Industrial Tubes Market Overview

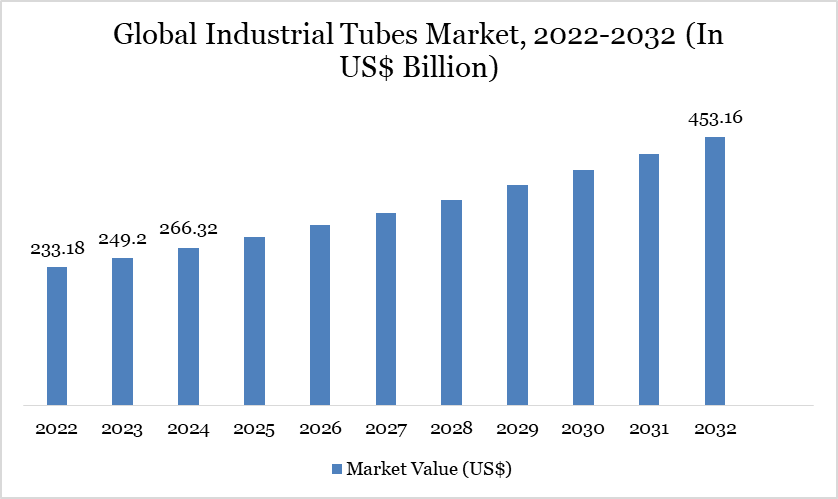

Global Industrial Tubes Market reached US$ 266.32 billion in 2024 and is expected to reach US$ 453.16 billion by 2032, growing with a CAGR of 6.87% during the forecast period 2025-2032.

The global industrial tubes market is expanding as governments drive infrastructure modernization and clean energy deployment. Government-funded programs like the DOE’s Industrial Assessment Centers have generated approximately US $890 million in implemented energy-cost savings across more than 600 manufacturing sites, underscoring industry-wide energy efficiency efforts. Additionally, the EU’s Industrial Emissions Directive mandates that heavy industries, including steel tube producers, reduce emissions through Best Available Techniques, contributing to a 26% emissions reduction in EU steel since 1990. These policies are prompting manufacturers to adopt low-carbon production methods and invest in advanced value chains.

Industrial Tubes Market Trend

A unique trend reshaping the sector is the digital transformation of tube manufacturing, backed by public-private initiatives. The US Department of Energy’s Save Energy Now program helped identify annual energy savings of 190 billion Btu (6.5% source energy) in large industrial facilities, highlighting how IoT and automation can unlock efficiency.

In Europe, mounting support for electric arc furnaces integral to tube production aligns with hydrogen-based steelmaking and decarbonization goals, significantly lowering CO₂ intensity. As a result, digitally enabled and energy-optimized production lines are becoming essential, allowing manufacturers to meet regulatory standards while enhancing operational performance and sustainability.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Type | Process Pipes, Mechanical Tubes, Heat Exchanger Tubes, Structural Tubes, Hydraulic & Instrumentation Tubes, Others |

| By Material | Steel, Non-Steel |

| By Manufacturing Method | Welded, Seamless |

| By End-User | Oil & Gas, Automotive, Petrochemical, Construction, Chemicals, Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Industrial Tubes Market Dynamics

Expansion of Hydrogen Infrastructure and Carbon Capture Projects Boosting Demand for Alloy and Stainless Steel Tubes

Expansion of hydrogen infrastructure and carbon capture projects is significantly driving the global industrial tubes market. In 2024, the US alone had approximately 1,600 miles of low-pressure hydrogen pipelines, requiring high-purity stainless and alloy steel tubes for safe transport at pressures up to 7,000 psi. Federal investment under the Bipartisan Infrastructure Law and Inflation Reduction Act has allocated over US $12 billion toward carbon capture, transport, and storage projects, supporting pipelines and storage networks tied to industrial hubs.

Additionally, Tata Steel in India operates a pilot CO₂ capture plant that sequesters 5 tonnes per day from blast furnace gas, signaling a growing need for specialized tubing in CCUS systems. These developments are fueling demand for durable, corrosion-resistant tubes in emerging clean energy and decarbonization infrastructure.

Volatile Raw Material Prices and Trade Tariffs Disrupting Steel Tube Supply Chains

Volatile raw material prices and shifting trade tariffs are disrupting steel tube supply chains, putting upward pressure on costs and squeezing margins. For example, US steel tariffs triggered a 15% rise in OCTG costs, since nearly 40% of these tubes are imported. Additionally, Section 232 tariffs caused steel tube import sourcing to pivot—raising costs by US$ 30–45 per metric ton and forcing manufacturers to reorganize supply strategies amid widespread uncertainty.

Industrial Tubes Market Segment Analysis

The global industrial tubes market is segmented based on type, manufacturing method, material, end-user and region.

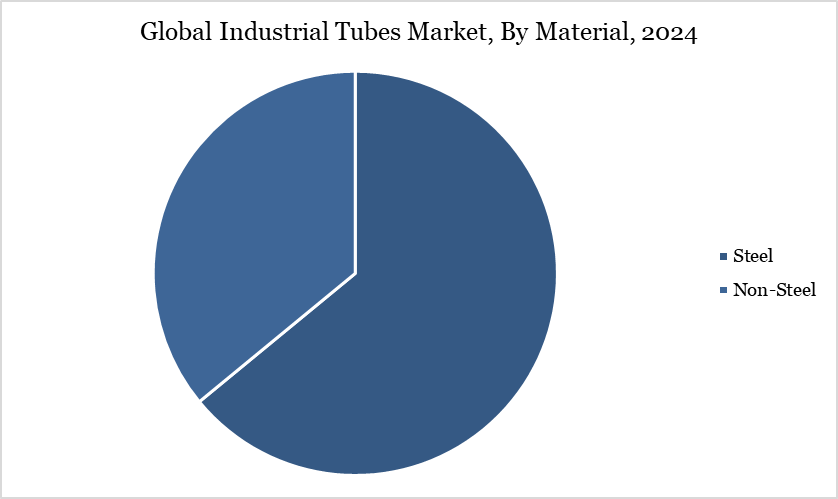

Steel Segment Driving Industrial Tubes Market

The steel segment accounted for approximately 65% of the global industrial tubes market in 2024, with a market size of around US$ 173.1 billion. This growth is primarily fueled by the widespread use of steel tubes in oil and gas infrastructure, construction, and industrial equipment manufacturing. Steel remains the preferred material due to its strength, durability, and cost-effectiveness in both high-pressure and structural applications.

Welded and seamless steel tubes continue to dominate due to their versatility and efficiency in industrial systems. Companies like Tenaris are expanding output of specialized steel tubes that meet the performance demands of energy and oilfield services. Additionally, rising investments in liquefied natural gas terminals, hydrogen pipeline development, and the reshoring of US manufacturing are all reinforcing the demand for steel industrial tubes. As infrastructure modernization accelerates, steel tubes are expected to remain the backbone of industrial transport and structural systems.

Industrial Tubes Market Geographical Share

North America Drives the Global Industrial Tubes Market

North America accounted for approximately 27% of the global industrial tubes market in 2024, with a market size of about US$ 71.8 billion. This demand is driven by robust activity in sectors such as oil and gas, construction, and automotive manufacturing. The US alone recorded an industrial tubes market value of over 20% in 2024, with projections indicating steady growth. Increased investments in pipeline infrastructure and energy projects are contributing to sustained tube consumption across the region.

Tenaris has maintained stable demand in North America, with higher volumes in OCTG and line pipe products supporting regional output. Expansions in liquefied natural gas (LNG) terminals and hydrogen pipeline networks are boosting the need for high-grade alloy and stainless-steel tubes. Domestic policies encouraging reshoring of manufacturing are also enhancing demand for precision and structural tubing. Overall, North America remains a key growth engine in the global industrial tubes market.

Sustainability Analysis

The global industrial tubes market is spearheading sustainability efforts through major manufacturers’ ambitious decarbonization and circular economy initiatives. Vallourec, for instance, has cut its carbon footprint from 1.79 to 1.45 tCO₂e per tonne of tubes between 2019 and 2023—a 19% reduction—by leveraging 61% recycled scrap steel, renewable electricity (over 90%), biomass charcoal substitution in Brazil, and electric arc furnaces in North America with 98% recycled steel feedstock. Its water withdrawal per tonne of tube has dropped by 40% since 2008, and the company has set even more aggressive goals: a further 30–35% reduction in CO₂ intensity by 2030–2035.

Additionally, Tenaris commits to a 30% reduction in carbon emissions intensity (compared to 2018 levels) by 2030, powered by its use of electric arc furnaces and recycled steel scrap in production operations. These efforts align tightly with public-sector regulations and national policies such as the EU Industrial Emissions Directive and the US DOE's Critical Material Innovation program driving the integration of low-carbon processes, energy- and water-use efficiency, and material reclamation in tube manufacturing.

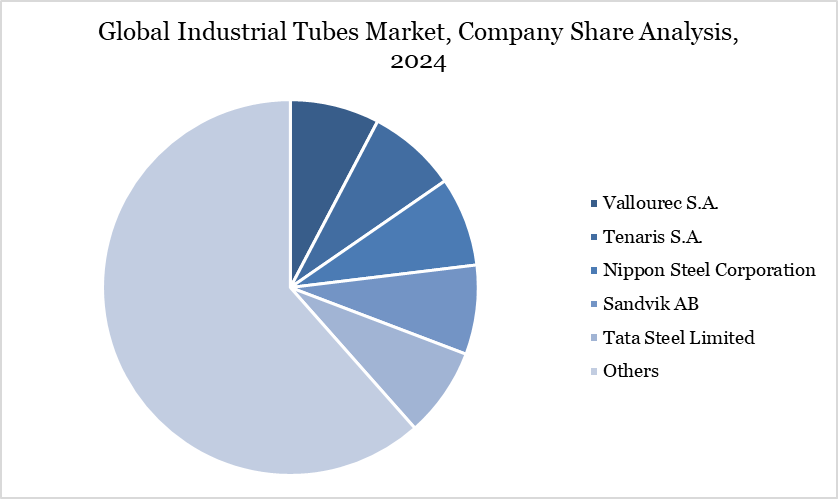

Industrial Tubes Market Major Players

The major global players in the market include Vallourec S.A., Tenaris S.A., Nippon Steel Corporation, Sandvik AB, Tata Steel Limited, JFE Steel Corporation, Benteler International AG, ArcelorMittal S.A., Maruichi Steel Tube Ltd., and Hyundai Steel Company.

Key Developments

In June 2024, Vallourec, a world leader in premium tubular solutions, has secured a contract to supply Petrobras with 1,800 tonnes of premium carbon steel tubes with Glass Reinforced Epoxy liners (GRE technology), together with the associated top-of-the-range CRA (Corrosion Resistant Alloy) accessories. These products will be used in various offshore development wells, mainly off the Brazilian coastline in the Campos pre-salt basin. This contract is in addition to the 3-year long-term agreement with Petrobras for the supply of OCTG tubes announced in January 2023.

In July 2023, ArcelorMittal, the world’s leading steel and mining company, launched new, low carbon-emissions steel tubes; This new solution, made of XCarb recycled and renewably produced steel, has up to 75% less CO2 equivalent - one of the highest CO2 emissions reductions rates in the steel tube industry. Using XCarb recycled and renewably produced steel tubes enables customers to reduce the global CO2 footprint of their projects, products, and finished goods, thereby meeting their own decarbonization targets and aligning with the Paris climate goals and the European Green Deal.