Global Hypersonic Vehicle Market: Industry Outlook

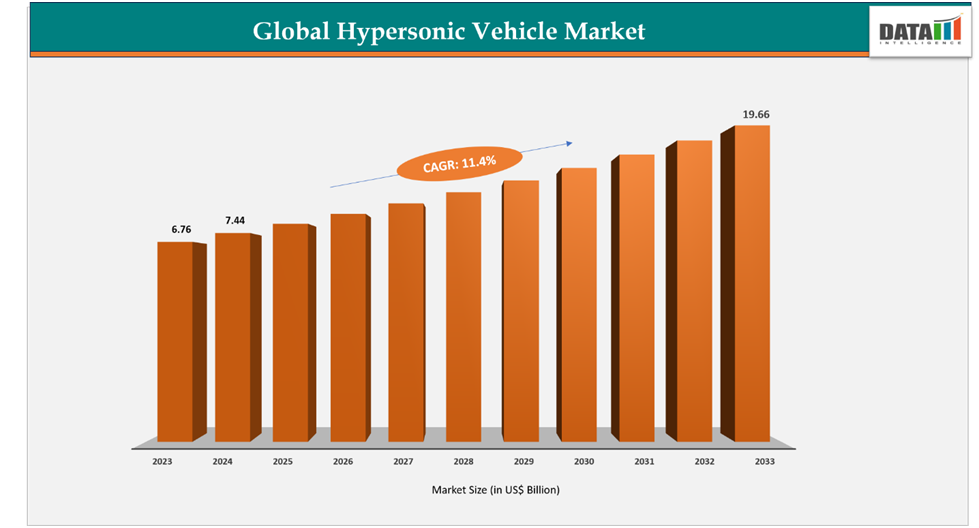

The global hypersonic vehicle market reached US$ 6.76 billion in 2023, with a rise to US$ 7.44 billion in 2024, and is expected to reach US$ 19.66 billion by 2033, growing at a CAGR of 11.4% during the forecast period 2025–2033.

The global hypersonic vehicle market is witnessing strong growth, fueled by rising defense requirements, rapid technological advancements, and intensifying geopolitical competition. Hypersonic vehiclescapable of traveling at speeds above Mach 5are increasingly being developed for strategic strike missions, missile defense, and advanced reconnaissance. This growth is further supported by large-scale R&D investments, modernization initiatives, and collaborations between governments and leading aerospace contractors.

The US is at the forefront of the hypersonic vehicle market, driven by its extensive defense programs and focus on maintaining technological superiority. In 2024, the US deployed a hypersonic missile-interceptor system with a 1,000-mile range near China, highlighting its efforts to counter hypersonic threats and strengthen its Indo-Pacific security posture. With deep R&D capabilities, advanced infrastructure, and strong partnerships with defense primes, the U.S. continues to dominate global hypersonic innovation and deployment.

Japan is rapidly advancing its position in the market as part of its broader defense modernization agenda. In 2024, Japan released footage of the first test launch of a homegrown hypersonic missile, underscoring its commitment to indigenous development and enhanced deterrence capabilities. Supported by growing defense budgets, strategic collaborations, and a focus on advanced aerospace technology, Japan is emerging as a key player in the Asia-Pacific hypersonic landscape.

Key Market Trends & Insights

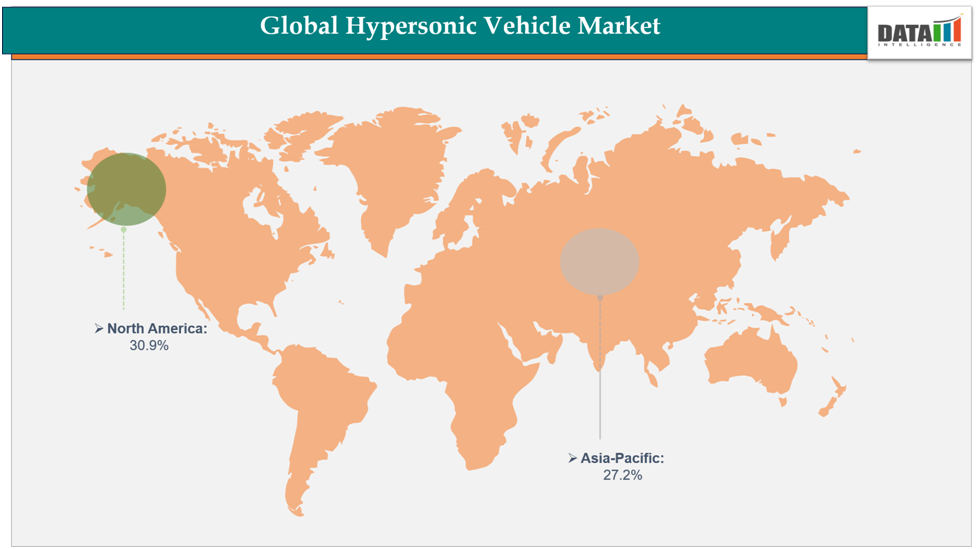

North America held approximately 30.9% of the global hypersonic vehicle market in 2024 and is expected to maintain its dominance throughout the forecast period. This strong position is driven by substantial defense spending, advanced R&D programs, and ongoing testing of next-generation systems. For example, the US conducted a hypersonic missile test in mid-March 2024 but chose not to publicize the event widely in order to avoid heightening tensions with Russia. Such developments highlight the region’s focus on strengthening strategic capabilities while balancing geopolitical sensitivities.

Asia-Pacific is anticipated to be the fastest-growing market, supported by large-scale investments in defense modernization and growing security challenges. China recently unveiled a Mach 10 hypersonic cruise missile alongside its first ship-launched YJ-19, YJ-20, YJ-15, and YJ-17 systems, signaling a major leap in naval strike power and intensifying the Indo-Pacific arms race. At the same time, Japan showcased video footage of its maiden hypersonic missile test, reinforcing its commitment to advanced strike capabilities and regional defense readiness.

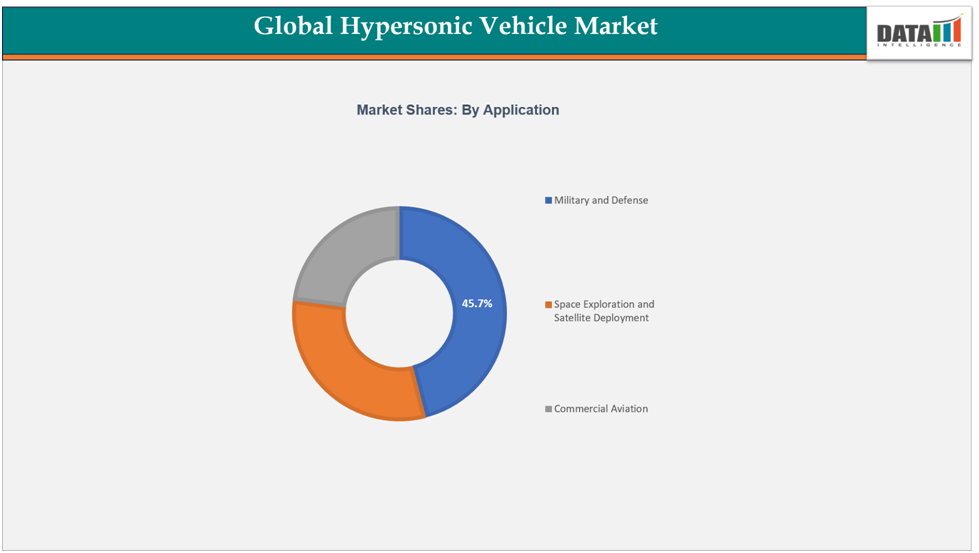

The Military and Defense segment continues to dominate market demand, as hypersonic vehicles play a crucial role in long-range precision strike, deterrence, and missile defense operations. Their expanding deployment across air, land, and sea platforms reflects their growing strategic importance, supported by advancements in propulsion, thermal protection systems, and AI-based guidance technologies.

Market Size & Forecast

2024 Market Size: US$7.44 Billion

2033 Projected Market Size: US$19.66 Billion

CAGR (2025–2033): 11.4%

North America: Largest market in 2024

Asia-Pacific: Fastest-growing market

Drivers & Restraints

Driver: Rising Defense Investments

The global hypersonic vehicle market is expanding rapidly, fueled by increasing defense investments and efforts to modernize military capabilities across air, land, and naval platforms. Nations are focusing on indigenous technologies, autonomous systems, and advanced propulsion and guidance solutions, which are driving innovation and accelerating deployment of hypersonic weapons.

For instance, India is enhancing its defense capabilities through domestic programs. The Defense Research and Development Organization (DRDO) is developing hypersonic missiles and long-range air defense systems, while the Brahma's missile is being upgraded to a smaller, more versatile variant. The Advanced Medium Combat Aircraft (AMCA) fighter jet is designed to counter emerging threats with advanced autonomous features, and naval weapons programs are approaching induction. These initiatives highlight how growing defense investments are fueling the global hypersonic vehicle market and reinforcing strategic military readiness.

Restraint: High Development Costs

Despite their strategic significance, hypersonic vehicles face substantial development costs that can limit adoption. Building and deploying these systems requires advanced materials, high-performance propulsion technologies, and specialized testing infrastructure, all of which demand significant financial resources.

Even well-funded programs encounter budgetary pressures due to the costs associated with R&D, flight testing, and thermal protection systems. Without sustained government support, cost optimization, and potential international collaborations, high development expenses are likely to remain a major barrier to the market’s sustained growth.

For more details on this report - Request for Sample

Segmentation Analysis

The global hypersonic vehicle market is segmented based on vehicle type, component, application and region.

Application:

The Military and Defense segment represents an estimated 45.7% of the global hypersonic vehicle market and continues to be the dominant application due to its crucial role in long-range strike, missile defense, and strategic deterrence. Hypersonic vehicles are increasingly deployed across air, land, and naval platforms, providing rapid, precise, and resilient capabilities for modern defense operations.

Companies in this space focus on developing high-performance hypersonic systems with advanced propulsion, navigation, and guidance technologies to ensure real-time targeting and operational reliability. Market growth is driven by rising defense expenditures, modernization programs, and heightened geopolitical tensions. Major players such as Lockheed Martin, Raytheon Technologies, Northrop Grumman, and Boeing lead the market with sophisticated platforms, while emerging entrants are creating modular, versatile, and mission-specific solutions for tactical deployments.

Regional developments further reinforce growth. For example, on September 14, 2025, Russia launched a Zircon (Tsirkon) hypersonic cruise missile at a target in the Barents Sea during joint military exercises with Belarus as part of the Zapad 2025 drills, conducted across Russia, Belarus, and the Baltic and Barents Seas. Such events highlight the strategic importance of hypersonic vehicles in defense and demonstrate their growing role in regional security operations.

Looking ahead, the Military and Defense segment is expected to maintain its leading position, fueled by demand for rapid strike capabilities, missile defense solutions, and strategic deterrence. While high development costs and technical challenges persist, ongoing advancements in propulsion, materials, and AI-guided navigation are likely to sustain robust growth in this segment.

Geographical Analysis

The North America hypersonic vehicle market was valued at 30.9%market share in 2024

The North America hypersonic vehicle market held approximately 30.9% of the global share in 2024 and remains the largest regional contributor. Growth is fueled by substantial defense budgets, advanced R&D programs, and strong technological capabilities. For instance, the Boundary Layer Transition 1B (BOLT-1B) experiment, a collaboration between the US Air Force Research Laboratory (AFRL), Johns Hopkins Applied Physics Laboratory (APL), and the German Aerospace Center (DLR), launched from Andøya Space in Norway on September 2, 2024. Traveling at Mach 7.2 over the Norwegian Sea, the experiment delivered critical insights into hypersonic airflow, demonstrating North America’s leadership in hypersonic research and testing. Ongoing defense partnerships and technological innovation continue to reinforce the region’s dominance in the global hypersonic market.

The Asia-Pacific hypersonic vehicle market was valued at 27.2% market share in 2024

The Asia-Pacific hypersonic vehicle market is expected to be the fastest-growing region, driven by increasing defense modernization, maritime security investments, and advanced weapons development programs. Countries such as China, Japan, and South Korea are leading regional growth with indigenous hypersonic initiatives. Notably, China unveiled a Mach 10 hypersonic cruise missile and the first ship-launched YJ-19, YJ-20, YJ-15, and YJ-17 systems, marking a significant expansion in naval strike capabilities and intensifying the Indo-Pacific arms race. Government-backed programs and regional defense collaborations are accelerating the adoption of hypersonic vehicles, boosting Asia-Pacific’s contribution to the global market.

Competitive Landscape

The major players in the hypersonic vehicle market include Lockheed Martin Corporation, RTX, Northrop Grumman, The Boeing Company, BAE Systems, Thales, MBDA, L3Harris Technologies, Inc, HERMEUS CORP, Hypersonic Launch Systems Pty Ltd

Lockheed Martin Corporation: Lockheed Martin Corporation is a leading global aerospace and defense company specializing in advanced technology solutions, including hypersonic vehicles, missile systems, and strategic defense platforms. The company plays a pivotal role in the development, testing, and deployment of next-generation hypersonic weapons for air, land, and naval applications. Leveraging strong R&D capabilities, government partnerships, and cutting-edge propulsion and guidance technologies, Lockheed Martin continues to drive innovation in rapid-strike and missile defense systems. Its projects include the design and testing of hypersonic cruise missiles and boost-glide vehicles, positioning the company as a dominant player in the expanding global hypersonic vehicle market.

Market Scope

Metrics | Details | |

CAGR | 11.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Vehicle Type | Hypersonic Glide Vehicles (HGVs), Hypersonic Cruise Missiles, Hypersonic Aircraft and Spaceplanes |

| Component | Propulsion Systems, Aero structures and Materials, Avionics and Guidance Systems, Warheads |

| Application | Military and Defense, Space Exploration and Satellite Deployment, Commercial Aviation |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global hypersonic vehicle market report delivers a detailed analysis with 62 key tables, more than 53visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.