Glaucoma Therapeutics Market Size & Industry Outlook

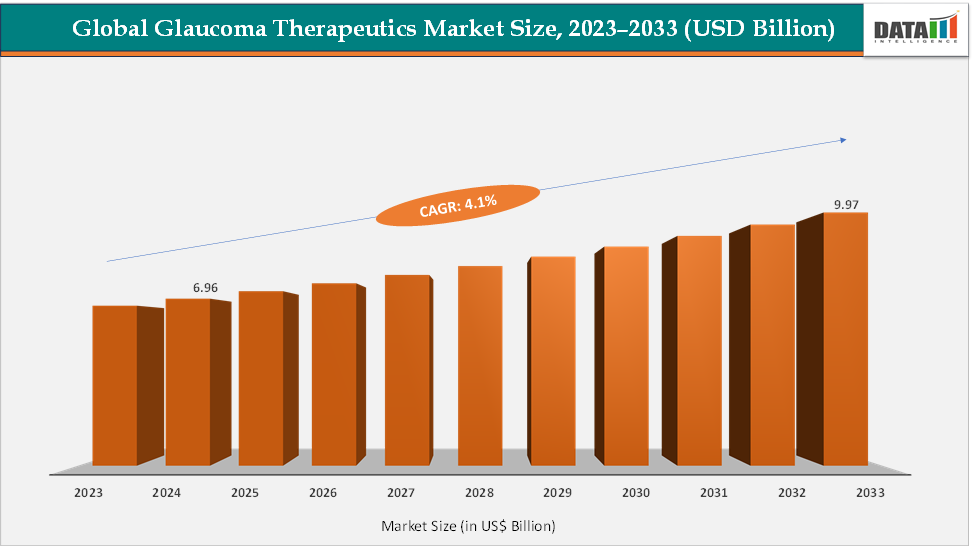

The global glaucoma therapeutics market size reached US$ 6.96 Billion in 2024 from US$ 6.71 Billion in 2023 and is expected to reach US$ 9.97 Billion by 2033, growing at a CAGR of 4.1% during the forecast period 2025-2033. The market is experiencing robust growth, driven by several key factors. Advancements in treatment options, such as minimally invasive surgical procedures and novel drug formulations, are enhancing patient outcomes and expanding treatment accessibility.

The increasing global prevalence of glaucoma, particularly among the aging population, is further propelling market demand. Additionally, the introduction of combination therapies and sustained-release drug delivery systems is improving patient compliance and efficacy. For instance, products like Lumigan (bimatoprost), Combigan (brimonidine/timolol), and DURYSTA (bimatoprost implant) exemplify these innovations.

Key Market Highlights

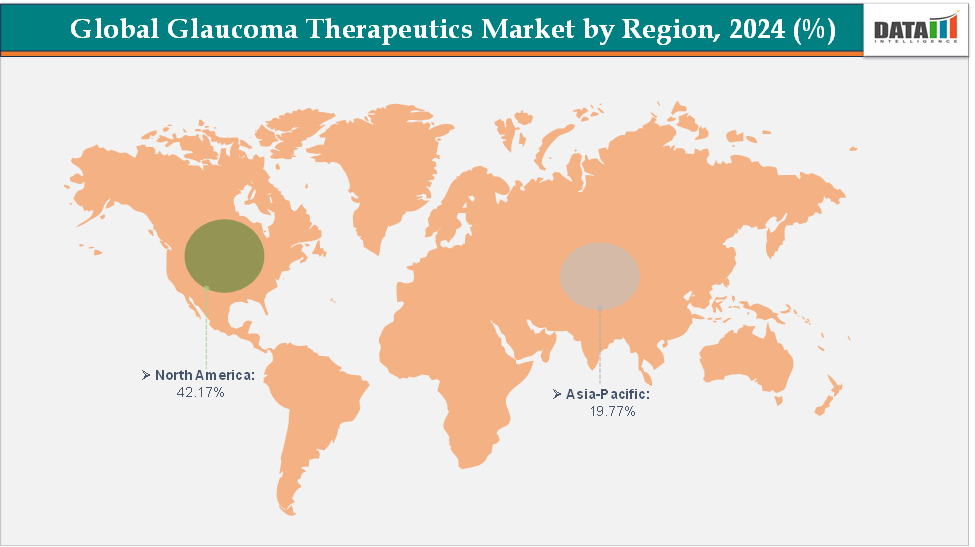

- North America dominates the glaucoma therapeutics market with the largest revenue share of 42.17% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 4.7% over the forecast period.

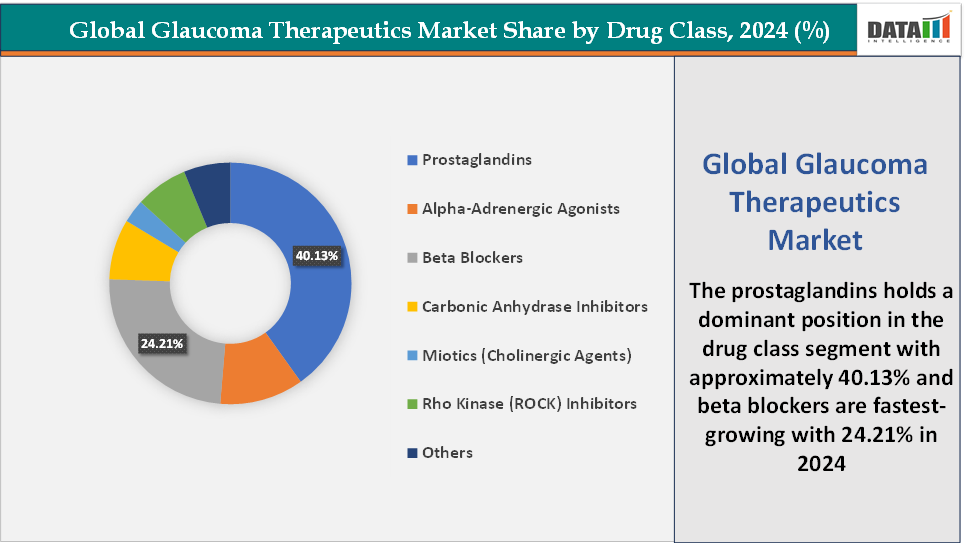

- Based on drug class, the prostaglandins segment led the market with the largest revenue share of 40.13% in 2024.

- The major market players in the glaucoma therapeutics market are AbbVie, Viatris Inc., Thea Pharma Inc., Novartis AG, Bausch + Lomb, MERCK & CO., Inc., and Alcon Inc., among others

Market Dynamics

Drivers: Rising prevalence of glaucoma is significantly driving the glaucoma therapeutics market growth

The rising prevalence of glaucoma is a major driver of growth in the glaucoma therapeutics market, reflecting both demographic trends and increasing disease awareness worldwide. For instance, according to the Glaucoma Research Foundation, around 4.22 million people in the U.S. have glaucoma, and nearly half are unaware of their condition. Globally, over 80 million people worldwide have glaucoma, with 60 million affected by open-angle glaucoma. Glaucoma-related blindness is 6 to 8 times more prevalent in African Americans than in Caucasians. Additionally, according to the World Glaucoma Association, based on prevalence studies, it is estimated that 79.6 million individuals will have glaucoma in 2020. This number is likely to increase to 111.8 million individuals in 2040.

This growing patient pool is fueling demand for effective therapeutic interventions, stimulating innovation and expansion in the market. Key FDA-approved products addressing this need include prostaglandin analogs such as Xalatan (latanoprost), Lumigan (bimatoprost), and Travatan Z (travoprost), which primarily function by increasing aqueous humor outflow to reduce intraocular pressure. Rising prevalence also underscores the importance of patient compliance, driving the adoption of sustained-release implants such as DURYSTA (bimatoprost implant) and fixed-dose combination therapies like Combigan (brimonidine/timolol) to improve adherence. Overall, the growing incidence of glaucoma, coupled with demographic shifts and the availability of advanced therapeutics, continues to expand the market.

Restraints: Medication adherence challenges are hampering the growth of the market

Medication adherence challenges are a significant factor hampering the growth of the glaucoma therapeutics market, despite the availability of effective treatments. Glaucoma is a chronic and often asymptomatic condition, which makes patients less likely to consistently follow prescribed regimens, especially when using eye drops that require daily dosing. Factors contributing to non-adherence include forgetfulness, difficulty administering eye drops, side effects like ocular irritation or redness, and complex multi-drug regimens.

For instance, patients using combination therapies such as Cosopt (dorzolamide/timolol) or Combigan (brimonidine/timolol) may struggle with timing and technique, reducing therapeutic efficacy. Additionally, socioeconomic factors, including low health literacy and limited access to pharmacies, exacerbate adherence issues, particularly in underserved regions. Poor adherence not only limits the effectiveness of first-line treatments like prostaglandin analogs (Xalatan, Lumigan, Travatan Z) but also reduces the uptake of newer therapies like Rhopressa (netarsudil) and Vyzulta (latanoprostene bunod), thereby slowing market growth. This challenge has prompted the development of sustained-release drug delivery systems, such as DURYSTA (bimatoprost implant), and patient education initiatives, yet adherence remains a persistent barrier.

For more details on this report – Request for Sample

Segmentation Analysis

The global glaucoma therapeutics market is segmented based on disease type, drug class, distribution channel, and region.

Drug Class: The prostaglandins segment is dominating the glaucoma therapeutics market with a 40.13% share in 2024

Prostaglandin analogs have firmly established themselves as the dominant segment in the glaucoma therapeutics market. Their dominance is primarily attributed to their superior efficacy in reducing intraocular pressure (IOP), which is the key therapeutic target in managing glaucoma. These medications are highly favored for first-line therapy due to their once-daily dosing regimen, minimal systemic side effects, and favorable safety profiles, which significantly improve patient compliance.

Notable FDA-approved prostaglandin analogs include Latanoprost (Xalatan), approved in 1996, which has remained a cornerstone of glaucoma therapy; Bimatoprost (Lumigan), approved in 2001, known for rapid IOP reduction and dual utility in eyelash growth; Travoprost (Travatan Z), approved in 2001, preferred for patients with preservative sensitivities; Tafluprost (Zioptan), approved in 2012, which is preservative-free and suitable for sensitive patients; and Latanoprostene bunod (Vyzulta), approved in 2017, which combines latanoprost with nitric oxide to enhance IOP-lowering through dual mechanisms.

The adoption of combination therapies such as Rocklatan (netarsudil/latanoprost) and Ganfort (bimatoprost/timolol) further highlights the preference for prostaglandin-based regimens, as these combinations target multiple pathways in IOP regulation while simplifying dosing schedules to enhance adherence. These factors efficacy, convenience, safety, and ongoing innovation collectively reinforce prostaglandin analogs’ dominant position in the glaucoma therapeutics market, making them the preferred choice for both clinicians and patients globally and driving sustained growth within the segment.

The beta blockers segment is the fastest-growing in the glaucoma therapeutics market, with a 24.21% share in 2024

The beta-blockers segment is emerging as the fastest-growing category in the glaucoma therapeutics market, driven by a combination of long-established efficacy, affordability, and increasing adoption in combination therapies. Beta-blockers function primarily by reducing aqueous humor production, thereby lowering intraocular pressure (IOP), which is critical for preventing optic nerve damage and progression of glaucoma. Key FDA-approved medications in this class include Timolol (Timoptic), Betaxolol (Betoptic), and Carteolol (Ocupress), all of which have been widely prescribed for decades due to their proven effectiveness and favorable safety profiles.

The growth of this segment is also fueled by the development of fixed-dose combination products, such as Combigan (brimonidine/timolol), which simplify treatment regimens, enhance patient adherence, and provide additive IOP-lowering effects; for instance, Combigan recorded over 1 million prescriptions in the United States in 2020. The rising prevalence of glaucoma, particularly among the aging population, has further accelerated demand for beta-blockers, as clinicians seek reliable, cost-effective options that can be integrated into multi-drug regimens. This trend underscores the expanding role of beta-blockers in glaucoma management, particularly as part of personalized treatment strategies aimed at optimizing patient outcomes and improving adherence.

Geographical Analysis

North America is expected to dominate the global glaucoma therapeutics market with a 42.17% in 2024

North America is expected to dominate the global glaucoma therapeutics market due to a combination of presence of major market players, high disease awareness, and a significant aging population, which collectively drive demand for effective glaucoma management.

US Glaucoma Therapeutics Market Trends

The market growth in the US is fueled by early disease detection, widespread access to advanced diagnostic tools, and high levels of patient engagement, which together enhance treatment adherence and outcomes. The availability of FDA-approved therapies such as latanoprost (Xalatan), bimatoprost (Lumigan), and timolol (Timoptic), along with combination therapies like Combigan (brimonidine/timolol), has expanded the therapeutic options for clinicians and patients, improving intraocular pressure (IOP) management and patient compliance.

Recent approvals, such as Omlonti (omidenepag isopropyl) in 2022, further diversify available treatment modalities and demonstrate regulatory support for innovative therapies. Major pharmaceutical companies, including Alcon, AbbVie, Bausch + Lomb, Novartis, and other emerging market players, actively contribute to the market’s growth through research, development, and strategic product launches, creating a competitive and dynamic landscape. Collectively, these factors such as proactive disease management, regulatory support, presence of key industry players, and innovative therapeutics position US as the leading and most influential region in the global glaucoma therapeutics market, ensuring sustained growth and a robust pipeline of new treatment options.

The Asia Pacific region is the fastest-growing region in the global glaucoma therapeutics market, with a CAGR of 4.7% in 2024

The Asia Pacific region is currently the fastest-growing market in the global glaucoma therapeutics sector, driven by a combination of demographic, economic, and healthcare factors that are reshaping the treatment landscape. This rapid growth is primarily fueled by the aging population across countries such as India, China, and Japan, where the incidence of glaucoma is rising alongside urbanization and increasing awareness of eye health.

India, in particular, is expected to witness the highest growth rate in the coming years, driven by government-led early detection programs, awareness campaigns, and improving accessibility to effective treatment options. The therapeutic landscape in the region is diverse: prostaglandin analogs continue to lead due to their efficacy and once-daily dosing, while beta-blockers and fixed-dose combination therapies are gaining traction because of their cost-effectiveness and ability to improve patient adherence.

Major pharmaceutical companies, including Novartis, Merck, and Alcon, are actively expanding their operations in Asia Pacific through strategic partnerships, product launches, and localized manufacturing, tailoring therapies to meet regional needs. The combination of rising disease prevalence, increased healthcare spending, regulatory support, and the introduction of novel drugs and devices is driving rapid market expansion, positioning Asia Pacific as a pivotal and highly dynamic hub for the future of glaucoma care globally.

Europe Glaucoma Therapeutics Market Trends

The European glaucoma therapeutics market is witnessing steady growth, driven by an aging population, increasing awareness about eye health, and significant advancements in both pharmacological and surgical treatment options. The region benefits from well-established healthcare infrastructure and strong regulatory support, which facilitate the timely approval and adoption of innovative therapies. Key pharmaceutical companies active in Europe include Alcon AG, AbbVie Inc., Bausch & Lomb Inc., Viatris Inc., Novartis AG, Thea Pharma Inc., and other emerging players, all of which offer a diverse range of glaucoma treatments encompassing prostaglandin analogs, beta-blockers, alpha-adrenergic agonists, carbonic anhydrase inhibitors, and combination drugs.

Recently approved medications such as latanoprostene bunod (Vyzulta) and netarsudil (Rhopressa) have provided clinicians with new mechanisms to lower intraocular pressure, expanding therapeutic options for patients. The combination of demographic trends, rising disease prevalence, increasing patient awareness, and the continuous introduction of novel drugs and devices positions Europe as a steadily growing market within the global glaucoma therapeutics landscape. These factors collectively ensure that the region remains attractive for investment, research, and expansion by leading pharmaceutical players, fostering innovation and improved care for glaucoma patients across Europe.

Competitive Landscape

Top companies in the glaucoma therapeutics market include AbbVie, Viatris Inc., Thea Pharma Inc., Novartis AG, Bausch + Lomb, MERCK & CO., Inc., and Alcon Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 4.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Disease Type | Primary Glaucomas and Secondary Glaucomas |

| Drug Classs | Prostaglandins, Alpha-Adrenergic Agonists, Beta Blockers, Carbonic Anhydrase Inhibitors, Miotics (Cholinergic Agents), Rho Kinase (ROCK) Inhibitors, and Others | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global glaucoma therapeutics market report delivers a detailed analysis with 53 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.