Rheumatoid Arthritis Drugs Market Size& Industry Outlook

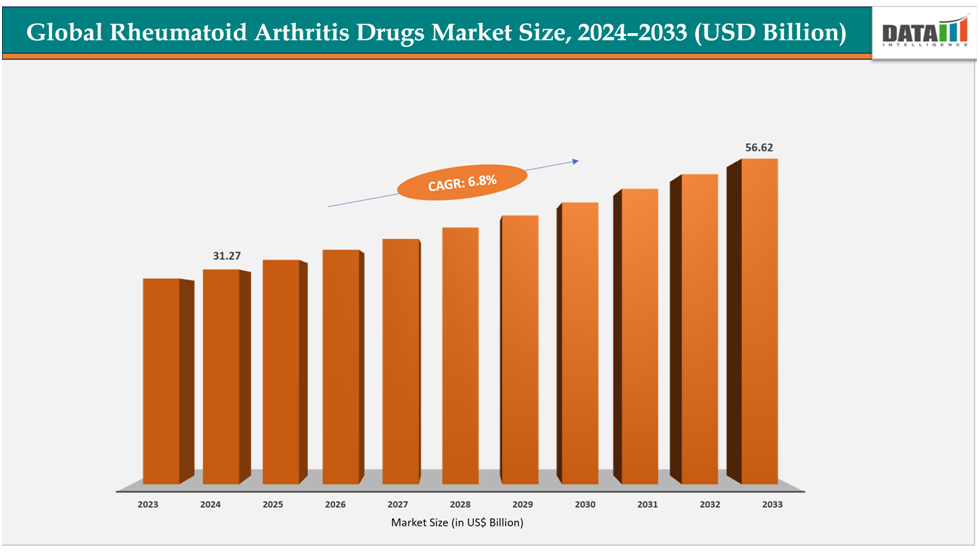

The global rheumatoid arthritis drugs market size reached US$31.27billion in 2024 is expected to reach US$ 56.62billion by 2033, growing at a CAGR of 6.8%during the forecast period 2025-2033.Increased awareness among patients and healthcare professionals about rheumatoid arthritis (RA) and its early symptoms is a key driver of the global RA drugs market. Early diagnosis and timely treatment are vital to prevent joint damage and enhance patient outcomes. Campaigns by organizations like the Arthritis Foundation and advocacy groups have significantly educated individuals on recognizing symptoms such as joint stiffness and fatigue. This has led to an uptick in the use of disease-modifying anti-rheumatic drugs (DMARDs), biologics, and targeted therapies. Moreover, healthcare providers are actively screening high-risk individuals and monitoring disease progression, further boosting demand for effective RA treatments and contributing to market growth.

Key Highlights

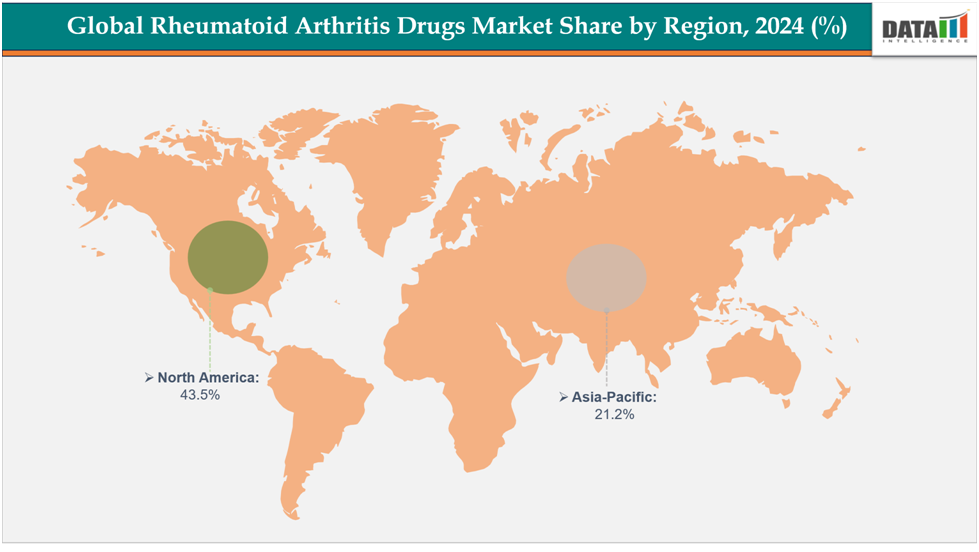

- North America dominatesthe rheumatoid arthritis drugs market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of8.1% over the forecast period.

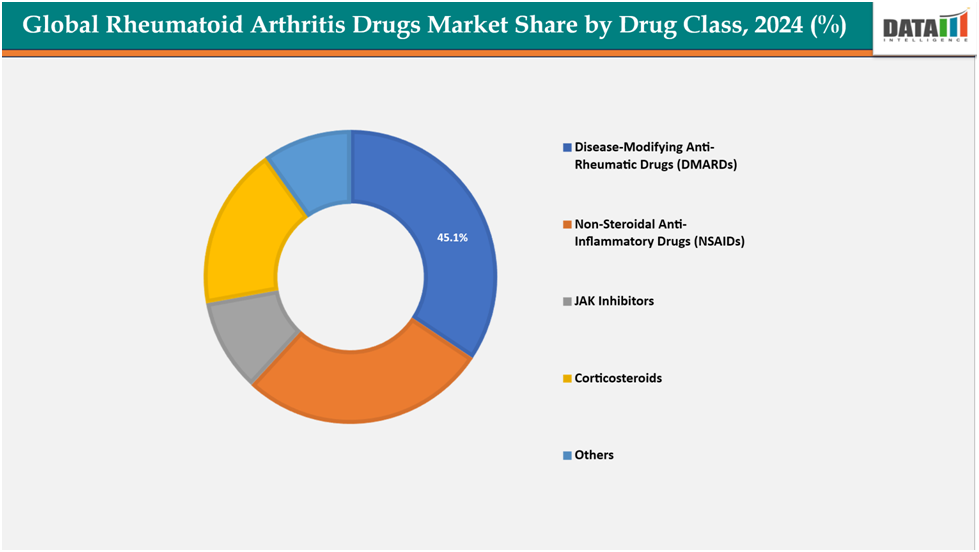

- Based on drug class, disease-modifying anti-rheumatic drugs (DMARDs)segmented the market with the largest revenue share of 45.1% in 2024.

- The major market players in the rheumatoid arthritis drugs market includes AbbVie Inc, Bristol-Myers Squibb Company, Eli Lilly and Company, Regeneron Pharmaceuticals, Inc., Genentech USA, Inc., Pfizer Inc, Amgen Inc, Janssen Biotech, Inc, Teva Pharmaceutical Industries Limited and among others.

Market Dynamics

Drivers: Rising prevalence of rheumatoid arthritis is significantly driving the rheumatoid arthritis drugs market growth

The rising prevalence of rheumatoid arthritis significantly drives the growth of the RA drugs market by increasing the demand for effective treatments. As more individuals are diagnosed, healthcare providers and pharmaceutical companies prioritize early intervention and access to advanced therapies, including DMARDs, biologics, and targeted treatments. This expanding patient base stimulates research, innovation, and adoption of new drugs, making the growing prevalence a key factor fueling market expansion.

For instance, Rheumatoid arthritis (RA) is a chronic inflammatory disorder that primarily affects the joints, with a global prevalence estimated at 0.5–1.0% according to epidemiological studies. The condition disproportionately impacts females, with a male-to-female ratio ranging from 1:2 to 1:3, and can occur at any age, most commonly peaking around 60 years. The incidence of RA varies over time and across regions, reflecting the influence of both genetic predisposition and environmental factors.

Restraints:

Strict regulatory frameworks are hampering the growth of the rheumatoid arthritis drugs market

One of the major challenges in the rheumatoid arthritis drugs market is the high cost of treatment, particularly for advanced therapies such as biologics and targeted synthetic DMARDs. These medications often require long-term administration and frequent monitoring, which increases the financial burden on patients and healthcare systems. The cost of biologic drugs for RA can range from $10,000 to $30,000 per year, with some treatments exceeding $40,000 annually.

High costs can limit accessibility, especially in low- and middle-income regions, leading to delayed treatment initiation or reliance on less effective alternatives. Consequently, the economic barrier posed by expensive therapies can hinder market growth and restrict the reach of innovative RA treatments to a broader patient population.

For more details on this report – Request for Sample

Segmentation Analysis

The global rheumatoid arthritis drugs market is segmented based on drug class, route of administration, distribution channel, and region.

Drug Class:

The Disease-Modifying Anti-Rheumatic Drugs (DMARDs) from Drug Class segment to dominate the Rheumatoid Arthritis Drugs market with a 45.1% share in 2024

The Disease-Modifying Anti-Rheumatic Drugs (DMARDs) segment is crucial for the growth of the rheumatoid arthritis (RA) drugs market. DMARDs encompass a variety of therapeutic options, including conventional synthetic agents, biologics, and targeted therapies such as JAK inhibitors. These drugs are integral to RA treatment as they not only relieve symptoms but also decelerate disease progression and mitigate joint damage. Their capacity to alter the fundamental autoimmune processes characteristic of RA positions them as the preferred treatment choice for healthcare providers, especially for patients with moderate to severe forms of the disease.

Ongoing advancements in DMARD development, focusing on enhanced efficacy and safety profiles, have led to their increasing integration into early-stage RA management. This trend has significantly broadened the demographic of patients benefiting from such therapies. As a result, the rising adoption of DMARDs has become a pivotal factor driving the market, fostering research initiatives, boosting production, and promoting commercial advancements across the global RA pharmacological landscape.

Route of Administration:

The oral segment is estimated to have a 40.1% of the rheumatoid arthritis drugs market share in 2024

The oral route segment is a significant driver in the rheumatoid arthritis drugs market due to its convenience, patient compliance, and ease of administration compared to injectable therapies. Oral drugs such as conventional DMARDs (e.g., methotrexate, leflunomide) and newer targeted synthetic DMARDs like JAK inhibitors have gained strong adoption, as they eliminate the need for hospital visits or complex administration procedures. This accessibility makes them especially appealing for long-term disease management, where adherence plays a critical role in treatment outcomes.

Moreover, the rising preference for at-home therapies and the ongoing development of next-generation oral agents with enhanced safety and efficacy profiles further strengthen the growth of this segment, positioning the oral route as a key driver of market expansion.

Geographical Analysis

North America dominates the global Rheumatoid Arthritis Drugs market with a 43.5% in 2024

North America drives the RA drugs market through strong healthcare infrastructure, high diagnosis rates, and widespread availability of advanced biologics and targeted therapies. Supportive reimbursement frameworks and continuous R&D investment by leading pharmaceutical companies further fuel market growth in the region. In the U.S., the market is propelled by the high prevalence of RA, rapid adoption of innovative therapies such as JAK inhibitors, and strong presence of key players like AbbVie, Pfizer, and Amgen. Patient advocacy initiatives and favorable insurance coverage also encourage early diagnosis and treatment uptake.

For instance, in September 2025, Researchers at the Allen Institute, in collaboration with the CU Anschutz, University of California San Diego, and Benaroya Research Institute, have made significant advancements in understanding rheumatoid arthritis through a study published in the journal Science Translational Medicine. This research provides the most comprehensive visualization of the immune system changes that occur in individuals at risk of developing rheumatoid arthritis, well before any symptoms manifest.

Europe is the second region after North America which is expected to dominate the global Rheumatoid Arthritis Drugs market with a 34.5% in 2024

Europe’s market growth is driven by robust regulatory support, government-funded healthcare systems, and rising adoption of biosimilars, which enhance affordability and access. Increasing awareness campaigns and clinical guidelines promoting early intervention further strengthen drug uptake across the region.

Germany is a leading market within Europe due to its, growing prevalence rate, high biologics adoption rate, and significant investment in clinical research. The country’s emphasis on innovation and strong reimbursement policies makes it a key driver of RA drug demand.

For instance, in the baseline scenario, rheumatoid arthritis (RA) cases are expected to rise by 417,000 among women and 179,000 among men by 2040, with the highest numbers occurring in the 70-80 age group, notably among women. In a more favorable scenario, assuming a decline in incidence, total RA cases are projected to increase by 284,000 by 2040, representing a 38% rise from 2015.

The Asia Pacific region is the fastest-growing region in the global Rheumatoid Arthritis Drugs market, with a CAGR of 8.1% in 2024

The Asia Pacific market is fueled by growing patient populations, rising awareness of autoimmune diseases, and expanding access to advanced therapies. Economic development and improving healthcare infrastructure in countries like China and India are creating new opportunities for both branded and biosimilar RA drugs.

In Japan, market growth is driven by a rapidly aging population with higher RA incidence, early adoption of innovative biologics and targeted therapies, and government initiatives to improve access to advanced treatments. Strong domestic pharma players also support the expansion of the RA drugs market.

For instance, in May 2024, in Eisai Co., Ltd and Nippon Medac Co., Ltd. a subsidiary of the Medac Group has announced the launch of the anti-rheumatic agent Metoject Subcutaneous Injection in Japan. The product is available in 7.5 mg Pen (0.15 mL), 10 mg Pen (0.20 mL), 12.5 mg Pen (0.25 mL), and 15 mg Pen (0.30 mL) formulations, containing methotrexate (MTX)

Competitive Landscape

Top companies in the rheumatoid arthritis drugs market include AbbVie Inc, Bristol-Myers Squibb Company, Eli Lilly and Company, Regeneron Pharmaceuticals, Inc., Genentech USA, Inc., Pfizer Inc., Amgen Inc, Janssen Biotech, Incō, Teva Pharmaceutical Industries Limitedand among others.

AbbVie Inc:-AbbVie Inc. plays a pivotal role in the global rheumatoid arthritis drugs market through its portfolio of advanced therapies, particularly biologics and targeted synthetic DMARDs. The company’s flagship product, Humira (adalimumab), has long been a leading treatment for RA, offering TNF inhibition to reduce inflammation and slow disease progression. Additionally, AbbVie’s Rinvoq®(upadacitinib), a JAK inhibitor, provides a targeted oral therapy option for patients who have had an inadequate response to conventional treatments.

Market Scope

| Metrics | Details | |

| CAGR | 6.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Class | Disease-Modifying Anti-Rheumatic Drugs (DMARDs), Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), JAK Inhibitors Corticosteroids, Others |

| Route of Administration | Oral, Parenteral | |

| Distribution Channel | Hospital Pharmacies, Online Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Rheumatoid Arthritis Drugs market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here