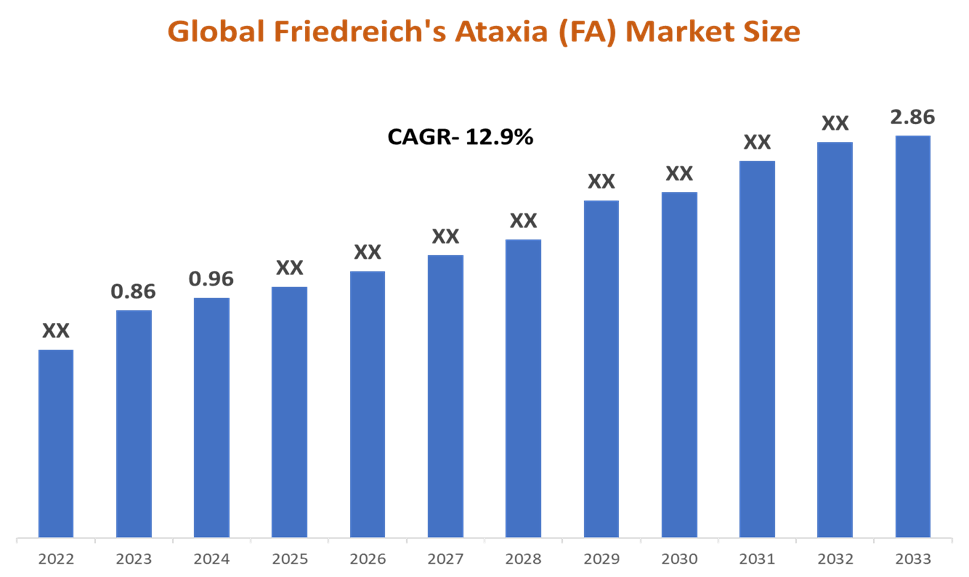

Friedreich’s Ataxia (FA) Market Size

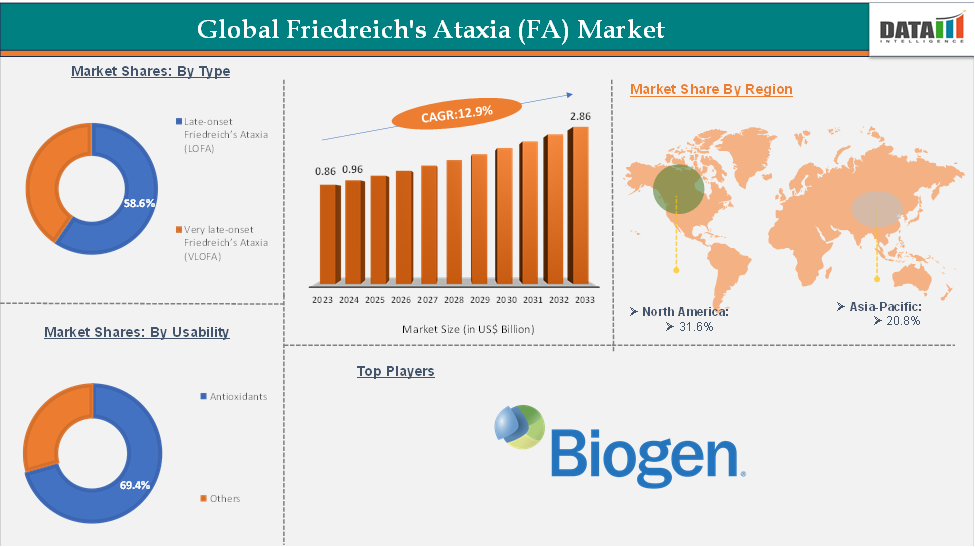

In 2023, the global Friedreich’s Ataxia (FA) market was valued at US$ 0.86 Billion. The global Friedreich’s ataxia (FA) market size reached US$ 0.96 Billion in 2024 and is expected to reach US$ 2.86 Billion by 2033, growing at a CAGR of 12.9% during the forecast period 2025-2033.

Friedreich’s Ataxia (FA) Market Overview

The Friedreich’s ataxia (FA) market is gaining momentum as pharmaceutical and biotech companies intensify their focus on rare neurodegenerative disorders. The market is primarily driven by strong clinical trial activity and a promising pipeline of innovative therapies, particularly in the areas of gene therapy and disease-modifying treatments. The designation of FA therapies as orphan drugs by regulatory bodies such as the FDA and EMA has further accelerated development by offering incentives like market exclusivity and fast-track approvals.

Additionally, there is a noticeable surge in pharmaceutical investment in neurological and genetic disorders, as companies recognize the high unmet need and commercial potential of novel therapies for FA. As clinical research advances and patient advocacy strengthens, the FA market is positioned for significant growth over the coming years.

Friedreich’s Ataxia (FA) Market Executive Summary

Friedreich’s Ataxia (FA) Market Dynamics: Drivers & Restraints

Strong clinical trial activity and pipeline momentum are significantly driving the Friedreich’s ataxia (FA) market growth

Strong clinical trial activity and a robust pipeline are key growth drivers for the Friedreich's Ataxia (FA) market. From 2023 through 2025, several promising investigational therapies have entered advanced stages: Larimar Therapeutics’ nomlabofusp (CTI‑1601) completed its Phase II dose-exploration study. PTC Therapeutics’ oral agent vatiquinone (PTC‑743) also pushed forward, delivering strong long-term data in the MOVE‑FA Phase III trial and preparing an NDA submission based on its statistically significant benefits. Gene therapy agents like Lexeo’s LX2006 have shown encouraging interim results in Phase I/II trials targeting cardiomyopathy, while Solid Biosciences’ SGT‑212 and Voyager’s AAV-based programs progressed under FDA IND and Fast Track designations for upcoming clinical testing.

These cumulative advancements, spanning protein replacement, small molecules, and gene therapy, are bolstering investor confidence, accelerating regulatory momentum, and paving the way for transformative treatments in FA.

Restraint:

The high treatment costs are hampering the growth of the Friedreich’s Ataxia (FA) market

High development costs are a major challenge that is expected to hamper growth in the Friedreich's Ataxia (FA) market. As a rare, genetically complex neurodegenerative disorder, FA requires highly specialized research, long-term clinical trials, and advanced technologies such as gene therapy and protein replacement. These treatments often involve lengthy development timelines, small patient populations, and high regulatory scrutiny, all of which contribute to escalating R&D costs. The cost burden is intensified by the need for specialized infrastructure, patient registries, and long-term safety monitoring, all of which are necessary for rare disease therapies.

Opportunity:

Gene therapy & crispr innovations is expected to create a lucrative opportunity for the growth of the Friedreich’s Ataxia (FA) market

Gene therapy and CRISPR innovations present a transformative opportunity for the Friedreich’s Ataxia (FA) market, offering the potential to address the root genetic cause of the disease rather than just managing symptoms. FA is caused by mutations in the FXN gene, leading to reduced frataxin protein levels. Gene therapy approaches aim to restore normal protein expression, potentially halting or reversing disease progression. Companies like Lexeo Therapeutics (LX2006) and Solid Biosciences (SGT-212) are actively advancing gene therapies through early-phase trials, showing promising safety and efficacy signals.

Pipeline Analysis:

For more details on this report – Request for Sample

Friedreich’s Ataxia (FA) Market, Segment Analysis

The global Friedreich’s ataxia (FA) market is segmented based on disease type, medication, and region.

The antioxidants from the medication segment are expected to hold 69.4% of the market share in 2024 in the Friedreich’s ataxia (FA) market

The antioxidants segment is expected to hold a dominant position in the Friedreich’s Ataxia (FA) market due to its established therapeutic role in mitigating mitochondrial dysfunction and oxidative stress, which are central to FA pathophysiology. This segment gained significant traction with the FDA approval of omaveloxolone in 2023, marking the first approved treatment specifically for FA. Its subsequent approvals in Europe and the UK by 2025 further solidified its market leadership.

Omaveloxolone, a potent Nrf2 activator, demonstrated statistically significant improvements in neurological function and disease progression in pivotal clinical trials, making it a cornerstone therapy. The combination of successful regulatory milestones, clinical efficacy, and continued innovation positions the antioxidants segment as a key driver in the growth and dominance of the FA treatment market.

Friedreich’s Ataxia (FA) Market, Geographical Analysis

North America is expected to hold a significant position in the global Friedreich’s ataxia (FA) market with a 41.6% share in 2024

North America holds a significant portion of the Friedreich’s Ataxia (FA) market due to several key factors, including strong clinical research infrastructure, favorable regulatory frameworks, and early adoption of innovative therapies. The region benefits from the presence of leading pharmaceutical companies and active patient advocacy groups that support awareness, diagnosis, and trial recruitment.

For instance, in December 2024, PTC Therapeutics announced the submission of the New Drug Application (NDA) for vatiquinone to the U.S. Food and Drug Administration (FDA), aimed at treating both children and adults with FA. This submission highlights North America's pivotal role in advancing late-stage therapeutics and securing timely regulatory approvals.

Moreover, the FDA’s orphan drug and fast track designations have incentivized the development of FA therapies, while well-established reimbursement systems and high healthcare spending further enable market growth. Together, these factors make North America a central hub for FA innovation, commercialization, and patient access.

Asia-Pacific is growing at the fastest pace in the Friedreich’s ataxia (FA) market, holding 20.8% of the market share

The Asia-Pacific region is emerging as the fastest-growing market in the Friedreich’s Ataxia (FA) landscape, driven by a combination of improving healthcare infrastructure, rising awareness of rare genetic disorders, and increased government and private investment in rare disease research.

Countries like China, Japan, South Korea, and India are expanding their capabilities in genomics, early diagnosis, and advanced therapeutic development, making the region more attractive for clinical trials and biopharmaceutical collaborations. Additionally, regional regulatory bodies are increasingly aligning with international standards, streamlining the approval process for orphan drugs and encouraging global companies to enter these markets.

Friedreich’s Ataxia (FA) Market Competitive Landscape

Top companies in the Friedreich’s ataxia (FA) market include Biogen (Reata Pharmaceuticals, Inc.), among others.

Friedreich’s Ataxia (FA) Market Key Developments

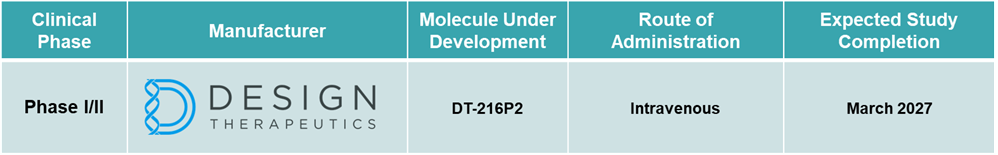

In June 2025, Design Therapeutics, Inc. announced that the first patient with Friedreich’s ataxia (FA) had been dosed via intravenous infusion in its RESTORE-FA Phase 1/2 open-label, multiple-ascending dose (MAD) clinical trial of DT-216P2. This marks a key milestone in the clinical evaluation of DT-216P2, a novel therapeutic candidate aimed at reactivating FXN gene expression by overcoming repeat expansions, which are the underlying genetic cause of FA.

Friedreich’s Ataxia (FA) Market Scope

Metrics | Details | |

CAGR | 7.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Disease Type | Late-onset Friedreich’s Ataxia (LOFA), Very late-onset Friedreich’s Ataxia (VLOFA) |

Medication | Antioxidants, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Friedreich’s ataxia (FA) market report delivers a detailed analysis with 25+ key tables, more than 30+ visually impactful figures, and 145 pages of expert insights, providing a complete view of the market landscape.