Pregnancy Testing Market Size and Growth

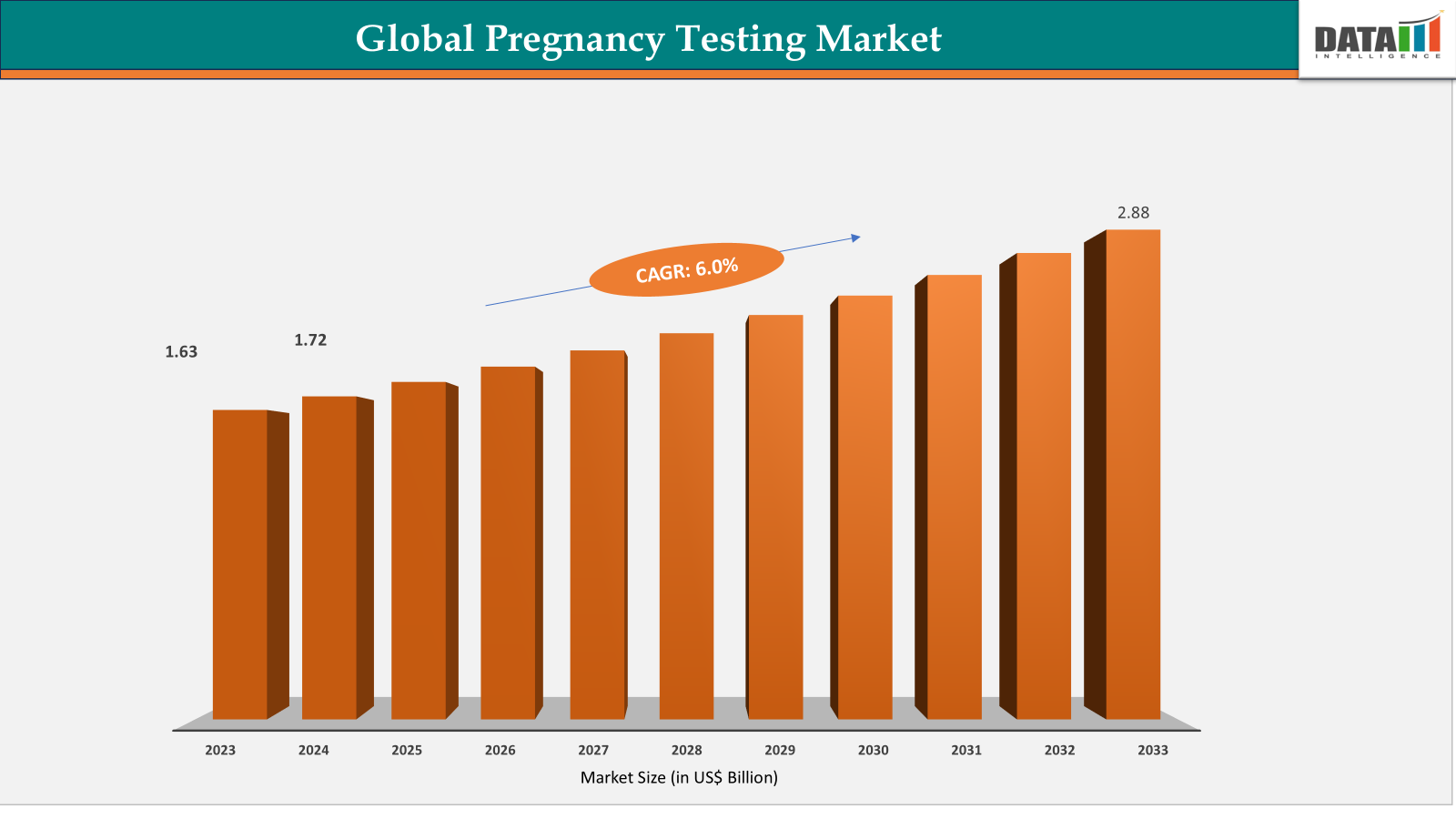

The global pregnancy testing market reached US$ 1.63 billion in 2023, with a rise to US$ 1.72 billion in 2024, and is expected to reach US$ 2.88 billion by 2033, growing at a CAGR of 6.0% during the forecast period 2025–2033. The pregnancy testing market is experiencing steady growth, driven by increasing awareness around reproductive health, and the growing demand for convenient at-home diagnostic solutions. Advancements in testing technologies have enhanced accuracy, user experience, and accessibility. Additionally, the global shift toward proactive personal healthcare and the availability of over-the-counter pregnancy tests through online and retail channels have further fueled market expansion.

Key Market Trends & Insights

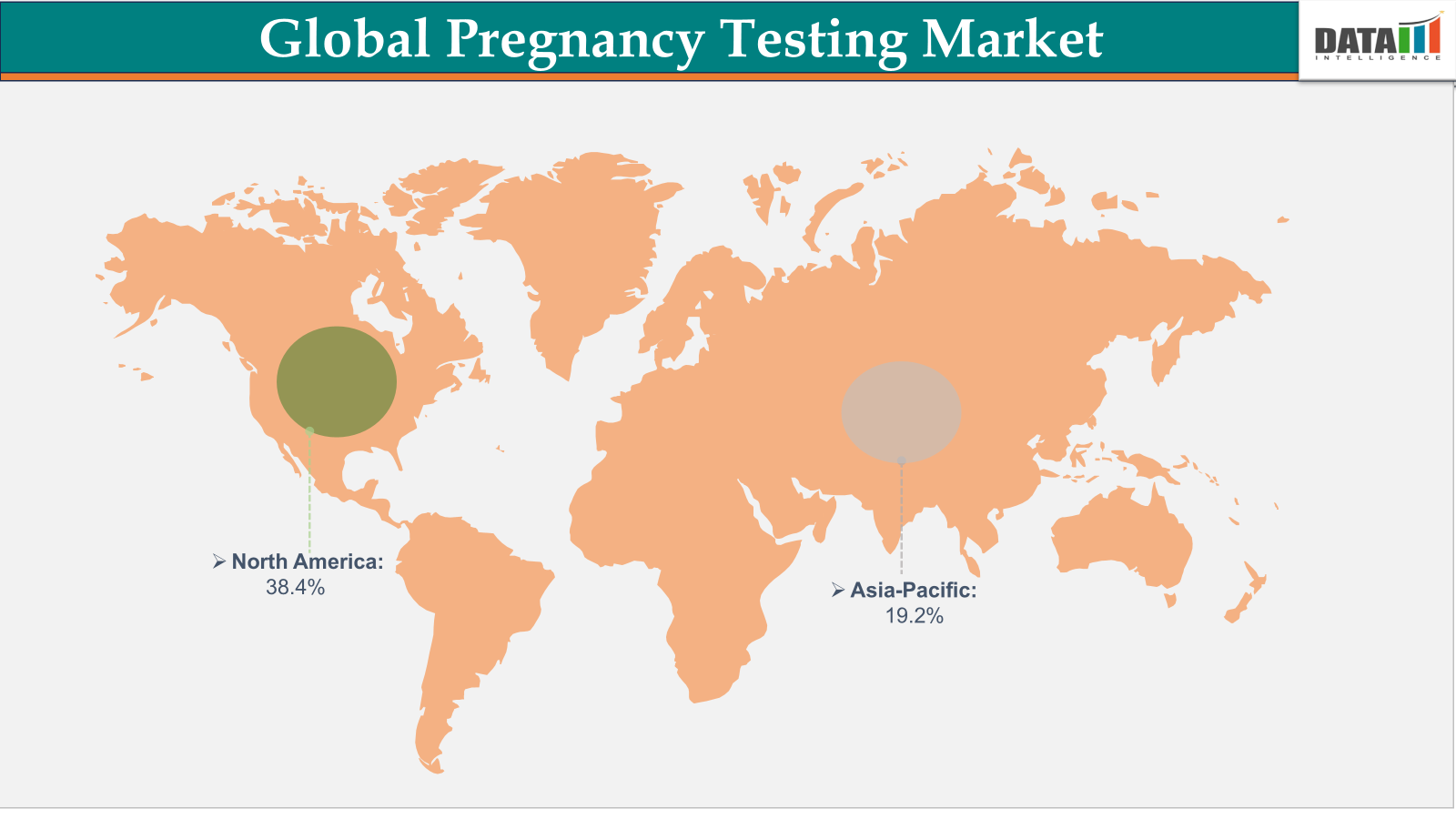

North America accounted for approximately 38.4% of the pregnancy testing market in 2024 and is expected to maintain its leading position throughout the forecast period. This dominance is driven by high consumer awareness around reproductive health, well-established healthcare infrastructure, widespread availability of over-the-counter pregnancy tests, and rapid adoption of advanced digital and smart pregnancy testing technologies.

Asia Pacific is projected to be the fastest-growing region, fueled by expanding healthcare access, rising reproductive-age female population, increasing awareness of maternal health, and growing adoption of convenient at-home diagnostic solutions. Economic development and growing e-commerce penetration further accelerate market growth in this region.

Line Indicator Kits remain the dominant product segment, favored for their affordability, ease of use, and wide availability across retail and clinical channels.

Market Size & Forecast

2024 Market Size: US$ 1.72 Billion

2033 Projected Market Size: US$ 2.88 Billion

CAGR (2025–2033): 6.0%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Rising Awareness of Reproductive Health

The increasing awareness of reproductive health is playing a pivotal role in driving the growth of the pregnancy testing market. As education on reproductive wellness expands globally, more individuals are recognizing the importance of early pregnancy detection for both maternal and fetal health outcomes. This growing knowledge base encourages timely pregnancy testing, enabling women to seek appropriate prenatal care and make informed decisions.

Additionally, public health initiatives and digital information platforms have contributed to reducing social stigma surrounding reproductive health, particularly in emerging economies. This has translated into higher acceptance and adoption of home-based pregnancy testing kits, which offer convenience, privacy, and affordability.

Furthermore, the emphasis on reproductive planning and self-care is motivating consumers to actively monitor their fertility status, thereby boosting demand for reliable and easy-to-use pregnancy tests. Healthcare providers and policymakers’ efforts to promote reproductive health education further support market expansion by increasing consumer awareness and engagement. Overall, the rising focus on reproductive health awareness is expected to sustain strong growth in the pregnancy testing market by driving consumer adoption and encouraging innovation.

Restraint: False Positives/Negatives and Test Accuracy Concerns

False positives, false negatives, and test accuracy concerns can significantly hamper the pregnancy testing market by undermining consumer trust and confidence. False positives can cause emotional distress and lead to legal liabilities, while false negatives may delay crucial prenatal care, impacting health outcomes. These inaccuracies damage the reputation of brands and the overall market, prompting customers to seek more reliable alternatives or clinical testing. Additionally, accuracy issues can increase regulatory scrutiny and operational costs due to returns and complaints. As a result, consumer demand may decline, and companies might face challenges in innovation and maintaining market share, ultimately slowing market growth and profitability.

For more details on this report, Request for Sample

Market Segmentation Analysis

The pregnancy testing market is segmented by product type, test type, distribution channel, end-user, and region.

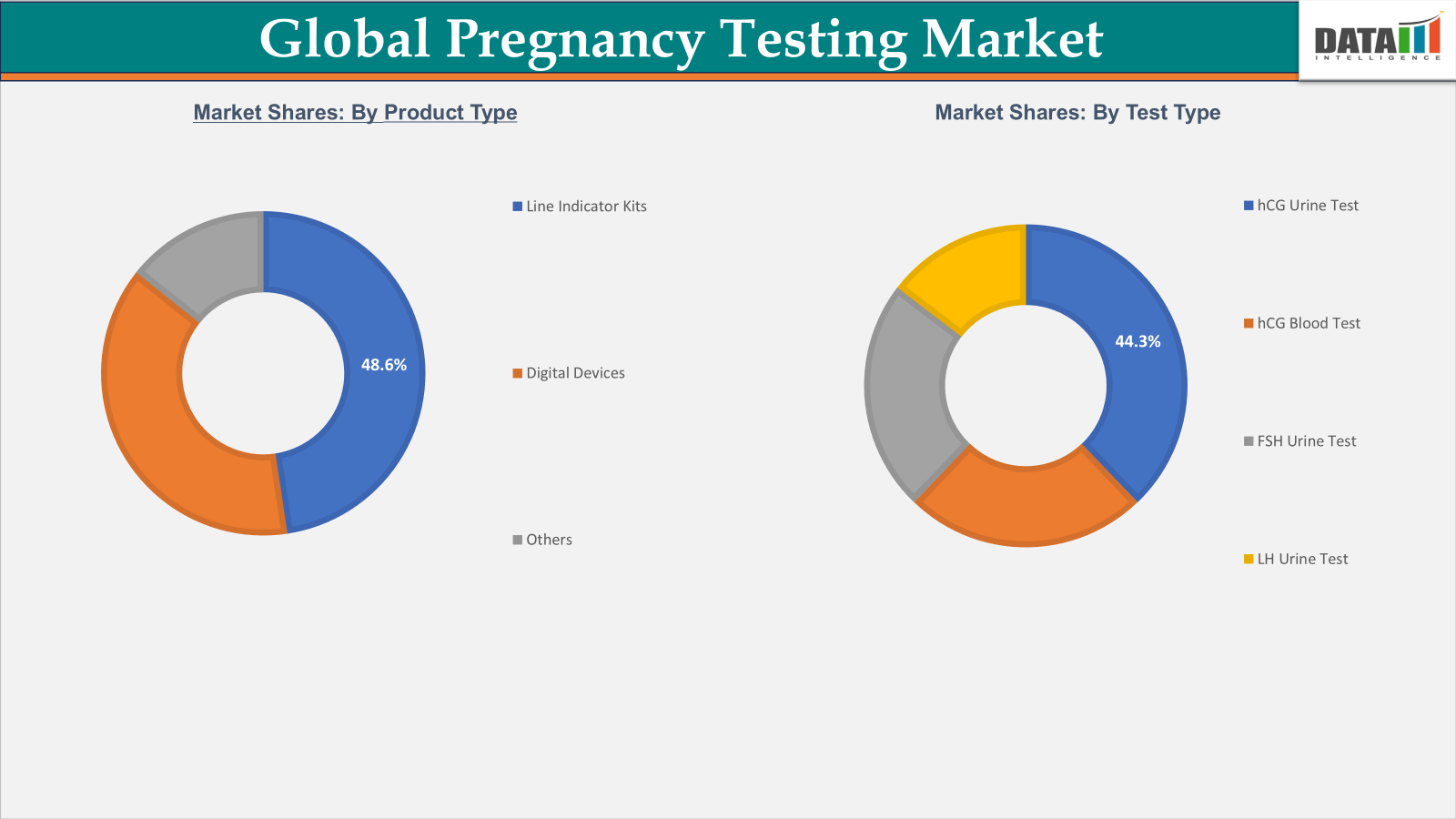

Product Type-The line indicator kits segment is estimated to have 39.7% of the pregnancy testing market share.

The line indicator kits segment is poised to dominate the pregnancy testing market due to their affordability, simplicity, and widespread availability. These kits, which include strips, cassettes, and mid-stream devices, utilize lateral flow immunoassay technology to detect the presence of human chorionic gonadotropin (hCG) hormone in urine. The results are indicated by one or two colored lines, making them easy to interpret without requiring technical expertise.

The line indicator segment accounted for approximately 48.6% of the pregnancy test kit market in 2024. Their affordability ensures accessibility across a broad spectrum of income groups, especially in low- and middle-income countries. For instance, in densely populated regions across Asia, Latin America, and Africa, low-cost healthcare solutions are in high demand, and line indicator kits perfectly align with this need.

They offer several benefits, such as cost-efficiency, self-care, and self-diagnosis of pregnancy. Moreover, companies are actively involved in new pregnancy testing product launches, which increase the availability of products, driving the market growth.

Market Geographical Share

The North America pregnancy testing market was valued at 38.40% market share in 2024

North America holds a commanding position in the global pregnancy testing market, accounting for approximately 38.4% of the market share as of 2023. This dominance is driven by several key factors, including high consumer awareness about reproductive health, well-established healthcare infrastructure, and the widespread availability of advanced pregnancy testing products. The region benefits from a strong network of pharmacies, retail outlets, and online platforms that make pregnancy tests highly accessible to consumers.

Moreover, North America has witnessed the rapid adoption of cutting-edge digital and smartphone-enabled pregnancy tests, which offer enhanced accuracy and user-friendly interfaces, appealing to tech-savvy and health-conscious consumers alike. The presence of major market players and continuous investment in research and development further bolsters the region’s leadership, enabling the introduction of innovative products that meet evolving consumer demands. For instance, in November 2024, Myriad Genetics, Inc. announced expanded retail availability of its SneakPeek prenatal test. Now accessible over-the-counter in more than 8,800 retail locations across the U.S., including Walmart stores, SneakPeek becomes the first gender test of its kind available on the shelf at major retailers.

Additionally, growing emphasis on women’s health, increased awareness of early pregnancy detection, and supportive regulatory frameworks contribute to sustaining North America’s position as the largest and most mature market globally.

The Asia-Pacific pregnancy testing market was valued at 19.20% market share in 2024

Asia-Pacific is emerging as the fastest-growing region in the pregnancy testing market, driven by a convergence of demographic, economic, and healthcare factors. The region boasts the world’s largest reproductive-age female population, creating a vast and expanding customer base for pregnancy testing products. Rising awareness of reproductive and maternal health, coupled with improvements in healthcare infrastructure, is facilitating greater adoption of pregnancy tests, particularly in urban and semi-urban areas.

Furthermore, the rapid expansion of e-commerce platforms is playing a crucial role in overcoming traditional distribution challenges, enabling convenient and discreet access to pregnancy tests. Governments and non-profit organizations are actively promoting maternal health awareness, further fueling demand. The region is also witnessing significant innovation, with manufacturers introducing affordable, easy-to-use products tailored to local consumer preferences. As a result, Asia-Pacific represents a highly attractive and dynamic market, offering substantial growth opportunities for both established players and new entrants eager to capitalize on rising demand across diverse and populous countries such as China, India, Japan, and Southeast Asian nations.

Market Competitive Landscape

The major players in the pregnancy testing market include Procter & Gamble, Abbott, Biosynex SA, NG Biotech, BIOMÉRIEUX, EKF Diagnostics Holdings plc, Atlas Medical GmbH, QuidelOrtho Corporation, Cardinal Health, among others.

Key Developments:

In October 2024, First Response is excited to introduce the Multi Check Pregnancy Test Kit, featuring EasyCup. EasyCup offers a unique combination of a sample collection cup with an integrated test strip, making the testing process more convenient and user-friendly. This design leverages the familiar urine collection experience commonly used in clinical settings, delivering reliable and accurate results with ease.

In February 2023, Abingdon Health plc announced a new distribution agreement with Salignostics for the launch of Salistick, the UK and Ireland’s first saliva-based pregnancy test.

Market Scope

Metrics | Details | |

CAGR | 6.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Line Indicator Kits, Digital Devices, Others |

Test Type | hCG Urine Test, hCG Blood Test, FSH Urine Test, LH Urine Test | |

Distribution Channel | Pharmacies/Drugstores, Online Sales, Gynecology/ Fertility Clinics, Supermarkets, Hypermarkets | |

| End-User | Home Care, Hospitals, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The pregnancy testing market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here