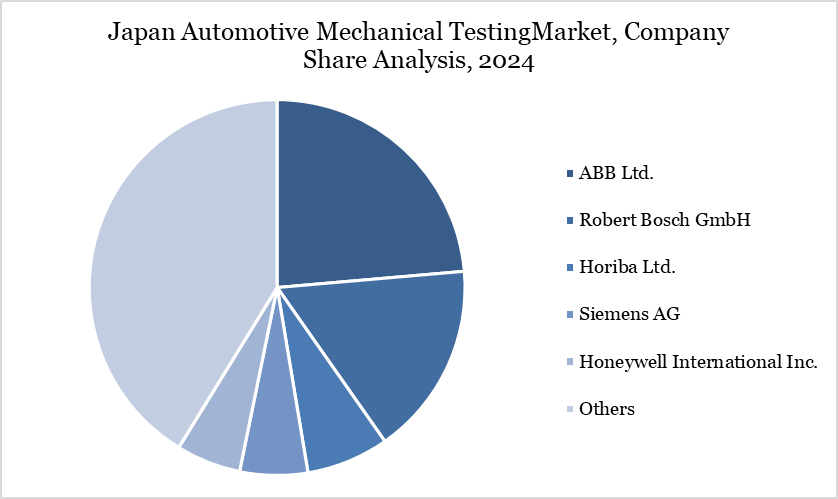

The major players in the market include ABB Ltd., Robert Bosch GmbH, Horiba Ltd., Siemens AG, Honeywell International Inc., AVL List GmbH, Continental AG, Delphi Technologies (BorgWarner), National Instruments Corporation, and Vector Informatik GmbH

Key Developments

In July 2024, Shimadzu Corp.’s partnership with TESCAN Group to launch advanced SEM products in Japan strengthens the country’s automotive mechanical testing market by enhancing nanometer-scale material and surface analysis. With Japan’s SEM market growing over 10% annually, this collaboration introduces robust, high-resolution testing tools critical for automotive R&D. The integration of TESCAN’s SEM into Shimadzu’s portfolio enables precise evaluation of coatings, wear patterns, and micro-defects in automotive components. This development supports Japan’s push for higher reliability and safety standards in next-generation vehicles.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies