India CAR-T Cell Therapy Market Size & Industry Outlook

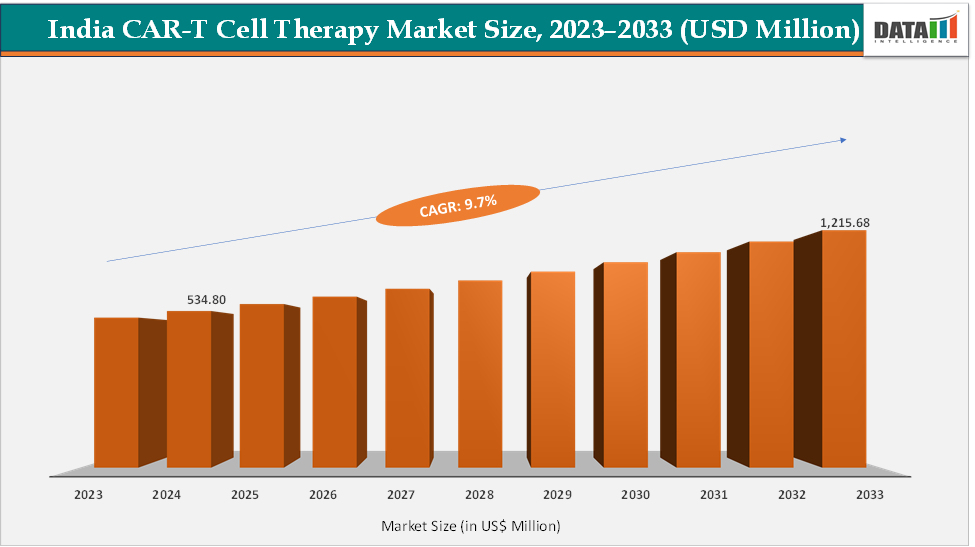

The India CAR-T cell therapy market size reached US$ 534.80 Million in 2024 from US$ 491.95 Million in 2023 and is expected to reach US$ 1,215.68 Million by 2033, growing at a CAGR of 9.7% during the forecast period 2025-2033. The approval of NexCAR19 in 2023 marked a major inflexion point for India’s CAR-T cell therapy market, proving that world-class innovation could emerge domestically at a fraction of global costs. Developed by IIT Bombay, Tata Memorial Centre, and ImmunoACT, it demonstrated the feasibility of local R&D, manufacturing, and clinical application within India’s ecosystem. Its success has boosted investor and government confidence, accelerated regulatory momentum, and paved the way for more indigenous CAR-T programs, making India a potential hub for affordable, accessible advanced cell therapies.

Beyond ImmunoACT, other Indian firms such as Immuneel Therapeutics, Laurus Bio, Intas, and others are focusing on CAR-T pipelines and GMP manufacturing infrastructure, signaling a maturing ecosystem. Academic and clinical institutions like AIIMS Delhi, Christian Medical College Vellore, and Tata Memorial Centre are conducting trials and building CAR-T-ready facilities, expanding treatment access beyond metro cities.

The success of NexCAR19 has also accelerated regulatory momentum, with the Central Drugs Standard Control Organization (CDSCO) drafting clearer frameworks for Advanced Therapy Medicinal Products (ATMPs). Together, these factors, indigenous R&D capability, cost-effective manufacturing, expanding infrastructure, and supportive policy, are positioning India as a regional hub for affordable and scalable CAR-T therapies, bridging the gap between cutting-edge innovation and real-world accessibility for thousands of cancer patients.

Key Market Highlights

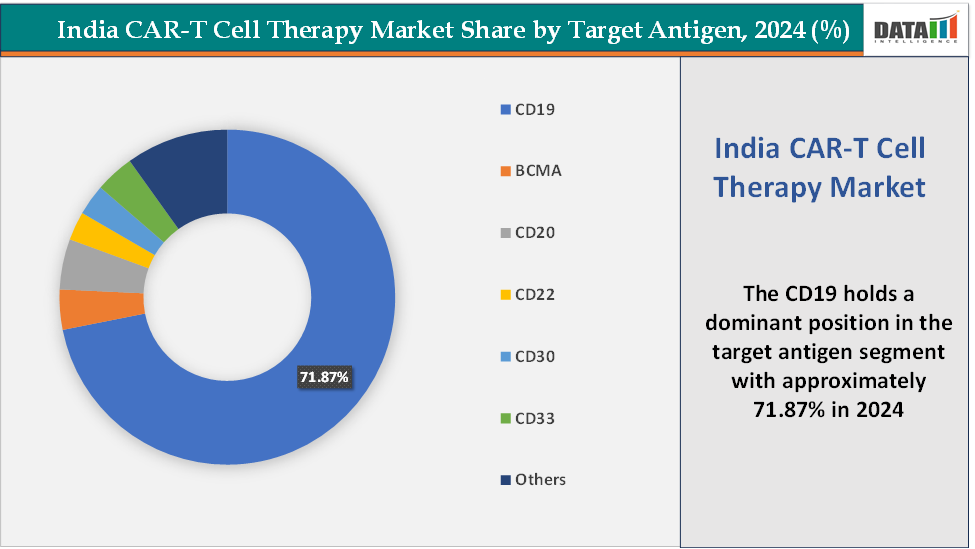

- Based on target antigen, the CD19 segment led the market with the largest revenue share of 71.87% in 2024.

- The major market players in the India CAR-T cell therapy market are ImmunoACT and Immuneel Therapeutics, among others

Market Dynamics

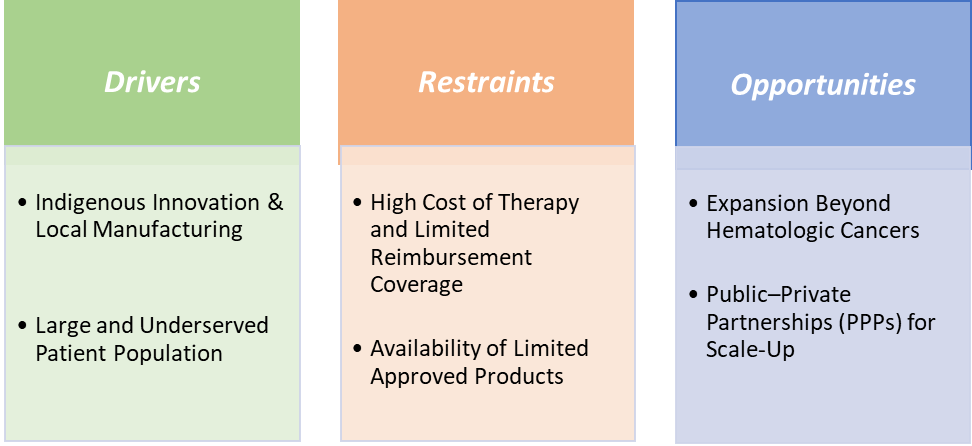

Drivers: Indigenous innovation & local manufacturing are significantly driving the India CAR-T cell therapy market growth

Indigenous innovation and local manufacturing are accelerating India’s CAR-T market by turning what was once imported, prohibitively expensive technology into an on-shore, scalable industry that fits India’s cost and access realities. The approval and launch of NexCAR19 in October 2023, developed by IIT Bombay, Tata Memorial Centre and ImmunoACT, proved end-to-end domestic capability and first CAR-T cell therapy product in India and created a price benchmark that is dramatically lower than Western alternatives, boosting payer, hospital and investor interest.

This continuous indigenous innovation further accelerates the market growth by launching various products in India. For instance, in January 2025, India’s Central Drugs Standard Control Organization (CDSCO) approved varnimcabtagene autoleucel (var-cel), a CD19-targeted chimeric antigen receptor (CAR) T-cell therapy, to treat adult patients with relapsed or refractory B-cell non-Hodgkin’s lymphoma. Var-cel, marketed as Qartemi by Immuneel Therapeutics, received approval based on findings from the phase 2 IMAGINE trial, which took place at hospitals throughout India and reported an 83.3% overall response rate at 90 days among patients who received the treatment. The therapy is India’s second indigenously developed CAR T-cell therapy and the first in India to be benchmarked to global standards.

The visible success of an indigenous product has catalysed private capital and international collaborations, all of which shorten commercialization cycles for new constructs and position India as a cost-effective regional hub for CAR-T development and export.

Restraints: The availability of limited approved products is hampering the growth of the market

The limited availability of approved CAR-T products currently restricted to NexCAR19 (talicabtagene autoleucel) and Qartemi (varnimcabtagene autoleucel), is one of the key factors slowing the broader growth of India’s CAR-T cell therapy market. While both therapies target CD19-positive B-cell malignancies, their scope covers only a narrow set of indications, such as relapsed or refractory acute lymphoblastic leukemia and non-Hodgkin lymphoma, leaving large unmet needs in other cancers, especially solid tumors, unaddressed.

With only two commercial suppliers, treatment capacity remains limited, and manufacturing bottlenecks mean long waiting times for patients. Most treatment centres are still concentrated in metro cities like Mumbai, Delhi, and Bengaluru, which restricts accessibility for patients from Tier-2 and rural areas. The lack of diversity in available products also limits physician familiarity and clinical experience, slowing adoption and referrals. In contrast, mature markets like the U.S. have multiple approved CAR-T therapies across different targets, driving both innovation and affordability. Until India’s product portfolio expands beyond NexCAR19 and Qartemi to include new antigens and next-generation constructs, the market’s growth trajectory will remain constrained despite strong underlying demand and government support.

List of Approved Products in India:

For more details on this report – Request for Sample

CAR-T Cell Therapy Market, Segment Analysis

The India CAR-T cell therapy market is segmented based on therapy type, target antigen, and application.

Target Antigen: The CD19 segment is dominating and the fastest-growing in the India CAR-T cell therapy market, with a 71.87% share in 2024

The CD19 segment dominates India’s CAR-T market because CD19 is a proven, high-value antigen for the B-cell malignancies that make up the clearest early commercial use-case for CAR-T (relapsed/refractory ALL, DLBCL and other B-cell lymphomas), so most developers initially target it. Clinical precedent from product approvals in India established strong efficacy and regulatory pathways for CD19 CAR-T, lowering technical and clinical risk for Indian developers to follow the same route.

For instance, in January 2025, Immuneel Therapeutics announced that India’s Central Drugs Standard Control Organization (CDSCO) approved varnimcabtagene autoleucel (var-cel), marketed as Qartemi, a CD19-targeted chimeric antigen receptor (CAR) T-cell therapy, to treat adult patients with relapsed or refractory B-cell non-Hodgkin’s lymphoma. Qartemi received approval based on findings from the phase 2 IMAGINE trial, which took place at hospitals throughout India and reported an 83.3% overall response rate at 90 days among patients who received the treatment.

Similarly, India’s first indigenous CAR-T, NexCAR19 (actalycabtagene autoleucel), is a humanized anti-CD19 product whose CDSCO approval in October 2023 and commercial launch in 2024 created the first home-grown, lower-cost benchmark for CD19 CAR-T in India, rapidly validating the market and accelerating clinician referrals.

Competitive Landscape

Top companies in the CAR-T cell therapy market include ImmunoACT and Immuneel Therapeutics, among others.

Market Scope

| Metrics | Details | |

| CAGR | 9.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Therapy Type | Allogeneic CAR-T Cell Therapy and Autologous CAR-T Cell Therapy |

| Target Antigen | CD19, BCMA (B-cell maturation antigen), CD20, CD22, CD30, CD33, and Others | |

| Application | Acute Lymphoblastic Leukemia (ALL), Non-Hodgkin Lymphoma, Chronic Lymphocytic Leukemia (CLL), Multiple Myeloma (MM), Follicular Lymphoma, and Others | |

The India CAR-T cell therapy market report delivers a detailed analysis with 15 key tables, more than 24 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here