Advanced Rocket and Missile Propulsion Systems Market Overview

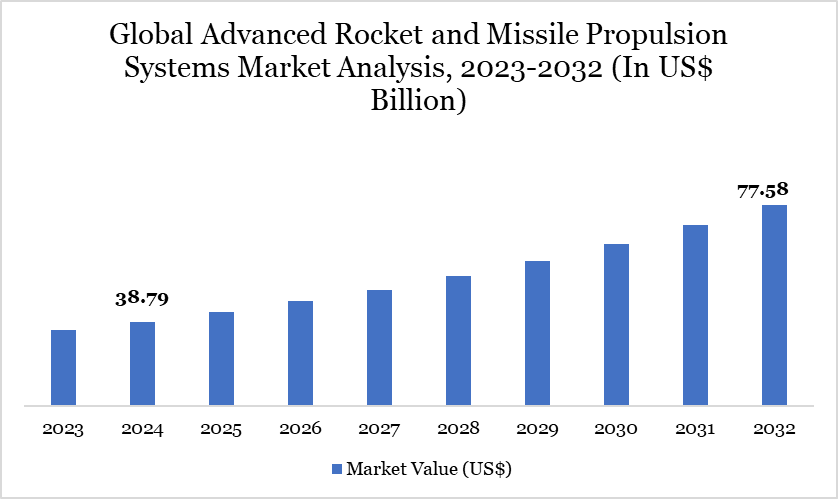

Global advanced rocket and missile propulsion systems market size reached US$ 38.79 billion in 2024 and is expected to reach US$ 77.58 billion by 2032, growing with a CAGR of 9.05% during the forecast period 2025-2032.

The global market for advanced rocket and missile propulsion systems is experiencing consistent growth, propelled by rising demand for enhanced defense capabilities and advancements in propulsion technologies. These systems transform stored energy into high-velocity exhaust gasses to produce thrust, allowing missiles to accurately and swiftly reach their targets.

Contemporary propulsion systems comprise essential elements such igniters, valves, actuators and control mechanisms to provide stability and maneuverability in flight. The defense sector's emphasis on high-performance propulsion systems, especially given rising geopolitical tensions and the evolution of modern warfare, highlights the crucial importance of these technologies.

Current investigations in cryogenic fluid management and eco-friendly propellants seek to improve sustainability and efficiency. As countries endeavor to fortify their borders and enhance their military systems, the need for advanced propulsion technologies is anticipated to stay strong, presenting potential for manufacturers and innovation-driven partnerships in the future.

Advanced Rocket and Missile Propulsion Systems Market Trend

Recent years have witnessed an increase in investment in hypersonic missile technologies and sophisticated air defense systems, prompting substantial transformations in the rocket and missile propulsion systems market. The advent of hypersonic missiles, which may surpass speeds of Mach 5, has made conventional defense systems progressively inadequate. Nations are significantly investing in technologies capable of countering these rapid threats.

In January 2025, RTX (US) obtained a US$ 333 million contract from the US Navy to manufacture Standard Missile-6 (SM-6) Block IA missiles, underscoring the strategic emphasis on hypersonic defense. The integration of sophisticated guiding systems, including GPS, inertial navigation systems (INS) and contemporary radar technologies, is increasingly standard in the market. This tendency is further substantiated by multi-domain threats, which require integrated, networked missile systems. The global desire for nimble, interoperable missile platforms is propelling the advancement of propulsion systems that are faster, more precise, modular and easily upgradable.

Market Scope

| Metrics | Details | |

| By Propulsion Type | Advanced Rocket and Missile Propulsion Systems Metal, Advanced Rocket and Missile Propulsion Systems Compounds | |

| By Platform | Advanced Rocket and Missile Propulsion Systems Sponge, Advanced Rocket and Missile Propulsion Systems Ingots, Advanced Rocket and Missile Propulsion Systems Plates, Advanced Rocket and Missile Propulsion Systems Powder, Other | |

| By Component | Aerospace & Defense, Chemical Processing, Power Generation, Medical, Automotive, Paints & Coatings, Others | |

| By Range | Short Range, Medium Range, Intermediate Range, Intercontinental Range | |

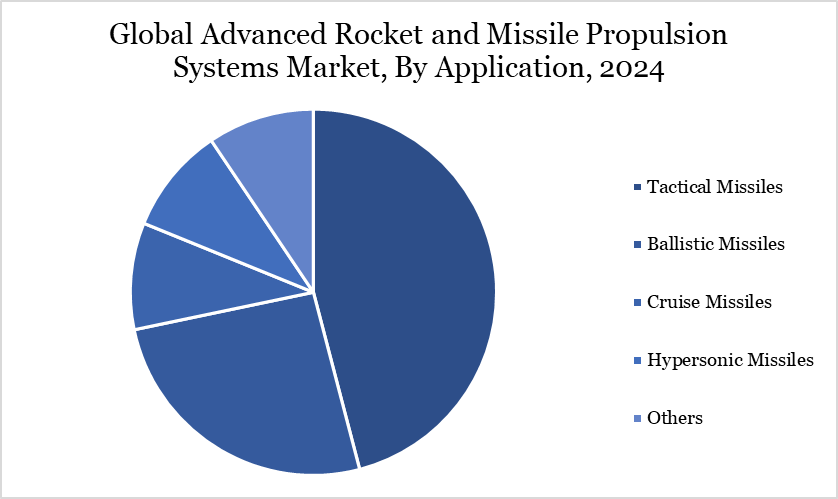

| By Application | Tactical Missiles, Ballistic Missiles, Cruise Missiles, Hypersonic Missiles, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Advanced Rocket and Missile Propulsion Systems Market Dynamics

Increasing Defense Expenditures Propel Technological Advancement

The increasing global defense expenditure is a primary catalyst for the advanced rocket and missile propulsion systems industry. US, China, India and Russia persistently augment their military expenditures to address new security concerns. US allotted US$ 2.53 billion to the Ground-based Midcourse Defense (GMD) Program and contracted Boeing and Northrop Grumman for interceptor enhancements.

In October 2024, RTX secured a contract worth US$ 676 million to manufacture TOW missile systems for US Army. These investments underscore a transition in strategic priority towards precision missile systems and advanced propulsion technology. As countries strive to preserve a competitive advantage in contemporary conflict, the focus on research and development has intensified, fostering partnerships between governments and defense firms. The allocation of resources to missile development not only bolsters national security but also expedites innovation, guaranteeing the provision of advanced propulsion systems that can satisfy future combat requirements.

Technology Readiness Deficiencies and Demonstration Obstacles

Notwithstanding considerable investment in research and development, the advanced rocket and missile propulsion systems market encounters formidable obstacles in advancing innovative technologies from the laboratory to operational implementation. Numerous propulsion advancements, including electric propulsion, nuclear thermal propulsion and satellite tethers, presently exhibit medium technology readiness levels.

Options for terrestrial or extraterrestrial demonstration are constrained, resulting in a technology development "valley of death." Affordably bridging this gap is crucial to achieving their full potential. In the absence of adequate demonstration platforms or sustained financing, these advanced systems are likely to remain at the prototype phase. Moreover, intricate regulatory frameworks and elevated expenses related to testing and validation impede advancement.

Immediate solutions like as cryogenic fluid management and green propellants are progressing, enduring advancements in propulsion necessitate continuous investment and interdisciplinary cooperation. Overcoming these obstacles will be essential for the prompt implementation of next-generation propulsion systems, especially in a progressively competitive aerospace and defense environment.

Global Advanced Rocket and Missile Propulsion Systems Market Segment Analysis

The global advanced rocket and missile propulsion systems market is segmented based on propulsion type, platform, component, range, application and region.

Ballistic Missiles Enhancing Strategic Deterrence with Advanced Propulsion Systems

Ballistic missiles constitute a vital section in the advanced rocket and missile propulsion systems market, propelled by escalating geopolitical tensions and defense modernization initiatives. Intercontinental ballistic missiles (ICBMs) necessitate advanced propulsion systems that provide substantial thrust and extended range capabilities. Countries are currently concentrating on the development and testing of next-generation intercontinental ballistic missiles to augment deterrent and strategic capabilities.

The US Air Force is developing the LGM-35A Sentinel weapon system to succeed the obsolete LGM-30G Minuteman III. This endeavor, supported by a US$ 13.3 billion contract granted to Northrop Grumman in 2020, is anticipated to be completed by 2029.

Russia has advanced the Samrat ICBM, which was successfully tested in April 2022 with a 6,000 km flight to Kamchatka and is slated for deployment by the end of 2022. These advancements underscore an increasing dependence on sophisticated propulsion systems, bolstering market growth through ongoing innovation and strategic military expenditures.

Geographical Penetration

Strategic Investments Cement North America's Dominance in Missile Propulsion Systems

North America remains the preeminent region in the worldwide advanced rocket and missile propulsion systems market, supported by substantial defense expenditures and a formidable industrial foundation. The US Department of Defense's FY2025 budget proposal of US$ 310.7 billion, consisting of US$ 167.5 billion for procurement and US$ 143.2 billion for research and development, exemplifies the region's dedication to technological progress.

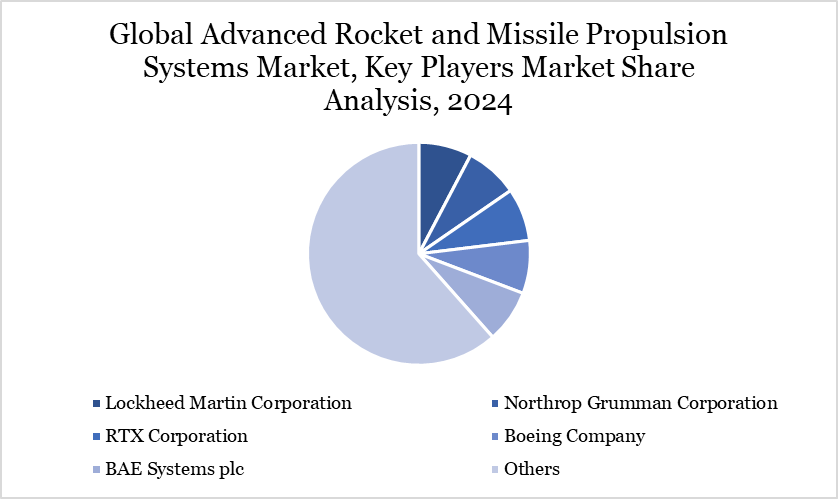

The allocation of US$ 13.5 billion for the Missile Defense Program and US$ 29.8 billion for munitions highlights the strategic significance of missile capabilities. Prominent companies including as Lockheed Martin, Northrop Grumman, Boeing and RTX are based in the US, establishing North America as a center for worldwide innovation.

In September 2024, BAE Systems obtained a contract to enhance the manufacture of Evolved Sea Sparrow Missile (ESSM) Block 2 components, utilized by 12 nations and installed aboard Royal Australian Navy vessels. Beneficial policies, a proficient workforce and defense-oriented public-private collaborations establish North America as a crucial location propelling market expansion and global military preparedness.

Sustainability Analysis

Sustainability is progressively emerging as a fundamental concern in the global advanced rocket and missile propulsion systems market. Environmental factors and long-term objectives are propelling the advancement of cleaner, safer propulsion alternatives. Organizations like NASA’s Marshall Center are enhancing technology in cryogenic fluid management (CFM) and evaluating novel green propellants to mitigate environmental effect.

The initiatives not only address present in-space propulsion requirements but also facilitate the development of future technologies such as nuclear thermal propulsion, satellite tethers, solar sails and electric propulsion. The shift to these systems is impeded by restricted demonstration opportunities and substantial development expenses.

Bridging the divide between mid-readiness technologies and full-scale implementation is crucial for attaining sustainability and mission success. Incorporating these solutions into defense applications necessitates adherence to rigorous military performance criteria. With the tightening of environmental rules and the evolution of defense policies, integrating sustainability into propulsion system development will be essential for future global security frameworks.

Competitive Landscape

The major global players in the market include Lockheed Martin Corporation, Northrop Grumman Corporation, RTX Corporation, Boeing Company, BAE Systems plc, Aerojet Rocketdyne Holdings, Inc., Safran S.A., Thales Group, General Dynamics Corporation and L3Harris Technologies, Inc.

Key Developments

- In December 2024, Saab AB (Sweden) entered into a contract of US$ 72.41 million with the Swedish Defense Materiel Administration to enhance Sweden's coastal anti-ship missile capabilities.

- In September 2024, RTX (US) obtained a contract modification from the US Air Force to manufacture Advanced Medium-Range Air-to-Air Missiles (AMRAAM) for both domestic and international clients. The contract encompasses telemetry systems, spare parts and engineering support, with operations based in Tucson, Arizona, extending until December 2028.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Suggestions for Related Report