Electrophysiology Market: Industry Outlook

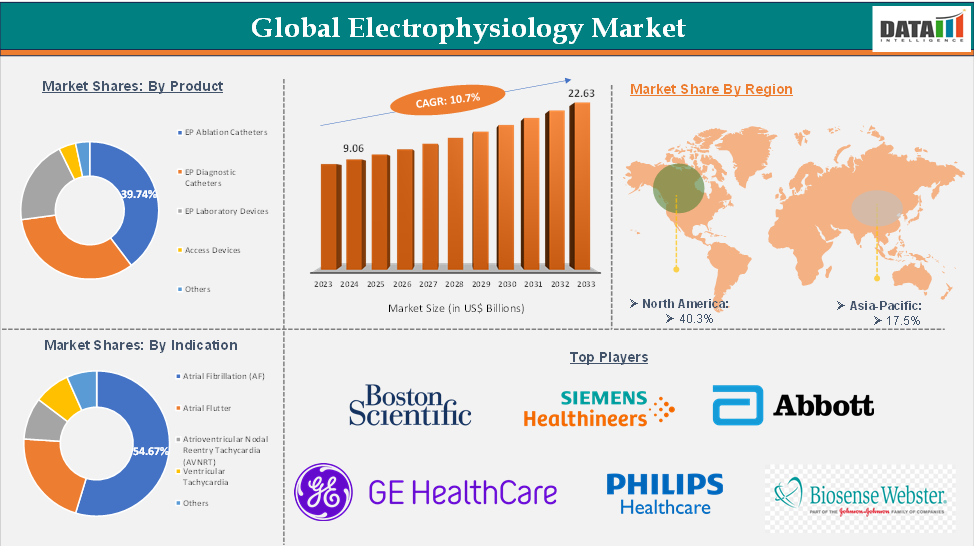

Electrophysiology Market reached US$9.06 Billion in 2024 and is expected to reach US$22.63 Billion by 2033, growing at a CAGR of 10.7% during the forecast period 2025-2033, according to DataM Intelligence report.

The global electrophysiology (EP) market is experiencing significant growth due to the rise in cardiac arrhythmias and the demand for minimally invasive procedures. Advancements in EP technologies, such as 3D mapping systems and catheter ablation devices, have improved diagnostic and therapeutic interventions, leading to better patient outcomes.

Artificial intelligence and real-time monitoring systems are revolutionizing cardiac care, enabling personalized treatment strategies and early detection of arrhythmic events.

North America currently dominates the market due to its advanced healthcare infrastructure and high adoption rates of innovative technologies. However, challenges like high costs and specialized training may hinder market expansion. Despite these challenges, ongoing research and development efforts and government initiatives are expected to sustain market growth.

Executive Summary

For more details on this report, Request for Sample

Electrophysiology Market Dynamics: Drivers & Restraints

Driver: Rise in technological advancements

The global electrophysiology market is growing due to technological advancements in diagnostic and therapeutic tools. Advanced mapping systems, catheter designs, and robotic-assisted procedures are improving cardiac arrhythmia diagnosis and treatment efficiency. Artificial intelligence and machine learning are revolutionizing data analysis, enabling personalized treatment plans and reducing procedural risks. The development of wireless and miniaturized devices and real-time monitoring capabilities is expanding electrophysiology Indications, improving patient outcomes, and addressing the growing demand for minimally invasive procedures.

For instance, in January 2024, GE HealthCare introduced the Prucka 3 with CardioLab EP Recording system, a cutting-edge electrophysiology tool, to aid clinicians in diagnosing and treating cardiac arrhythmias. This system, built on over twenty years of electrophysiology expertise, offers a comprehensive ecosystem of mapping technologies for accurate, efficient, and advanced analytics in cardiac arrhythmia diagnosis and treatment.

Electrophysiology Market Dynamics: Restraints

Restraint: Shortage of skilled professionals

The global electrophysiology market faces a significant shortage of skilled professionals due to the complexity of procedures requiring specialized expertise. This, especially in developing regions, can hinder the widespread adoption of advanced technologies like catheter-based ablation and electrophysiology mapping systems.

This shortage results in increased pressure on existing professionals, longer wait times, and potentially compromised patient outcomes. Addressing this skill gap is crucial for market growth and the efficient use of advanced technologies.

Electrophysiology Market Segment Analysis

The global electrophysiology market is segmented based on product type, indication, end user, and region.

Product Type:

The EP ablation catheters segment of the product is expected to hold 39.74% of the electrophysiology market.

The EP ablation catheters segment holds a major portion of the electrophysiology market share and is expected to continue to hold a significant portion of the electrophysiology market share during the forecast period.

EP ablation catheters are essential in the global electrophysiology market for treating arrhythmias like atrial fibrillation and ventricular tachycardia. They deliver radiofrequency energy or cryotherapy to specific heart areas, disrupting abnormal electrical pathways. Their growth is driven by the rise in cardiovascular diseases, advancements in catheter technology, and the need for more efficient, safer, and less invasive treatments. Innovations like improved designs, navigation systems, and real-time imaging have made EP ablation catheters a cornerstone in electrophysiology, improving patient outcomes and market expansion.

For instance, in October 2024, Medtronic received FDA approval for an early feasibility study to evaluate the Affera Mapping and Ablation System with Sphere-9 Catheter for treating sustained ventricular tachycardia (VT), a potentially life-threatening abnormal heart rhythm affecting the lower chamber of the heart. The system is an all-in-one, dual-energy ablation and high-density mapping catheter used in cardiac electrophysiology ablation procedures.

Electrophysiology Market Geographical Analysis

North America dominated the global electrophysiology market with the highest share of 40.3% in 2024

North America holds a substantial position in the electrophysiology market and is expected to hold most of the market share due to advanced healthcare infrastructure, acquisitions, high healthcare spending, and emphasis on technological innovations.

The region's medical device industry invests heavily in research and development for cutting-edge electrophysiology technologies. The increasing prevalence of cardiovascular diseases and an aging population drive demand for electrophysiology procedures. North America's skilled healthcare professionals and favourable reimbursement policies further fuel the market's growth.

For instance, in November 2024, Boston Scientific acquired Cortex, a pioneer in pulsed field ablation (PFA) technology, to enhance its capabilities in electrophysiology and cardiac care solutions. This acquisition is a significant step for Boston Scientific, which aims to refine treatments for heart rhythm disorders, potentially improving patient outcomes.

Moreover, in May 2024, Biosense Webster, part of Johnson & Johnson MedTech, launched the CARTO 3 System Version 8, the latest version of its three-dimensional heart mapping system for cardiac ablation procedures. The software includes new modules like the CARTO ELEVATE Module and CARTOSOUND FAM Module, enhancing efficiency, reproducibility, and accuracy for electrophysiologists treating patients with atrial fibrillation and other arrhythmias.

Asia-Pacific is the global electrophysiology market with a market share of 17.5% in 2024.

The electrophysiology market in the Asia-Pacific region is growing due to factors such as rising cardiovascular diseases, aging populations, lifestyle-related risk factors, and increased awareness of heart health. Emerging economies like China, India, and Southeast Asia are investing heavily in medical technology and hospital capacity. Advanced electrophysiology technologies like 3D mapping and catheter ablation systems are also boosting market expansion. Additionally, medical tourism, favorable reimbursement policies, and private healthcare investment are contributing to the market's momentum.

For instance, in September 2024, Boston Scientific received approval from the Pharmaceuticals and Medical Device Agency in Japan for the FARAPULSE Pulsed Field Ablation System, a novel alternative to standard-of-care thermal ablation treatment for the isolation of pulmonary veins in the treatment of paroxysmal atrial fibrillation.

Electrophysiology Market Key Players

The major global players in the electrophysiology market include Biosense Webster, Inc. (Johnson & Johnson), Abbott Laboratories, Medtronic, Boston Scientific Corporation, Siemens Healthineers AG, GE, HealthCare, Philips Healthcare, Acutus Medical, Inc, Stereotaxis, Inc, and MicroPort Scientific Corporation among others.

Industry Key Developments

In December 2024, Havasu Regional Medical Center, a LifePoint hospital, launched an electrophysiology program to diagnose and treat heart arrhythmia. The program aims to improve patient outcomes and reduce the stress and financial burden associated with traveling for care. Arrhythmias, which occur when the heart beats too slowly, too fast, or irregularly, affect around 9.5 million people in the US. AFib, the most common type, has a five-fold higher stroke risk in those with AFib compared to those without it.

- In October 2024, KIMSHEALTH Trivandrum inaugurated a state-of-the-art Electrophysiology Lab with advanced 3D mapping technology, inaugurated by Dr. S Somanath, Chairman of ISRO.

Market Scope

Metrics | Details | |

CAGR | 10.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product | EP Ablation Catheters, EP Diagnostic Catheters, EP Laboratory Devices, Access Devices, Others |

Indication | Atrial Fibrillation (AF), Atrial Flutter, Atrioventricular Nodal Reentry Tachycardia (AVNRT), Ventricular Tachycardia, Others | |

End User | Hospitals, Ambulatory Surgical Centers (ASCs), Specialized Clinics, Diagnostic Centers | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |