Gene Transfer Technologies Market Size

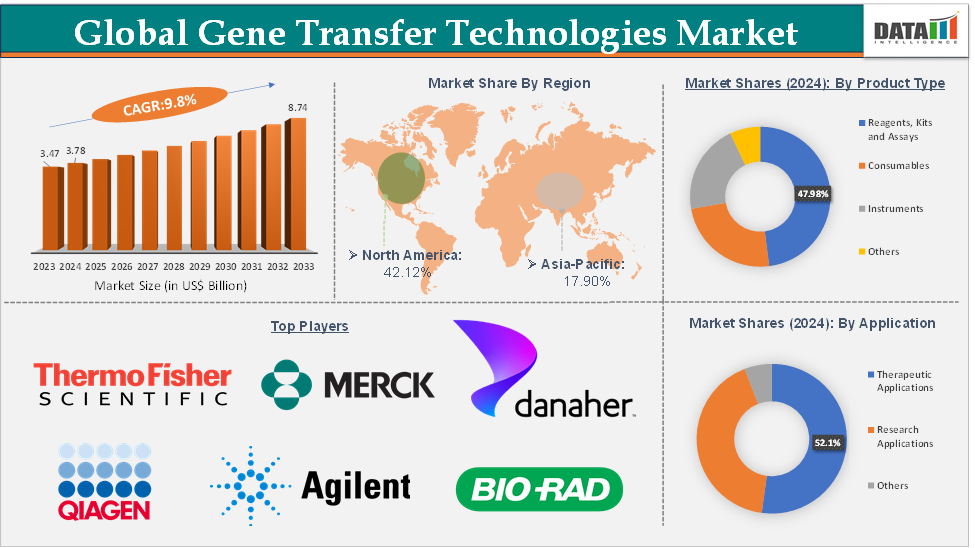

The global gene transfer technologies market size reached US$ 3.78 Billion in 2024 from US$ 3.47 Billion in 2023 and is expected to reach US$ 8.74 Billion by 2033, growing at a CAGR of 9.8% during the forecast period 2025-2033.

Gene Transfer Technologies Market Overview

The gene transfer technologies market is poised for continued growth, driven by technological advancements, increasing disease prevalence, and supportive regulatory environments. However, addressing challenges related to cost, manufacturing, and safety will be crucial for realizing the full potential of gene therapies. Strategic investments in research, development, and infrastructure will be essential to overcome these hurdles and ensure equitable access to innovative treatments globally.

The market is characterized by the presence of key players such as Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, Qiagen, Bio-Rad Laboratories, and Agilent Technologies. These companies are focusing on strategic collaborations, product innovations, and expanding their product portfolios to strengthen their market position.

Gene Transfer Technologies Market Executive Summary

Gene Transfer Technologies Market Dynamics

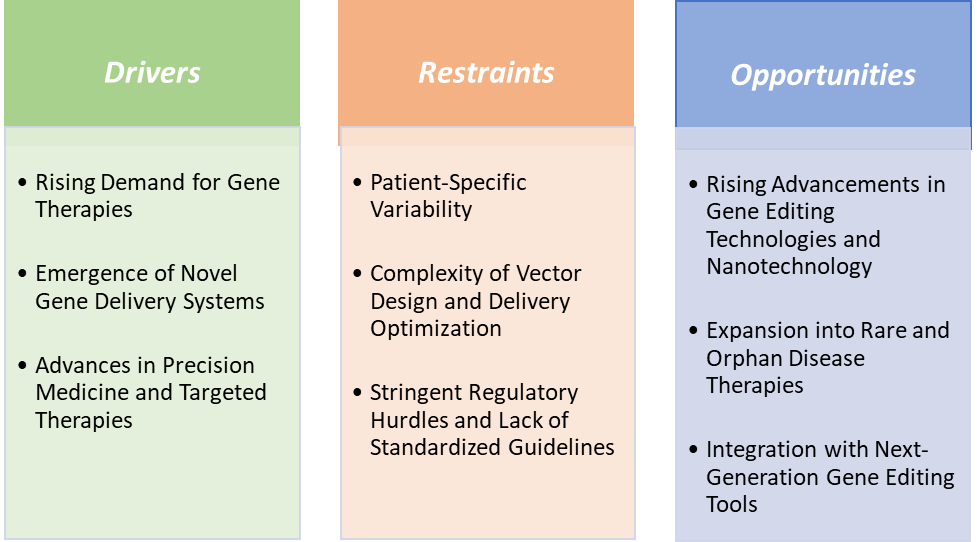

Drivers:

Rising demand for gene therapies is significantly driving the gene transfer technologies market growth

The rising demand for gene therapies is significantly driving the growth of the gene transfer technologies market, primarily due to the increasing prevalence of genetic disorders and cancers, advancements in technology, and a growing acceptance of gene therapies as viable treatment options. The World Health Organization forecasts over 35 million new cancer cases by 2050, a staggering increase from the estimated 20 million cases in 2022. This rise underscores the need for effective treatments, for gene therapies that target tumors, which directly increases the demand for gene transfer technologies.

Innovations in viral vectors, have enhanced the safety and efficacy of gene therapies. These vectors are crucial for delivering therapeutic genes into patients' cells with minimal immune response, thus broadening their application across various diseases. For instance, in May 2024, Charles River Laboratories International, Inc. introduced its Modular and Fast Track viral vector technology (tech) transfer frameworks to deliver effective, rapid process transfer to its Maryland-based viral vector center of excellence in as little as nine months.

Restraints:

Patient-specific variability is hampering the growth of the gene transfer technologies market

Patient-specific variability is a significant challenge hampering the growth of the gene transfer technologies market. This variability arises from differences in individual patient genetics, immune responses and disease characteristics, which can affect the efficacy and safety of gene therapies.

Each patient's unique genetic profile can influence how their body responds to gene therapies. For instance, the effectiveness of viral vectors used for gene delivery can vary based on the patient's genetic background, leading to inconsistent therapeutic outcomes. This inconsistency complicates the development process and may result in therapies being less effective for certain populations, limiting their market potential.

Patients may exhibit different immune responses to viral vectors used in gene therapies. Some individuals may produce neutralizing antibodies against these vectors, reducing the therapy's effectiveness or leading to adverse reactions. For instance, a NIH study highlighted that about 50% of patients treated with AAV-based therapies experienced immune responses that hindered treatment efficacy.

Opportunities:

Rising advancements in gene editing technologies and nanotechnology create a market opportunity for the gene transfer technologies market

The development of advanced gene editing technologies, particularly CRISPR-Cas9 and its successors like prime editing and base editing, has revolutionized genetic manipulation. These technologies provide higher precision and fewer off-target effects, making them more suitable for therapeutic applications. This growth reflects the increasing adoption of these technologies in developing targeted therapies for genetic disorders, thereby boosting the demand for effective gene transfer systems.

Nanotechnology plays a crucial role in enhancing the delivery mechanisms of gene therapies. Engineered nanoparticles, such as liposomes and polymeric nanoparticles, enable targeted and efficient delivery of genetic material while minimizing toxicity. For instance, mRNA vaccines developed by Pfizer-BioNTech and Moderna utilize lipid-based nanoparticles to deliver genetic instructions effectively, showcasing the successful application of nanotechnology in real-world scenarios. This integration not only improves therapeutic outcomes but also expands the potential applications of gene transfer technologies across various diseases.

The synergy between gene editing and nanotechnology opens up new avenues for applications beyond traditional genetic disorders. For instance, advancements in these fields are facilitating innovative approaches in cancer immunotherapy and regenerative medicine. This expansion is largely driven by increasing applications in vaccine development and personalized medicine.

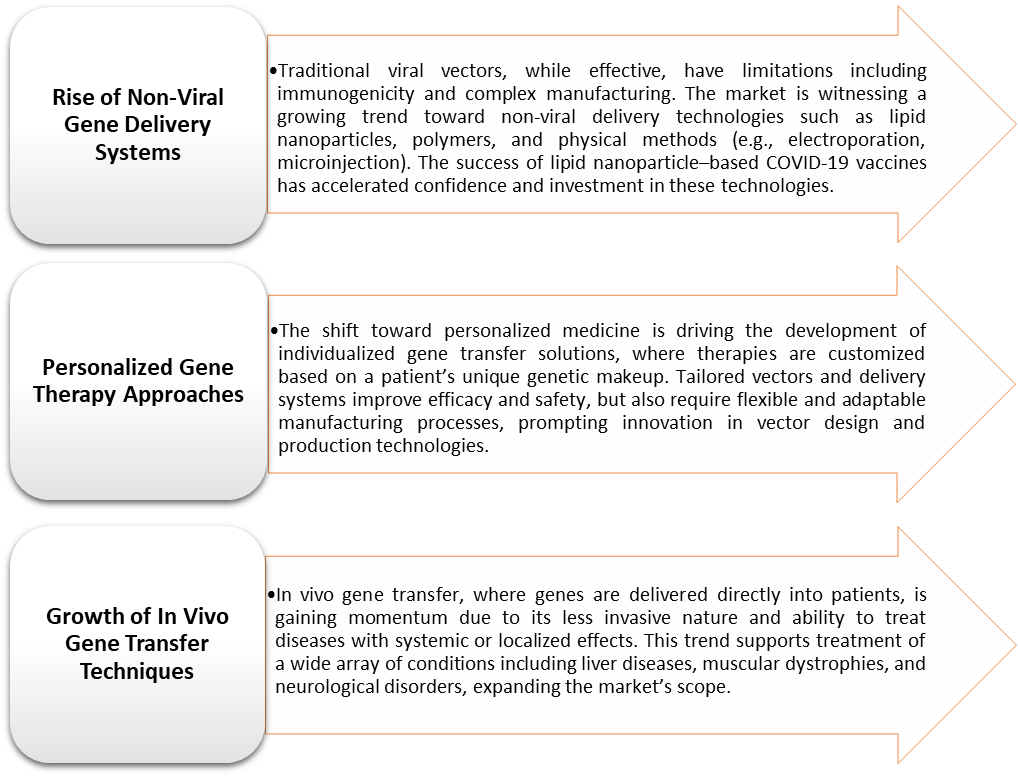

Gene Transfer Technologies Market Trends

For more details on this report – Request for Sample

Gene Transfer Technologies Market, Segment Analysis

The global gene transfer technologies market is segmented based on product type, mode, method, application, end-user, and region.

The therapeutic applications segment from the application reached US$ 1.97 Billion in 2024 in the gene transfer technologies market

The therapeutic applications segment primarily includes gene therapy for treating genetic disorders, cancers, and rare diseases. This segment leads the market because gene transfer technologies are central to delivering corrective or functional genes to patients’ cells, enabling treatment of previously incurable conditions. For instance, gene therapies like Luxturna (for inherited retinal dystrophy) and Zolgensma (for spinal muscular atrophy) have showcased remarkable clinical success, driving the adoption of gene transfer platforms.

The increasing number of regulatory approvals for gene therapies has accelerated the therapeutic application of gene transfer technologies. As of March 18, 2024, there are now 36 gene therapies approved by the FDA, with an additional 500 in the pipeline and the expectation that 10–20 will be approved annually by 2025, highlighting clinical validation and commercial potential, addressing therapeutic needs using gene transfer.

Pharmaceutical and biotechnology companies are investing billions in therapeutic gene transfer research and clinical trials. The global gene therapy clinical trial pipeline has grown exponentially, with hundreds of ongoing trials focusing on therapeutic indications, underscoring the central role of gene transfer in treatment development.

Gene Transfer Technologies Market, Geographical Analysis

North America is expected to dominate the global gene transfer technologies market with a US$ 1.59 Billion in 2024

The North America is home to major biotechnology and pharmaceutical companies that plays a crucial role in gene transfer technologies, such as Thermo Fisher Scientific Inc., Danaher Corporation, Cytiva, Merck KGaA and other emerging startups, which are heavily invested in gene therapy research and development. This concentration of industry leaders fosters innovation and accelerates the commercialization of new gene transfer technologies.

For instance, In September 2024, Cytiva introduced its latest innovation, the RNA delivery LNP kit, specifically designed for use with the NanoAssemblr Ignite and Ignite+ systems. This new product complements the GenVoy-ILM off-the-shelf LNP kits product line, set to transform RNA-LNP delivery, particularly in infectious disease vaccine development.

A significant number of clinical trials are being conducted in the U.S., exploring the viability of gene therapies for various conditions, including cancer and genetic diseases. This robust clinical trial landscape not only enhances the understanding of gene therapies but also builds confidence among investors and stakeholders regarding their potential efficacy.

The combination of a strong presence of key players, substantial investments in R&D, a favorable regulatory environment, and increasing demand for advanced therapies position North America as a dominant region in the gene transfer technologies market. These factors collectively create a robust ecosystem that fosters innovation and drives growth within this critical sector of healthcare.

Asia-Pacific is growing at the fastest pace in the gene transfer technologies market, holding 17.90% of the market share

Governments and private players in APAC countries like China, India, Japan, and South Korea are significantly boosting investments in biotechnology R&D, gene therapy development, and healthcare infrastructure. For instance, China’s National Gene Bank and various biotech incubators support accelerated gene transfer research and commercialization.

The large and genetically diverse populations in APAC contribute to a high burden of genetic diseases, cancers, and chronic conditions that could benefit from gene therapies. The incidence of cancer and rare genetic diseases is rapidly rising, driving demand for advanced gene transfer technologies tailored to these populations.

There is a surge in clinical trials focused on gene therapy and gene editing within the region, supported by regulatory reforms that expedite approvals. Countries like Japan and South Korea have streamlined regulatory pathways for gene therapy clinical trials, attracting multinational pharma investments. Clinical trial registries show a growing number of gene therapy trials being initiated in APAC countries annually.

Gene Transfer Technologies Market Competitive Landscape

Top companies in the gene transfer technologies market include Thermo Fisher Scientific Inc., Danaher Corporation, Merck KGaA, Qiagen, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., MaxCyte, and Cytiva, among others.

Gene Transfer Technologies Market Scope

Metrics | Details | |

CAGR | 9.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Reagents, Kits and Assays, Consumables, Instruments, and Others |

Mode | Viral Vectors, Non-Viral Vectors, and Physical Methods | |

Method | In Vivo, Ex Vivo, and In Vitro | |

Application | Therapeutic Applications, Research Applications, and Others | |

End-User | Pharmaceutical and Biotechnology Companies, Academic & Research Institutes, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights on Gene Transfer Technologies Market

According to DMI analysis, the global gene transfer technologies market size reached US$ 3.78 Billion in 2024 and is expected to reach US$ 8.74 Billion by 2033, growing at a CAGR of 9.8% during the forecast period 2025-2033.

The gene transfer technologies market is poised for robust growth over the next decade, driven by remarkable advancements in gene therapy and personalized medicine. The convergence of cutting-edge delivery systems, regulatory support, and expanding therapeutic applications is transforming gene transfer from a niche research tool into a cornerstone of modern healthcare innovation.

The dominant driver of this market remains the increasing adoption of gene transfer technologies in therapeutic applications. Rising prevalence of genetic disorders, cancers, and rare diseases creates a substantial unmet medical need that gene transfer can address. With multiple FDA-approved gene therapies and an expanding clinical pipeline, demand for reliable and efficient gene transfer platforms is accelerating.

The gene transfer technologies Market is on a strong growth trajectory, fundamentally reshaping treatment paradigms across multiple therapeutic areas. While challenges remain, the continuous evolution of delivery technologies, growing clinical validation, and expanding global adoption create a compelling outlook. Companies that invest in innovation, cost-effective manufacturing, and strategic partnerships will be well-positioned to capitalize on this transformative market opportunity.

The global gene transfer technologies market report delivers a detailed analysis with 72 key tables, more than 71 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here