Feminine Hygiene Products Market Size and Trends

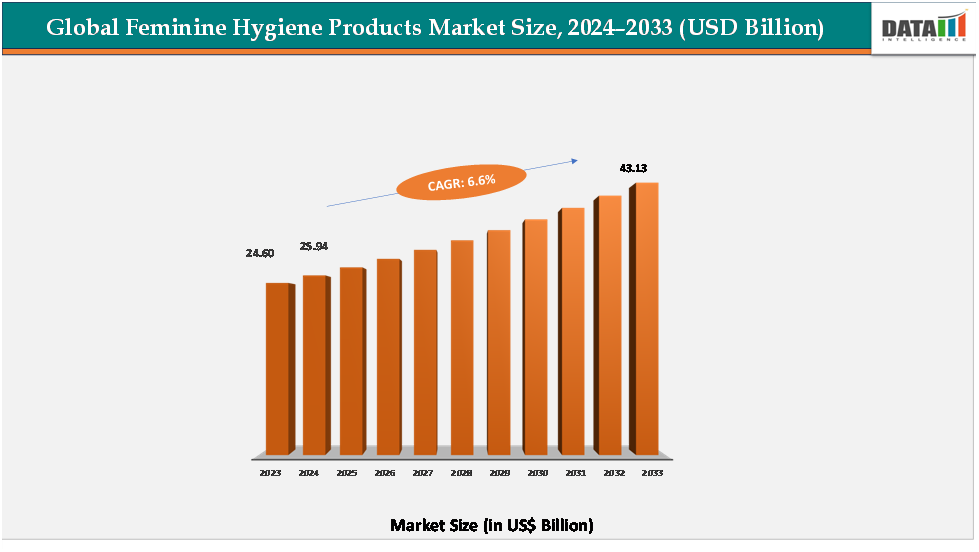

The global feminine hygiene Products Market reached US$ 24.60billion in 2023, with a rise to US$ 25.94 billion in 2024, and is expected to reach US$ 43.13 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025–2033.

The growing emphasis on women’s health and wellness is transforming the feminine hygiene products market, as modern solutions are enabling safer, more convenient, and sustainable menstrual care. With their ability to provide reliable protection, promote comfort, and support better hygiene practices, these products are empowering women to manage menstruation with greater confidence and dignity. The rising availability of innovative offerings such as organic pads, menstrual cups, biodegradable products, and period underwear is meeting the dual demand for effectiveness and eco-friendliness, while expanding retail and e-commerce channels are improving accessibility worldwide. This increasing reliance on high-quality feminine hygiene solutions is not only enhancing women’s quality of life but also addressing critical issues of health equity, education, and workplace productivity, positioning feminine hygiene products as an indispensable part of modern personal care and public health initiatives globally.

Key Market highlights

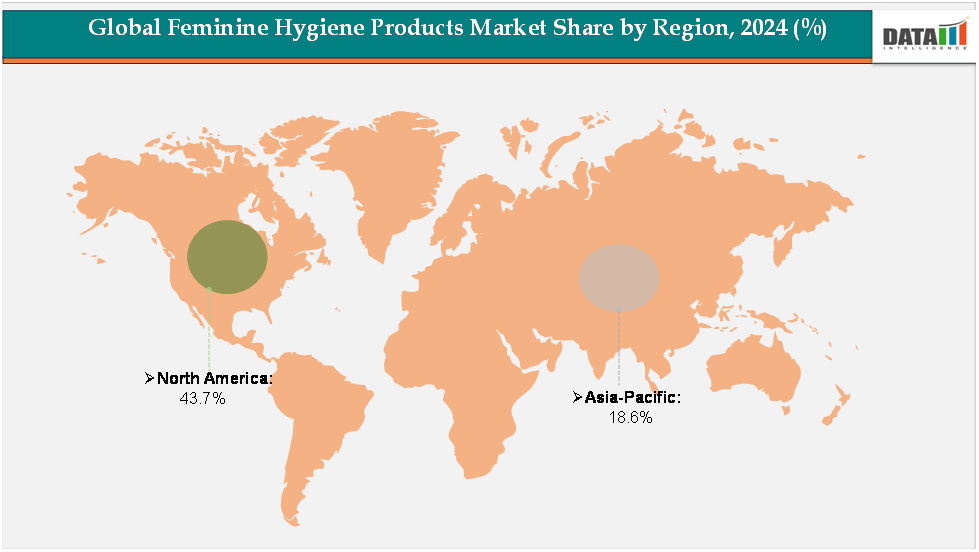

North America dominates the market with over 43.7% revenue share, driven by high awareness of menstrual health, strong presence of leading brands such as Procter & Gamble and Kimberly-Clark, and widespread adoption of premium and eco-friendly products supported by robust retail and e-commerce networks.

Asia-Pacific is emerging as the fastest-growing region with nearly 18.6% share, fueled by government-led menstrual hygiene initiatives, rising female workforce participation, improving disposable incomes, and increasing product accessibility in high-population countries such as India and China.

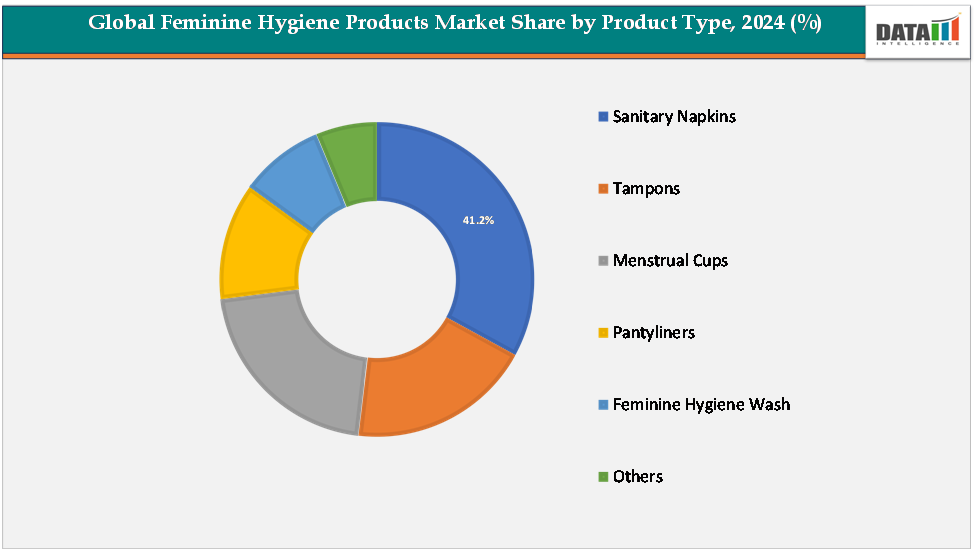

The sanitary napkins segment leads the market, accounting for more than 41.2% of global revenue, owing to their affordability, ease of use, and widespread distribution through awareness programs and retail channels, making them the most widely adopted product type in the feminine hygiene products sector.

Market Size & Forecast

2024 Market Size: US$25.94Billion

2033 Projected Market Size: US$43.13Billion

CAGR (2025–2033): 6.6%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Drivers & Restraints

Driver: Rising Awareness of Menstrual Health and Hygiene

Rising awareness of menstrual health and hygiene is expected to be one of the most significant drivers of the feminine hygiene products market, as increasing education, advocacy campaigns, and government-led initiatives are encouraging more women to adopt safe and reliable menstrual care solutions. In both developed and emerging economies, schools, NGOs, and healthcare organizations are working to break taboos, promote open discussions, and distribute sanitary products, which is boosting acceptance and reducing stigma around menstruation. This shift is particularly impactful in rural and underserved areas, where access to menstrual products has historically been limited. For instance, in April 2023, the Supreme Court of India urged the Central Government, in collaboration with States and Union Territories, to frame a uniform national policy on menstrual hygiene in schools. The proposed policy is intended to ensure the availability of sanitary pads, proper vending and disposal facilities, and dedicated washrooms for girl students, thereby promoting better menstrual health and hygiene in educational institutions. As more women gain knowledge about the importance of hygienic practices during menstruation, demand for sanitary pads, tampons, menstrual cups, and eco-friendly alternatives continues to rise.

The growing emphasis on menstrual health not only improves women’s quality of life and reduces health risks but also positions feminine hygiene products as essential to gender equality, workplace productivity, and overall public health, thereby fueling steady market growth worldwide.

Restraint: Stringent regulatory requirements

Cultural taboos and social stigma around menstruation continue to act as major restraints for the feminine hygiene products market, particularly in developing and rural regions. The stigma also affects product distribution, as some retailers and consumers are hesitant to purchase or display sanitary items openly. Additionally, social pressure and myths related to menstruation can restrict women’s participation in education, work, and community activities, further reducing demand for commercial products. As a result, despite rising innovation and availability, cultural barriers slow adoption rates and hinder the full market potential, making awareness campaigns and education crucial for breaking these taboos and expanding access to feminine hygiene solutions.

For more details on this report - Request for Sample

Segmentation Analysis

The global feminine hygiene products market is segmented by product type, distribution channel, and region.

Product Type: The sanitary napkins segment is estimated to have 41.2% of the feminine hygiene products market share.

Sanitary napkins remain the dominant segment in the feminine hygiene products market, holding the largest share of revenue worldwide, and their strong position can be attributed to multiple interlinked factors. First, sanitary napkins are widely available across both developed and developing regions, making them the most commonly used menstrual care product globally. Their ease of use, comfort, and relatively low cost compared to other alternatives, such as tampons or menstrual cups, ensure mass adoption among women of different age groups and socioeconomic backgrounds.

In many emerging markets, sanitary napkins are the first product introduced in government and NGO-led awareness and distribution programs aimed at improving menstrual hygiene, particularly in rural and underserved areas where access to menstrual care is limited. This has positioned sanitary napkins as the entry-level solution for menstrual health, significantly increasing their penetration.

Additionally, strong brand presence and aggressive marketing strategies by global leaders such as Procter & Gamble (Always), Kimberly-Clark (Kotex), and Essity (Libresse) have helped build consumer trust and loyalty, further reinforcing their dominance. Continuous product innovations have also played a crucial role in sustaining leadership, with advancements such as ultra-thin pads, improved absorbency technology, organic and biodegradable options, and specialized variants catering to different needs like overnight protection, sensitive skin, or extra-long coverage. For instance, in August 2025, two alumni of Marwadi University, Foram Kundalia and Khushal Katdare, have developed an eco-friendly solution to tackle pollution and hygiene challenges by converting agricultural stubble into biodegradable sanitary napkins. Through their startup, Nishkaam Innovations, they have also created UriMate, a portable female urination device designed to improve public hygiene. The venture is DPIIT-recognized and incubated at the Marwadi University Centre of Innovation, Incubation and Research (MUIIR Centre). These innovations not only enhance user comfort and safety but also respond to rising consumer preferences for health-conscious and environmentally sustainable products.

The menstrual cups segment is estimated to have 19.7% of the feminine hygiene products market share.

Menstrual cups are emerging as the fastest-growing segment in the feminine hygiene products market, and this rapid expansion is fueled by the rising global demand for sustainable, cost-effective, and eco-friendly menstrual care solutions. With increasing awareness of the environmental impact of disposable sanitary products such as pads and tampons, consumers are actively seeking alternatives that reduce waste. Menstrual cups, being reusable for several years, not only address sustainability concerns but also offer substantial long-term cost savings compared to disposable products, making them an increasingly attractive choice for women across both developed and developing regions.

In addition to their eco-friendly benefits, menstrual cups provide convenience and practicality that align with modern lifestyles. Their extended wear time, comfort during physical activities, and suitability for travel make them highly appealing to urban women with busy schedules. These factors have significantly boosted their popularity among tech-savvy and health-conscious demographics, who are also more open to trying innovative solutions. While adoption in rural and conservative areas remains limited due to cultural taboos, lack of awareness, and hesitation to embrace internal menstrual products, this barrier is gradually being reduced through targeted educational campaigns. NGOs, advocacy groups, and healthcare professionals are increasingly promoting the benefits of menstrual cups, emphasizing their safety, hygiene, and cost-effectiveness.

Manufacturers are also investing in marketing strategies, product diversification (different sizes and materials), and distribution through both traditional retail and e-commerce channels to enhance accessibility. As conversations around menstrual health and sustainability gain momentum globally, menstrual cups are positioned as the most rapidly expanding category in the feminine hygiene products market, expected to capture an increasing share in the years ahead.

Geographical Analysis

The North America feminine hygiene products market was valued at 43.7%market share in 2024

North America holds a dominant position in the global feminine hygiene products market, supported by high awareness levels, advanced healthcare and retail infrastructure, and strong adoption of premium menstrual care solutions. Women in the region benefit from widespread access to a wide range of products, including sanitary pads, tampons, menstrual cups, pantyliners, and feminine hygiene washes, available through both offline retail and rapidly growing e-commerce channels. Cultural openness and proactive campaigns around menstrual health have significantly reduced stigma, further driving usage.

Moreover, consumers in North America show a strong preference for innovative and sustainable options, such as organic pads, biodegradable products, and reusable menstrual cups, which has encouraged manufacturers to invest heavily in eco-friendly product development. The presence of leading multinational players like Kimberly-Clark and Procter & Gamble, along with their strong brand portfolios and marketing strategies, further strengthens the region’s leadership in the market.

The Europe feminine hygiene products market was valued at 22.3% market share in 2024

Europe represents a significant market for feminine hygiene products, driven by high levels of menstrual health awareness, strong consumer demand for sustainable and eco-friendly solutions, and supportive regulatory frameworks. Consumers in Europe are increasingly shifting towards biodegradable pads, organic tampons, and reusable menstrual cups, influenced by strict environmental policies and a growing preference for green lifestyles. Countries like Germany, the UK, and France are at the forefront of this transition, with consumers willing to pay a premium for high-quality, eco-conscious products.

Additionally, several European governments have taken steps to improve menstrual equity, such as reducing or eliminating the "tampon tax" and providing free sanitary products in schools and public institutions, further boosting market penetration. The strong presence of both global brands and emerging local players focusing on sustainable innovations makes Europe a highly competitive and evolving market segment.

The Asia-Pacific feminine hygiene products market was valued at 18.6% market share in 2024

Asia-Pacific is emerging as the fastest-growing region in the feminine hygiene products market, fueled by rising awareness of menstrual health, government-led initiatives, and rapid urbanization across countries like India, China, and Indonesia. Increasing female workforce participation, improving disposable incomes, and better retail penetration are driving higher product adoption, even in semi-urban and rural areas. Several governments and NGOs are actively distributing sanitary napkins and launching educational campaigns to break cultural taboos around menstruation, which is significantly boosting demand.

At the same time, the growing popularity of e-commerce platforms in the region is improving product accessibility, particularly among younger, tech-savvy consumers. While affordability remains a challenge for some populations, the market’s large and underserved base represents a significant growth opportunity, making Asia-Pacific the most dynamic and rapidly expanding region for feminine hygiene products.

Competitive Landscape

The major players in the feminine hygiene products market include Kimberly-Clark Worldwide, Inc., Procter & Gamble, Essity Aktiebolag, Unicharm Corporation, Premier Care Industries, Ontex BV, Natracare LLC, Albaad, Drylock Technologies, Edgewell Personal Care, among others.

Kimberly-Clark Worldwide, Inc:

Kimberly-Clark Worldwide, Inc. holds a strong position in the feminine hygiene products market with its globally recognized brands such as Kotex. The company focuses on delivering innovative, comfortable, and safe menstrual care solutions, including pads, liners, and tampons, while also expanding into sustainable offerings to meet rising demand for eco-friendly products. With a wide distribution network across retail and e-commerce channels, Kimberly-Clark leverages strong brand equity, continuous product innovation, and consumer trust to maintain its leadership in the global feminine hygiene segment.

Key Developments:

In August 2025, T.N. Dickinson's Witch Hazel introduced two new gentle and effective solutions designed to relieve hemorrhoidal, rectal, and vaginal discomfort: T.N. Dickinson's Medicated Cooling Foam and T.N. Dickinson's Medicated Cooling Pads. Alongside these product launches, the brand also unveiled the #TNCoolMomsClub Campaign, a social media initiative created to celebrate and support expecting and new mothers as they navigate the challenges of postpartum care.

Market Scope

Metrics | Details | |

CAGR | 6.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Product Type | Sanitary Napkins, Tampons, Menstrual Cups Pantyliners, Feminine Hygiene Wash, Others |

Distribution Channel | Hypermarkets/ Supermarkets, Pharmacies, Online Stores, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global feminine hygiene products market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more consumer-packaged goods-related reports, please click here