Market Size

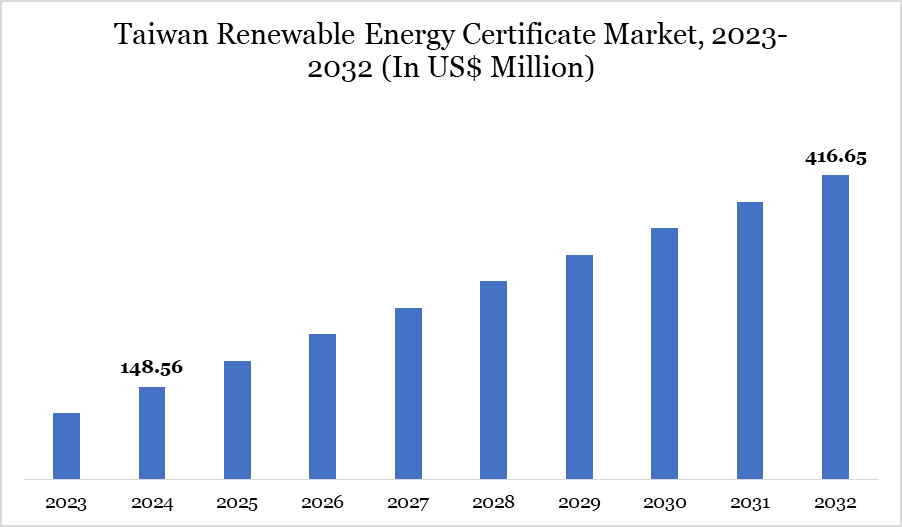

The Taiwan renewable energy certificate market is experiencing rapid growth, valued at US$ 148.56 million in 2024 and projected to reach US$ 416.65 million by 2032, at a CAGR of 12.1%.

Taiwan’s strong policy framework, robust industrial base, and sustainability commitments drive this expansion. The Renewable Energy Development Act (REDA) and government incentives ensure a transparent and efficient REC trading system. Taiwan’s large semiconductor and electronics industries, led by TSMC, generate significant green energy demand. Advanced infrastructure for solar and offshore wind projects, along with multinational corporations’ sustainability goals, further bolster the REC market.

Market Trends

Corporate Investments in Green Energy

Multinational corporations are increasingly investing in Taiwan’s renewable energy sector to meet their ESG commitments. For example, Google partnered with BlackRock to invest in New Green Power Co., aiming to develop 1 GW of solar capacity. Google plans to procure 300 MW from this project via power purchase agreements (PPAs) and T-RECs. Such large-scale investments enhance market liquidity, making Taiwan a hub for green energy trading. Additionally, local enterprises like Tex Year are acquiring T-RECs to reinforce their sustainability efforts, demonstrating the growing corporate demand for certified green energy.

Policy Reforms Driving Market Expansion

Taiwan has introduced favorable policies to enhance REC trading. The government’s September 2024 policy update allows large energy consumers to purchase portions of electricity from multiple facilities, making PPAs more flexible. Additionally, the feed-in tariff (FiT) system continues to support renewable energy development, attracting domestic and international investors. Financial guarantees from the National Development Fund (US$ 3.4 billion) provide further market confidence. These initiatives foster an open, competitive environment for REC trading, accelerating Taiwan’s transition to a low-carbon economy.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | I-REC, GEC | |

| By Energy Source | Solar RECs, Wind RECs, Hydro RECs, Biomass, Geothermal | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Strong Policy Framework and Industrial Demand

Taiwan’s REC market is driven by a robust policy framework and the industrial sector’s demand for green energy. The Renewable Energy Development Act (REDA) has laid a strong foundation for REC certification and trading. The Taiwanese government’s incentives, such as the feed-in tariff system and financial guarantees, encourage businesses to transition to renewable energy. Additionally, Taiwan’s semiconductor and electronics industries, led by global players like TSMC, require substantial clean energy to maintain sustainability commitments. The growing number of multinational corporations investing in Taiwan’s green energy infrastructure further accelerates REC adoption, positioning Taiwan as a key player in the Asia-Pacific REC market.

Regulatory and Market Complexity

Despite its growth, Taiwan’s REC market faces challenges, including regulatory complexity and market transparency concerns. The evolving policy landscape, while beneficial, can create uncertainties for investors and businesses. Additionally, the requirement for detailed compliance with T-REC certifications and trading mechanisms poses challenges for smaller enterprises. High initial costs for renewable energy projects and REC procurement can also act as a barrier for businesses looking to transition. Ensuring streamlined regulations, increased market awareness, and simplified participation processes will be crucial for overcoming these challenges and sustaining long-term market growth.

Market Segmentation Analysis

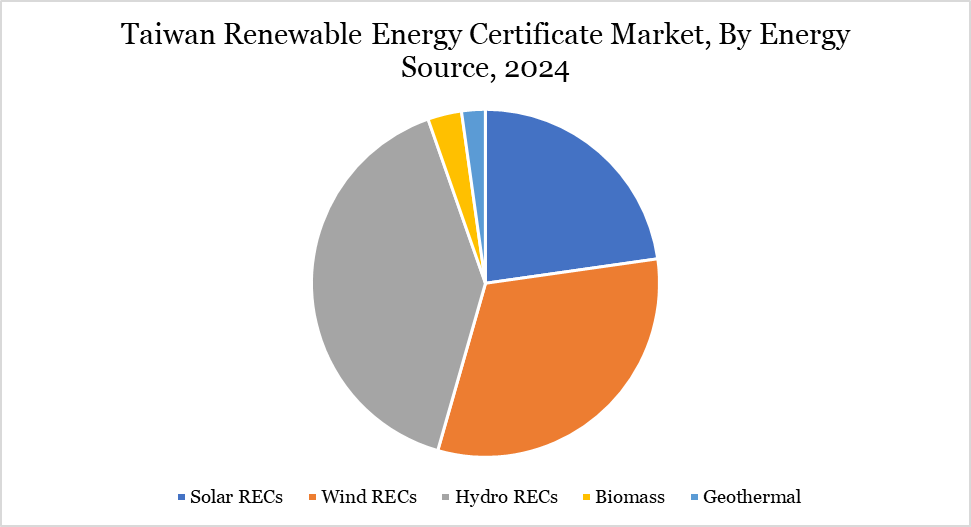

The Taiwan renewable energy certificate market is segmented based on type and energy source.

Solar REC Leading the Market due to Government Support.

Taiwan’s REC market is primarily driven by solar and offshore wind energy. Solar energy holds the largest share due to Taiwan’s favorable climate conditions and government support for photovoltaic (PV) installations. The recent partnerships, such as Google and BlackRock’s investment in New Green Power Co., further strengthen this segment. Offshore solar energy is also a key contributor, with Taiwan emerging as a regional leader in wind power development. Government policies, financial incentives, and collaborations with foreign investors continue to accelerate offshore solar project deployment. As a result, both solar sectors dominate the REC market, making Taiwan a green energy powerhouse in the region.

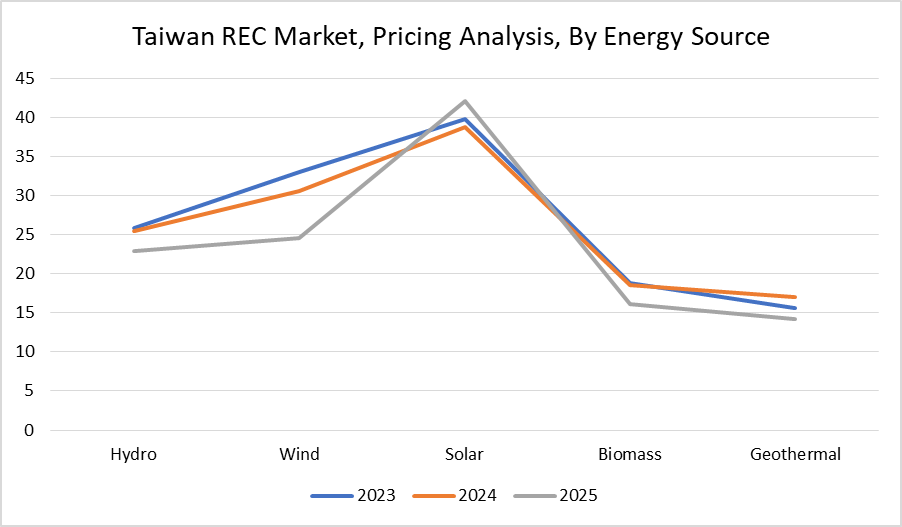

Pricing Analysis

REC pricing in Taiwan is influenced by demand from corporations, policy support, and the overall supply of renewable energy. As of 2024, one T-REC is issued per 1,000 kWh of generated power. Pricing is competitive due to strong corporate participation, with large-scale buyers such as Google and TSMC driving demand. The recent policy shift allowing more flexible PPAs has made RECs more accessible, contributing to market liquidity. However, fluctuations in renewable energy generation and policy adjustments can impact prices. Government subsidies, tax incentives, and the continued expansion of solar and offshore wind projects will play a crucial role in determining future REC prices.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies