Global Forklift Truck Market: Industry Outlook

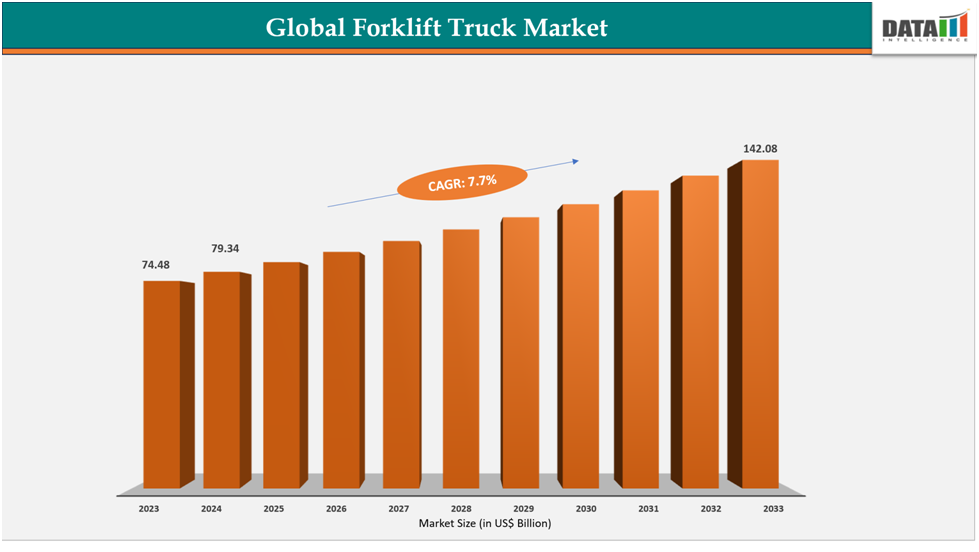

The global forklift truck market reached US$74.48 Billion in 2023, with a rise to US$79.34 Billion in 2024, and is expected to reach US$142.08 Billion by 2033, growing at a CAGR of 7.7% during the forecast period 2025–2033.

The forklift truck market is witnessing robust growth, largely driven by the rapid expansion of e-commerce and logistics sectors. With over a third of the global population shopping online, e-commerce has become a $6.8 trillion industry, expected to reach US$8 trillion by 2027. The rising number of online shoppers—approximately 2.77 billion globally—has significantly increased demand for efficient warehousing and last-mile delivery solutions, directly boosting forklift sales.

Similarly, according to the US Census Bureau, in the US, retail e-commerce sales reached US$304.2 billion in Q2 2025, a 1.4% increase from Q1, while total retail sales were US$1,865.4 billion, up 0.4% from the previous quarter. This steady growth in online and overall retail activity has amplified the need for advanced material handling solutions, including electric and automated forklifts. Industries are investing in modernized warehouses equipped with forklifts that enhance speed, efficiency, and safety, catering to the growing consumer demand.

Technological advancements, such as electric and autonomous forklifts, are further accelerating market growth by improving energy efficiency and reducing operational costs. Additionally, government initiatives promoting sustainable logistics and carbon neutrality encourage adoption of eco-friendly forklifts. Expansion in manufacturing, construction, and retail sectors, combined with financing and leasing options for small and medium enterprises, ensures continued market penetration. Overall, the forklift market is poised for steady growth, driven by e-commerce proliferation, technological innovation, and strategic investments.

Key Market Trends & Insights

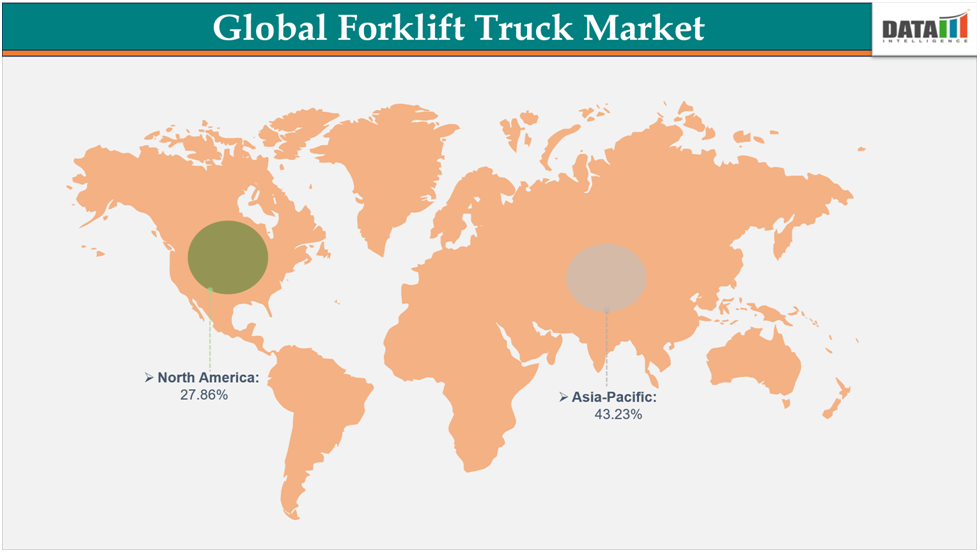

Asia-Pacific leads the global forklift truck market, accounting for 43.23% of the total share. The dominance is driven by rapid industrialization, booming e-commerce, and strong manufacturing activity across countries like China, India, and Japan.

North America is recognized as the fastest-growing region in the global UAV market, supported by high CAGRs. The growth is fueled by the region’s dominance is driven by strong demand from logistics, e-commerce, and manufacturing sectors, supported by advanced technology adoption and frequent product launches.

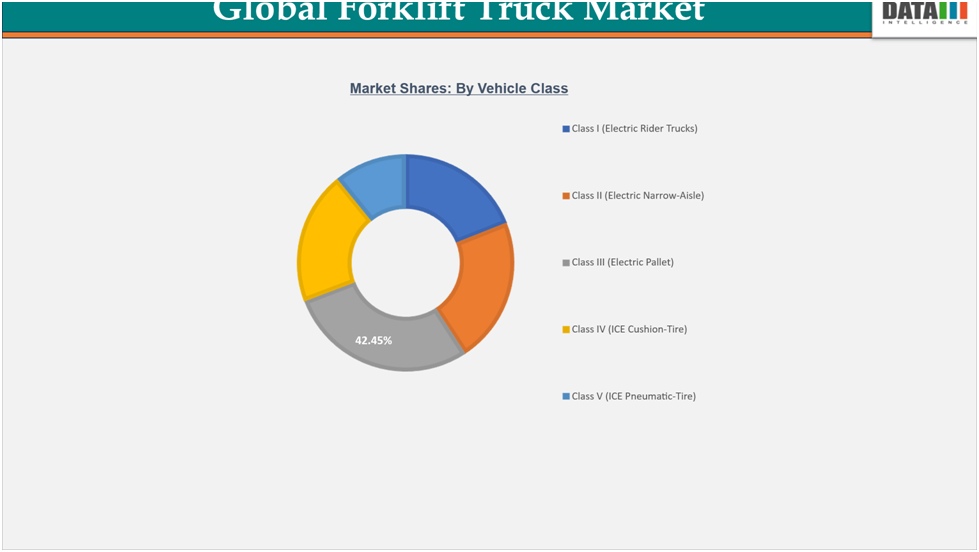

Class III forklifts currently dominate the global forklift truck market, holding a 42.45% share. These electric motor hand/rider trucks, including pallet movers and stackers, are widely used in warehouses and logistics due to their efficiency and versatility. Their strong adoption keeps them as the leading vehicle class globally.

Market Size & Forecast

2024 Market Size: US$79.34 Billion

2033 Projected Market Size: US$142.08 Billion

CAGR (2025–2033): 7.7%

Asia-Pacific: Largest market in 2024

North America: Fastest-growing market

Drivers & Restraints

Driver: Industrial and Manufacturing Expansion

The expansion of the industrial and manufacturing sector is significantly driving the global forklift truck market, as rising production volumes demand efficient material handling solutions. Factories and warehouses are increasingly adopting modern forklifts to move raw materials, components, and finished goods safely and quickly. Companies are also seeking automation to optimize operations, reduce labor costs, and enhance overall productivity. In line with this trend, on July 15, 2025, Hangcha Group launched its US subsidiary, Hangcha America Smart Logistics (HASL), in Houston, providing integrated smart logistics solutions, including AGV/AMR robots, automated storage systems, and new energy forklifts.

Hangcha’s global deployment of over 7,000 AGV units for clients such as P&G, BMW, and JD.com, along with RMB 1 billion in smart logistics contracts in 2024 and another planned RMB 1 billion investment in 2025, demonstrates the strong demand for technology-driven material handling in manufacturing hubs. These advancements are not only enhancing operational efficiency but also supporting sustainability goals through the adoption of electric and automated forklifts. As manufacturing operations scale, companies increasingly rely on smart logistics solutions to meet tight production schedules and manage growing inventory volumes.

Simultaneously, the rapid urbanization in emerging markets, particularly India, is amplifying forklift demand. According to the IEA, India’s urban population is projected to grow by 270 million by 2040, equivalent to adding a city the size of Los Angeles every year, yet less than 50% of the population will reside in urban areas. This urban expansion drives industrial hubs, warehouse development, and logistics infrastructure, all of which require modern forklifts. Together, industrial growth, technology adoption, and urbanization are creating a dynamic market landscape that fuels continuous demand for forklifts worldwide.

Restraint: Maintenance and Operating Costs

Maintenance and operating costs are key restraints on the forklift truck market because high expenses can deter companies from investing in new equipment. Internal combustion engine forklifts require frequent fuel, oil, and filter replacements, while electric forklifts involve costly battery replacements and charging infrastructure. Regular servicing, spare parts, and skilled labor for complex repairs further increase the total cost of ownership. Unexpected breakdowns can also lead to operational downtime, reducing productivity and adding financial pressure on businesses.

Older forklift fleets tend to incur higher maintenance costs, prompting companies to delay upgrades or opt for second-hand units. Energy consumption, especially in high-usage warehouses, adds to operating budgets, while regulatory compliance and safety inspections contribute indirect costs. These combined financial burdens slow the adoption of new forklifts, limit market growth, and make businesses more cautious about expanding or upgrading their fleets.

For more details on this report : Request for Sample

Segmentation Analysis

The global forklift truck market is segmented based on power-train type, vehicle class, load capacity, end-user, and region.

End-User: Class III Forklifts Lead with 42.45% Share, Driven by High Warehouse and Logistics Usage

Class III forklifts, or electric pallet trucks, hold a significant share in the forklift truck market because of their compact design, cost efficiency, and ability to operate in tight warehouse spaces. They are widely used in e-commerce, retail, and logistics hubs where frequent, short-distance load movements are required. Their maneuverability in narrow aisles has made them essential to modern distribution operations.

Their growing demand is also driven by sustainability and cost benefits. Electric pallet trucks run on clean energy, produce zero emissions, and are quieter compared to fuel-based models, making them ideal for indoor use. Lower maintenance requirements and improved ergonomics further enhance productivity and reduce worker fatigue, encouraging businesses to adopt them on a large scale. In July 2025, Crown launched its WJ 50 Series pedestrian pallet truck, a lightweight model capable of handling up to 1,500kg with high efficiency, which highlights the continuous innovation in this segment.

Ongoing product developments, such as improved battery technology and smart warehouse integration, ensure that Class III forklifts remain competitive and future-ready. Customer feedback on new launches like Crown’s WJ 50 Series has been positive, particularly for handling, comfort, and durability. As logistics demands rise with e-commerce growth, Class III electric pallet trucks will continue to dominate the forklift market and maintain their strong market share.

Geographical Analysis

Asia-Pacific Leads Forklift Market With 43.23%, Driven By Rapid Industrialization, Growing E-Commerce, and Robust Manufacturing Activities

The Asia-Pacific region holds the largest share in the global forklift truck market, driven by its strong industrial base, rapid urbanization, and booming e-commerce sector. China stands out as the global leader in digital retail, with over 60% of its 1.4 billion population shopping online and 37% of retail spending coming through e-commerce channels. This surge in online shopping has created massive demand for advanced warehousing and logistics infrastructure, where forklifts play a critical role in efficient goods movement and inventory handling.

Adding to this momentum, India is preparing to enter the core of the Fourth Industrial Revolution with its first indigenously made semiconductor chip, expected by the end of 2025. This step toward self-reliance will foster a resilient, technology-driven industrial base, further expanding the demand for automated and efficient material-handling solutions. As industries adopt digitalization and advanced manufacturing, the need for modern forklifts in logistics and production facilities will continue to accelerate across the region.

At the same time, manufacturers are introducing innovative solutions tailored for Asia-Pacific’s needs. For instance, in February 2025, Yale Lift Truck Technologies launched its ERP2.0-3.5MXLG electric counterbalance forklift in the region. Powered by lithium-ion batteries, it offers a sustainable, emission-free option with reduced maintenance costs, weatherproof cabins, and quiet operation, helping businesses achieve both efficiency and environmental goals. Together, these developments underline why Asia-Pacific maintains the highest share in the forklift truck market globally.

North America Tops Forklift Market (27.86%) – Driven by E‑Commerce & Automation

North America commands a significant share of the global forklift truck market, supported by its robust industrial base, extensive warehousing network, and rapidly growing e-commerce sector. In Canada alone, over 27 million people shopped online in 2022, representing 75% of the population, with the share expected to rise to 77.6% by 2025 — a trend that directly fuels warehouse expansion and forklift demand. Additionally, large infrastructure investments and reshoring of supply chains in the US and Canada keep forklift utilization rates high across manufacturing and construction.

OEM innovation further strengthens North America’s leadership. For example, in January 2025, Toyota Material Handling launched its Integrated Mid & Large Electric Pneumatic Forklifts and refreshed Core Electric Forklift in the US, designed to serve both heavy-duty outdoor and versatile indoor applications. These lithium-ion powered models deliver IC-like performance with greater sustainability, reflecting the region’s rapid shift toward electrification. Similar efforts by Crown, Hyster-Yale, and Raymond with new electric and automated lines showcase how product rollouts align with North America’s operational priorities of efficiency, safety, and carbon reduction.

The region’s share is also reinforced by continuous adoption of automation, AI-assisted forklifts, and operator-comfort upgrades, which attract investment from logistics providers and retailers. Strong dealer networks, financing options, and aftersales services ensure faster replacement cycles, further sustaining demand. Together, e-commerce growth, infrastructure spending, and high-profile launches like Toyota’s 2025 models illustrate how North America remains a key hub for innovation and consumption in the forklift truck market, securing its prominent global position.

Competitive Landscape

The major players in the Forklift truck market include Toyota Industries Corporation, KION Group AG, Jungheinrich AG, Crown Equipment Corporation, Mitsubishi Logisnext Co., Hyster-Yale Materials Handling, Anhui Forklift Group Co. (HELI), Hangcha Group Co., Doosan Bobcat, and Clark Material Handling

Northrop Grumman Corporation: Toyota Industries Corporation is a Japanese multinational company with a diversified business portfolio spanning automotive, materials handling, electronics, and logistics solutions. The company is a pioneer in the forklift industry, offering a comprehensive range of forklift trucks including electric, internal combustion (ICE), and fuel-cell models. Key products include Electric Forklifts, Integrated Electric Forklifts, Electric Pallet Jacks, Pallet Stackers, Reach Trucks, Order Pickers, Pneumatic Tire Forklifts, Cushion Tire Forklifts, Heavy Duty Forklifts, Tow Tractors & Tuggers, Hand Pallet Jacks, and Automated Guided Vehicles, catering to industries such as manufacturing, logistics, construction, and retail. The company continues to expand its global footprint with a strong focus on sustainability and smart material handling solutions.

Market Scope

Metrics | Details | |

CAGR | 7.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Power-train Type | Internal Combustion Engine (ICE), Electric, Hydrogen Fuel-cell Vehicle (HFCV) |

Vehicle Class | Class I (Electric Rider Trucks), Class II (Electric Narrow-Aisle), Class III (Electric Pallet), Class IV (ICE Cushion-Tire), Class V (ICE Pneumatic-Tire) | |

Load Capacity | Less than 5 Tons, 5-15 Tons, Above 15 Tons | |

| End-user | Manufacturing, Logistics & Warehousing, Construction & Infrastructure, Retail & Wholesale, Food & Beverage Cold-Chain, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Forklift truck market report delivers a detailed analysis with 70 key tables, more than 76visually impactful figures, and 67 pages of expert insights, providing a complete view of the market landscape.