Overview

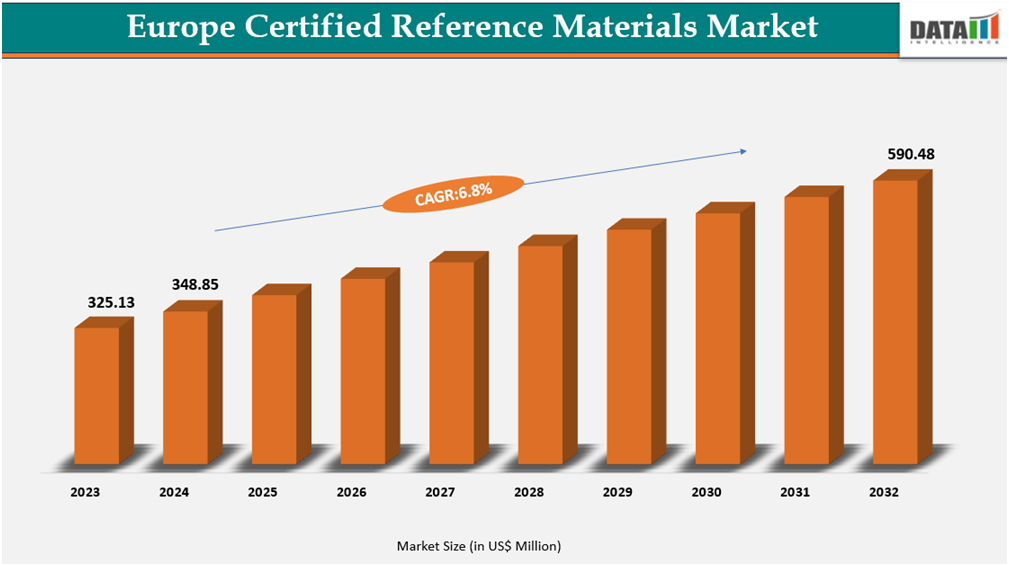

The European certified reference materials market was US$348.85 million in 2024 and is expected to reach US$590.48 million in 2032, growing at a CAGR of 6.8% during the forecast period (2025-2032).

Europe Certified Reference Materials (CRM) market is witnessing robust growth, driven by stringent regulatory frameworks, rapid industrial transformation and the EU’s commitment to climate neutrality and safe chemical practices. CRMs are central to ensuring accuracy, compliance and traceability in analytical testing, supporting critical industries such as pharmaceuticals, food and beverage, environmental monitoring, energy and advanced manufacturing.

Technological innovation is further reshaping the CRM landscape. Players such as Merck have introduced digital solutions such as Chemist win, the first-ever digital reference materials platform, automating purity analysis and reducing human error. As laboratories adopt smarter, data-driven QC systems, CRM suppliers are integrating digital signatures, automation tools and cloud-based traceability into their offerings to stay aligned with evolving regulatory and operational expectations.

The market’s growth will be shaped by customized, high-purity CRMs for energy technologies, environmental compliance and advanced industrial processes. By aligning with EU climate targets and industry-specific quality needs, CRM providers are well-positioned to play a pivotal role in enabling Europe’s energy transition, regulatory compliance and sustainable economic growth.

Certified Reference Materials Industry Trends and Strategic Insights

- Government labsdominate the end-user segment in the market, capturing the largest revenue share of 27.93% in 2024.

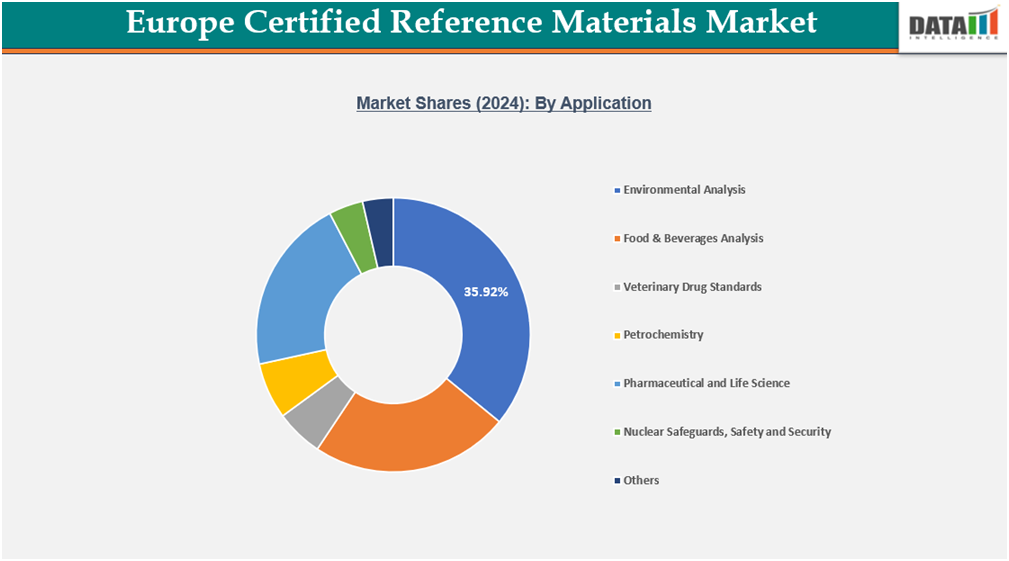

- By application, environmental analysis experiences the largest market, registering a significant 35.92% in 2024.

Europe Certified Reference Materials Market Size and Future Outlook

- 2024 Market Size: US$348.85 Million

- 2032 Projected Market Size: US$590.48 Million

- CAGR (2025-2032): 6.8%

- Largest Market: Germany

Fastest Market: France

source: DataM Intelligence Email: [email protected]

Market Scope

| Metrics | Details |

| By Type | Organic, Inorganic |

| By Application | Environmental Analysis, Food & Beverages Analysis, Veterinary Drug Standards, Petrochemistry, Pharmaceutical and Life Science, Nuclear Safeguards, Safety and Security, Others |

| By End-User | Government Labs, Private Laboratories, QC Labs of Food Companies, Universities and Scientific Research Centre, Mass Spectrometer Manufacturing Companies, Others |

| By Country | Germany, the UK, France, Italy, Spain, and the Rest of Europe |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For more details on this report – Request for Sample

Market Dynamics

Environmental & Green Testing Initiatives

The rising environmental & green testing initiatives are expected to drive the CRM market demand in Europe. Germany sets the path to net-zero emissions by 2045, with interim targets of 65% emission reduction by 2030 and 88% by 2040. Achieving these goals requires rigorous analytical testing across renewables, industry and transport. Germany has set ambitious clean energy goals, targeting 80% renewables in total electricity consumption by 2030. Beginning in 2025, the country plans to install 10 GW of new onshore wind energy annually, with government proposals pushing auction volumes up to 12 GW per year to accelerate deployment. Offshore wind targets have also been raised significantly, positioning Germany to build over 10 GW of new wind capacity annually from 2025 onwards.

This large-scale renewable energy expansion is expected to fuel substantial demand for specialized Certified Reference Materials (CRMs). It includes trace gas CRMs for ensuring hydrogen purity, multi-element CRMs for quality control in battery metal production, and reference standards for emissions monitoring across renewable infrastructure and energy-intensive processes.France has strengthened environmental monitoring through micropollutant testing in the Seine and Loire river basins under its national action plans. The programs require multi-residue aqueous CRMs to detect pesticides, pharmaceuticals and emerging contaminants at ultra-trace levels.

Stringent EU & National Regulatory Requirements

The certified reference materials (CRM) market in Europe is primarily driven by the continent's highly evolved regulatory environment, which requires stringent quality control, traceability and measurement accuracy across industries.Multiple binding regulations, both at the EU and national levels, require public laboratories and private enterprises to use CRMs for analytical validation, calibration and method development. Regulations increasingly need ISO 17034-accredited products in a variety of fields, including food and medicines, industrial emissions and environmental monitoring, to ensure that results are scientifically sound and internationally recognized.

One of the most influential drivers is EU Regulation (EC) No 396/2005, which establishes maximum residual levels (MRLs) for pesticides in food and feed. To comply, laboratories must use matrix-specific CRMs to detect trace pollutants precisely. Similarly, the Drinking Water Directive (EU 2020/2184) and the REACH Regulation (EC 1907/2006) have increased the demand for trace metal and organic contaminant CRMs in water and chemical analysis. In 2023, several EU member states, including Germany, the Netherlands and France, strengthened their national food and water safety laws beyond EU minimums, increasing CRM in public testing facilities.

Furthermore, national metrology institutes like BAM (Germany), LGC (UK) and JRC-Geel (Belgium) are not only subject to EU-wide regulation but also operate under domestic frameworks that emphasize the creation of new CRMs for developing concerns.

Europe Certified Reference Materials Market, Segmentation Analysis

The European certified reference materials market is segmented based on type, application, end-user and country.

Europe's Green Deal is driving unprecedented demand for Certified Reference Materials, ensuring precision in pollution control

The demand for environmental analysis certified reference materials (CRMs) in Europe is steadily increasing as regulatory frameworks become more stringent and pollution monitoring expands across industries. These CRMs, which cover substances such as pesticide residues, volatile and semi-volatile organic compounds (VOCs/SVOCs), flame retardants, PCBs and dioxins, alkyl phenols, and solid waste contaminants, are essential tools for ensuring accurate measurement, instrument calibration, and method validation in environmental laboratories. The European Union’s Green Deal and Zero Pollution Action Plan (2021) have committed the region to reducing air, water, and soil pollution to levels no longer considered harmful by 2050. This push has led to increased demand for high-quality CRMs, especially as environmental quality monitoring becomes more advanced and standardized.

Pesticide residue testing is a major driver of CRM demand in Europe. Regulation (EC) No 396/2005 defines maximum residue levels (MRLs) for over 500 pesticide active substances in food and environmental samples. In its 2023 report, the European Food Safety Authority (EFSA) analyzed 87,863 food samples across 27 EU member states plus Iceland and Norway. According to Germany’s Federal Office of Consumer Protection and Food Safety (BVL), there was a 17% increase in CRM acquisitions by pesticide testing laboratories between 2021 and 2023, reflecting increased enforcement efforts on both domestic and imported produce. According to France’s Agency for Food, Environmental and Occupational Health Safety (ANSES), over 90% of accredited labs performing BFR testing in 2023 used CRM-based method validation, especially in compliance testing for toys, furniture, and construction materials.

Europe's certified reference materials market is the bedrock of pharmaceutical quality, safety, and regulatory compliance

The European Directorate for the Quality of Medicines & HealthCare (EDQM) maintains a catalogue of over 3,100 European Pharmacopoeia (Ph. Eur.) reference standards, including chemical, herbal, biological and spectral standards used across Europe for official quality testing of medicines and related substances. In May 2024 alone, EDQM released 5 new Ph. Eur. reference standards and 13 replacement batches, underscoring continual expansion to support evolving regulatory and analytical requirements. These reference materials are essential for accurate quantification of active pharmaceutical ingredients (APIs), excipients, impurities, herbal actives, and cosmetic ingredients under ISO 17034 and the legally binding monographs of Ph. Eur.

Herbal drug and phytopharmaceutical standards are governed by the EMA’s Committee on Herbal Medicinal Products (HMPC). By 2025, over 1,300 traditional-use herbal medicines had been registered and more than 600 granted marketing authorizations under EU Directive 2004/24/EC, each requiring validated quality assessment in support of safety and efficacy. European registration procedures rely heavily on herbal reference standards to validate identity, purity, and batch uniformity for components used in herbal monographs.

Pharmaceutical impurity reference standards are critical for compliance testing within the framework of Ph. Eur. monographs; impurity sections are core to quality standards and cover potentially toxic or unapproved substances in APIs. Cosmetic standards, though regulated separately, often reference Ph. Eur. monographs or EDQM-provided chemical standards for preservatives, dyes, and fragrance ingredients ensuring safety and regulatory compliance.

Tariff And Regulatory Landscape

Europe CRM industry is governed by one of the world's most severe regulatory systems, which both maintains high product quality and generates significant compliance barriers for new or foreign competitors. From a tariff standpoint, approved reference materials are frequently classified as chemical, diagnostic or laboratory-use product HS codes. CRMs are subject to low or zero import taxes in several EU member states, particularly when used for scientific or research purposes. It aligns with the EU's commitment to supporting research, innovation and quality infrastructure through programs such as Horizon Europe. Importers must, however, meet VAT responsibilities as well as severe documentation requirements for product classification, labeling and intended use.

The European market is tightly regulated by ISO standards and EU-specific legal frameworks, particularly those about environmental protection, food safety, pharmaceuticals and metrology. CRMs used in regulated environments must comply with ISO 17034 (General requirements for the competence of reference material producers) and ISO/IEC 17025 (for testing and calibration laboratories). In addition, many European customers expect pharmaceutical reference materials to meet Good Laboratory Practices (GLP) and European Pharmacopoeia requirements. The European Union Reference Laboratories (EURLs) and the Joint Research Centre (JRC) are essential partners in CRM development, validation and certification for food contaminants, environmental pollutants and veterinary medication residues.

SUSTAINABILITY ANALYSIS

European sustainability efforts in the CRM sector are driven by policy-backed programs and institutional frameworks. The Joint Research Centre (JRC), through its Institute for Reference Materials and Measurements (IRMM) in Geel, produces over 760 certified reference materials supporting the Water Framework Directive, Marine Strategy Directive and Air Quality Directive.

The materials are specifically designed to monitor priority pollutants such as PFAS, heavy metals and emerging contaminants, providing SI‑traceable values and uncertainty statements, an essential requirement for regulatory reporting and compliance.

LGC Limited, one of Europe’s key CRM producers, has expanded its ISO/IEC 17034 and ISO/IEC 17025-accredited environmental CRM portfolio to include multi‑residue mixtures and stable isotope‑labelled compounds. This reduces the need for multiple individual standards, thereby cutting laboratory solvent use, packaging volumes and waste generation. Their product strategy reflects not just regulatory adaptation but also operational sustainability in laboratory workflows, directly aligning with EU goals to improve efficiency and reduce the environmental impact of analytical testing.

Additionally, large stakeholders such as Merck KGaA (Germany) have integrated their CRM operations within broader net‑zero and resource‑efficiency strategies. Merck has committed to achieving climate neutrality by 2045, shifting to 100% renewable electricity by 2025 and reducing operational waste to landfill by 80% by 2025. The commitments extend to its life‑science segment, which includes reference material production, ensuring that CRM development is embedded within ISO 14001‑aligned environmental management systems and tied to supplier sustainability audits.

Competitive Landscape

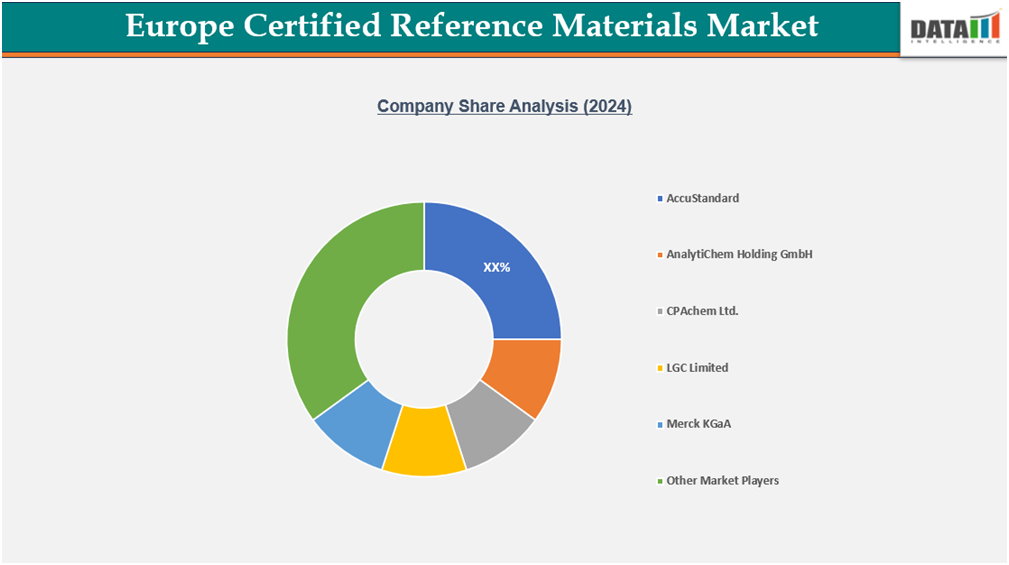

The European certified reference materials (CRM) market is characterized by a competitive landscape with a mix of globally recognized producers and a diverse array of highly specialized niche manufacturers. The market is moderately concentrated, with a few major players like the Joint Research Centre (JRC) of the European Commission, LGC Group, and Merck KGaA holding significant shares due to their broad portfolios and official status.

However, a substantial portion of the market is occupied by specialized, application-focused producers and National Metrology Institutes (NMIs), resulting in a fragmented structure ripe for strategic partnerships, acquisitions, and the emergence of new players targeting high-growth analytical fields.

Key Developments

- In June 2022, AnalytiChem Holding GmbH acquired Chem Service, Inc., a manufacturer of high-purity analytical standards and certified reference materials. Founded in 1962 and located in West Chester, PA, Chem Service is accredited to ISO 17034, ISO/IEC 17025 and ISO 9001 for the production and distribution of organic neat and synthetic reference materials. This acquisition significantly enhances AnalytiChem’s portfolio of neat CRMs and pesticide standards, enabling broader market reach through its existing global customer network.

Why Choose This European Certified Reference Materials Market Report?

For investors, corporate strategists, policymakers, and laboratory directors, navigating the complex and critical European Certified Reference Materials market requires precise, actionable intelligence. This comprehensive report serves as an essential strategic tool, offering:

- Granular Market Intelligence: Detailed assessment of market size, growth trajectories, and a segment-by-segment analysis through 2032. This provides a complete view of the evolving opportunity landscape, including the shift towards high-purity materials, matrix CRMs, and digital reference materials.

- Regulatory Intelligence: In-depth, actionable analysis of the complex European regulatory framework driving CRM demand. This includes directives and regulations for water (EU Drinking Water Directive), food (EU Regulation 2017/625), pharmaceuticals (European Pharmacopoeia), chemicals (REACH, CLP), and environmental monitoring, which mandate the use of accredited CRMs for compliance.

- Competitive Benchmarking: Thorough evaluation of the strategies, accreditation scopes, technical capabilities, and market positioning of leading global producers, European NMIs, and specialized niche developers. This enables informed partner selection and competitive positioning in a quality-driven market.

- Investment and Opportunity Mapping: Identification of high-growth applications and emerging demand pockets across key sectors such as pharmaceutical quality control, clinical diagnostics, food safety & authenticity, environmental pollution monitoring, and advanced material science, with targeted insights on regional technological adoption disparities.

- Supply Chain and Quality Audit: Critical analysis of the value chain from raw material sourcing and characterization to production, certification, and distribution. This includes insights into challenges related to material stability, homogeneity assessment, long-term storage, and the logistical complexities of shipping sensitive materials across borders.

- Expert, Forward-Looking Insights: Strategic recommendations and insights derived from industry specialists with deep expertise in analytical chemistry, metrology, quality assurance frameworks, and European regulatory dynamics, designed to inform high-stakes investment, R&D prioritization, partnership, and market entry decisions.