Market Size

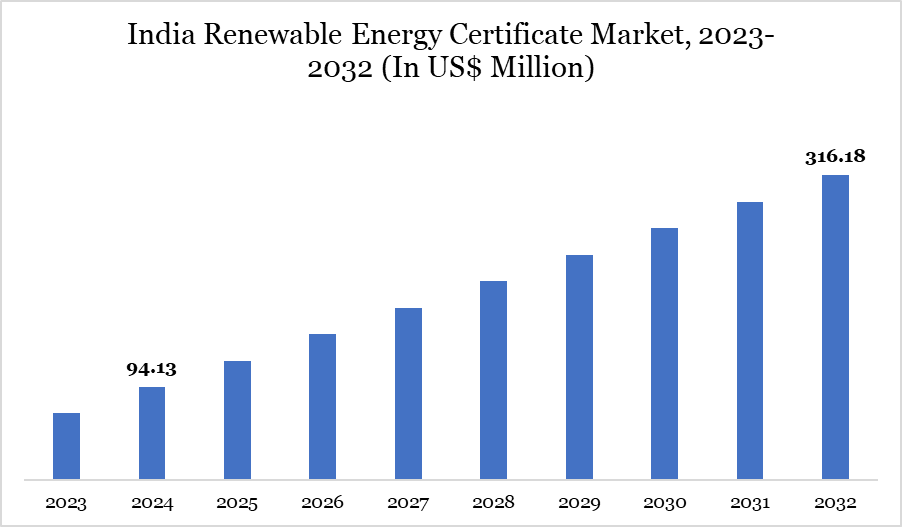

India’s renewable energy certificate (REC) market is witnessing rapid growth, valued at US$ 94.13 million in 2024 and projected to reach US$ 316.18 million by 2032 at a CAGR of 15.0%.

This growth is driven by India’s commitment to achieving 500 GW of non-fossil power capacity by 2030. The market is fueled by corporate demand for clean energy, government incentives, and increasing renewable energy capacity. RECs, issued by the National Load Despatch Centre (NLDC), play a crucial role in meeting Renewable Purchase Obligations (RPOs) and corporate sustainability targets. The market's expansion is further supported by favorable policies and private sector investments.

Market Trends

Rising Corporate Participation in the REC Market

India’s large industrial base, including IT, manufacturing, and infrastructure, is actively engaging in the REC market to offset carbon emissions. Companies are voluntarily purchasing RECs to meet sustainability goals and align with global standards such as RE100 and Science-Based Targets. Government initiatives like green open-access regulations and interstate transmission charge waivers further encourage corporate participation. Additionally, foreign direct investment (FDI) in the renewable sector supports the expansion of REC trading, ensuring liquidity and stability in the market.

Growth in Renewable Energy Investments

India's renewable sector is attracting massive investments from both domestic and foreign entities. In December 2024, Adani Group announced an US$ 88 billion investment in Rajasthan for a 100 GW green energy ecosystem. Similarly, ONGC Green’s acquisition of PTC Energy for US$ 106 million in March 2025 added 288 MW of operational wind capacity. These investments increase the availability of RECs, ensuring a robust supply for compliance and voluntary buyers. The rise in large-scale renewable projects enhances trading activity, making RECs a key instrument in India's energy transition.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | I-REC, GEC | |

| By Energy Source | Solar RECs, Wind RECs, Hydro RECs, Biomass, Geothermal | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Supportive Government Policies and Market Expansion

The Indian government plays a pivotal role in driving the REC market through favorable policies and regulatory support. The Central Electricity Regulatory Commission (CERC) introduced the Terms and Conditions for Renewable Energy Certificates Regulations, 2022, broadening REC eligibility to include renewable generators, captive generators, DISCOMs, and open-access consumers. The government’s commitment to auctioning 50 GW of renewable energy annually enhances market liquidity. Additionally, initiatives like the Make in India campaign encourage domestic production of renewable components, reducing import dependency and fostering a self-reliant renewable ecosystem. These factors collectively contribute to REC market growth and increased participation from industries seeking carbon neutrality.

Limited Awareness and Market Complexity

Despite strong policy support, limited awareness and market complexity remain key challenges in India’s REC market. Many businesses, especially SMEs, lack knowledge about REC trading and its benefits, hindering wider adoption. Moreover, the market involves regulatory nuances, making it difficult for new participants to navigate compliance requirements effectively. The expiration period of RECs (1,095 days) adds pressure on holders to trade them within a fixed timeframe. Additionally, price volatility due to supply-demand fluctuations can deter smaller players. Addressing these challenges requires targeted awareness campaigns, streamlined regulations, and enhanced market transparency to foster greater participation.

Market Segment Analysis

The India renewable energy certificate market is segmented based on type and energy source.

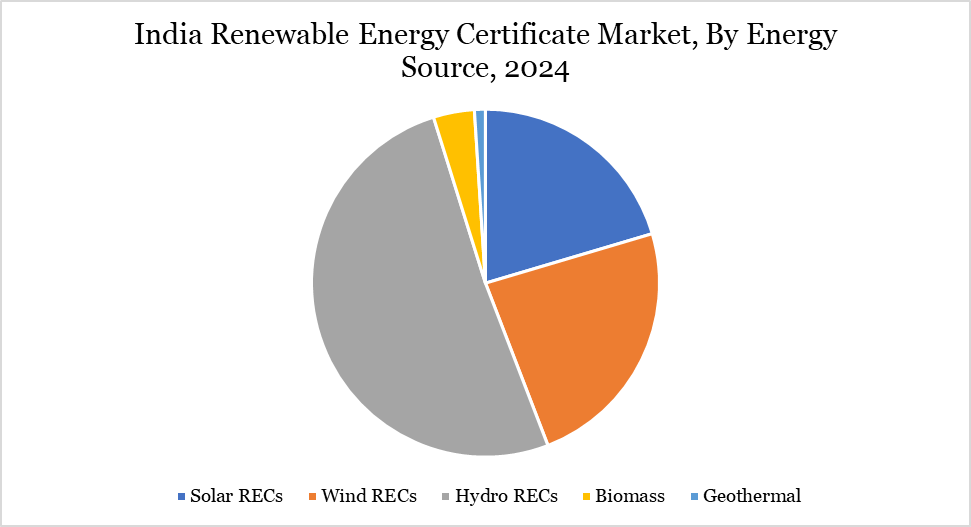

Hydro REC Leading the Market due to Large-Scale Investments in India.

The hydro renewable energy certificate (REC) market in India was valued at approximately $48.01 million in 2024 and is expected to grow significantly, reaching $148.32 million by 2032, reflecting a CAGR of 13.9% from 2025 to 2032. This market is segmented by end-users, which include industries, Distribution Companies (DISCOMs), open-access consumers, and voluntary buyers.

Corporate and industrial buyers are the primary drivers of demand for Hydro RECs, with large enterprises in sectors such as IT, manufacturing, and infrastructure actively purchasing these certificates to meet their sustainability targets and comply with regulatory requirements. The Renewable Purchase Obligations (RPOs) mandate that industries and DISCOMs procure a specified percentage of their energy from renewable sources, further propelling the adoption of RECs.

The voluntary market is also witnessing expansion as businesses align their operations with global sustainability commitments, such as the Science-Based Targets initiative and RE100. Additionally, foreign investments are contributing to the growth of this market, solidifying India's status as a key REC hub in the Asia-Pacific region.

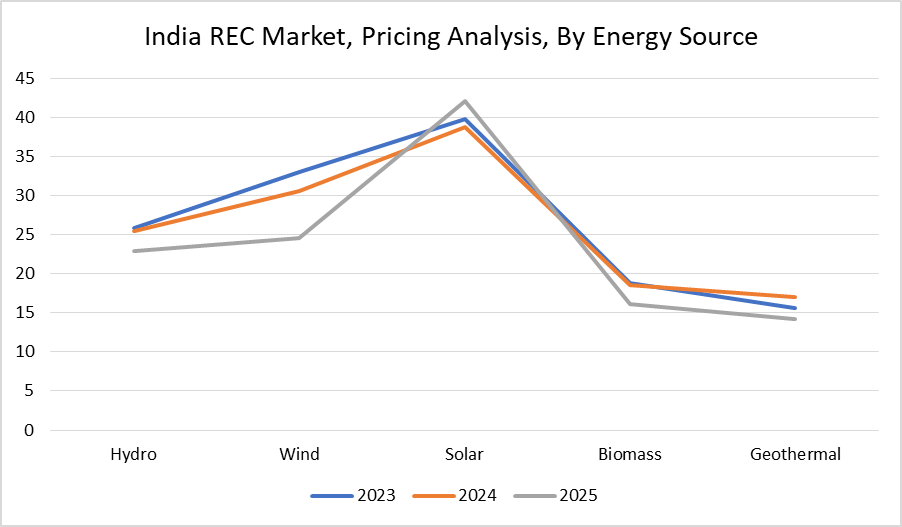

Pricing Analysis

India’s REC prices are influenced by supply-demand dynamics, policy changes, and renewable energy expansion. The influx of new renewable capacity, backed by government auctions of 50 GW annually, stabilizes REC prices by ensuring ample supply. Increased corporate demand for voluntary RECs strengthens price resilience, preventing sharp fluctuations. However, price volatility can arise from compliance uncertainties and changing regulatory frameworks. The government’s push for green hydrogen and battery storage further enhances REC value by integrating renewable energy into broader sustainability initiatives. Overall, price trends are expected to remain stable, with gradual appreciation as market participation increases and demand for clean energy intensifies.

Major Players

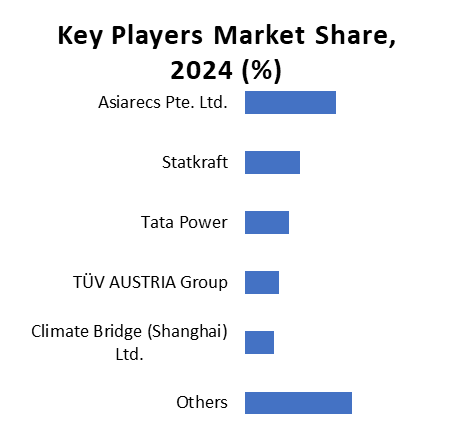

The major players in the market are Asiarecs Pte. Ltd., Statkraft, Tata Power, TÜV AUSTRIA Group, REDEX Pte. Ltd., and Climate Bridge (Shanghai) Ltd.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies