India Orthopedic Appliances and Fracture Aids Market – Industry Trends & Outlook

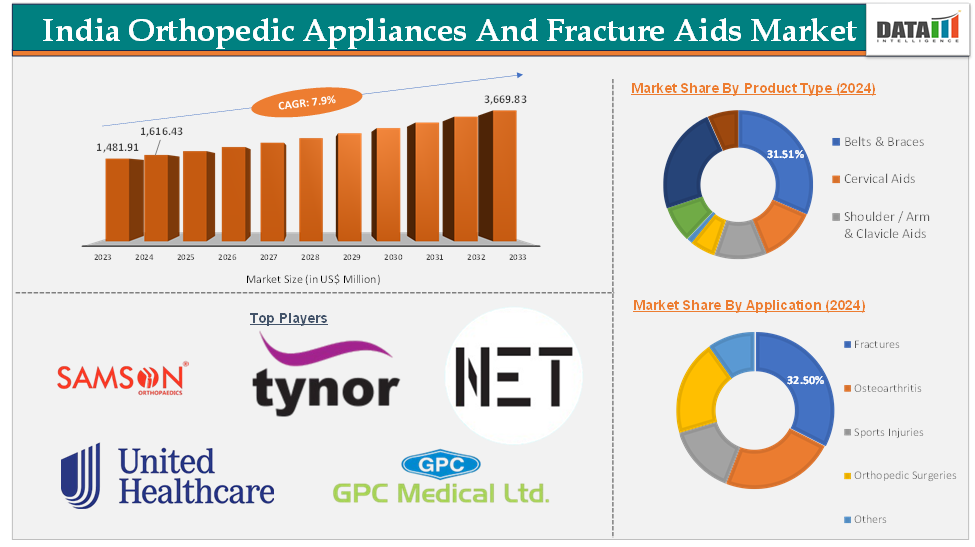

The India orthopedic appliances and fracture aids market was valued at US$ 1,481.91 Million in 2023. The market size reached US$ 1,616.43 Million in 2024 and is expected to reach US$ 3,669.83 Million by 2033, growing at a CAGR of 7.9% during the forecast period 2025-2033.

Orthopedic appliances and fracture aids are specialized medical devices designed to support, stabilize, or assist the musculoskeletal system, particularly in the management of injuries, deformities, or conditions affecting bones and joints. Orthopedic appliances include products such as braces, splints, belts, and supports, which are used to restrict or eliminate movement in an injured, weak, or deformed body part, thereby facilitating healing and improving functionality. These devices are built for repeated use and serve specific medical purposes, often prescribed following trauma, surgery, or in the presence of chronic musculoskeletal disorders.

The India orthopedic appliances and fracture aids market is expected to experience huge growth in the forecast period, driven by several significant factors. Rising incidence of fractures in India and the growth of sports and fitness culture are expected to propel the market growth by increasing the demand for these appliances and fracture aids. Additionally, an aging population & geriatric care solutions, and the integration of digital health & smart aids are expected to create opportunities for the market growth.

India Orthopedic Appliances and Fracture Aids Market – Executive Summary

India Orthopedic Appliances and Fracture Aids Market Dynamics: Drivers

Rising incidence of fractures in India

India has one of the highest rates of road traffic accidents globally. According to the Ministry of Road Transport and Highways, over 4,80,000 road accidents occur annually. These incidents often result in orthopedic injuries like fractures, boosting the demand for fracture aids such as splints, braces, and orthopedic fixators. For instance, the surge in trauma cases has increased hospital admissions requiring orthopedic intervention, thereby accelerating the demand for surgical and non-surgical orthopedic aids.

With a rapidly aging population, India is witnessing more age-related degenerative conditions such as osteoporosis and arthritis, which make bones fragile and prone to fractures even from minor falls. For instance, the elderly often require long-term orthopedic supports like walkers, canes, and joint supports, driving sustained market demand. The rise in fitness consciousness and participation in sports has also led to a higher number of sports-related injuries and fractures.

Overall, the rising incidence of fractures due to accidents, aging, and active lifestyles is directly fueling the growth of the Indian orthopedic appliances and fracture aids market. As awareness and access improve, so does the uptake of orthopedic solutions, driving market expansion across urban and rural India.

India Orthopedic Appliances and Fracture Aids Market Dynamics: Restraints

Fragmented distribution & poor last-mile reach

The fragmented distribution network and deficient last-mile logistics significantly constrain the scalability and reach of orthopedic appliances and fracture aids in India. Addressing these issues through supply chain consolidation, digital logistics platforms, and regional distribution hubs could facilitate broader market access and improve health outcomes, particularly in underserved areas.

Most major distributors and medical device suppliers are concentrated in metropolitan areas such as Delhi, Mumbai, Bengaluru, and Chennai. Outside these regions, access to orthopedic products such as braces, supports, and fixators is inconsistent. In Tier-II and Tier-III cities, orthopedic products are often available only in tertiary hospitals or select medical stores, resulting in long lead times for procurement.

The supply chain is dominated by a large number of small-scale distributors with limited logistical capabilities. These entities typically lack cold-chain storage, digital inventory systems, or efficient transportation networks, leading to delays and stockouts. Due to weak distribution coverage, orthopedic appliances often reach peripheral areas through informal channels with mark-ups of 20–30% over MRP. In turn, patients face affordability challenges and risk using substandard or counterfeit products in the absence of verified suppliers.

India Orthopedic Appliances and Fracture Aids Market Dynamics: Opportunities

Aging population & geriatric care solutions

India’s population aged 60 and above is expected to reach 194 million by 2031 (Census & Ministry of Statistics). This demographic is more prone to age-related bone disorders such as osteoporosis, arthritis, and reduced bone density, increasing susceptibility to fractures from minor falls or movements. According to the Indian Orthopaedic Association, nearly 50% of people over 60 suffer from joint or mobility issues, requiring long-term support such as walkers, canes, knee braces, lumbar belts, and fracture stabilizers.

The elderly face higher risks of hip, wrist, and spinal fractures due to falls. Recovery in such cases often involves prolonged use of orthopedic aids like commode chairs, joint supports, and physiotherapy devices. With more families opting for home-based elder care, there is a growing demand for portable and easy-to-use orthopedic appliances, including adjustable walkers, anti-slip supports, orthotic insoles, and elder-specific rehab kits.

India’s aging population is a long-term and stable growth factor, creating a market opportunity for the orthopedic appliances and fracture aids market. The shift toward preventive care, home-based recovery, and supportive government policies makes elder-specific orthopedic solutions a high-potential segment for innovation, investment, and expansion.

For more details on this report, Request for Sample.

India Orthopedic Appliances and Fracture Aids Market - Segment Analysis

The India orthopedic appliances and fracture aids market is segmented based on product type, age group, and indication.

Product Type:

The belts & braces product type segment in the India orthopedic appliances and fracture aids market was valued at US$ 509.17 Million in 2024

The belts and braces segment is experiencing a significant portion owing to the increase in musculoskeletal disorders in India, such as arthritis, back pain, and sports injuries. These injuries often require recovery time, which also requires the use of orthopedic belts and braces.

The increase in the number of orthopedic injuries in India is expected to play a significant role in holding the segment in the dominant position. For instance, every year, approximately 14% of Indians seek medical attention for this joint condition. Additionally, according to a publication by a Sports Injury Specialist and Joint Preservation Surgeon at Nexus Day Surgery Centre, it is estimated that injury rates among young athletes have significantly increased during the last 10–15 years.

Football and cricket players are suffering 500 more knee and ankle injuries. Whereas 400 more people are suffering from anterior cruciate ligament (ACL) injuries. Thus, these injuries boost the segment growth over the forecast period. In urban clinics and pharmacies, lumbar support belts and knee braces are among the top-selling orthopedic products due to a surge in sedentary lifestyles, poor posture, and back pain among IT and desk workers in India.

Belts and braces are non-invasive, over-the-counter (OTC) aids that don’t require surgery or hospital admission. They’re available at local pharmacies, online platforms (e.g., PharmEasy, Flipkart Health+), and orthopedic clinics. Domestic manufacturers like Tynor, Vissco, Flamingo, and Dyna offer a wide range of belts and braces with multiple sizes, designs, and material variants, meeting needs across demographics.

Indication:

The fractures indication segment in the India orthopedic appliances and fracture aids market was valued at US$ 525.34 Million in 2024

The fractures indication segment within the India orthopedic appliances and fracture aids market refers to the category of products and solutions specifically designed for the treatment, management, and rehabilitation of bone fractures. This segment encompasses a range of devices such as splints, braces, casts, slings, and orthotic supports, all intended to immobilize, stabilize, and support bones and joints during the healing process after a fracture.

Orthopedic appliances and fracture aids in India are primarily used to support, align, and stabilize bones, joints, and muscles following injury or surgery. These devices, which include braces, splints, casts, slings, and orthopedic shoes, are crucial for immobilizing affected areas, promoting proper healing, and providing pain relief. They are widely applied in the treatment of fractures, sprains, strains, and various musculoskeletal conditions.

The growth of the India orthopedic appliances and fracture aids market is propelled by several factors. There is a rising incidence of musculoskeletal disorders, such as arthritis, back pain, and sports injuries, which increases the demand for supportive devices. The growing elderly population, more prone to fractures and bone-related conditions, further fuels market expansion.

Technological advancements, including the development of lighter, more ergonomic, and customizable products, enhance patient comfort and compliance. Additionally, increased awareness about the benefits of early fracture management, expanding healthcare infrastructure, and greater accessibility through retail and e-commerce channels contribute to the robust growth of this market segment

India Orthopedic Appliances and Fracture Aids Market – Competitive Landscape

The major players in the India orthopedic appliances and fracture aids market include Samson Scientifics & Surgicals Pvt. Ltd., Tynor Orthotics Pvt Ltd, United Medicare, Narang Medical Limited, GPC Medical Ltd., Osteoplast Wellness Private Limited, Orthosys, Naugra Medical Lab, GWS Surgicals LLP, R.G SURGICAL, Vissco Healthcare Pvt. Ltd., Flamingo Health, Rizen Healthcare, HCM ORTHOCARE PVT.LTD, and Saket Ortho Rehab International Private Limited, among others.

India Orthopedic Appliances and Fracture Aids Market – Key Developments

In April 2025, Magniflex India launched the Riposo Orthopedic Mattress, designed to provide exceptional comfort and support by evenly distributing body weight. Addressing orthopedic concerns, the mattress helps maintain spinal alignment, reduces pressure points, and minimizes sleep disturbances. Engineered with advanced technology, it enhances posture and overall sleep quality, reinforcing Magniflex India’s dedication to innovation and superior craftsmanship.

In March 2025, MicroPort Orthopedics Inc. announced the introduction of its flagship second-generation solution, the Evolution Medial-Pivot Knee, in India. This innovative solution is designed to deliver superior flexion stability, anatomic motion, and wear-limiting design, replicating the natural stability and motion of the knee to allow superior patient outcomes after total knee replacement surgery.

India Orthopedic Appliances and Fracture Aids Market – Scope

Metrics | Details | |

CAGR | 7.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Belts & Braces, Cervical Aids, Shoulder / Arm & Clavicle Aids, Fracture Aids, Knee Support, Ankle Support, Orthopedic Splints, Others |

Age Group | Children, Adults, Geriatric | |

Indication | Fractures, Osteoarthritis, Sports Injuries, Orthopedic Surgeries, Others | |

DMI Insights:

According to DMI analysis, the India orthopedic appliances and fracture aids market was valued at US$ 1,481.91 Million in 2023. The market size reached US$ 1,616.43 Million in 2024 and is expected to reach US$ 3,669.83 Million by 2033, growing at a CAGR of 7.9% during the forecast period 2025-2033.

The growth of the India orthopedic appliances and fracture aids market is being propelled by a rising incidence of musculoskeletal disorders such as arthritis, back pain, and sports-related injuries, affecting both the aging population and younger individuals involved in athletic activities. Increasing cases of road accidents, workplace injuries, and lifestyle changes that contribute to posture-related spinal issues are also driving demand for orthopedic supports, braces, and fracture aids.

The market is further shaped by key trends like the adoption of advanced technologies, including 3D-printed implants, customized joint replacements, and minimally invasive surgical procedures, all aimed at improving patient outcomes and speeding up recovery. The expansion of telemedicine and remote consultations is making orthopedic care more accessible, particularly in rural and semi-urban areas, while breakthroughs in regenerative medicine, such as stem cell therapies, offer new alternatives to conventional treatments.

The market outlook remains highly positive, supported by ongoing investments in healthcare infrastructure, broader insurance coverage, and government initiatives to modernize medical facilities. Collaborations between domestic manufacturers and global medtech companies are enhancing the availability of innovative orthopedic solutions, and as awareness of early intervention and mobility-improving treatments increases, demand for these products is expected to continue rising, solidifying their critical role in India’s healthcare system.

The India orthopedic appliances and fracture aids market report delivers a detailed analysis with 54 key tables, more than 38 visually impactful figures, and 156 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here