Point-of-Care (POC) Lipid Test Market Size and Trends

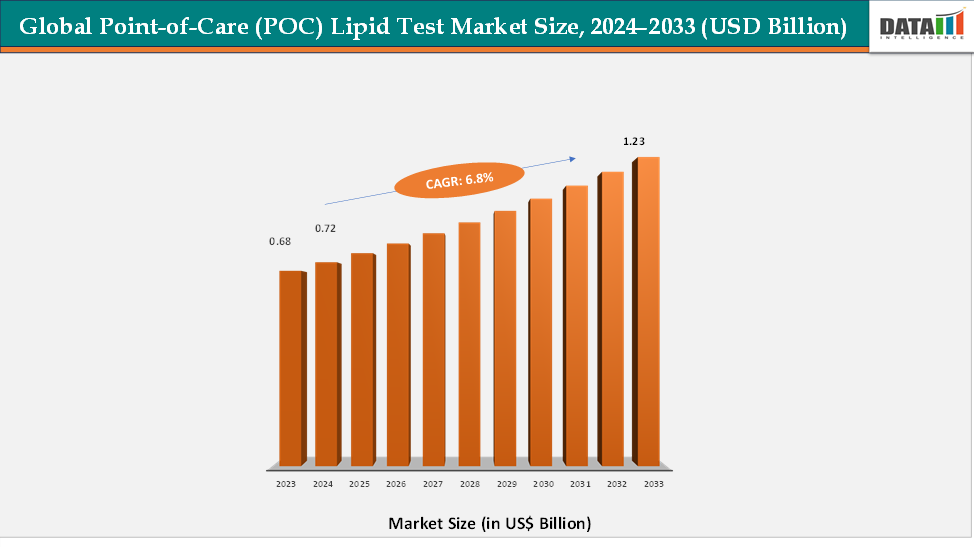

The global point-of-care (POC) lipid test market reached US$ 0.68 billion in 2023, with a rise to US$ 0.72 billion in 2024, and is expected to reach US$ 1.23 billion by 2033, growing at a CAGR of 6.8% during the forecast period 2025–2033. The growing emphasis on preventive healthcare, decentralized diagnostics, and patient-centered care is reshaping the point-of-care (POC) lipid test market, as rapid testing solutions become increasingly vital for managing cardiovascular risk. By delivering immediate, reliable results outside traditional laboratories, POC lipid tests empower clinicians, pharmacists, and patients to make faster and more informed decisions, ultimately improving outcomes in cholesterol management and heart disease prevention.

Advancements in portable analyzers, smartphone-enabled devices, and digital connectivity are enhancing test accuracy and integration into broader healthcare systems, while the shift toward pharmacy-based services, home-based monitoring, and telehealth applications is broadening accessibility. At the same time, expanding adoption across emerging markets, driven by the need for affordable and scalable diagnostic solutions, is creating significant opportunities for long-term growth in the global POC lipid testing market.

Key Market highlights

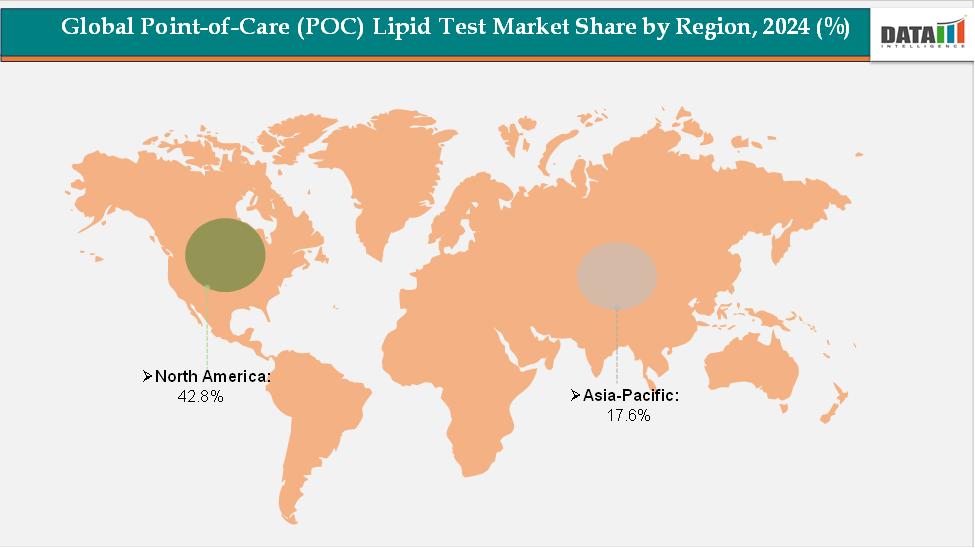

- North America leads the point-of-care (POC) lipid test market, accounting for approximately 42.8% of global revenue, driven by its advanced healthcare infrastructure, strong presence of diagnostic device manufacturers, and widespread adoption of preventive healthcare practices.

- Asia-Pacific represents the fastest-growing regional market, holding about 17.6% of the share, fueled by the rising incidence of cardiovascular and metabolic disorders in countries such as China, India, Japan, and South Korea.

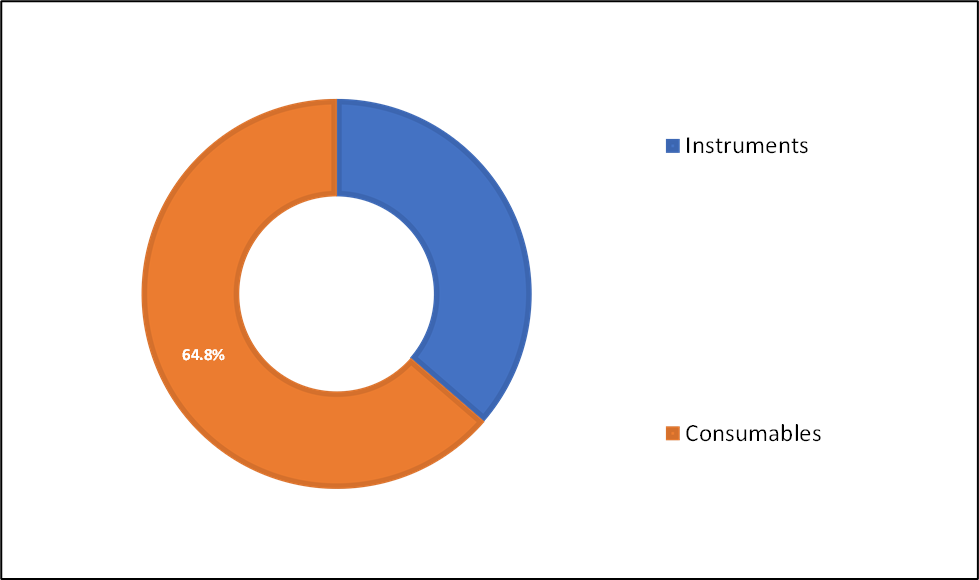

- Consumables remain the dominant product segment, contributing around 64.8% of market revenue. The recurring demand for test strips and cartridges ensures steady growth, as each lipid test requires a disposable component. Their widespread use in hospitals, primary-care settings, pharmacies, and community screenings underscores their critical role in driving overall market expansion.

Market Size & Forecast

- 2024 Market Size: US$ 0.72 Billion

- 2033 Projected Market Size: US$ 1.23 Billion

- CAGR (2025–2033): 6.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Global Point-of-Care (POC) Lipid Test Market: Executive Summary

Market Dynamics

Driver: Rising Cardiovascular Disease (CVD) Burden & Screening Demand

The global rise in cardiovascular disease (CVD) prevalence is a major driver of the point-of-care (POC) lipid test market, as early detection and continuous monitoring of lipid levels are essential for preventing heart attacks, strokes, and related complications. According to the World Health Organization, CVDs remain the leading cause of death worldwide, with elevated cholesterol recognized as a key modifiable risk factor. This growing disease burden has created strong demand for faster and more accessible lipid testing solutions, particularly in primary care clinics, pharmacies, and community health programs where patients can be screened without relying on centralized laboratories.

POC lipid tests enable immediate results, empowering healthcare providers to initiate timely interventions such as statin therapy or lifestyle modifications during the same consultation. The rising emphasis on preventive healthcare and routine cholesterol screening, coupled with an increasing focus on managing high-risk populations like diabetics and the elderly, further underscores the critical role of POC lipid tests in improving cardiovascular outcomes.

Restraint: Variable Accuracy and Quality Concerns

One of the key restraints hindering the growth of the point-of-care (POC) lipid test market is the variability in accuracy and quality of test results compared to centralized laboratory testing. While POC devices offer the advantage of speed and convenience, several studies have highlighted inconsistencies in lipid measurements across different brands and devices, raising questions about their reliability for definitive diagnosis or long-term patient management. Inaccurate results can lead to inappropriate treatment decisions, such as under- or over-prescription of cholesterol-lowering therapies, which undermines clinician confidence in adopting these tests widely.

For more details on this report, Request for Sample

Segmentation Analysis

The global point-of-care (POC) lipid test market is segmented by product type, disease indication, application, and end-user, and region.

Product Type: The consumables segment is estimated to have 64.8% of the point-of-care (POC) lipid test market share.

Consumables are the backbone of the POC lipid-test market and therefore the single largest revenue segment. Every single test run consumes a disposable item, so volumes scale directly with screening programs, chronic-disease monitoring and pharmacy/clinic throughput. They benefit from a large installed base of analyzers worldwide: once an instrument is placed, it generates repeat consumable purchases for months or years.

Manufacturers can also create “lock-in” through proprietary cartridge designs, which preserve margin even when unit price pressure exists. Distribution is broad (hospitals, primary-care clinics, pharmacies, community screening programs, and direct-to-consumer channels), so demand is diversified and less vulnerable to single-channel disruption.

The Instruments segment is estimated to have 35.2% of the point-of-care (POC) lipid test market share.

Instruments are the fastest-growing segment because technological advances and changing care models are increasing demand for new, smarter devices. Improvements in miniaturization, accuracy, sensor chemistry, connectivity (Bluetooth/cloud/EHR integration), and multiplexing (lipids + glucose/HbA1c) make modern analyzers far more attractive to clinics, pharmacies and home-care programmes than earlier generations. Instruments command higher unit selling prices and are often purchased during new clinic rollouts and by emerging-market healthcare expansion. In addition, new commercial models accelerate instrument adoption because they lower upfront cost barriers for buyers.

Instruments also benefit when manufacturers secure regulatory clearances or CLIA waivers. Risks include longer sales cycles, higher customer support/service costs and the threat of rapid obsolescence if devices aren’t continuously upgraded, but for companies and investors seeking growth and differentiation, instruments are the place to innovate and capture premium value.

Geographical Analysis

The North America point-of-care (POC) lipid test market was valued at 42.8% market share in 2024

North America is expected to remain the dominant region in the point-of-care (POC) lipid test market, holding the largest share of global revenues. The U.S. and Canada benefit from highly advanced healthcare infrastructures, widespread availability of diagnostic facilities, and strong adoption of decentralized healthcare models such as pharmacy clinics and physician offices. Cardiovascular disease remains one of the leading causes of mortality in the region, fueling continuous demand for regular cholesterol and lipid screening.

Clear regulatory guidance from the FDA and CLIA waivers, and growing awareness of preventive healthcare, contribute to the strong uptake of POC lipid tests. Additionally, the presence of major diagnostic device manufacturers, ongoing product launches, and technological advancements further reinforce the region’s dominance. With healthcare providers increasingly focused on early detection and quick decision-making at the point of care, North America is expected to retain its leadership position over the forecast period.

The Europe point-of-care (POC) lipid test market was valued at 19.4% market share in 2024

Europe accounts for a substantial share of the point-of-care (POC) Lipid Test Market, supported by its advanced healthcare infrastructure, strong regulatory frameworks, and increasing emphasis on preventive healthcare. Leading economies such as Germany, the U.K., France, and Italy are at the forefront of adoption, driven by government-backed initiatives that encourage early detection and effective management of cardiovascular risk factors. The region benefits from a well-established network of hospitals, specialty clinics, and diagnostic centers that are progressively integrating POC solutions to reduce diagnostic turnaround times and enhance patient care pathways.

At the same time, pharmacy-based testing and community-led screening programs are expanding, particularly in Western Europe, where health systems are under pressure to manage growing patient volumes efficiently. However, adoption across Eastern Europe remains comparatively slower due to infrastructure limitations, cost constraints, and varying reimbursement structures.

The Asia-Pacific point-of-care (POC) lipid test market was valued at 17.6% market share in 2024

The Asia-Pacific region is projected to register the fastest growth in the global POC lipid test market, driven by rapid urbanization, lifestyle changes, and a significant rise in cardiovascular and metabolic disorders. Countries such as China, India, Japan, and South Korea are witnessing a surge in healthcare demand as large populations grapple with rising incidences of hyperlipidemia and related conditions. Expanding healthcare infrastructure, increasing government investment in preventive health programs, and greater awareness of early diagnosis are fueling the adoption of POC lipid tests across hospitals, clinics, and even rural healthcare settings.

Moreover, growing disposable incomes, rising middle-class populations, and the proliferation of pharmacy-based health services are creating new opportunities for market penetration. The integration of digital health platforms and telemedicine in the region also supports remote lipid monitoring and chronic care management, further accelerating adoption. With strong demand in both developed and emerging economies, the Asia-Pacific region is expected to outpace other regions in growth, making it a critical focus area for manufacturers and investors.

Competitive Landscape

The major players in the point-of-care (POC) lipid test market include Abbott, F. Hoffmann-La Roche Ltd, Siemens Healthcare Private Limited (Siemens Healthineers AG), SD Biosensor, INC., ACON Laboratories, Inc., PTS Diagnostics, Woodley Equipment Company Ltd, among others.

Market Scope

| Metrics | Details | |

| CAGR | 6.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Instruments, Consumables |

| Disease Indication | Hyperlipidemia, Hypercholesterolaemia, Tangier Disease, Hyperlipoproteinemia, Familial Hypercholesterolemia, Others | |

| Application | Research and Development, Diagnostics, Biotechnological Product Manufacturing, Agriculture, Others | |

| End-User | Pharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organizations (CDMOs), Diagnostic Laboratories & Clinical Research Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Point-of-Care (POC) Lipid Test market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here