Global Heavy Duty Construction Equipment Market: Industry Outlook

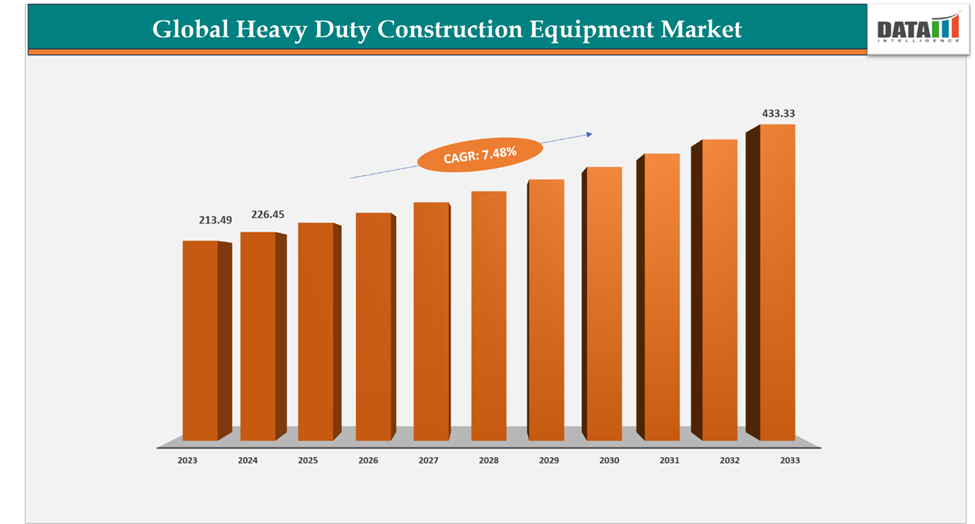

The global heavy duty construction equipment market reached US$ 213.49 billion in 2023, with a rise to US$ 226.45 billion in 2024, and is expected to reach US$ 433.43 billion by 2033, growing at a CAGR of 7.48% during the forecast period 2025–2033. The heavy duty construction equipment market is witnessing consistent growth, fueled by rapid urban development, expanding infrastructure projects, and rising investments across residential, commercial, and industrial construction sectors worldwide. Demand for machinery such as excavators, loaders, bulldozers, and cranes is being propelled by the expansion of road networks, smart city programs, and increased activity in the mining and oil & gas industries.

Furthermore, advancements in technologies like telematics, GPS-enabled fleet management, automation, and electrification of equipment are improving operational efficiency, minimizing downtime, and lowering overall costs. Growing emphasis on environmental sustainability and stricter emission regulations are also driving adoption of energy-efficient and eco-friendly machinery.

In addition, the rise of the equipment rental industry, combined with significant government infrastructure funding and public–private partnership (PPP) initiatives, is strengthening market growth. With construction activity intensifying globally and technology integration gaining momentum, the heavy duty construction equipment market is positioned to sustain a robust growth path in the years ahead.

Key Market Trends & Insights

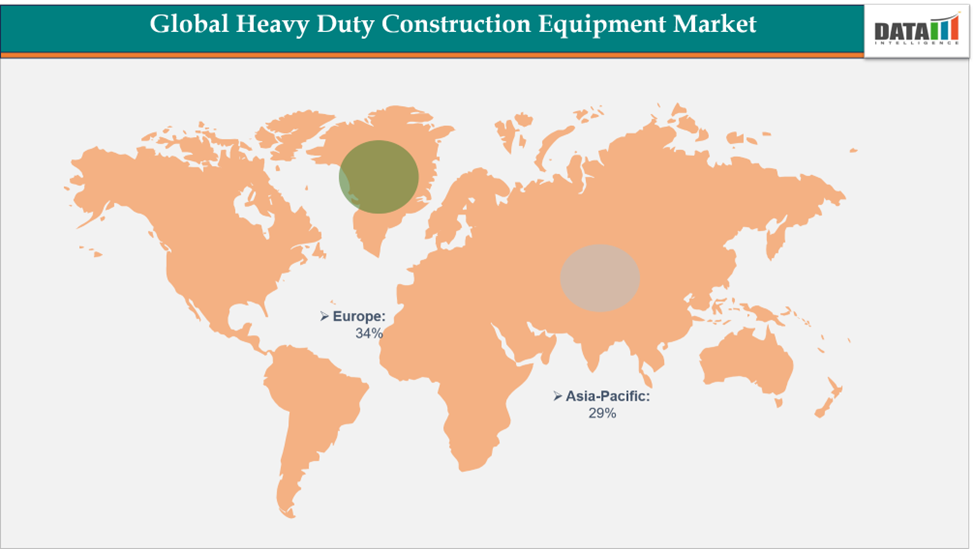

Europe accounted for approximately of the 34% global heavy duty construction equipment market in 2023 and is expected to retain its dominance throughout the forecast period. Its leadership is driven by robust infrastructure growth, advanced construction techniques, and substantial investments in smart city initiatives and sustainable building projects.

Asia Pacific is anticipated to witness the fastest growth, propelled by rapid urbanization, large-scale infrastructure development, expanding industrialization, and increasing government expenditure on roads, housing, and energy sectors.

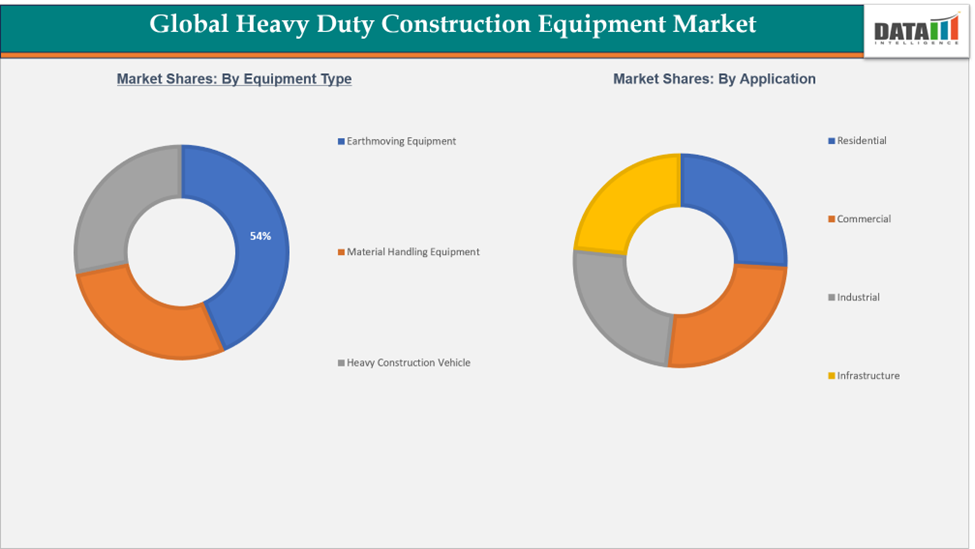

The Earthmoving Equipment segment remains the leading category due to its extensive use in construction, mining, and infrastructure projects, supported by rising demand for excavators, loaders, and bulldozers.

Market Size & Forecast

2024 Market Size: US$ 226.45 Billion

2033 Projected Market Size: US$ 433.43 Billion

CAGR (2025–2033): 7.48%

Europe: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Urbanization and Infrastructure Expansion

Urbanization and the rapid pace of infrastructure expansion are key factors propelling the Heavy Duty Construction Equipment market. Growing city populations are driving demand for residential, commercial, and industrial construction across the globe. According to UN-Habitat, nearly 68% of the world’s population will reside in urban areas by 2050, requiring extensive investment in transport networks, housing, and public infrastructure. This construction boom is significantly increasing the use of excavators, bulldozers, cranes, and loaders in multiple applications.

Additionally, government-backed initiatives for smart cities, renewable energy facilities, and transport upgrades are opening new growth avenues for equipment manufacturers. Rising mining activities and oil & gas projects are also stimulating machinery demand. With increasing construction intensity worldwide, coupled with industrial growth and infrastructure modernization, heavy duty equipment remains critical, positioning the market for continued expansion.

Restraint: High Investment Needs and Regulatory Pressure

The high capital requirement for purchasing heavy machinery, alongside stringent environmental regulations, poses challenges to the heavy duty construction equipment market. Equipment such as earthmovers, cranes, and excavators demand significant upfront investment, which can be difficult for smaller contractors to afford. Moreover, costs tied to fuel consumption, maintenance, and operator training further elevate total ownership expenses, limiting adoption in cost-sensitive markets.

On the regulatory front, governments are tightening emission standards and promoting sustainable, fuel-efficient machinery. While this encourages innovation, it raises manufacturing costs for OEMs. Another restraint is the shortage of skilled operators in many emerging economies, affecting productivity and safe usage. Collectively, these factors can dampen adoption rates, particularly in regions where budgets are constrained, even though construction and infrastructure needs continue to expand globally.

For more details on this report, Request for Sample

Segmentation Analysis

The global heavy duty construction equipment market is segmented based on equipment type, application, propulsion, sales channel, power output, and region.

Equipment Type-The earthmoving equipment heavy duty construction equipment segment is estimated to have 54% of the heavy duty construction equipment market share.

This category encompasses excavators, bulldozers, and loaders, all of which are vital in road construction, mining, and large-scale infrastructure projects. Their versatility, durability, and efficiency across different terrains make them indispensable to contractors worldwide.

Rising integration of automation, telematics, and smart fleet management tools is improving operational efficiency, while flexible purchase and rental models are broadening access. Their ability to handle a wide range of tasks from excavation and grading to material handling further underlines their importance. Supported by ongoing megaprojects and high demand across both mature and emerging markets, earthmoving equipment is expected to retain its leadership throughout the forecast period.

Geographical Analysis

The Europe heavy duty construction equipment market was valued at 34% market share in 2024

The region’s leadership is supported by advanced construction technologies, well-established infrastructure, and a strong focus on sustainability. European countries are at the forefront of green building initiatives and smart city projects, driving consistent demand for modern and eco-friendly heavy machinery. Nations such as Germany, France, and the UK are spearheading infrastructure modernization, with a particular emphasis on renewable energy facilities, transport upgrades, and sustainable housing developments.

The region also benefits from the strong presence of globally recognized OEMs such as Volvo CE, Liebherr, and JCB, which are continuously innovating in automation, electrification, and telematics integration. Additionally, government-backed programs for expanding roadways, railways, ports, and public facilities ensure stable market opportunities. Stringent environmental regulations, while challenging for equipment manufacturers, have also accelerated the adoption of low-emission, fuel-efficient machinery across the region. Together, these factors position Europe as the most mature and innovation-driven market for heavy duty construction equipment globally.

The Asia-Pacific heavy duty construction equipment market was valued at 29% market share in 2024

The region’s rapid expansion is fueled by large-scale industrialization, robust economic growth, and extensive infrastructure investments across key economies such as China, India, Japan, and Southeast Asia. Rising government spending on transport networks including highways, airports, ports, and metro systems—has significantly boosted the demand for earthmoving and material-handling equipment. In addition, energy infrastructure projects, such as renewable energy plants and oil & gas facilities, are creating long-term opportunities for machinery suppliers.

The region’s advantages also include a large labor force, rapidly growing urban populations, and increasing foreign direct investment (FDI) in construction and industrial projects. Urbanization is creating massive demand for residential and commercial buildings, while rural development programs are driving the need for road building, irrigation, and power projects. With governments actively pursuing infrastructure modernization and smart city development, Asia Pacific is expected to record the highest growth rate globally. Supported by favorable policies, technological adoption, and the sheer scale of infrastructure pipelines, the region is set to surpass other markets in future growth momentum.

Competitive Landscape

The major players in heavy duty construction equipment market include JCB, AB Volvo, Caterpillar, HD Hyundai Construction Equipment Co.,Ltd., Hitachi Construction Machinery Americas Inc., Deere & Company, LIEBHERR, CNH Industrial N.V., Doosan Corporation., Atlas Copco AB

JCB: JCB is a prominent player in the heavy duty construction equipment market, renowned for its innovative approach and versatile machinery that supports large-scale infrastructure and construction activities worldwide. Its core product lineup, featuring backhoe loaders and excavators, is engineered for superior performance, durability, and ease of operation. These equipment solutions are essential in earthmoving, road construction, and industrial projects, helping optimize productivity while minimizing downtime. With a strong commitment to sustainability, JCB continues to advance electric and hybrid technologies, solidifying its role as a leader in next-generation construction equipment.

Market Scope

Metrics | Details | |

CAGR | 7.48% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Equipment Type | Earthmoving Equipment (Excavators (including mini-excavators) Dozers (bulldozers) Loaders (wheel, backhoe, skid-steer) Motor Graders Compactors and Rollers Scrapers), Material Handling Equipment (Cranes (tower, crawler, telescopic handler) Forklifts Conveyor Systems Hoists), Heavy Construction Vehicle (Dump Trucks (articulated and rigid) Concrete Mixers Asphalt Pavers), Others |

Application | Residential, Commercial, Industrial, Infrastructure | |

Propulsion | Diesel, CNG/LNG, Electric | |

| Sales Channel | OEM, Aftermarket, Rental |

| Power Output | Below 200 HP, 200-400 HP, Above 400 HP |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Heavy Duty Construction Equipment market report delivers a detailed analysis with 74 key tables, more than 78 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more heavy duty construction equipment-related reports, please click here