India Continuous Glucose Monitoring (CGM) Market Overview

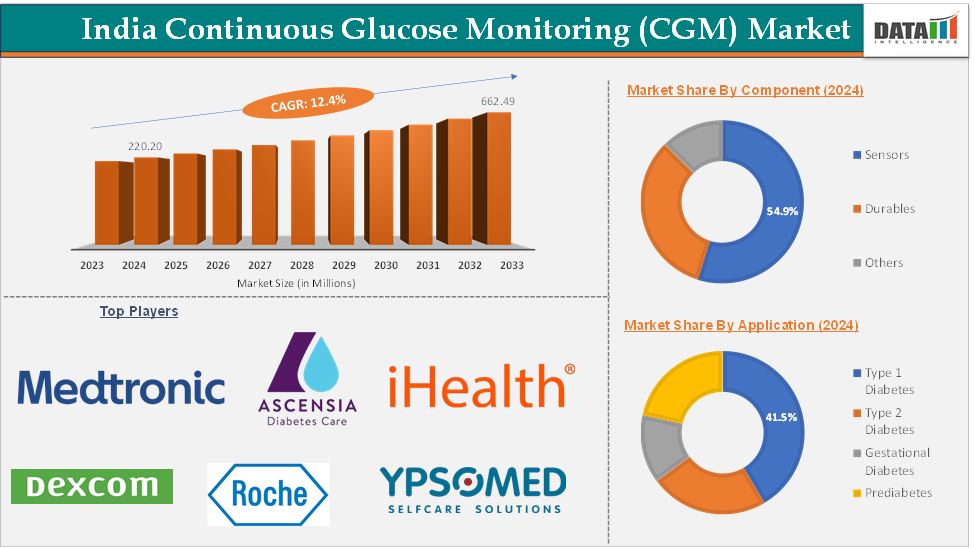

The India continuous glucose monitoring (CGM) market reached US$ 220.20 Million in 2024 and is expected to reach US$ 662.49 Million by 2033, growing at a CAGR of 12.4 % during the forecast period 2025-2033.

Continuous glucose monitoring (CGM) is an advanced technology that enables individuals, particularly those with diabetes, to continuously track their blood glucose levels throughout the day and night. CGM systems consist of a small sensor that is inserted under the skin, which measures glucose levels in the interstitial fluid. This data is then transmitted to a receiver or smartphone app, providing real-time insights into glucose trends and allowing users to make informed decisions regarding their health management.

The market was driven by a combination of rising diabetes prevalence, technological advancements, and a shift toward personalized healthcare. Additionally, ongoing innovations in sensor technology, smartphone integration, and data analytics are making CGM devices more accurate, user-friendly, and accessible, further propelling market growth.

The increasing demand for home-based healthcare, supportive government policies, and the gradual evolution of reimbursement frameworks are also expected to boost CGM adoption. Furthermore, ongoing investments, mergers, and product innovations-such as the launch of more affordable and user-friendly devices-are creating new market segments and expanding the user base.

Several key trends are shaping the future of the CGM market in India. There is a clear move toward mobile and app integration, allowing users to track and share their glucose data in real time. Personalized diabetes management is becoming a reality, with artificial intelligence and advanced analytics helping tailor treatment plans to individual needs.

Executive Summary

For more details on this report – Request for Sample

India Continuous Glucose Monitoring (CGM) Market Dynamics: Drivers

Rising prevalence of diabetes

Diabetes is a chronic condition that arises when the pancreas fails to produce sufficient insulin or when the body cannot effectively utilize the insulin it produces. Insulin is a crucial hormone responsible for regulating blood sugar levels. When diabetes is uncontrolled, it can lead to hyperglycemia, or elevated blood sugar levels, which over time can cause serious damage to various bodily systems, particularly affecting nerves and blood vessels.

According to the recent ICMR-INDIAB study, the number of people living with diabetes in India has surged by 44% between 2019 and 2023, now exceeding 101 million individuals. Managing a chronic condition like diabetes can be demanding, but individuals can adopt a holistic approach to maintain healthy glucose levels. This includes making positive lifestyle changes, engaging in regular physical activity, following a balanced diet, and consistently monitoring blood glucose levels.

India Continuous Glucose Monitoring (CGM) Market Dynamics: Restraints

High cost of CGM devices

The high cost of continuous glucose monitoring (CGM) systems can be prohibitively high for many patients, especially in a country where a substantial portion of the population lacks access to adequate healthcare resources. The initial investment required for the device, along with the ongoing expenses for sensor replacements, can discourage patients from adopting this technology, thereby limiting its market penetration.

The India continuous glucose monitoring (CGM) market faces significant challenges due to the high costs associated with CGM systems, which can deter many potential users. For instance, Abbott’s FreeStyle Libre System is priced at approximately ₹11,000 for the reader and biosensor, with the sensor costing around ₹5,000 and providing continuous readings for 14 days. This recurring expense can be a financial burden for many consumers, especially in a country where many individuals live on limited incomes.

The initial investment required for CGM devices, combined with the ongoing costs of sensor replacements, poses a significant barrier to adoption. Many households may struggle to allocate funds for such advanced medical technology, particularly when basic healthcare needs are often unmet. As a result, the high price point limits market penetration and accessibility for individuals who could benefit from continuous glucose monitoring. Thus, the above factors could be limiting India's continuous glucose monitoring (CGM) market's potential growth.

India Continuous Glucose Monitoring Market Segment Analysis

The India continuous glucose monitoring (CGM) market is segmented based on component, application, and end-user.

Component:

The sensor component segment is expected to hold 54.9% of the India continuous glucose monitoring (CGM) market share in 2024

Sensors are fundamental elements of continuous glucose monitoring (CGM) systems, designed to continuously measure glucose levels in the interstitial fluid beneath the skin. By providing real-time data, these sensors enable users to monitor their blood glucose levels throughout the day and night, eliminating the need for frequent finger-prick tests.

The sensors utilized in continuous glucose monitoring (CGM) systems typically consist of a small electrode that measures glucose levels. They are inserted under the skin and can function for several days before needing replacement. Several leading sensor products are available in India, including the FreeStyle Libre Pro (14-day sensor), Dexcom G4 (10-day sensor), and Medtronic Guardian (7-day sensor). These sensors are designed for ease of use, with some models allowing users to download glucose data within seconds.

Technological advancements are further improving sensor accuracy, wear time, and user comfort, while new developments such as non-invasive and microneedle-based sensors are emerging to address the need for painless, longer-lasting, and cost-effective solutions. The sensors segment is not only the largest but also one of the fastest-growing areas in the Indian CGM market, driven by rising diabetes rates, technological innovation, and increasing adoption of real-time and minimally invasive monitoring solutions.

Furthermore, as manufacturers continue to innovate and enhance sensor technology, this segment will play a vital role in improving patient outcomes and expanding access to continuous glucose monitoring solutions across India. For instance, in November 2023, Abbott launched the FreeStyle LibreLink mobile app in India, a significant advancement in diabetes management technology.

This app allows users of the FreeStyle Libre system to monitor their glucose levels conveniently on their smartphones without needing painful finger pricks. These factors have solidified the segment's position in the India continuous glucose monitoring (CGM) market.

India Continuous Glucose Monitoring (CGM) Market Major Players

The major players in the India continuous glucose monitoring (CGM) market include Abbott, Dexcom, Inc., Medtronic Pvt. Ltd., Ascensia Diabetes Care Holdings AG., F. Hoffmann-La Roche Ltd, iHealth Labs Inc., Ypsomed AG, Medtrum Technologies Inc., Menarini Diagnostics s.r.l, and Nemaura, among others.

Key Developments

In April 2025, Ambrosia launched India's first 24x7 real-time glucose and stress monitoring service after its successful rollout in the United States and Europe. This innovative service is designed to address the growing burden of diabetes and stress-related disorders in India, a country with over 100 million people affected by diabetes and millions more experiencing chronic stress.

In September 2024, Trinity Biotech plc, a company specializing in human diagnostics and diabetes management solutions, announced plans to conduct an in-country study in India as part of its global launch strategy for its next-generation continuous glucose monitoring (CGM) technology. This initiative aims to gather valuable feedback from diabetes patients and healthcare professionals in India to refine the product specifically for the Indian market.

In August 2024, Medtronic and Abbott, two of the world’s leading medical technology companies, formed a global partnership to integrate Abbott’s FreeStyle Libre continuous glucose monitoring (CGM) technology with Medtronic’s automated insulin delivery (AID) systems and smart insulin pens. This collaboration is designed to address Medtronic’s recent struggles in the diabetes care market and to provide patients with a more advanced, user-friendly diabetes management solution.

Market Scope

Metrics | Details | |

CAGR | 12.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Component | Sensors, Durables, Others |

Application | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes | |

End-User | Hospitals & Clinics, Homecare Settings, Diagnostic Centers, Others | |