The global industrial film market Overview

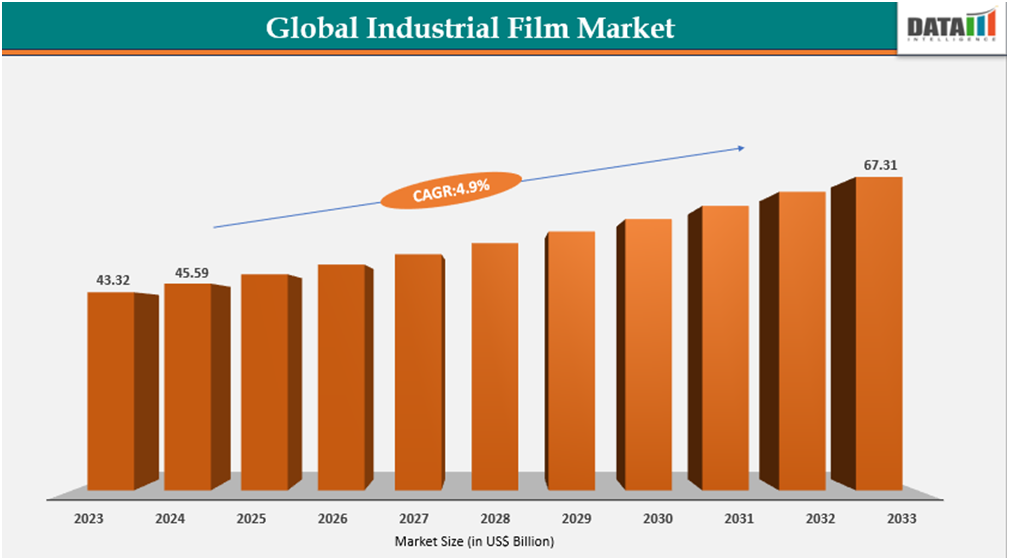

The global industrial film market reached US$45.59 billion in 2024 and is projected to grow to US$67.31 billion by 2032, at a CAGR of 4.99% during 2025–2032.

This market is a key segment of the global materials and manufacturing industry, driven by rising demand for versatile, high-performance, and sustainable film solutions across packaging, agriculture, construction, healthcare, and electronics. Industrial films, including polyethylene (PE), polypropylene (PP), PVC, PET, biodegradable, and co-extruded variants, are increasingly positioned as essential materials that support both functional requirements and sustainability goals for diverse industrial applications.

Market growth is fueled by technological advancements in smart and functional films, regulatory emphasis on recyclability and environmental sustainability, and the expansion of industrial infrastructure and e-commerce-driven packaging demand.

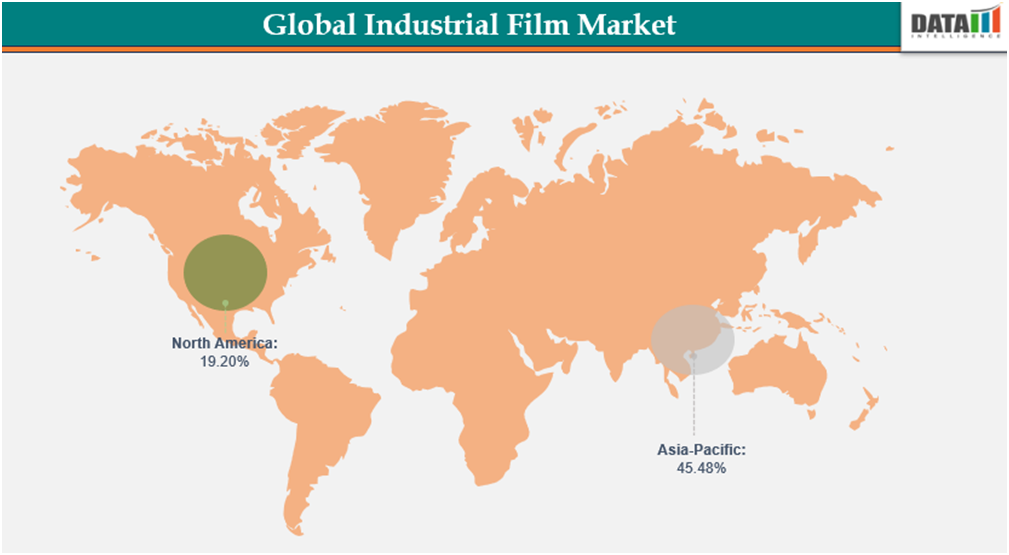

The Asia-Pacific region leads in both market size and growth momentum, while challenges such as raw material price volatility and compliance with circular economy principles persist. Nevertheless, innovations in high-performance, multi-layered, and biodegradable films create strong opportunities for sustained expansion, making the industrial film market a dynamic sector that balances functionality, sustainability, and industrial efficiency.

Global Industrial Film Market Trends and Strategic Insights

The Asia-Pacific region dominates the market, capturing the largest revenue share of 45.48% in 2024.

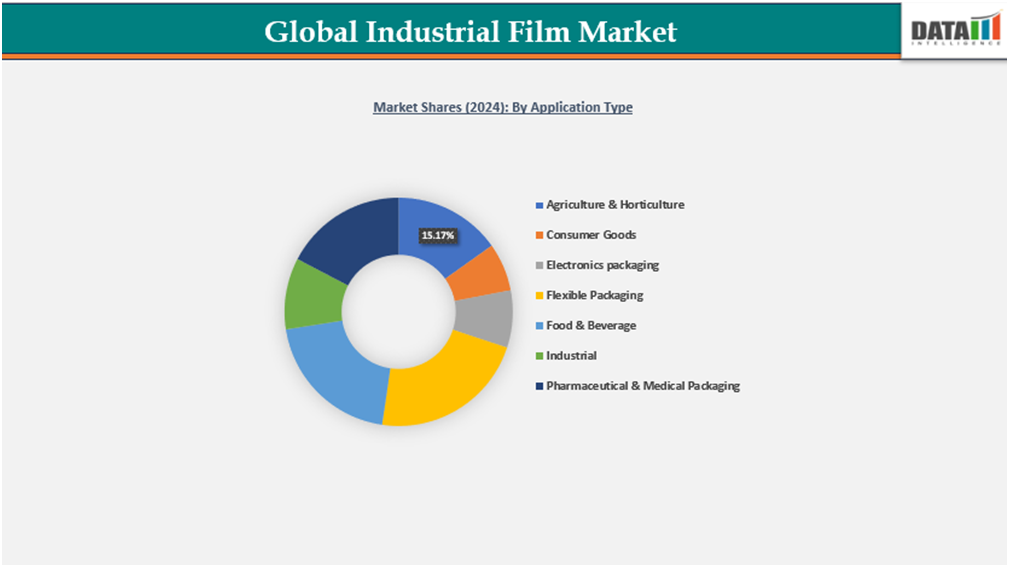

By application type, the flexible packaging segment experienced the largest market, registering a significant 22.25% in 2024.

Market Size and Future Outlook

2024 Market Size: US$45.59 Billion

2034 Projected Market Size: US$67.31 Billion

CAGR (2025–2034): 4.99%

Largest Market: Asia-Pacific

Fastest-Growing Market: North America

Market Scope

Metrics | Details |

By Film Type | BOPP (Biaxially Oriented Polypropylene) Film, PE Films (LDPE / LLDPE / HDPE), CPP (Cast Polypropylene) Film, PET (Polyethylene Terephthalate) Film, PVC Film, EVOH / PA / Multilayer Barrier Films, Bioplastic Films (PLA, PHA), Metallized Films / Aluminized Film |

By Thickness | Less Than 20 µm, 20–100 µm, More Than 100 µm |

By Application Type | Agriculture &Horticulture, Consumer Goods, Electronics packaging, Flexible Packaging, Food & Beverage, Industrial, Pharmaceutical & Medical Packaging |

By Region | North America, South America, Europe, Asia-Pacific, Middle Eastand Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising demand for sustainable, recyclable films across the packaging industries globally

The accelerating pace of urbanization and shifting consumer behaviors are driving growing demand for industrial films across the packaging and manufacturing sectors globally. With increasing industrial output, expanding e-commerce, and time-sensitive supply chains, efficiency, durability, and sustainability have become key selection criteria. Industrial films, including flexible packaging films, barrier films, and specialty protective films, support product safety, shelf-life extension, and logistics optimization, making them essential across food & beverage, pharmaceuticals, electronics, and consumer goods industries. This trend is particularly pronounced in regions such as Asia-Pacific and North America, where industrial modernization, automated production, and eco-conscious initiatives are rapidly shaping the adoption of high-performance and recyclable films.

Raw material price volatility is impacting production costs and profit margins.

Volatility in raw material prices is significantly impacting production costs and profit margins within the global industrial film market. Fluctuations in the prices of polymers, additives, and specialty resins create cost pressures for manufacturers, affecting pricing strategies and profitability. Rising feedstock costs may also lead to increased end-product prices, influencing demand and adoption rates across sectors such as food & beverage, pharmaceuticals, and consumer goods. Companies are increasingly investing in alternative materials, recycling initiatives, and process optimizations to mitigate cost variability and maintain competitive margins in a dynamic market landscape.

Segmentation Analysis

The global industrial film market is segmented based on film type, thickness, application type, and region.

Eco-Friendly and Plant-Based Industrial Films Drive Global Growth

The rising focus on sustainability and eco-conscious production is driving growing demand for plant-based, biodegradable, and recyclable industrial films worldwide. Environmentally aware consumers and businesses are increasingly favoring films made from renewable resources, bio-based polymers, and compostable materials over conventional petroleum-based options. Innovations in films derived from corn starch, cellulose, polylactic acid (PLA), and other plant-based materials are meeting the need for durability, barrier performance, and functional versatility. This trend is particularly strong in regions such as Europe, North America, and Asia-Pacific, where regulatory pressures, corporate sustainability initiatives, and consumer preference for eco-friendly packaging are shaping material choices. Manufacturers are responding by developing high-performance, clean-label, and recyclable films, creating opportunities for premiumization, differentiation, and long-term market growth.

Geographical Penetration

Asia-Pacific Industrial Film Market – Fastest Growing Regional Hub

Asia-Pacific (APAC) is poised to be the fastest-growing region for industrial film demand, fueled by rapid urbanization, rising disposable incomes, and evolving consumer lifestyles. China leads the region with a strong preference for packaged and innovative snack varieties, driven by its large population base and increasing adoption of Western snacking habits. Domestic players and multinational brands are actively expanding portfolios with localized Applications to capture consumer interest.

India Industrial Film Market Outlook

India is one of the fastest-growing and most dynamic markets for industrial film, driven by its large consumer base, rising disposable incomes, and strong cultural preference for snacking. The market is fueled by both traditional favorites such as namkeen, bhujia, and sev, as well as modern packaged products like chips, extruded snacks, and popcorn. Strong demand from the FMCG sector and expanding retail networks are propelling market growth, with significant contributions from tier II and tier III cities alongside metro markets.

A young population with evolving lifestyles is increasingly embracing convenient, branded, and healthier snacking options, pushing manufacturers to innovate with baked, multigrain, and protein-rich alternatives.

The Indian industrial film market accounts for a significant share of the Asia-Pacific region, supported by the presence of leading domestic players such as Haldiram’s, Balaji Wafers, Prataap Snacks, and multinational companies like PepsiCo and ITC. Continuous investments in product diversification, modern packaging, and rural distribution are reinforcing India’s position as a major growth engine in the global industrial film industry.

China Industrial Film Market Trends

China is a leading market in the Asia-Pacific region, driven by rapid urbanization, rising incomes, and strong demand for packaged snacks. Consumers are increasingly seeking on-the-go and innovative Application options, boosting product diversification. E-commerce and modern retail growth are accelerating distribution and accessibility.

Manufacturers are focusing on healthier, baked, and premium snack varieties to attract urban consumers.

Both domestic and international players are expanding portfolios with localized Applications.

China remains a key growth hub for the global industrial film industry.

North America Industrial Film Market

North America is a well-established market for industrial film driven by strong consumer demand and advanced retail infrastructure. The United States leads the region, with high consumption of chips, popcorn, and healthier snack alternatives. Canada is seeing growth in plant-based, organic, and premium snack varieties. Mexico contributes with the rising demand for spicy, traditional, and affordable snack products. Innovation in healthier formulations and sustainable packaging is shaping market trends. The region remains a mature yet dynamic hub for global industrial film growth.

United States Industrial Film Market Insights

The United States is one of the most mature and advanced markets for industrial film driven by its large-scale food and beverage industry, advanced retail infrastructure, and high consumer demand for convenient, on-the-go products. Strong demand for potato chips, extruded snacks, and popcorn continues to propel market growth, supported by innovations in Applications, packaging, and healthier formulations.

The increasing health-conscious consumer behavior is boosting demand for baked, low-fat, plant-based, and protein-rich snack alternatives. Regulatory focus on clean-label ingredients, reduced sodium, and sustainable packaging is pushing companies to innovate and align with evolving consumer expectations.

The U.S. market accounts for a significant share of the North American industrial film industry, supported by the presence of leading global players such as PepsiCo (Frito-Lay), Kellogg’s, Campbell Soup Company, Mondelez International, and emerging niche brands. Continuous strategic investments in product diversification, distribution expansion, and digital marketing are reinforcing the country’s position as a leader in the global industrial film market.

Canada Industrial Film Market Growth

Canada represents a steadily expanding market for the industrial film sector, supported by rising demand for sustainable packaging, advanced materials, and eco-friendly solutions. Government regulations promoting recyclability, reduced plastic waste, and carbon-neutral manufacturing are reshaping the competitive landscape, encouraging innovation in biodegradable, recyclable, and bio-based industrial films.

Leading domestic and international players are investing heavily in R&D to develop high-performance, multi-layered, and sustainable film applications, addressing needs across packaging, agriculture, healthcare, and electronics. The focus remains on food & beverage packaging, agricultural films, protective industrial uses, and medical-grade applications, with strong demand from both domestic manufacturing and export-driven industries.

Sustainability Analysis

Sustainability has become a central focus in the industrial film market, shaping both production and consumption trends. Manufacturers are reducing plastic packaging and shifting toward eco-friendly, recyclable, and biodegradable materials to address environmental concerns. At the product level, companies are reformulating snacks with clean-label, plant-based, and healthier ingredients, aligning with consumer demand for sustainable lifestyles.

The industry is also investing in energy-efficient manufacturing processes and adopting responsible sourcing practices for raw materials such as potatoes, corn, and pulses. Governments worldwide are enforcing stricter food safety, labeling, and packaging regulations, compelling companies to accelerate eco-innovation and waste reduction strategies.

Competitive Landscape

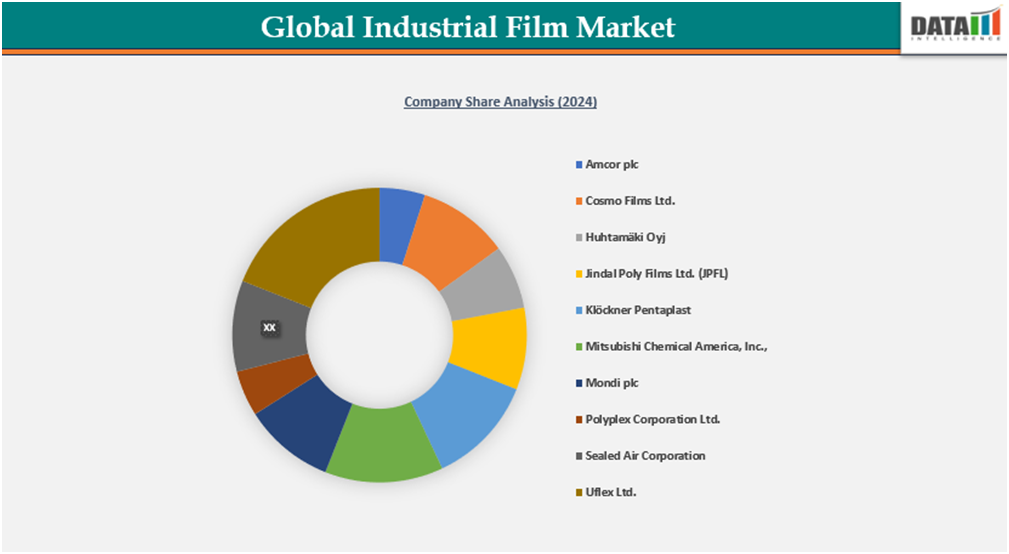

The global industrial film market is highly competitive and moderately consolidated, led by multinational chemical and materials companies leveraging economies of scale, advanced production technologies, and diversified regional footprints.

Market leaders benefit from global distribution networks, strong R&D pipelines, and application-specific expertise, focusing on engineered films tailored for packaging, agriculture, construction, healthcare, and electronics.

Companies are innovating with biodegradable, recyclable, and smart industrial film solutions, enhancing sustainability credentials and meeting circular economy requirements.

Strategic partnerships, capacity expansions, and digital manufacturing innovations are core strategies used to strengthen market positioning and customer value.

The emphasis on high-performance, multi-layered, and functional industrial films enables leading players to deliver superior ROI, meet stringent regulatory standards, and capture growth in both developed and emerging economies.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares, and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies