Europe Gene Therapy Market – Industry Trends & Outlooks

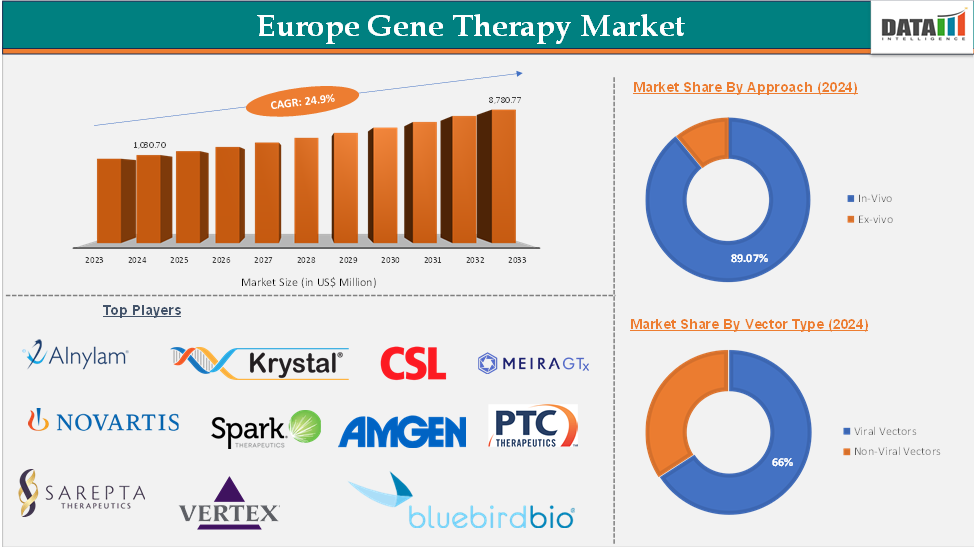

Europe Gene Therapy Market reached US$ 1,030.70 Million in 2024 and is expected to reach US$ 8,780.77 Million by 2033, growing at a CAGR of 24.9 % during the forecast period 2025-2033.

The European gene therapy market refers to the sector within Europe dedicated to the research, development, approval, and commercialization of gene-based treatments that modify, replace, or introduce genetic material into a patient’s cells to treat or prevent disease. This market encompasses therapies for various conditions, including rare genetic disorders, cancers, and acquired diseases, and involves both in vivo and ex vivo techniques.

Key drivers of the European gene therapy market include strong research and development (R&D) and product approvals, a rising prevalence of genetic and rare diseases, a strong regulatory framework that supports innovation, robust investment from both public and private sectors, and a high prevalence of rare and genetic diseases that are often untreatable with conventional therapies.

Opportunities in the European gene therapy market are substantial. There is increasing demand for personalized and precision medicine, one-time, potentially curative treatments, particularly for rare diseases and certain cancers. The region is witnessing a surge in partnerships, licensing agreements, and cross-border collaborations.

Trends shaping the market include the rapid expansion of clinical pipelines, with a growing number of gene therapies advancing through late-stage trials and receiving regulatory approval. There is also a notable shift toward the development of personalized and precision medicine approaches, utilizing technologies like CRISPR and CAR-T.

Executive Summary

For more details on this report, Request for Sample

Europe Gene Therapy Market Dynamics: Drivers

Increasing prevalence of genetic and rare disorders

The gene therapy market in the Europe region is expected to grow due to various factors like the increasing prevalence of genetic, and rare disorders. Gene therapy offers potential treatments for these conditions by modifying genes through surgical or pharmaceutical interventions.

As per European Commission data in September 2024, in the European Union, a rare disease affected more than 1 person in 2000. Over 6000 distinct rare diseases affect up to 36 million EU citizens. Approximately 3.5 million people in the UK are estimated to have a rare disease. In France & Spain, rare diseases affect more than 3 million people. Italy has an estimated prevalence of 20 rare disease cases per 10,000 people. All these factors are driving the market in the Europe region.

Furthermore, key players’ strategies such as investments, partnerships, collaborations, and product approvals would drive the gene therapy market growth. For instance, in March 2024, Roche invested US$ $94 million to establish a gene therapy development center in Penzberg near Munich.

This investment aligns with the German government's "National Strategy for Gene and Cell Therapies," a collaborative initiative involving Bayer AG and the Berlin Institute of Health. The strategy aims to consolidate previously scattered gene therapy efforts and improve R&D coordination. The German government has allocated an estimated US$ $46 million in public funds to this initiative.

Also, in July 2024, the European Commission (EC) granted conditional marketing authorization for Pfizer's DURVEQTIX (fidanacogene elaparvovec), a one-time gene therapy for severe and moderately severe hemophilia B in adult patients who lack a history of factor IX inhibitors and detectable antibodies to variant AAV serotype Rh74. This approval allows individuals with hemophilia B to produce their own factor IX (FIX) through a single dose, eliminating the need for frequent intravenous FIX infusions, which is the current standard of care.

Europe Gene Therapy Market Dynamics: Restraints

High cost of gene therapies

One of the most significant barriers to the widespread adoption and scalability of gene therapies in Europe is their extremely high cost. While these treatments offer groundbreaking potential, often promising a one-time cure for life-threatening or chronic genetic disorders, they come with substantial price tags that pose challenges for healthcare systems, insurers, and patients alike.

For instance, Novartis’ Zolgensma, priced at US$ 1.9 million, is the most expensive gene therapy in the EU for spinal muscular atrophy. However, it presents a cost-effective alternative when compared to the estimated US$ 4 million lifetime cost of traditional treatments.

Europe Gene Therapy Market Segment Analysis

The Europe gene therapy market is segmented based on approach, vector type, technique, and application.

Approach:

The in vivo segment was valued at US$ 916.93 million in 2024 and is estimated to reach US$ 8,071.46 million by 2033, growing at a CAGR of 25.3% during the forecast period from 2025-2033

The in vivo segment of gene therapy involves delivering genetic material directly into a patient's body to treat diseases at the molecular level. Unlike ex vivo therapies, which involve extracting cells, modifying them in a laboratory, and reintroducing them into the patient, in vivo approaches simplify the therapeutic process by eliminating the need for cell manipulation outside the body.

This method enables more efficient and targeted treatment, particularly for tissues and organs that are difficult to reach with traditional techniques. In the European context, the demand for in vivo gene therapies is increasing due to their potential to treat a wide range of monogenic disorders, neurological conditions, and rare genetic diseases.

Europe is emerging as a key region in advancing in vivo gene therapy, thanks to a combination of technological innovation, regulatory support, and research funding. Moreover, the European Medicines Agency (EMA) has provided a relatively clear regulatory framework for gene therapies, encouraging more companies and research institutions to invest in in vivo approaches.

The rising number of clinical approvals and market launches of in vivo gene therapies is further boosting the segment's growth. For example, the approval of Zolgensma (an AAV-based gene therapy for SMA) in Europe marked a major milestone, showcasing the clinical potential and commercial viability of in vivo gene delivery.

For instance, in March 2024, iECURE, Inc., a gene editing company developing mutation-agnostic in vivo gene insertion (knock-in) therapies for liver disorders with high unmet medical need, announced that the U.K. Medicines and Healthcare products Regulatory Agency (MHRA) approved its Clinical Trial Authorisation (CTA) application to expand the OTC-HOPE study into the United Kingdom.

Europe Gene Therapy Market - Major Players

The major players in the Europe gene therapy market include Alnylam Pharmaceuticals, Inc., NOVARTIS AG, Sarepta Therapeutics, Inc., Krystal Biotech, Inc., CSL, Bluebird Bio, Inc., SPARK THERAPEUTICS, INC., Ferring, Vertex Pharmaceuticals Incorporated, Amgen, Inc., Orchard Therapeutics Plc, CRISPR Therapeutics, BioMarin Pharmaceutical Inc., MeiraGTx Holdings plc, and PTC Therapeutics, Inc. among others.

Europe Gene Therapy Market - Key Developments

In October 2024, Ferring Pharmaceuticals has strengthened its global gene therapy supply chain with the establishment of a new European manufacturing facility, marking a major milestone in its production capabilities. This expansion is aimed at supporting the anticipated increase in demand for Adstiladrin (nadofaragene firadenovec-vncg), a gene therapy developed for the treatment of non-muscle invasive bladder cancer (NMIBC).

In January 2023, Genethon, a unique non-profit gene therapy R&D organization founded by the French Muscular Dystrophy Association, launched a pivotal clinical trial in Europe for the treatment of Crigler-Najjar syndrome, a life-threatening liver disease. The trial of the gene therapy, GNT-003, will be conducted in France, Italy, and the Netherlands and will enroll patients aged 10 years and older to confirm the efficacy and safety seen in the previous clinical part.

In February 2023, a global biotechnology leader CSL reported that HEMGENIX (etranacogene dezaparvovec), the first and only one-time gene therapy for the treatment of severe and moderately severe hemophilia B (congenital Factor IX deficiency) in adults without a history of Factor IX inhibitors, has received conditional marketing authorization (CMA) from the European Commission. Economic Area (EEA), it is the first gene treatment for hemophilia B to receive approval.

Market Scope

Metrics | Details | |

CAGR | 24.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Approach | In-Vivo, Ex-vivo |

Vector Type | Viral Vectors, Non-Viral Vectors | |

Technique | Gene Addition, Gene Silencing, Gene Editing | |

Application | Rare Diseases, Musculoskeletal Conditions, Blood Disorders, Oncology, Ophthalmology, Others | |