Diabetic Foot Ulcers Market Size and Growth

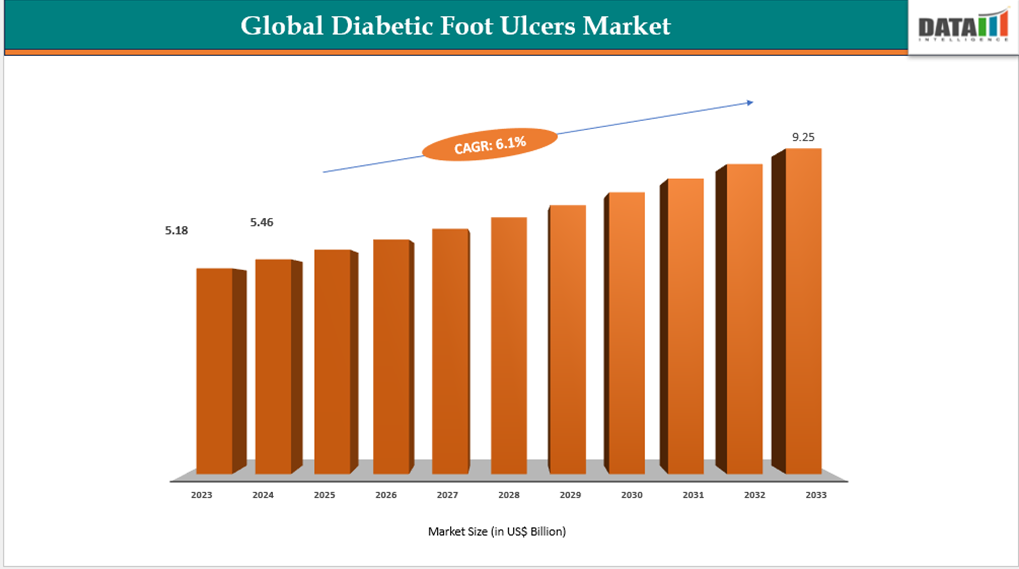

The global diabetic foot ulcers market size reached US$ 5.18 billion in 2023, with a rise to US$ 5.46 billion in 2024, and is expected to reach US$ 9.25 billion by 2033, growing at a CAGR of 6.1% during the forecast period 2025–2033. The diabetic foot ulcer (DFU) market is witnessing significant growth, fueled by the escalating prevalence of diabetes and its associated complications such as peripheral neuropathy and peripheral arterial disease. These conditions contribute to impaired sensation and reduced blood flow, dramatically increasing the risk of foot ulceration. As the global diabetic population continues to rise, so does the demand for effective prevention, early detection, and advanced wound care solutions.

Key Market Trends & Insights

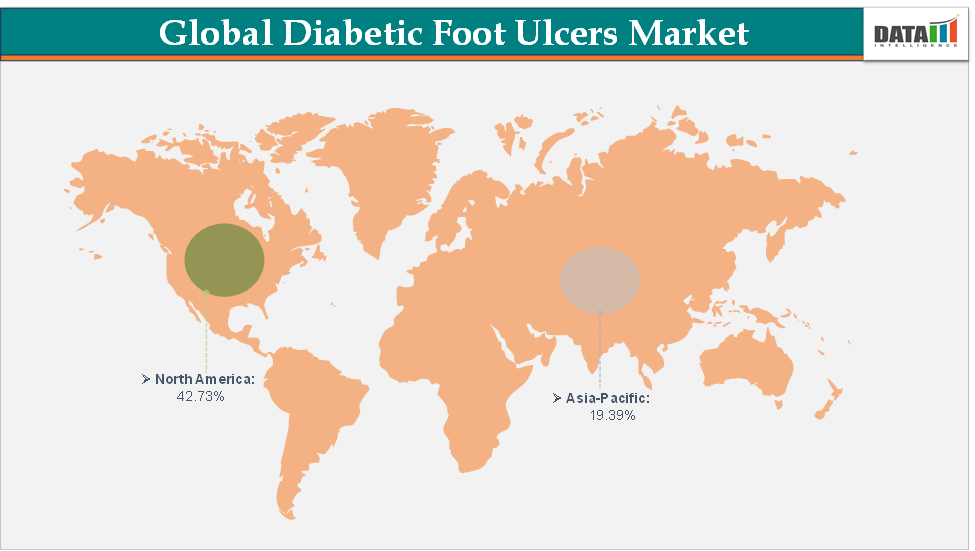

North America accounted for approximately 39.7% of the Diabetic Foot Ulcers market in 2023 and is projected to maintain its leading position throughout the forecast period, driven by high disease prevalence, established healthcare infrastructure, and growing adoption of advanced wound care technologies.

Asia Pacific is expected to be the fastest-growing region, supported by expanding healthcare access, rising diabetes incidence, increasing patient awareness, and greater investment in modern medical technologies.

Wound Care Dressings remains as the dominant treatment type.

Market Size & Forecast

2024 Market Size: US$ 5.46 Billion

2033 Projected Market Size: US$ 9.25 Billion

CAGR (2025–2033): 6.1%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Increasing Global Diabetes Prevalence

The explosive rise in global diabetes prevalence is a pivotal factor driving expansion in the Diabetic Foot Ulcer (DFU) treatment market. According to the International Diabetes Federation (IDF) Diabetes Atlas 2025, approximately 589 million adults aged 20–79, representing 11.1% or 1 in 9 of the global adult population, are currently living with diabetes. Alarmingly, over 4 in 10 of these individuals are unaware of their condition. The vast majority, over 90%, have type 2 diabetes, which is primarily driven by socio-economic, demographic, environmental, and genetic factors. Furthermore, more than 4 in 5 people with diabetes (81%) live in low- and middle-income countries, where access to early diagnosis and quality care remains limited. Looking ahead, the global diabetes burden is projected to rise sharply, with the number of adults living with diabetes expected to reach 853 million by 2050, equivalent to 1 in 8 adults an increase of 46% from current figures.

With 15% to 25% of individuals with diabetes expected to develop a foot ulcer during their lifetime, the burden on healthcare systems and demand for effective DFU management solutions are mounting. Treatment complexities necessitate advanced therapies like bioengineered skin substitutes, negative pressure wound therapy (NPWT), and next-generation smart wound dressings, all of which are fueling market growth. As healthcare systems across the globe seek scalable, proactive, and patient-friendly interventions amid surging disease burden, diabetes prevalence stands as the core accelerant of DFU treatment market expansion.

Restraint: High Treatment Costs

The high cost of treating diabetic foot ulcers (DFUs) poses a significant barrier to market growth, particularly in low- and middle-income regions. The average annual cost per patient for diabetic foot ulcer (DFU) treatment in Turkey is estimated at $14,287.70. Of this, hospital admissions account for $7,357.40, representing 51.5% of the total cost, while DFU-related complications contribute $210.30, or 1.5%. Despite ongoing advancements in managing diabetic foot ulcers, the high cost of treatment remains a major barrier to market growth.

Caring for DFUs often involves a long and complex process of diagnostic tests and, in severe cases, surgeries or hospital stays. These treatments can place a heavy financial burden on both patients and healthcare systems. For people living in low- and middle-income countries, limited insurance coverage and inadequate reimbursement options make it even harder to access proper care. As a result, many patients may delay seeking treatment or be unable to stick to prescribed care plans, increasing the risk of serious complications like infections or amputations. This not only affects individual outcomes but also slows down the overall growth of the diabetic foot ulcer treatment market.

For more details on this report, Request for Sample

Market Segment Analysis

The diabetic foot ulcers market is segmented based on treatment type, ulcer type, end-user and region.

Treatment Type-The wound care dressings segment is estimated to have 39.7% of the diabetic foot ulcers market share.

The wound care dressings segment is poised to dominate the diabetic foot ulcers (DFU) market, owing to its fundamental role as the first line of defense in wound management. These dressings are crucial for creating and maintaining an optimal healing environment, which is essential for managing chronic wounds like DFUs. Advanced wound care dressings, such as hydrocolloids, alginates, foam dressings, hydrofibers, and film dressings, are specifically designed to keep the wound moist, absorb excess exudate, and protect against external contaminants, thereby accelerating the healing process and minimizing the risk of infection. Their clinical effectiveness, combined with ease of application, cost-efficiency, and availability across diverse healthcare settings, has led to their widespread adoption among healthcare providers.

Innovations in dressing technologies have also contributed significantly to this segment’s growth. The integration of antimicrobial agents like silver and iodine, as well as advancements in absorbent capacity and oxygen permeability, have improved clinical outcomes and reduced complication rates. Moreover, the rising emphasis on evidence-based wound care practices has enhanced awareness among clinicians, leading to greater use of advanced dressings over traditional methods.

Patient preferences are also shifting toward non-invasive, home-manageable options, further driving demand. Coupled with the growing global diabetic population and increasing incidence of chronic wounds, the wound care dressings segment is expected to remain a key revenue driver in the DFU market for the foreseeable future.

Market Geographical Share

The North America diabetic foot ulcers market was valued at 39.7% market share in 2024

North America maintains a dominant position in the global Diabetic Foot Ulcer (DFU) treatment market due to several key factors. The region exhibits a high prevalence of diabetes, with over 38 million Americans diagnosed, leading to a significant number of DFU cases. Advanced healthcare infrastructure, including specialized wound care centers and diabetic clinics, facilitates effective management and treatment of DFUs. Several companies are introducing advanced products through direct sales or e-commerce to help individuals suffering from diabetic ulcers. For instance, in July 2025, CelluHeal, a leading provider of advanced wound care solutions, announced the nationwide and international launch of its complete range of professional wound dressings. The portfolio includes the company’s flagship Cellufil and Cellusheet collagen-based dressings, designed to support effective healing across a variety of wound types.

Substantial investments in research and development have led to the introduction of innovative treatment options, such as biologics and advanced wound care dressings. Government initiatives and favorable reimbursement policies further support the adoption of these treatments, enhancing accessibility for patients. Collectively, these factors reinforce North America's leadership in the DFU treatment market.

The Asia-Pacific diabetic foot ulcers market was valued at 19.39% market share in 2024

The Asia-Pacific region is expected to emerge as the fastest-growing market for diabetic foot ulcers, driven by the rapidly increasing prevalence of diabetes, growing healthcare awareness, and improving access to medical care. Countries such as China, India, and Southeast Asian nations are witnessing a surge in diabetic populations due to lifestyle changes and aging demographics, which in turn is escalating the incidence of DFUs.

Moreover, governments and healthcare providers across the region are investing in expanding wound care infrastructure and launching initiatives to improve early diagnosis and management of diabetic complications. The adoption of advanced wound care products, including bioengineered dressings and negative pressure wound therapy, is also gaining momentum.

Additionally, rising healthcare spending, increasing availability of skilled professionals, and growing involvement of regional and international players are fueling innovation and accelerating the adoption of modern DFU treatments. These combined factors position Asia-Pacific as a key growth hub in the global DFU market.

Market Key players

The major players in the diabetic foot ulcers market include Convatec, Smith+Nephew, Solventum, Flen Health, B. Braun SE, AROA BIOSURGERY INC, MIMEDX Group, Inc., among others.

Convatec: Convatec is a global leader in advanced wound care, offering a comprehensive suite of dressings tailored specifically for diabetic foot ulcers (DFUs). Their AQUACEL family leverages Hydrofiber® technology to absorb exudate and create an optimal moist healing environment, while their Ag+ variants add a powerful antimicrobial and antibiofilm action with ionic silver, emerging as a valuable defense against infection and promoting faster healing in DFU patients.

Key Developments:

- In January 2025, Mölnlycke Health Care, a global leader in medical technology with a strong focus on wound care, announced an investment of USD 8 million in Siren, a health tech company dedicated to preventing diabetic foot ulcers. Siren’s innovative solution uses temperature-sensing textile technology to detect early signs of injury, aiming to reduce the risk of complications for diabetic patients.

Market Scope

Metrics | Details | |

CAGR | 6.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Treatment Type | Wound Care Dressings, Biologics, Therapy Devices, |

Ulcer Type | Neuropathic Ulcers, Neuro-ischemic Ulcers | |

| End-User | Hospitals, Ambulatory Surgical Centers, Homecare |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The diabetic foot ulcers market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here