Formulations Additives Market Size

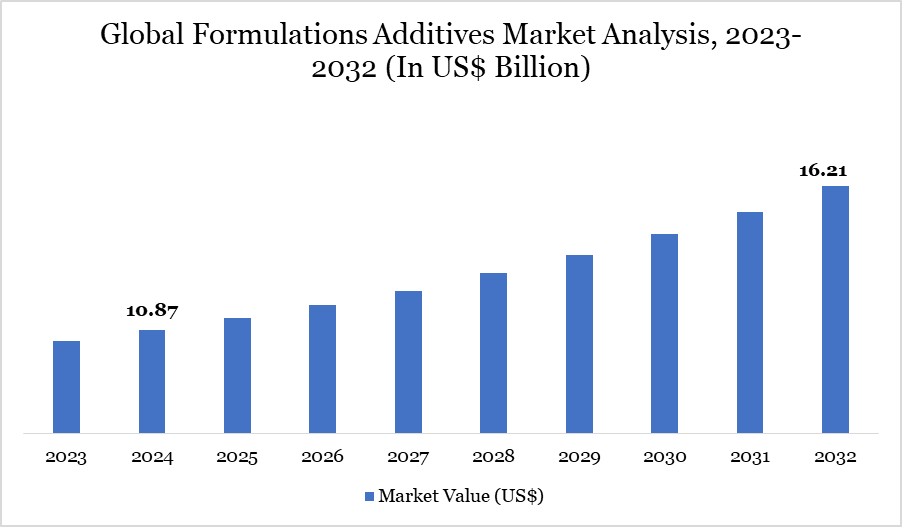

Formulations Additives Market Size reached US$ 10.87 billion in 2024 and is expected to reach US$ 16.21 billion by 2032, growing with a CAGR of 5.12% during the forecast period 2025-2032.

The formulation additives market is essential for enhancing the performance, stability, and environmental compatibility of end-use goods in sectors like paints and coatings, adhesives, sealants, construction materials, and plastics. These additives control essential qualities like as surface tension, rheology, ultraviolet resistance, and durability.

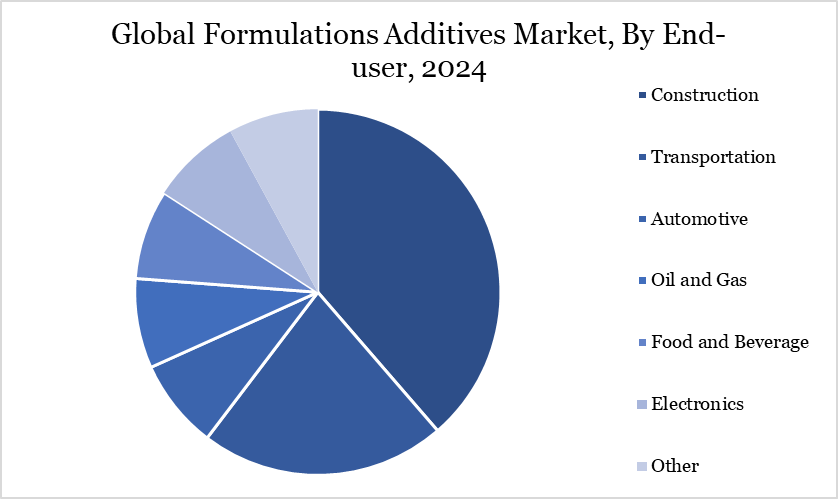

The market's expansion is driven by strong demand from industries including construction, automotive, packaging, and personal care. In 2023, specialty-purpose formulation additives in the US represented 21% of the market, with the automotive sector contributing 26% and the construction sector 53%, as reported by the American Coating Association.

The swift industrialization in the Asia-Pacific region and the growing need for product customization are broadening the market potential. Companies such as Clariant and Evonik are investing in innovative, customized formulations, while regulatory frameworks persist in influencing operating strategy. With the increasing emphasis on sustainability, bio-based and low-VOC formulations are gaining importance, transforming product development throughout the value chain.

Formulations Additives Market Trend

Prominent trends in the formulation additives market encompass heightened urbanization and an escalating need for customized solutions. By 2050, 68% of the world population a rise of 13% from 2018 will inhabit urban areas, resulting in an additional 2.5 billion individuals in cities. This transition is driving the furniture and construction industries, where formulation additives are essential for aesthetics, durability, and functional efficacy.

Consumer demand for customized products is compelling manufacturers to create additives for individualized skincare, shown by Clariant’s “Moor Skin” line, and medication delivery systems such as Evonik’s “RESOMER.” These innovations are increasing user experiences and stimulating demand for distinct and high-value additions.

The trend is reflected in industrial coating applications, exemplified by Clariant's 2023 introduction of new wetting and dispersion agents tailored for water-based formulations in the transportation and construction industries. These factors collectively promote an agile and innovation-driven environment in the formulation additives sector.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Type | Defoamers, Rheology Modifier, Dispersing Agents |

| By End-user | Construction, Transportation, Automotive, Oil and Gas, Food and Beverage, Electronics, Other |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Formulations Additives Market Dynamics

Green Chemistry and Sectoral Growth Catalyze Demand

The market for formulation additives is driven by industry-specific growth and increasing environmental obligations. The construction sector continues to be the predominant market, driven by increasing urban growth and renovation, with additives improving material aesthetics and durability while minimizing maintenance requirements.

Concurrently, the transportation sector is necessitating high-performance additives to comply with rigorous environmental regulations. Entities such as the American Petroleum Institute (API) and corporations like Lubrizol highlight the benefits of additives in enhancing fuel efficiency, diminishing pollutants, and extending engine longevity. Sustainability is crucial; low-VOC and bio-based additives are increasingly favored due to heightened regulatory pressure and customer awareness.

The US Environmental Protection Agency (EPA) asserts that compliance with green chemistry principles—minimizing toxicity and waste—is now an essential industrial requirement. BASF's 2024 investment in its Nanjing facility highlights the company's ambition to facilitate this transition, establishing itself as a leader in providing environmentally sustainable additive solutions adapted to changing industry demands.

Regulatory Compliance Burdens Industry Agility

Stringent regulatory regimes provide significant difficulties to the formulation additives business. Compliance requirements about environmental and health regulations established by the Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are augmenting operational complexity and expenses.

The European Union's REACH law mandates extensive testing and paperwork, imposing logistical and financial challenges on producers. The rising demand from consumers and authorities for environmentally friendly and sustainable additives imposes additional responsibilities. Manufacturers must reconcile innovation with environmental responsibility, frequently within limited timeframes.

The imperative to conform to green chemistry principles and utilize renewable raw materials, as advocated by organizations such as the American Chemical Society (ACS), necessitates substantial investment in research and development as well as reformulation methods. These limitations impede product rollouts and restrict the adaptability of smaller enterprises, eventually constraining market growth despite increasing demand in the construction, automotive, and consumer goods sectors.

Formulations Additives Market Segment Analysis

The global Formulations Additives market is segmented based on type, end-user and region.

Formulation Additives Fueling the Evolution of Sustainable Transportation Systems

The transportation sector is seeing increased demand for formulation additives due to changing regulatory and performance standards. Formulation additives are essential for augmenting fuel stability, minimizing engine wear, and enhancing cold-start performance key elements in contemporary transportation systems.

Prominent industry figures such as Lubrizol, Chevron, and ExxonMobil emphasize the significance of additives in achieving environmental compliance and ensuring engine durability. Additionally, regulatory organizations like the API have consistently revised fuel and lubricant standards to encourage reduced emissions and enhanced efficiency. Additives specifically designed for engine oils and fuel systems are increasingly crucial for compliance with these rules.

In 2023, Clariant's launch of dispersion agents for transportation coating applications demonstrates continuous innovation to address industry-specific requirements. As global transportation systems shift towards sustainability, the importance of specialized formulation additives will increase, rendering them essential for end-users in the automotive, aerospace, and commercial vehicle production industries.

Formulations Additives Market Geographical Share

Asia-Pacific's Industrial Dynamics Propelling Additive Adoption

The Asia-Pacific region has been the most dynamic sector in the worldwide formulation additives market, driven by rapid industrialization and infrastructure development in countries such as China, India, Japan, and South Korea. The Asian Development Bank (ADB) anticipates that ongoing industrial growth will maintain the region's demand for specialized chemicals, particularly formulation additives.

The expanding automobile, construction, and consumer goods industries are particularly crucial. Prominent corporations like BASF and Clariant have executed strategic investments in the area. BASF's recent 2024 expansion at its Nanjing plant demonstrates a dedication to fulfilling regional demand, as the facility transforms into a pivotal production center for additives in China and abroad.

Simultaneously, the expanding personal care sector, bolstered by local regulatory entities such as the Cosmetic, Toiletry and Fragrance Association of Japan, is intensifying the demand for high-performance, stable formulation additives utilized in skin care and cosmetic goods throughout the Asia-Pacific region.

Formulations Additives Market Major Players

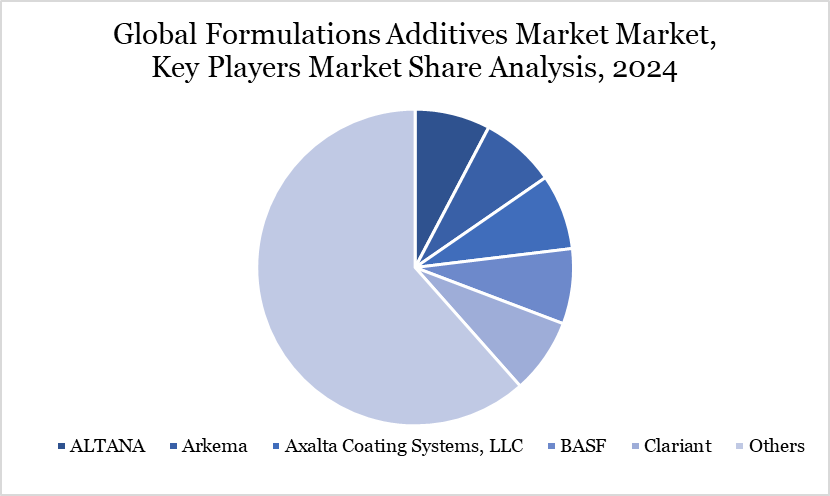

The major global players in the market include ALTANA, Arkema, Axalta Coating Systems, LLC, BASF, Clariant, Dow, Eastman Chemical Company, Honeywell International Inc., Mallard Creek Polymers, Ngoc Son and among others.

Sustainability Analysis

Sustainability is emerging as a fundamental element of the formulation additives market. Companies are progressively integrating their manufacturing with environmentally sustainable concepts, emphasizing renewable and bio-based raw resources. The American Chemical Society (ACS) indicates a notable transition towards bio-based additives that diminish reliance on fossil fuels.

The green chemistry principles advocated by the EPA are influencing the market, promoting the creation of safer, less harmful additives. Prominent companies like BASF and Evonik are diligently incorporating these concepts into their operations. BASF is investing in safer and more efficient formulations, whilst Evonik is enhancing its waste management and recycling systems to mitigate environmental effect.

The International Council of Chemical Associations (ICCA) advocates for optimal procedures to minimize industrial waste. With increasing environmental scrutiny and shifting consumer tastes, sustainability will continue to be pivotal for market innovation, regulatory adherence, and long-term success in the formulation additives sector.

Key Developments

In May 2024, BASF announced a significant investment in expanding its advanced additives plant at its Nanjing site. The move underscores BASF's unwavering commitment to delivering top-tier performance and formulation additives to the coatings industry. Over the past decade, the Nanjing site has evolved into a central hub for BASF's additives in China and the broader Asia-Pacific.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies