India Tinplate Market Overview

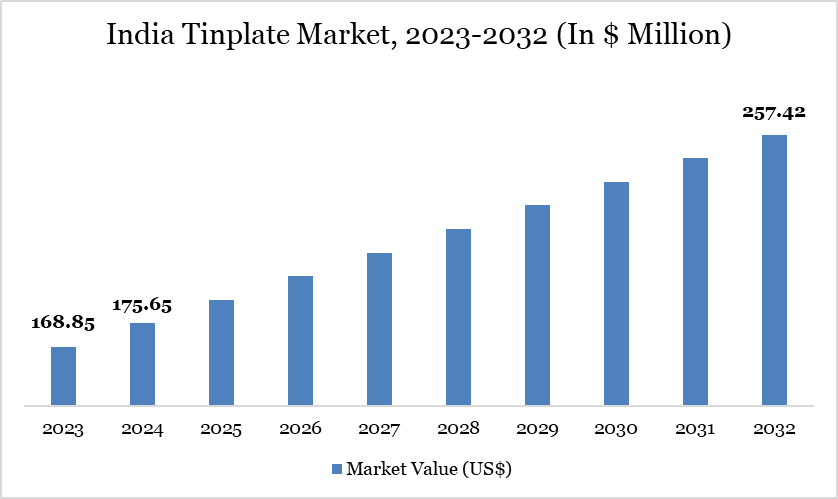

The India tinplate market reached US$175.65 million in 2024 and is expected to reach US$257.42million by 2032, growing at a CAGR of 4.99% during the forecast period 2025-2032.

The India tinplate market is witnessing robust growth, driven primarily by the rising demand for packaged food and beverages across urban and semi-urban regions. Increasing consumer preference for safe and hygienic packaging solutions has positioned tinplate as a preferred choice among manufacturers. In 2023, out of India’s annual tinplate consumption, around 280,000 metric tons were used to manufacture 15 kg edible oil tin containers, a format widely preferred by the HoReCa (hotel/restaurant/café) segment. From this, approximately 305 million new tin cans are produced each year, enabling the packaging of about 4,575 million kg of edible oil, which underscores tinplate’s critical role in India’s edible oil supply chain. Moreover, rising awareness about product safety and shelf-life extension is further fueling demand across sectors such as FMCG, beverages, and pharmaceuticals. The growing modern retail sector, combined with organized food processing industries, has amplified the need for durable and reliable packaging solutions.

India Tinplate Market Trend

Technological advancements in coating and forming processes have enhanced tinplate quality, making it suitable for diverse applications beyond food packaging. For instance, on January 4, 2024, the Tinplate Company of India (TCIL), a Tata Steel unit, signed an MoU with the Jharkhand government to set up a new US$ 204.2 million (₹1,787 crore) manufacturing facility in Jamshedpur, scheduled for commissioning in 2026. This state-of-the-art plant, equipped with advanced technology and automation, will strengthen TCIL’s position in versatile packaging substrates and cater to a wider range of industrial applications.

For more details on this report - Request for Sample

Market Scope

| Metrics | Details |

| By Purity | Single Reduced, Double Reduced |

| By Processing Method | Less Than 0.05 MM, 0.05 MM to 0.08 MM, 0.09 MM to 0.13 MM, 0.13 MM to 0.23 MM, More Than 0.23 MM |

| By Grade | Prime Grade, Secondary Grade, Others |

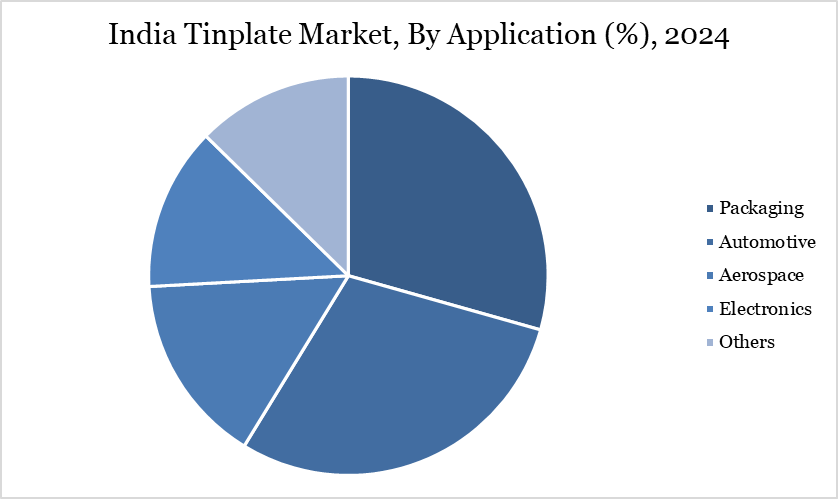

| By Application | Packaging, Automotive, Aerospace, Electronics, Others |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

India Tinplate Market Dynamics

Rising Demand for Packaged Food and Beverages

The rising demand for packaged food and beverages is a major growth driver for the tinplate market, as its durability, corrosion resistance, and excellent sealing properties make it ideal for preserving freshness and extending shelf life. With changing lifestyles, increasing urbanization, and a growing preference for convenience products, packaged food consumption is surging in India. According to a BDO report, India’s packaged convenience food industry was valued at approximately US 36.47 billion (INR 3,194 billion) in FY22 and is projected to grow at a robust CAGR of around 11%, reaching about US$ 55.76 billion (INR 4,883 billion) by FY26.

This strong growth is creating immense opportunities for packaging materials such as tinplate, which is widely used for canned foods, ready-to-drink beverages, and processed products. To meet this demand, manufacturers are expanding production capacities and upgrading technologies. For instance, in April 2023, the Tinplate Company of India (TCIL), a Tata Steel subsidiary, launched a US$ 228.4 million (₹2,000 crore) expansion project in Jharkhand, adding 300,000 tonnes to its existing 415,000 tonne capacity, with the total expected to reach 715,000 tonnes by 2026. The new facility will feature state-of-the-art technology, higher automation, and EU environmental compliance, enabling TCIL to better cater to domestic and export markets.

Raw Material Volatility and Supply Disruptions

Raw material volatility and supply disruptions are significant restraints on the Mexican Tinplate (EMA) market. EMA production relies heavily on ethylene and methyl acrylate, both of which are petrochemical derivatives subject to global price fluctuations. Any sharp increase in crude oil prices or raw material shortages can inflate production costs, affecting pricing and profitability. Moreover, India’s dependence on imports for certain chemical feedstocks makes the EMA market vulnerable to global supply chain disruptions. Events like geopolitical tensions, port delays, or logistical constraints can hinder the timely availability of raw materials. This unpredictability creates challenges for manufacturers in maintaining a consistent supply and planning long-term production. As a result, raw material instability directly impacts the growth and competitiveness of EMA in India.

India Tinplate Market Segment Analysis

The India tinplate market is segmented by type, thickness, grade, application.

Packaging Dominates India Tinplate Market Due to Rising FMCG and Food & Beverage Demand

Packaging commands a significant share in the Indian tinplate market due to its indispensable role in preserving product quality, enhancing shelf appeal, and ensuring safe transportation across diverse sectors, especially food and beverages. Its dominance is reinforced by the fact that packaging has emerged as the 5th largest sector of the Indian economy, projected to grow at a robust CAGR of 26.7% to reach US$204.81 billion by 2025, according to the India Brand Equity Foundation.

This rapid growth has positioned India as the world’s third-largest packaging market as of September 2024 surpassing Japan with an industry valuation exceeding ₹7,36,246 crore (US$86 billion). Tinplate is a preferred packaging material because of its durability, recyclability, and ability to provide superior protection for perishable and high-value goods. Its extensive use in packaging edible oils, canned foods, beverages, confectionery, aerosols, and pharmaceuticals ensures strong demand from FMCG, HoReCa, and export-oriented industries.

Sustainability Analysis

innovations, and growing policy support, all reinforcing each other in building a greener packaging ecosystem. Tinplate’s 100% recyclability without loss of quality makes it an ideal material to meet the nation’s rising demand for eco-friendly, durable, and safe packaging, especially as environmental regulations tighten and consumer preferences shift.

This push for sustainability has been strengthened by significant developments, such as the October 2024 launch of one of India’s first 99.90% pure tin manufacturing plants in Himachal Pradesh by Yash Gupta, founder of Rikayaa Enterprises Limited. By producing high-quality tin domestically, this facility reduces reliance on imports from Indonesia and Malaysia, ensuring a stable supply for critical sectors like electronics, packaging, construction, automotive, and renewable energy. The availability of pure tin also supports the production of superior tinplate, enhancing its performance and market competitiveness.

India Tinplate Market Major Players

The major players in the market include JSW Steel, Coated Products Limited, Tata Sons Private Limited, INDO GLOBAL STEEL, JMT STEEL-DOSHI STEEL GROUP, J. K. Steel Strips LLP, Jagdamba Sales Corporation, Easy Openends India Pvt Ltd, Nikita Containers Private Limited, Hindustan Tin Works Ltd, ASIAN GLOBAL LTD.

Key Development

In July 2023, Tata Steel and its subsidiary Tinplate Company of India Ltd (TCIL) initiated a pioneering tin can recycling program to address the health and safety concerns of reusing edible oil containers. This initiative, executed in partnership with Tata Steel’s Steel Recycling Business (SRB) and Industrial By-products Management Division (IBMD), established a complete supply chain for collecting, shredding, and baling used tin cans, enabling their reintegration into the manufacturing process.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies