Insulin Resistance Market Size & Industry Outlook

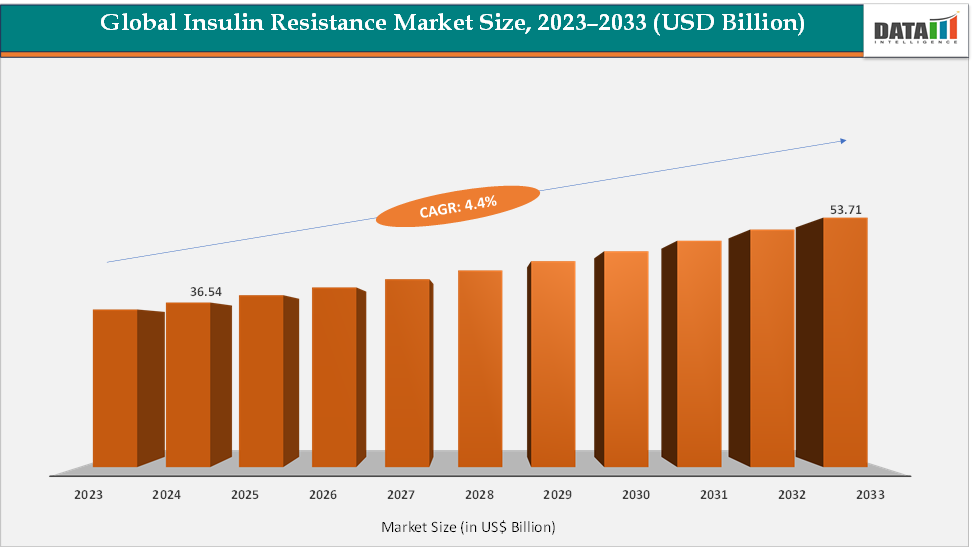

The global insulin resistance market size reached US$ 36.54 Billion in 2024 from US$ 35.12 Billion in 2023 and is expected to reach US$ 53.71 Billion by 2033, growing at a CAGR of 4.4% during the forecast period 2025-2033. The market is expanding rapidly, driven by the global surge in obesity, prediabetes, and type 2 diabetes, which are all rooted in insulin resistance. Next-generation drugs, notably GLP-1 receptor agonists (Ozempic, Mounjaro) and SGLT-2 inhibitors (Farxiga, Jardiance), are gaining strong traction as they address both glucose control and weight reduction, core to insulin resistance management. At the same time, digital therapeutics and lifestyle programs are being adopted by employers and payers to tackle IR earlier and at scale. Together, these trends are shifting the market from late-stage diabetes care toward prevention, early detection, and holistic metabolic management.

Key Market Highlights

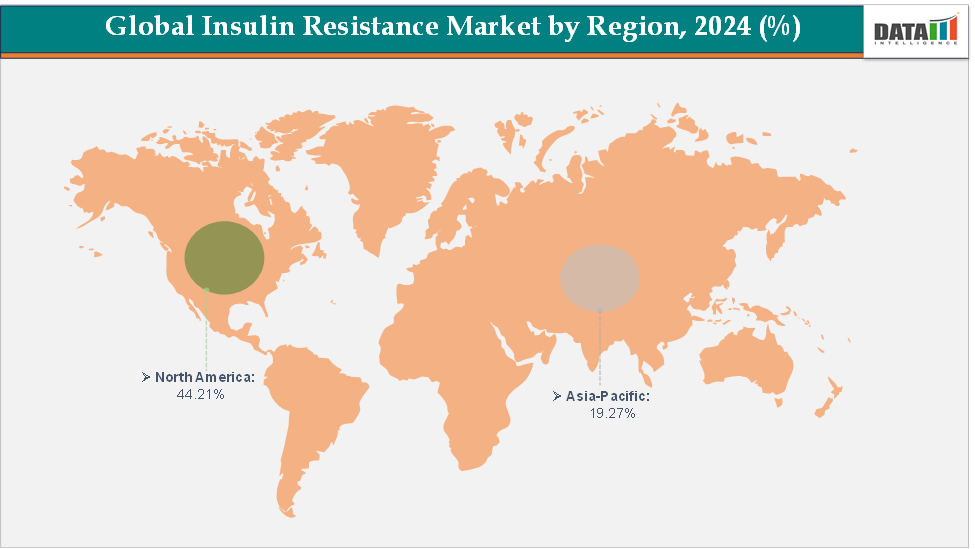

North America dominates the insulin resistance market with the largest revenue share of 44.21% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 6.1% over the forecast period.

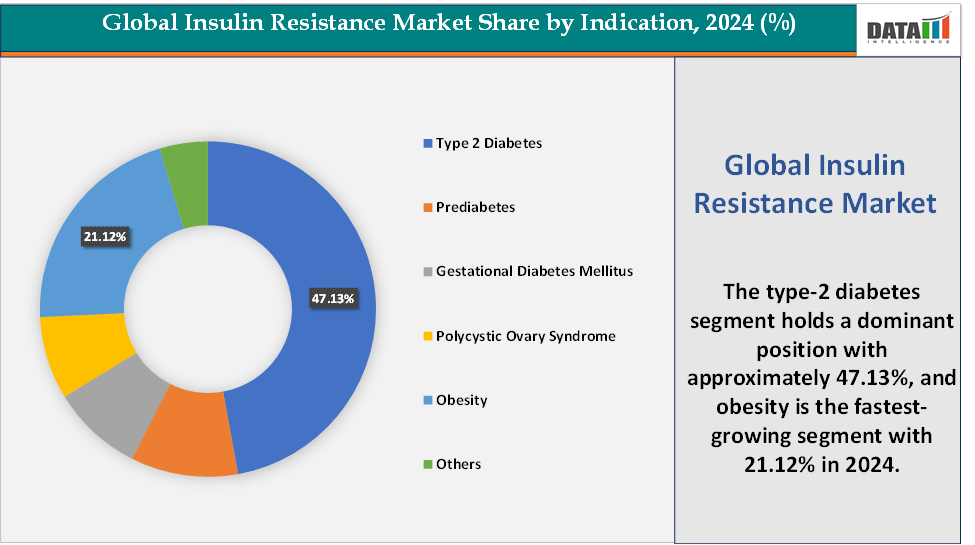

Based on indication, the type 2 diabetes segment led the market with the largest revenue share of 47.13% in 2024.

The major market players in the insulin resistance market are GLENMARK PHARMACEUTICALS LTD., Novo Nordisk A/S, AstraZeneca, Boehringer Ingelheim International GmbH, Sanofi, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., and Mylan N.V., among others

Market Dynamics

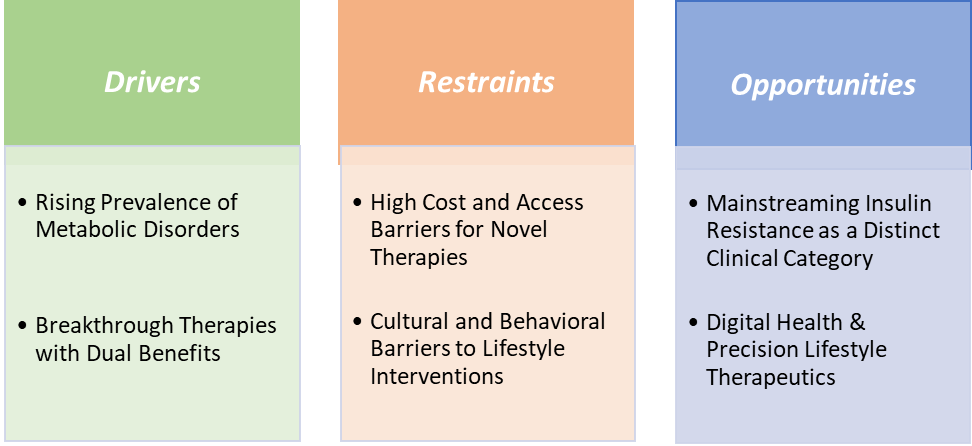

Drivers:The rising prevalence of metabolic disorders is significantly driving the insulin resistance market growth

The rising prevalence of metabolic disorders, including obesity, prediabetes, type 2 diabetes, PCOS, and NAFLD, is a central force driving the insulin resistance market. According to the International Diabetes Federation, over 500 million people worldwide live with diabetes in 2023, and projections suggest this will surpass 640 million by 2030, with the majority being type 2 cases linked to insulin resistance. Similarly, obesity now affects 1 in 8 people globally, creating a massive pool of individuals at risk. This epidemiological burden is fueling demand for therapeutics.

Blockbuster GLP-1 receptor agonists like Ozempic, Wegovy (Novo Nordisk) and Mounjaro/Zepbound (Eli Lilly) are gaining record adoption as they improve both insulin sensitivity and weight loss. Meanwhile, SGLT-2 inhibitors such as Jardiance (Boehringer Ingelheim/Eli Lilly) and Farxiga (AstraZeneca) are being increasingly prescribed for their metabolic and cardiovascular benefits. These products reflect a clear trend as metabolic disorders surge, healthcare systems are investing in earlier detection and comprehensive management of IR, turning it into a fast-growing, multi-billion-dollar global market.

Restraints: High cost and access barriers for novel therapies are hampering the growth of the market

One of the key restraints in the insulin resistance market is the high cost and limited accessibility of novel therapies, which slows their widespread adoption despite strong clinical benefits. Leading drugs such as Ozempic and Wegovy have demonstrated remarkable efficacy in improving insulin sensitivity, reducing body weight, and lowering cardiometabolic risks. However, these GLP-1 receptor agonists and dual incretin therapies are priced at hundreds of dollars per month in most markets, putting them out of reach for many patients without comprehensive insurance.

In the U.S., rising demand has already created supply shortages, while in emerging economies, lack of reimbursement and affordability limits uptake, even though obesity and type 2 diabetes prevalence are surging. Similarly, SGLT-2 inhibitors like Jardiance and Farxiga are costlier than traditional generics such as metformin, creating disparities in treatment adoption. These affordability gaps not only restrict patient access but also slow the overall expansion of the insulin resistance market. As a result, while demand is high, pricing and access barriers remain a structural brake on market growth.

For more details on this report – Request for Sample

Insulin Resistance Market, Segment Analysis

The global insulin resistance market is segmented based on drug class, indication, distribution channel, and region.

Indication:The type 2 diabetes segment is dominating the insulin resistance market with a 47.13% share in 2024

The Type 2 Diabetes (T2DM) segment is the dominant force within the insulin resistance market, largely because insulin resistance is the central mechanism driving disease progression and treatment demand. Globally, T2DM affects over 500 million people in 2023, a number projected to rise sharply by 2030, making it the single largest patient pool requiring consistent monitoring and treatment. Unlike prediabetes, obesity, or PCOS, T2DM is a fully recognized medical condition with established reimbursement pathways and treatment guidelines, ensuring strong institutional adoption.

This dominance is reinforced by the availability of a broad arsenal of approved therapeutics directly targeting insulin resistance and its downstream effects. Widely used first-line agents like metformin remain foundational, while newer drug classes have transformed management, GLP-1 receptor agonists such as Ozempic, Rybelsus, Wegovy (Novo Nordisk) and Trulicity (Eli Lilly) provide not only glucose-lowering benefits but also address weight and cardiovascular risks.

Dual incretin therapies like Mounjaro/Zepbound (Eli Lilly) are setting new benchmarks in both glycemic control and insulin resistance improvement. Additionally, SGLT-2 inhibitors, including Jardiance (Boehringer Ingelheim/Eli Lilly) and Farxiga (AstraZeneca), are expanding market value by offering renal and cardioprotective benefits beyond glucose lowering. Even long-established insulin therapies such as Lantus (Sanofi) and Humalog (Eli Lilly) remain integral for patients progressing to insulin dependency. Together, the sheer prevalence of T2DM, the wide therapeutic portfolio, and strong reimbursement support ensure that this segment not only leads the IR market today but will continue to drive its revenue trajectory in the foreseeable future.

The obesity segment is the fastest-growing segment in the insulin resistance market, with a 21.12% share in 2024

The obesity segment is the fastest-growing part of the insulin resistance market, fueled by the global surge in obesity prevalence and the arrival of breakthrough therapies. According to the World Health Organization, more than 1 billion people were obese in 2023, including 650 million adults, making obesity one of the largest contributors to insulin resistance worldwide. Unlike type 2 diabetes, which has a mature treatment landscape dominated by generics, the obesity space is experiencing a wave of innovative, premium-priced drugs that directly improve both weight and insulin sensitivity.

Blockbuster GLP-1 receptor agonists like Wegovy and Ozempic and dual GIP/GLP-1 agonists such as Mounjaro/Zepbound have shown unprecedented results in reducing body weight by 15–20% in clinical trials while improving metabolic markers. These drugs have seen explosive adoption, with Wegovy and Mounjaro generating multi-billion-dollar revenues within just a few years of approval, and demand continues to outpace supply in several regions. The rising integration of obesity drugs into insurance coverage, employer wellness programs, and cardiometabolic care pathways further accelerates uptake.

Geographical Analysis

North America is expected to dominate the global insulin resistance market with a 44.21% in 2024

North America is the dominant region in the global insulin resistance market, owing to its high disease burden and strong adoption of innovative therapies. The U.S. and Canada together account for some of the highest prevalence rates of obesity and type 2 diabetes worldwide. Moreover, the presence of leading pharma companies, academic research centers, and clinical trial hubs ensures rapid innovation and market penetration. Taken together, the epidemiological scale, advanced therapeutic adoption, supportive policy environment, and concentration of industry leaders firmly establish North America as the dominant region in the global insulin resistance market, a position it is expected to maintain in the foreseeable future.

US Insulin Resistance Market Trends

According to the Centers for Disease Control and Prevention (CDC), more than 37 million Americans live with diabetes, while over 96 million adults have prediabetes, conditions directly linked to insulin resistance. Obesity further amplifies demand, with nearly 42% of US adults classified as obese, making metabolic syndrome management a major public health priority. This epidemiological backdrop has created a fertile market for cutting-edge treatments.

The US leads in the adoption of blockbuster GLP-1 receptor agonists such as Ozempic, Wegovy and Mounjaro/Zepbound, which have witnessed record-breaking sales and rapid uptake across endocrinology and obesity management clinics. SGLT-2 inhibitors like Jardiance and Farxiga are also widely prescribed due to their dual cardiometabolic benefits. Favorable insurance coverage, reimbursement policies, and high healthcare spending further strengthen US leadership, as patients gain quicker access to novel therapies.

The Asia Pacific region is the fastest-growing region in the global insulin resistance market, with a CAGR of 6.1% in 2024

The Asia-Pacific region is the fastest-growing market for insulin resistance, driven by rapid demographic shifts, lifestyle changes, and an alarming rise in metabolic disorders. Countries like China, India, and Japan are at the forefront of this surge, with Asia already accounting for more than 60% of the global diabetes population, according to the International Diabetes Federation. China alone has over 140 million diabetes patients, while India has more than 77 million, with millions more living with prediabetes and obesity.

The Asia-Pacific region, particularly Japan driven by rising obesity, type 2 diabetes, and metabolic syndrome linked to urbanized lifestyles and aging populations. Japan has seen a steady increase in diabetes prevalence among adults, prompting rapid adoption of therapies like GLP-1 receptor agonists (Ozempic, Wegovy) and SGLT-2 inhibitors (Forxiga, Jardiance), alongside government-led screening and preventive programs that accelerate early detection and treatment of insulin resistance.

Rising urbanization, sedentary lifestyles, and increased consumption of calorie-dense diets are accelerating obesity rates, which act as a primary driver of insulin resistance. Access to therapies is also improving, with multinational companies like Novo Nordisk and Eli Lilly expanding the supply of GLP-1 receptor agonists (Ozempic, Wegovy, Mounjaro) to Asian markets, while local pharma players such as Sun Pharma (India) and Hengrui (China) are developing affordable generics and biosimilars to improve accessibility.

Europe Insulin Resistance Market Trends

In Europe, the insulin resistance market is being strongly driven by the region’s growing burden of metabolic disorders and a proactive healthcare policy framework. The World Health Organization estimates that over 60% of adults in Europe are overweight or obese, making insulin resistance-linked conditions such as type 2 diabetes, cardiovascular disease, and NAFLD major health priorities. Countries like the UK, Germany, and Italy are actively integrating early screening programs for prediabetes and obesity management into primary care, which fuels market demand.

Europe has rapidly adopted GLP-1 receptor agonists, including Ozempic, Wegovy and Trulicity, which are increasingly prescribed not only for diabetes but also for obesity management, reflecting a broader market shift toward addressing the root cause of insulin resistance. The market is further propelled by the EU’s emphasis on preventive healthcare and chronic disease management, with funding directed toward digital health solutions and lifestyle interventions.

Startups like Oviva (Switzerland) and Liva Healthcare (Denmark) are using digital therapeutics to deliver personalized lifestyle programs targeting insulin resistance and diabetes prevention, complementing pharmaceutical adoption. Together, the rising prevalence of metabolic diseases, strong clinical guideline support, rapid uptake of innovative therapies, and investment in digital health are the primary factors driving the growth of the insulin resistance market across Europe.

Insulin Resistance Market Competitive Landscape

Top companies in the insulin resistance market include GLENMARK PHARMACEUTICALS LTD., Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Mylan N.V., AstraZeneca, and Boehringer Ingelheim International GmbH, among others.

Market Scope

Metrics | Details | |

CAGR | 4.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | Biguanides, Glucagon-like Peptide 1 (GLP-1) Receptor Agonists, Concentrated Insulin Products, Sodium-Glucose Cotransporter 2 (SGLT2) Inhibitors, Dipeptidyl Peptidase-4 (DPP-4) Inhibitor, and Others |

Indication | Type 2 Diabetes, Prediabetes, Gestational Diabetes Mellitus, Polycystic Ovary Syndrome, Obesity, and Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global insulin resistance market report delivers a detailed analysis with 56 key tables, more than 56 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here