Heavy Electric Vehicle Market Size

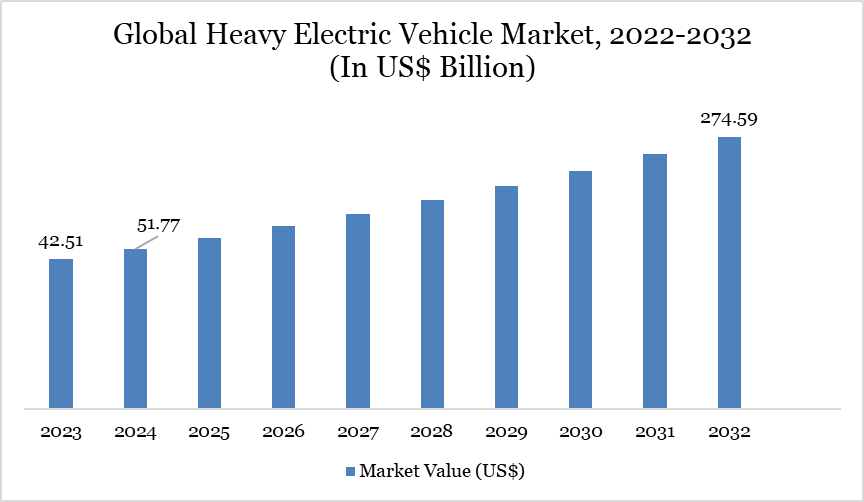

The Heavy Electric Vehicle Market size valued at US$ 51.77 billion in 2024, is projected to reach US$ 274.59 billion by 2032, expanding at a robust CAGR of 23.19% from 2025 to 2032.

Global electric truck sales surpassed 54,000 units in 2024, maintaining momentum and outpacing electric bus sales for the second consecutive year, underscoring the rapid shift in heavy-duty electrification. China accounted for around 70% of global electric truck sales, continuing its dominance though gradually losing share from earlier peaks, while Europe nearly tripled electric truck registrations, surpassing 10,000 units and achieving a sales share above 1.5%. These 2024 developments highlight a decisive transformation in global freight transport toward zero-emission heavy vehicles.

Heavy Electric Vehicle Market Trend

China continues to dominate the global landscape: in 2024, electric buses surpassed 70,000 units in global sales, driven by robust domestic demand-though sales outside China grew by a modest 5%, nearly tripling compared to 2020. While this stat covers buses, it signals aggressive electrification that likely extends into heavy-duty truck segments, reflecting the country’s leadership in heavy EV adoption and its comparative infrastructural and policy advantages.

Heavy Electric Vehicle Market Scope

Metrics | Details |

By Vehicle Type | Electric Construction & Mining Vehicles, Electric Trucks, Electric Buses |

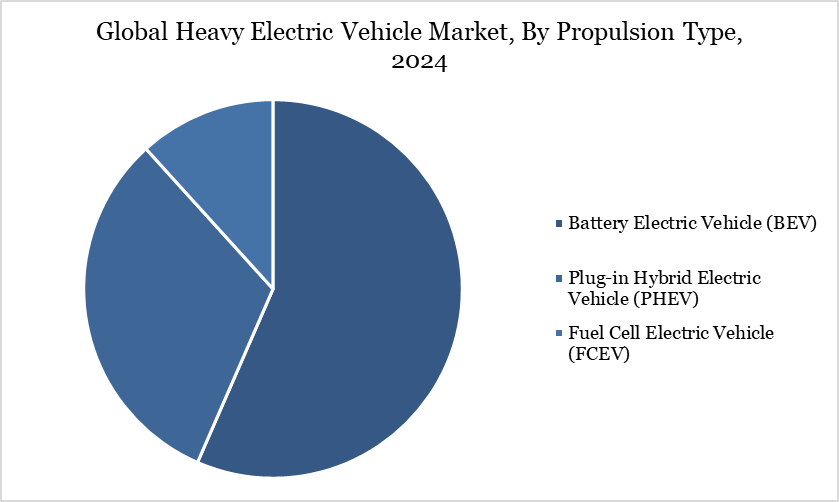

By Propulsion Type | Plug-in Hybrid Electric Vehicle (PHEV), Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV) |

By Battery Type | Lithium-Ion Battery, Nickel-Metal Hydride (NiMH) Battery, Solid-State Battery, Others |

By Battery Capacity | Less than 200 kWh, 200-500 kWh, Above 500 kWh |

By Application | Logistics and Freight Transportation, Public Transport, Construction & Mining, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rapid Electrification of Mining and Construction Fleets

Rapid electrification of heavy machinery is gaining pace-deployments of battery-powered surface mining trucks and electric loaders have more than doubled, with global counts now exceeding 650 units across surface and underground operations. In Asia-Pacific, electric dump trucks dominate with over 38% of the global electric dump truck market share in 2023, backed by significant investments such as a US$ 3 billion national charging infrastructure rollout. These advances, enabled by falling battery costs and strong institutional frameworks, are accelerating the shift toward zero-emission heavy-duty transport.

Limited High-Capacity Charging Infrastructure for Heavy-Duty Applications

The global heavy electric vehicle market faces a notable constraint in the form of insufficient high-capacity charging infrastructure tailored for heavy-duty applications. For instance, as of early 2023, Europe had deployed only about 160 truck-specific charging points, with just six located along the Rhine–Alpine freight corridor, each offering 300 kW of power.

Similarly, in the US, around 210 electric truck charging points were operational, with 1,020 additional stations planned, and an average charger capacity of approximately 180 kW. These figures reflect the slow pace of infrastructure expansion, which limits the practicality and adoption of heavy-duty electric trucks for long-haul and regional operations.

Segment Analysis

The global heavy electric vehicle market is segmented based on vehicle type, propulsion type, battery type, battery capacity, application and region.

Plug-in Hybrid Electric Vehicle (PHEV) Segment Driving Heavy Electric Vehicle Market

Plug-in hybrid electric vehicles (PHEVs) are increasingly seen as a bridge technology in the transition to zero-emission heavy transport. In 2024, global sales of plug-in hybrid and battery-electric cars combined reached 17 million units, accounting for nearly 20% of all vehicles sold worldwide. China remained the dominant market, with over 9 million EV and PHEV units sold, supported by national subsidies and fleet electrification programs.

The European Union also reported over 3.2 million new EV and PHEV registrations in 2023, driven by CO₂ compliance targets. While most of these figures come from passenger vehicles, the rapid scaling of PHEV adoption in fleets signals strong potential for heavy-duty truck applications. The segment offers extended range and operational flexibility, making it attractive for long-haul and industrial logistics use cases.

Geographical Penetration

Asia-Pacific Drives the Global Heavy Electric Vehicle Market

The Asia-Pacific region is emerging as the strongest demand hub for heavy electric vehicles, led by China and India. In 2024, China accounted for over 80% of global electric medium- and heavy-duty truck sales, with global volumes crossing 90,000 units and growing nearly 80% year-on-year. Government policies such as scrappage incentives and stricter emissions standards have accelerated adoption, with provinces like Hebei already deploying 30,000 electric trucks in industrial operations.

India, though at an early stage, is seeing demand from large-scale fleet operators, with UltraTech Cement ordering 100 electric trucks for a 400 km interplant route and Billion E-Mobility securing 180 units, including 55-tonne heavy-duty models. These corporate commitments are encouraging manufacturers like Ashok Leyland to expand electric truck production capacity. Together, China’s large-scale adoption and India’s strategic deployments underline Asia-Pacific’s pivotal role in the transition toward heavy-duty zero-emission transport. This demand trajectory signals strong government-industry alignment in advancing electrified freight mobility.

Sustainability Analysis

Sustainability analysis in the heavy EV sector focuses on environmental impact, regulatory alignment, and infrastructure readiness for decarbonizing transport. In India, an electric freight initiative has signaled demand for 7,750 electric freight vehicles by 2030, showing industry intent toward zero-emission logistics. China has already deployed around 12,000 medium- and heavy-duty electric trucks, highlighting rapid adoption and infrastructure maturity. These developments reflect both government-led and industry-driven momentum toward sustainable heavy transport. The progress signals strong alignment with global decarbonization and net-zero targets.

Competitive Landscape

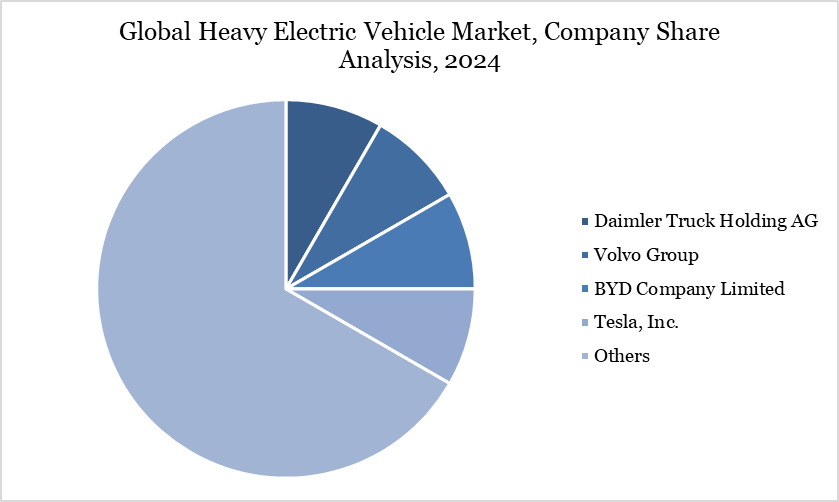

The heavy electric vehicle market key players include Daimler Truck Holding AG, Volvo Group, BYD Company Limited, Tesla, Inc., Nikola Corporation, Scania AB, PACCAR Inc., Tata Motors Limited, Ashok Leyland Limited, and Hyundai Motor Company.

Key Developments

In June 2025, the Ministry of Heavy Industries (MHI) launched the application portal for the Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI). The initiative, notified in March 2024 and detailed through guidelines issued in June 2025, aims to boost domestic EV manufacturing capacity.

In September 2024, Volvo announced its next-generation heavy-duty electric truck capable of achieving up to 600 km on a single charge. This milestone represents a major breakthrough for long-distance, zero-emission transport. The innovation strengthens the global push toward heavy vehicle electrification. It marks a critical step in making sustainable freight movement viable over extended routes.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies