Point of Care Diagnostics Market: Industry Outlook

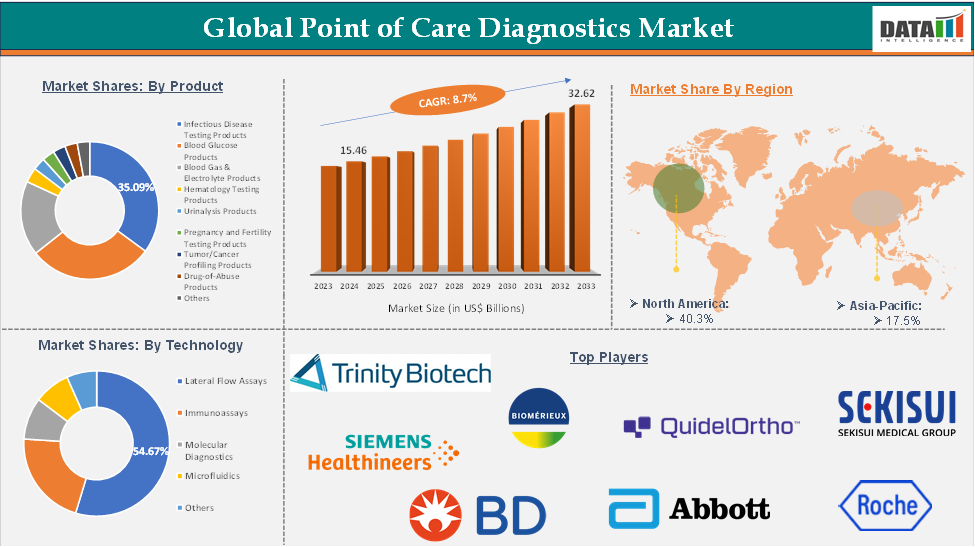

Point of Care Diagnostics Market reached US$ 44.72 Billion in 2024 and is expected to reach US$ 106.35 Billion by 2033, growing at a CAGR of 10.7% during the forecast period 2025-2033.

The point-of-care diagnostics market is experiencing significant growth due to increasing demand for accessible, efficient, and cost-effective diagnostic solutions. The market's expansion is driven by technological advancements, an aging population, rising incidences of chronic diseases, and the growing adoption of home-based testing. With rapid innovations in mobile health integration, artificial intelligence (AI), and digital diagnostics, the market is evolving to meet the needs of healthcare providers and patients for faster, more reliable diagnostics at the point of care.

Significant opportunities exist in Asia-Pacific, Latin America, and Africa, where healthcare infrastructure is rapidly improving, and there is an increasing need for low-cost, portable diagnostic solutions. The demand for point-of-care diagnostics is high in these regions due to the growing burden of infectious diseases and chronic conditions.

North America is the dominant region in the point-of-care diagnostics market, largely due to a combination of factors such as advanced healthcare infrastructure, strong presence of major players, favorable regulatory environments, and technological innovations. The United States and Canada, in particular, are at the forefront of this market, contributing significantly to its growth and global leadership.

Executive Summary

For more details on this report, Request for Sample

Point of Care Diagnostics Market Dynamics: Drivers & Restraints

Driver: Rising advancements in point-of-care diagnostics

New technologies like molecular diagnostics, microfluidics, and biosensors have improved the accuracy and speed of point-of-care diagnostic devices. These advancements allow tests to be performed rapidly, often in less than 30 minutes at a low cost.

For instance, in January 2024, 3EO Health received FDA Emergency Use Authorization (EUA) for its COVID-19 test utilizing 3TR technology. 3TR technology eliminates the need for sample preparation, expensive consumables, and complex equipment, creating a new category of “high efficiency” point-of-care molecular testing. High efficiency is defined as low-cost, easy-to-use molecular testing under $20 per test with no sample preparation required.

Artificial Intelligence (AI) is playing an increasing role in the interpretation of test results, offering quicker and more accurate decision-making. AI-powered point-of-care diagnostics can analyze diagnostic data and help clinicians make faster, more accurate diagnoses at low costs.

For instance, in February 2025, Avitia launched an AI-powered platform for rapid & point-of-care cancer testing. With Avitia’s platform, laboratories and clinicians now have access to advanced molecular testing. This technology will allow a healthcare team to accurately obtain cancer insights and begin treating patients faster, all at reduced costs.

Restraint: Connectivity & data integration issues

One of the primary barriers to the widespread adoption of point-of-care diagnostic technologies is the lack of interoperability between devices, healthcare IT systems, and electronic health records. In many healthcare environments, diagnostic devices, electronic health systems, and patient data platforms are not integrated, making it difficult to consolidate and access patient data in real-time.

As point-of-care diagnostic devices often transmit sensitive health data, maintaining the security and privacy of this information is critical. Poor data integration can expose patient information to unauthorized access, making it difficult for healthcare providers to ensure compliance with data protection regulations (such as HIPAA in the U.S. or GDPR in Europe).

For instance, according to the HIPAA Journal, in August 2023, 23 million breached healthcare records were reported. Over the past 12 months, an average of 9,989,003 healthcare records were breached each month. In the year to August 31, 2024, there have been 491 data breaches of 500 or more records, and at least 58,668,002 records are known to have been breached.

The issues related to connectivity and data integration, such as interoperability challenges, data security concerns, manual data entry, and cloud storage inefficiencies are significant barriers to the growth of the market.

Point of Care Diagnostics Market Segment Analysis

The global point of care diagnostics market is segmented based on product, technology, application, end user, and region.

Product:

The infectious disease testing products segment of the product is expected to hold 23.4% of the point of care diagnostics market. In 2022, the infectious disease testing segment represented one of the fastest-growing segments, reaching US$ 9.73 billion, and further increased to US$ 10.05 billion in 2023.

Infectious disease test products are diagnostic tools used to detect pathogens like bacteria or viruses in the body. They are crucial in identifying and controlling the spread of infectious diseases. Manufacturers offer various types of products, each tailored to detect specific pathogens or markers associated with specific diseases. Rapid tests provide quick results, often within minutes, and are commonly used for point-of-care testing.

For instance, in January 2025, Roche received FDA clearance and CLIA waiver for its cobas liat sexually transmitted infection multiplex assay panels. These tests, which include tests for chlamydia and gonorrhea and chlamydia, gonorrhea, and Mycoplasma genitalium, allow clinicians to diagnose and differentiate multiple STIs with a single sample. They will be exclusively available in the U.S. market in the coming months.

Moreover, diagnostic testing capabilities for infectious diseases like influenza, SARS-CoV-2, Clostridium difficile, HIV, Group A streptococcus, STIs, and Lyme disease have significantly improved over the past few years due to significant launches, product innovations, and other various factors.

Point of Care Diagnostics Market Geographical Analysis

North America dominated the global point of care diagnostics market with the highest share of 35.3% in 2024

North America led the point of care diagnostics market in 2022 with a market size of US$ 14.48 billion and reached further to US$ 38.36 billion in 2023.

North America, particularly the United States and Canada, holds a dominant position in the global POC diagnostics market. This market includes a wide range of diagnostic products such as blood glucose monitors, cardiac markers, pregnancy tests, infectious disease testing, and cholesterol testing.

The North American market is well-established with a high demand for diagnostic testing across various healthcare settings, including hospitals, clinics, urgent care centers, and even homecare environments.

The increasing incidence of chronic diseases such as diabetes, cardiovascular diseases, respiratory disorders, and cancer is one of the primary drivers of the POC diagnostics market in North America. These conditions require regular monitoring and testing, which is facilitated by POC devices.

Key players in the region are receiving regulatory approvals and launching their products in the region. For instance, in January 2025, Roche received FDA clearance with a CLIA waiver for its cobas Liat molecular tests designed to diagnose sexually transmitted infections (STIs) at the point of care. Roche's cobas Liat molecular tests have met the regulatory standards for safety and effectiveness in the U.S. market. This is a significant milestone, as it ensures that the tests can be used legally and widely in healthcare settings.

Asia-Pacific is the global point of care diagnostics market, with a market share of 23.2% in 2024 for the POC diagnostics market

The growing aging population, especially in countries like China, Japan, and India, has resulted in a higher incidence of these conditions. POC testing devices such as blood glucose meters, cholesterol testing kits, and cardiac marker testing devices are gaining popularity for the management and early detection of chronic diseases.

Australia’s healthcare system is incorporating POC diagnostics for efficient, cost-effective management of conditions like chronic diseases and infectious diseases. India and China, with large diabetic populations, are seeing a rise in demand for POC devices like blood glucose monitors. Japan, with a large aging population, has a growing need for cardiac and metabolic markers for the elderly.

Key players in the region, and product launches that would propel this market growth. For instance, in April 2024, Roche Diagnostics India launched a heart failure test designed specifically for individuals with diabetes, in the form of a point-of-care (POC) device. This new development marks an important step in addressing the growing need for faster, more accurate diagnostics, particularly for diabetic patients who are at higher risk for heart failure.

Point of Care Diagnostics Market Key Players

The major global players in the Point of Care Diagnostics market include BD, QuidelOrtho Corporation, QIAGEN, Trinity Biotech plc, BioMérieux SA, F. Hoffmann-La Roche Ltd, Siemens Healthineers AG, Abbott Laboratories, Danaher Corporation, and SEKISUI MEDICAL CO., LTD., among others.

Industry Key Developments

- In April 2025, SEKISUI Diagnostics launched the Metrix COVID/Flu Test, the second assay on the Metrix Molecular Platform, for use at point-of-care and home. The company has also partnered with Aptitude Medical Systems to sell the Aptitude Metrix COVID-19 Test in the US, following FDA authorization.

- In February 2025, Avitia launched an AI-powered platform for rapid & point-of-care cancer testing. With Avitia’s platform, laboratories and clinicians now have access to advanced molecular testing. This technology will allow a healthcare team to accurately obtain cancer insights and begin treating patients faster, all at reduced costs.

Market Scope

Metrics | Details | |

CAGR | 8.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product | Infectious Disease Testing Products, Blood Glucose Products, Blood Gas & Electrolyte Products, Hematology Testing Products, Urinalysis Products, Pregnancy and Fertility Testing Products, Tumor/Cancer Profiling Products, Drug-of-Abuse Products, Others |

Technology | Lateral Flow Assays, Immunoassays, Molecular Diagnostics Microfluidics, Others | |

Application | Infectious Diseases, Hematology, Cardiology, Endocrinology, Oncology, Drug Testing, Neurology, Others | |

End User | Hospitals & Clinics, Diagnostic Laboratories, Ambulatory Surgery Centers (ASCs), Home Care Settings | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |