Infectious Disease Testing Product Market Size & Industry Outlook

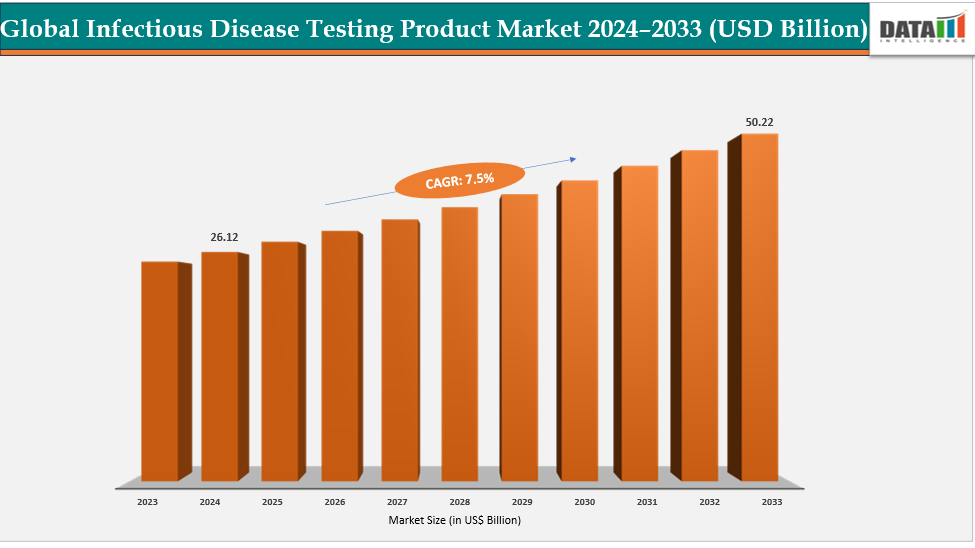

The global infectious disease testing product market size reached US$ 24.41 Billion in 2023 with a rise of US$ 26.12 Billion in 2024 and is expected to reach US$ 50.22 Billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

Technological advances in infectious disease testing products, including PCR, sequencing, isothermal amplification, and multiplex panels, are driving market growth by enabling faster, more sensitive, and highly specific pathogen detection. Point-of-care gadgets, automated systems, and high-throughput platforms are examples of innovations that improve patient outcomes by enabling doctors to detect infections in a matter of minutes to hours as opposed to days. For serious or contagious illnesses like COVID-19, influenza, and tuberculosis, early and precise identification is especially important because it lowers consequences, promotes prompt treatment, and slows the transmission of disease. Data interpretation and outbreak surveillance are improved by the combination of AI and bioinformatics.

Key Highlights

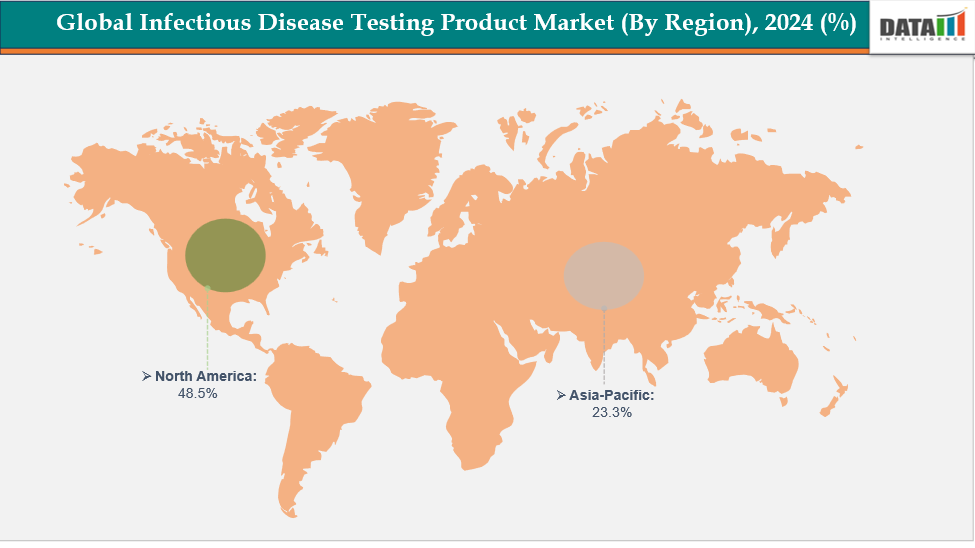

- North America is dominating the global infectious disease testing product market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global infectious disease testing product market, with a CAGR of 7.7% in 2024

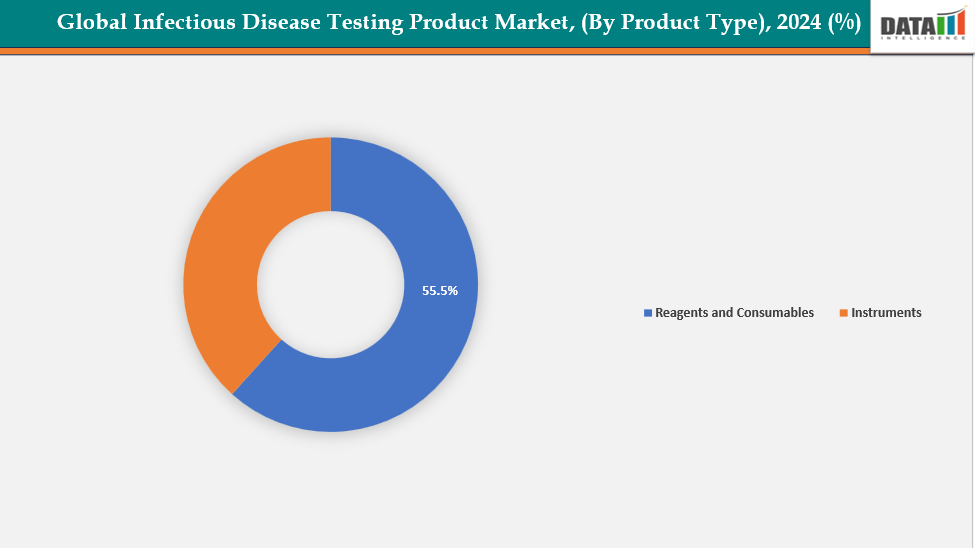

- The reagents and consumables segment from product type is dominating the infectious disease testing product market with a 55.5% share in 2024

- The polymerase chain reaction (PCR) segment form technology is dominating the infectious disease testing product market with a 35.3% share in 2024

- Top companies in the Infectious disease testing product market include F. Hoffmann-La Roche Ltd, Cepheid, Abbott, OraSure Technologies Inc., Hologic, Inc., BioFire Defense, Siemens Healthcare Private Limited, Avioq, Inc., QIAGEN, and Bio-Rad Laboratories, Inc., among others.

Market Dynamics

Drivers: Rising prevalence of infectious diseases are accelerating the growth of the infectious disease testing product market

The rising prevalence of infectious diseases is significantly driving the growth of the infectious disease testing product market. Increased cases of HIV, TB, hepatitis, COVID-19, and emerging pathogens have heightened the demand for accurate, rapid, and accessible diagnostics. For instance, according to WHO, in 2023 an estimated 1.3 million people acquired HIV, with a case-fatality ratio of 0.91%. The Eastern Mediterranean Region reported 23,406,897 cases, accounting for 3.03% of the worldwide burden, underscoring its ongoing impact. Over 80 million people are affected with respiratory diseases, and many more are undiagnosed worldwide.

Governments, public health bodies, and global health initiatives are investing heavily in screening, surveillance, and outbreak response. This surge in disease burden encourages innovation in molecular, point-of-care, and home-based testing technologies.

Restraints: The high cost of advanced diagnostic equipment and tests are hampering the growth of the infectious disease testing product market

The high cost of advanced diagnostic equipment and tests is significantly hindering the growth of the infectious disease testing product market. Complex technologies like multiplex systems, PCR machines, and NGS platforms demand a large initial outlay of funds. Adoption is hampered by these expenses, particularly in rural areas and low- and middle-income countries (LMICs) with constrained healthcare infrastructure and budgets. For instance, the Xpert MTB/RIF Ultra test by Cepheid, though highly accurate and WHO-approved, faces adoption challenges due to high costs ($17,000–$25,000 for the machine and $10–$20 per test), limiting its accessibility in low-resource, high-burden regions.

Additionally, skilled personnel are needed to operate these systems, adding further operational expenses. Low reimbursement rates from insurers or governments reduce the financial incentive for providers to adopt high-cost diagnostics.

For more details on this report, see Request for Sample

Segmentation Analysis

The global infectious disease testing product market is segmented based on product type, technology, application, end user and region

By Product Type: The reagents and consumables segment from product type is dominating the infectious disease testing product market with a 55.5% share in 2024

The reagents and consumables segment dominates the infectious disease testing product market due to its recurring demand, affordability, and essential role in test execution. Reagents and consumables are needed for every test, unlike instruments, which are one-time purchases. As testing volumes increase worldwide, this creates ongoing revenue. They are available in decentralized and low-resource environments due to their widespread compatibility and reduced cost.

Additionally, continuous research, innovation, and regulatory approvals for reagents, consumables, and kits further strengthen market penetration. For instance, in August 2025, CTK Biotech, part of SSI Diagnostica Group, achieved CE-IVDR certification for its OnSite RSV Ag Rapid Test, strengthening its global leadership in respiratory diagnostics and advancing innovation in rapid infectious disease detection.

By Technology: The polymerase chain reaction (PCR) segment form technology is dominating the infectious disease testing product market with a 35.3% share in 2024

The Polymerase Chain Reaction (PCR) segment dominates the infectious disease testing product market due to its exceptional sensitivity, specificity, and versatility. Early detection of illnesses like COVID-19, HIV, hepatitis, and tuberculosis is made possible by PCR's ability to precisely identify trace amounts of DNA or RNA from bacteria, viruses, and parasites. Time and resources can be saved by simultaneously detecting multiple pathogens thanks to its adaptability to multiplex panels.

Moreover, widespread adoption is supported by established laboratory infrastructure, automated platforms like Roche cobas and Abbott Alinity, and regulatory approvals, including FDA and CE marks. For instance, in August 2025, Roche announced that the FDA granted 510(k) clearance for the cobas Respiratory 4-flex, the first assay using Roche’s Temperature-Activated Generation of Signal technology, which streamlined respiratory testing and enabled timely, accurate patient diagnoses.

Geographical Analysis

North America is dominating the global infectious disease testing product market with a 48.5% in 2024

North America is expected to lead the global infectious disease testing product market due to its advanced healthcare infrastructure, well-established diagnostics industry, and strong adoption of molecular and immunoassay technologies. The market is expanding due to the high demand for multiplex, quick, and accurate testing options for illnesses such COVID-19, HIV, influenza, and tuberculosis.

In the USA, market expansion is fueled by significant investment in diagnostic research, supportive regulatory frameworks, and increasing use of PCR, sequencing, and point-of-care testing platforms. For instance, in August 2025, bioMérieux announced that its BIOFIRE SPOTFIRE R/ST Panel Mini received FDA 510(k) clearance and a CLIA waiver for anterior nasal swab specimens. This approval enhanced patient comfort and supported the growing demand for decentralized, point-of-care respiratory diagnostic testing in the United States.

Europe is the second region after North America which is expected to dominate the global infectious disease testing product market with a 34.5% in 2024

Europe’s infectious disease testing product market is expanding due to high disease awareness, strong healthcare infrastructure, and widespread access to hospitals, clinics, and laboratories. Further growth is driven by company collaborations with institutes and partnerships for the global infectious disease testing product, boosting the growth. For instance, at the end of 2024, bioMérieux announced a strategic research partnership with Vall d'Hebron, one of Spain’s leading healthcare institutions. The collaboration aimed to advance infectious disease research, enhance data surveillance, and improve laboratory automation, leveraging Vall d'Hebron’s comprehensive healthcare, research, and teaching expertise in Barcelona.

Germany’s infectious disease testing product market is driven by advanced healthcare infrastructure, strong regulatory support, and high public awareness. Extensive access via hospitals, clinics, pharmacies, and digital platforms, combined with government initiatives, ongoing research, and continuous innovation, further enhances adoption and market growth across the country.

The Asia Pacific region is the fastest-growing region in the global infectious disease testing product market, with a CAGR of 7.7% in 2024

The Asia-Pacific infectious disease testing product market, including Japan, China, India, and South Korea, is growing due to rising disease awareness, urbanization, and improved healthcare access. Public health campaigns, government initiatives, and advancements in diagnostic technologies are driving early detection, treatment adoption, and effective management of infectious diseases across the region.

India is the fastest-growing region in the global infectious disease testing product market, driven by increasing disease prevalence, physician awareness, and expanding healthcare infrastructure. Further strategic partnerships, licensing agreements, and the Central Drugs Standard Control Organization approvals are accelerating adoption and fueling rapid market growth across the country. For instance, in January 2024, QIAGEN announced the launch of two new syndromic testing panels for its QIAstat-Dx instruments in India: The Gastrointestinal Panel 2 and Meningitis/Encephalitis Panel. Approved by CDSCO, these panels joined the existing Respiratory SARS-CoV-2 Panel, enabling healthcare providers to diagnose infectious diseases faster, easier, and more accurately.

Competitive Landscape

Top companies in the infectious disease testing product market include F. Hoffmann-La Roche Ltd, Cepheid, Abbott, OraSure Technologies Inc., Hologic, Inc., BioFire Defense, Siemens Healthcare Private Limited, Avioq, Inc., QIAGEN, and Bio-Rad Laboratories, Inc., among others.

F. Hoffmann-La Roche Ltd.: F. Hoffmann-La Roche Ltd is a global leader in the infectious disease testing product market, offering advanced molecular diagnostics, including cobas PCR systems and multiplex panels. With a strong presence across North America, Europe, and Asia-Pacific, Roche focuses on rapid, accurate diagnostics, automated platforms, and innovative point-of-care testing solutions.

Key Developments:

- In September 2025, QIAGEN announced that its full QIAstat-Dx portfolio achieved CE-IVDR certification, including an expanded Meningitis/Encephalitis Panel. This approval reinforced the portfolio’s use in clinical syndromic testing and highlighted QIAGEN’s commitment to delivering high-quality infectious disease diagnostics.

- In May 2025, SSI Diagnostica Group announced that CTK Biotech received CE-IVDR approval for three key rapid tests: OnSite Syphilis Ab Combo, OnSite Dengue Ag, and OnSite H. pylori Ag. This milestone expanded the group’s global footprint and enhanced patient access to critical infectious disease diagnostics.

Market Scope

| Metrics | Details | |

| CAGR | 7.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product Type | Reagents, Consumables, and Instruments |

| By Technology | Polymerase chain reaction, In Situ Hybridization, Isothermal Nucleic Acid Amplification Technology, Chips and Microarrays, Mass Spectrometry, sequencing, and Others | |

| By Application | Respiratory Diseases, Tuberculosis, Meningitis, Human Papillomavirus, Hepatitis and Others | |

| By End User | Hospitals, Clinics, Diagnostics Laboratories, Research Institutes | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global infectious disease testing product market report delivers a detailed analysis with 70 key tables, more than 69 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here