The global energy transition market Size Overview

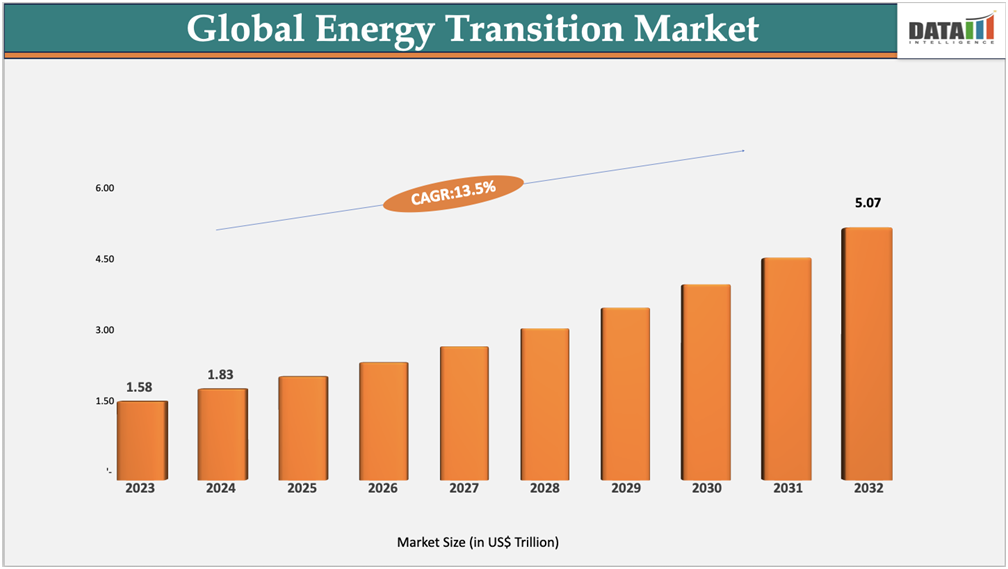

The global energy transition market was valued at US$1.83 trillion in 2024 and is projected to almost double, reaching US$5.07 trillion by 2033, at a steady CAGR of 13.59%. This momentum comes from the world’s push towards cleaner, low-carbon energy solutions solar, wind, batteries, and hydrogen that not only cut emissions but also improve efficiency. Strong government policies, net-zero pledges, and rapid innovation are making renewable power, electrification, and sustainable fuels more accessible, driving the shift to a greener global economy.

Trends and Strategic Insights

The Asia-Pacific region leads the global energy transition market, capturing the largest revenue share of xx % in 2024.

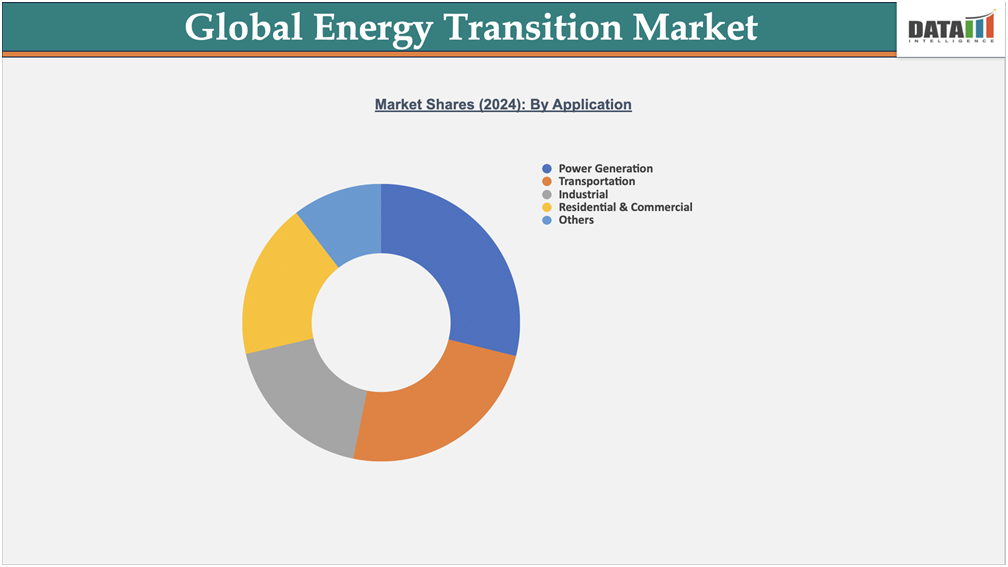

By application, the power generation sector dominates, driven by the rapid adoption of solar and wind energy, while transportation is projected to register the fastest growth.

Market Size and Future Outlook

2024 Market Size: US 1.83 Trillion

2032 Projected Market Size: US$5.07 Trillion

CAGR (2025-2032): 13.59%

Largest Market: Asia-Pacific

Fastest Market: North America

Source : DataM Intelligence Email : [email protected]

Market Scope

Metrics | Details |

|---|---|

By Technology | Renewable Energy, Energy Storage, Hydrogen & Alternative Fuels, Carbon Management, Electrification & Digitalization, Others |

By Application | Power Generation, Transportation, Industrial, Residential & Commercial, Oil & Gas Transition |

By End-User | Utilities & Power Producers, Industrial & Manufacturing Companies, Commercial & Residential Consumers, Transportation & Mobility Providers, Oil & Gas Companies transitioning |

By Region | North America, South America, Europe, Asia-Pacific, the Middle East, and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand from Renewable Energy & Clean Technology Sector

The renewable energy and clean technology sector is a major driver of the energy transition market, as governments and industries focus on reducing carbon emissions and meeting global net-zero targets. According to the IEA, global clean energy investments are projected to exceed USD 2 trillion in 2024, reflecting the growing emphasis on renewable power, energy storage, and grid modernization. The adoption of solar, wind, and battery technologies is accelerating, driven by technological advancements, policy incentives, and corporate sustainability initiatives.

To address this surging demand, companies are introducing innovative solutions and high-efficiency technologies. For instance, in 2024–2025, leading firms such as Siemens Energy and NextEra Energy expanded their portfolios with advanced grid integration systems and high-capacity energy storage solutions, enhancing the reliability and efficiency of renewable energy deployment. As countries and corporations continue prioritizing sustainable energy infrastructure, such innovations are expected to propel investments and accelerate the global energy transition, particularly in regions like Asia-Pacific, North America, and Europe.

Segmentation Analysis

The global energy transition market is segmented based on technology, application, end-user, and region.

Renewable Energy Sector Drives the Energy Transition Market Through Rising Demand for Clean Power

The renewable energy sector has become the backbone of the global energy transition, driven by the urgent need to replace fossil fuels with cleaner, sustainable sources of power. Solar, wind, hydro, and geothermal are witnessing unprecedented growth as governments, businesses, and consumers push for lower carbon footprints and energy independence.

The recent market estimates, renewable energy capacity additions accounted for more than 80% of global power expansion in 2024, underlining its dominance in shaping future energy systems. The demand is further accelerated by rapid electrification in transport and industry, alongside falling costs of renewable technologies, which have made solar and wind the most competitive sources of new power generation worldwide. This shift not only ensures decarbonization but also strengthens energy security, positioning renewables as the central force driving the energy transition market forward.

Grid Modernization & Energy Storage Sector Supports Sustained Market Growth

Grid modernization and energy storage have become critical enablers of the global energy transition, ensuring that clean power is not only generated but also delivered reliably. With renewable sources like solar and wind being intermittent, investments in smart grids, digital monitoring systems, and high-voltage direct current (HVDC) interconnectors are helping balance supply and demand across regions. At the same time, energy storage technologies, particularly advanced lithium-ion batteries and emerging long-duration storage solutions, are addressing variability by storing excess power for use during peak demand or low generation periods.

In 2024, global investment in power grids and storage reached record levels, reflecting their importance in stabilizing electricity markets and integrating large-scale renewables. By enhancing flexibility, resilience, and efficiency, grid modernization and storage are not only supporting sustained market growth but also laying the foundation for a low-carbon, electrified economy.

For more details on this report - Request for Sample

Geographical Penetration

Asia-Pacific Leads the Energy Transition Market Driven by Industrial Growth and Infrastructure

The Asia-Pacific region dominates the global energy transition market, fueled by rapid industrialization and urbanization in countries such as China, India, and Japan. Rising demand from the construction, automotive, and industrial sectors is driving the adoption of renewable energy, energy storage, and smart grid technologies across the region.

Government initiatives promoting large-scale infrastructure development, including highways, metro networks, and smart city projects, are accelerating the deployment of clean energy solutions. Innovations in renewable energy technologies, grid modernization, and energy efficiency improvements are enhancing system performance and sustainability. Combined with competitive manufacturing capabilities and abundant resources, the Asia-Pacific is expected to maintain its leading position in the global energy transition market in the coming years.

India Energy Transition Market Outlook

India’s energy transition market is experiencing robust growth, driven by infrastructure expansion and increasing energy demand from urban and industrial sectors. Government programs, including major investments in highways, metro systems, and the Smart Cities Mission, which has completed 7,555 of 8,067 projects worth USD 1,510 billion as of May 2025, are boosting renewable energy adoption and modern energy systems. Domestic innovation in renewable technologies, energy storage, and grid management is further supporting market growth. With steady economic expansion and rapid industrialization, India’s energy transition market outlook remains highly promising.

China Energy Transition Market Trends

China continues to be a global leader in energy transition, investing heavily in renewable energy, energy storage, and smart grid technologies. Strong domestic demand from the industrial, automotive, and urban sectors continues to drive market expansion. Ongoing government-led infrastructure initiatives and technological advancements are accelerating the deployment of clean energy solutions, ensuring China’s energy transition market remains robust and poised for steady growth in the coming years.

North America Leading the Charge in the Energy Transition

North America is emerging as one of the fastest-growing regions in the energy transition market, driven by increasing demand from the automotive, aerospace, and construction sectors. The region benefits from advanced industrial infrastructure, cutting-edge technologies, and strategic investments in renewable energy and sustainable infrastructure projects. The push toward electrification, clean mobility, and decarbonized industrial operations is accelerating the adoption of renewable power and energy-efficient systems. As governments and private players collaborate on clean energy initiatives, North America is solidifying its position as a global hub for green innovation and energy transition growth.

US Energy Transition Market Insights

In the United States, the energy transition market continues to grow steadily, supported by strong industrial and infrastructure demand. Sectors such as automotive, aerospace, and construction are increasingly prioritizing clean energy solutions, including renewable power generation, energy storage systems, and modernized grid infrastructure. Technological advancements are enhancing efficiency, flexibility, and reliability across energy networks, allowing renewable integration to scale faster. With strong domestic production and policy support, the US market is well-positioned to maintain robust growth, while simultaneously advancing national goals for emissions reduction and sustainable development.

Canada Energy Transition Industry Growth

Canada’s energy transition industry is accelerating, supported by clean energy investments of nearly USD 35 billion in 2025. The Oneida Energy Storage Project in Ontario, a 250-MW battery facility, is enhancing renewable integration and grid stability. The federal government has also committed CAD 16 million to renewable energy, carbon capture, and grid modernization projects in the Maritimes. In parallel, construction began on Canada’s first small modular nuclear reactor in Ontario, part of a broader plan to build four by 2030. These initiatives highlight Canada’s growing role in advancing clean power and decarbonization.

Sustainability Analysis

The energy transition market is increasingly embracing sustainability, driven by the push for low-carbon technologies and renewable energy adoption. Companies are investing heavily in clean energy generation, energy storage, and smart grid solutions to reduce greenhouse gas emissions. Sustainable practices, including responsible sourcing of materials and adherence to environmental regulations, are becoming standard across the sector. Lightweight and efficient energy solutions contribute to lower operational emissions in power, industrial, and mobility sectors, indirectly reducing overall carbon footprints. Overall, the market is evolving toward a more sustainable, innovation-led energy ecosystem, where technological advancement, efficiency, and responsible practices go hand in hand with global decarbonization goals.

Competitive Landscape

The global energy transition market is dominated by a mix of leading innovators and specialized technology players. NextEra Energy, Enel Green Power, and Iberdrola are at the forefront, collectively holding a significant share, leveraging expertise in renewable generation, storage solutions, and large-scale project execution.

A second tier, including Siemens Gamesa, Ørsted, and Total Energies, focuses on regional and sector-specific solutions, particularly in Europe and Asia-Pacific, and is steadily expanding its global footprint. The rest of the market is more fragmented, with companies like Bright mark, Tesla, and Vestas offering niche solutions in energy storage, electrification, and wind technologies.

Key Developments

In January 2025, Bright mark RNG Holdings LLC, a joint venture between Bright mark LLC and Chevron U.S.A. Inc., achieved a significant milestone by delivering its first gas at 10 renewable natural gas (RNG) projects across the Midwest.

The company announced plans for a nearly $1 billion investment in a new plastics recycling facility in Georgia, aiming to convert plastic waste into valuable materials.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares, and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, you enjoy the privilege of yearly updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies