Hemophilia Market: Industry Outlook

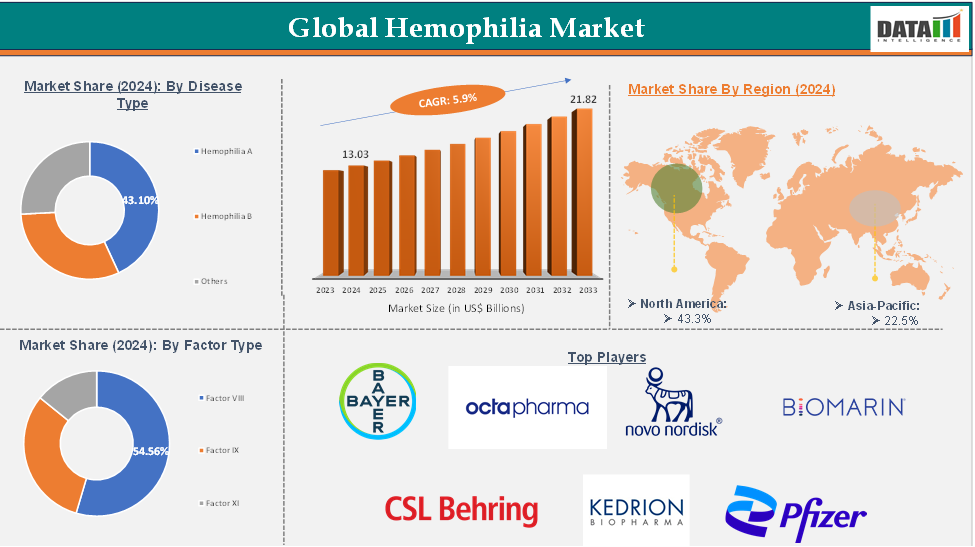

Hemophilia Market reached US$ 13.03 Billion in 2024 and is expected to reach US$ 21.82 Billion by 2033, growing at a CAGR of 5.9% during the forecast period 2025-2033.

The global hemophilia market is growing due to advancements in treatment technologies, increased awareness, and improved healthcare access. Common types of hemophilia are managed through various therapies, including factor replacement products, extended half-life treatments, bispecific antibodies, and gene therapies. Key drivers include rising disease prevalence, demand for prophylactic treatment, and pharmaceutical innovation.

North America and Europe dominate the market due to advanced healthcare systems and R&D investments, while the Asia-Pacific region is emerging as a high-potential growth area. Strategic collaborations, favorable regulatory policies, and expanded reimbursement support contribute to market expansion. The market is positioned for continued growth, focusing on personalized, convenient, and cost-effective therapies.

Executive Summary

For more details on this report, Request for Sample

Hemophilia Market Dynamics: Drivers & Restraints

Driver: Increasing prevalence of hemophilia

The global hemophilia market is growing due to the increasing prevalence of the condition. With improved screening and awareness, the demand for effective treatments is increasing. For instance, according to Perth Blood Institute, Haemophilia is an X-linked disorder with a 50% chance of being inherited by a female carrier. It affects 1 in 6000-10,000 of the male population worldwide. The disorder is inherited as an X-linked disorder, with the daughter having a 50% chance of being a carrier. The prevalence is 1 in 5000 males and 1 in 30,000 males.

Hence, the high prevalence of haemophilia, particularly among males, drives demand for treatment solutions, diagnostic services, and factor replacement therapies. Increased awareness and investment in gene therapy and innovative treatments further expand the global haemophilia market. Moreover, healthcare systems prioritize early diagnosis and management, boosting the adoption of traditional factor replacement therapies and newer non-factor and gene therapies.

The growing patient pool also encourages pharmaceutical companies to invest in research and development, leading to a broader, more innovative product pipeline. This contributes to market expansion by intensifying the need for long-term disease management solutions.

Restraint: Limited access to advanced care in developing countries

The global hemophilia market faces significant challenges due to limited access to advanced care in developing countries. Inadequate healthcare infrastructure, shortage of trained hematologists, and limited diagnostic facilities hinder patients' access to advanced treatments. High-income countries benefit from early diagnosis and access to advanced treatments, while under-resourced areas often rely on outdated or inconsistent methods. This disparity increases the risk of complications like joint damage, internal bleeding, and reduced life expectancy.

The global market's growth potential is hindered by this disparity, highlighting the need for international collaboration, public-private partnerships, and policy reforms to improve access, affordability, and education in hemophilia care in developing countries.

Hemophilia Market Segment Analysis

The global hemophilia market is segmented based on disease type, factor type, therapy, end user, and region.

The hemophilia A segment from the disease type is expected to hold 43.10% of the hemophilia market

Hemophilia A, also known as factor VIII (8) deficiency or classic hemophilia, is a genetic disorder resulting from the absence of factor VIII, a clotting protein, with about 1/3 of cases lacking a family history. High prevalence, increased awareness, product launches, and advancements in recombinant and gene therapies drive the Hemophilia A segment in the hemophilia market. Demand for long-acting replacement therapies and prophylactic treatments is also rising, supported by strong R&D investments and favorable healthcare policies.

For instance, according to the National Bleeding Disorders Foundation, Hemophilia is a common condition in 1 in 5,617 live male births, with between 30,000-33,000 males affected in the US. Over half of those diagnosed have severe hemophilia A, which is four times more common than hemophilia B and affects all races and ethnic groups.

Moreover, in October 2024, the U.S. FDA approved Hympavzi (marstacimab-hncq) for routine prophylaxis to prevent or reduce bleeding episodes in adults and pediatric aged 12 and older with hemophilia A or B without factor VIII or IX inhibitors. Furthermore, in December 2024, India made a significant breakthrough in treating severe Hemophilia A through gene therapy, with five patients experiencing zero bleeding episodes over an extended period, according to a study by the Centre for Stem Cell Research.

Hemophilia Market Geographical Analysis

North America dominated the global hemophilia market with the highest share of 43.3% in 2024

North America is a leading player in the global hemophilia market due to its established healthcare infrastructure, FDA approvals, product launches, high awareness, and widespread access to advanced therapies. Major pharmaceutical and biotechnology companies are actively involved in R&D, accelerating innovation.

For instance, in March 2025, the US FDA approved Qfitlia, the first antithrombin-lowering therapy for routine prophylaxis to prevent or reduce bleeding episodes in adult and pediatric patients with hemophilia A or B, with or without factor VIII or IX inhibitors. The approval is based on data from ATLAS phase 3 studies, which demonstrated clinically meaningful bleed protection.

Moreover, favorable reimbursement policies, strong government and non-profit support, and patient advocacy networks contribute to early diagnosis and proactive disease management. Additionally, clinical trials and regulatory support from agencies like the FDA further foster a dynamic environment for therapeutic advancements. This combination of advanced healthcare delivery, economic capacity, and innovation makes North America a dominant force in the hemophilia market, setting standards for care and driving growth.

Asia-Pacific is the global hemophilia market with a market share of 22.5% in 2024

The Asia-Pacific hemophilia market is expected to experience significant growth due to demographic, economic, and healthcare system advancements. The market is driven by a large and often underdiagnosed patient population, particularly in countries like India, China, Indonesia, and the Philippines. Historically, many hemophilia cases have remained untreated or mismanaged. However, with the rise of healthcare infrastructure and awareness programs, more patients are being identified and enrolled in treatment pathways.

For instance, in September 2023, the Japanese Ministry of Health, Labor, and Welfare approved ALTUVIIIO, a high-sustained factor VIII replacement therapy, for controlling bleeding in patients with hemophilia A. The therapy was also approved by the Taiwan Food and Drug Administration for treating adults and children with hemophilia A.

Economic growth in emerging Asia-Pacific economies is enabling greater government and private investment in healthcare, leading to improvements in insurance coverage, reimbursement mechanisms, and accessibility to advanced therapies. The shift from on-demand treatment to prophylactic regimens is gaining traction, with extended half-life and subcutaneous non-factor therapies becoming more available and affordable in the region.

Hemophilia Market - Key Players

The major global players in the hemophilia market include Bayer AG, BioMarin Pharmaceutical, Inc., CSL Behring, Novo Nordisk, Pfizer, Inc., Roche (Chugai Pharmaceutical Co.), Sanofi (Genzyme Corporation), Takeda Pharmaceutical (Shire Plc.), Octapharm, and Kedrion S.p.A among others.

Hemophilia Market – Key Developments

In December 2024, Novo Nordisk received FDA approval for Alhemo injection as a once-daily prophylaxis to prevent or reduce bleeding episodes in adults and pediatric patients aged 12 and older with hemophilia A or B with inhibitors, demonstrating its commitment to rare bleeding disorders for over 35 years.

In April 2024, Pfizer received US approval for a gene therapy against a rare and inherited blood clotting disorder, hemophilia B. Beqvez, given as a single intravenous infusion, was shown to be better at preventing bleeding in a clinical trial of 45 people compared to regular infusions of protein factor IX (FIX).

Market Scope

Metrics | Details | |

CAGR | 5.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Disease Type | Hemophilia A, Hemophilia B, Others |

Factor Type | Factor VIII, Factor IX, Factor XI | |

Therapy | Replacement Therapy, Non-factor Replacement Therapy Gene Therapy, Immune Tolerance Induction Therapy | |

End User | Hospitals, Specialty Clinics, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |