Electronic Clinical Outcome Assessment Solutions Market Size

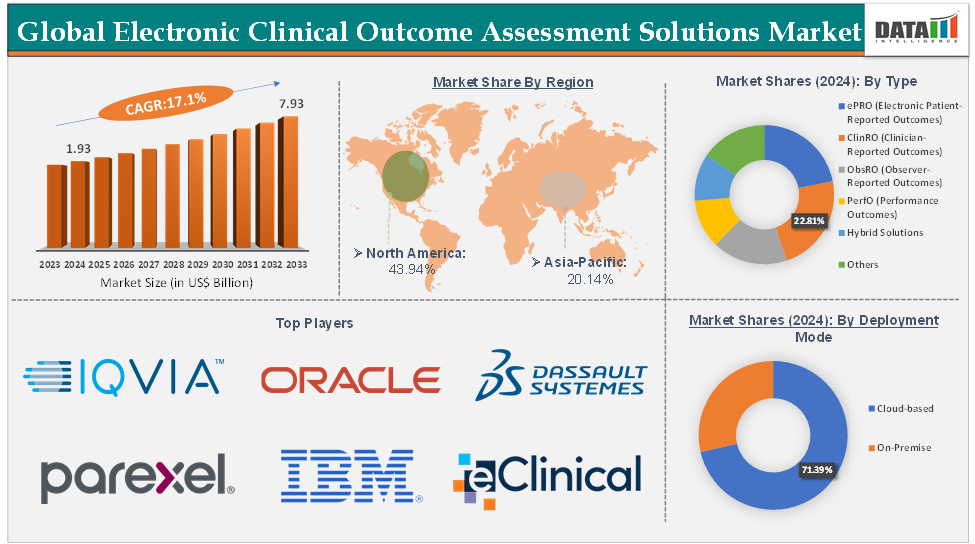

The global electronic clinical outcome assessment solutions market size reached US$ 1.93 Billion in 2024 from US$ 1.67 Billion in 2023 and is expected to reach US$ 7.93 Billion by 2033, growing at a CAGR of 17.1% during the forecast period 2025-2033.

Electronic Clinical Outcome Assessment Solutions Market Overview

The electronic clinical outcome assessment solutions market is a rapidly growing segment of the clinical trials ecosystem, playing a vital role in capturing validated patient-centered data in real time. eCOA technologies include digital platforms that collect Patient-Reported Outcomes (ePRO), Clinician-Reported Outcomes (ClinRO), Observer-Reported Outcomes (ObsRO), and Performance Outcomes (PerfO) using smartphones, tablets, PCs, and wearables.

The market is driven by the digitization of clinical research, an increased regulatory emphasis on real-world, patient-centric endpoints, and the growing prevalence of decentralized and hybrid clinical trials. eCOA platforms are transforming how stakeholders conduct clinical trials, measure treatment efficacy, and gather health data across diverse therapeutic areas.

Electronic Clinical Outcome Assessment Solutions Market Executive Summary

Electronic Clinical Outcome Assessment Solutions Market Dynamics

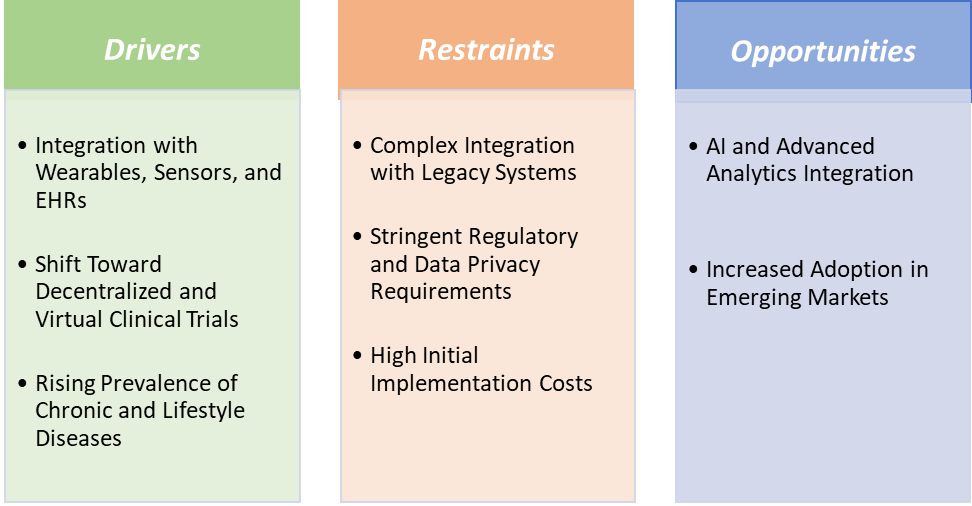

Drivers:

The integration of electronic clinical outcome assessment solutions with wearables, sensors, and Electronic Health Records (EHRs) is a key driver of market growth, enabling more comprehensive, real-time, and patient-centered data collection. In Parkinson’s disease trials, companies like Medidata and Clario integrate ePRO with wearable-based tremor and mobility tracking, allowing clinicians to correlate patient-reported symptom severity with quantified motor function. These advancements by market players are driving the market growth.

For instance. in October 2024, Medidata, in partnership with Cogstate, reshaped clinical trials and outcomes measurement for central nervous system (CNS) diseases. Together, the companies will deliver an improved experience, supported by Medidata eCOA (electronic clinical outcome assessment) that empowers customers through faster trial starts and optimal rater experiences.

By linking eCOA systems (like Medidata’s Rave) directly to hospital EHRs (Epic, Cerner), clinicians can pre-populate ClinRO forms from existing medical records, reducing redundant data entry and minimizing transcription errors.

Shift toward decentralized and virtual clinical trials is also driving the electronic clinical outcome assessment solutions market growth

Decentralized clinical trials and virtual trials leverage digital technologies to collect clinical data remotely, reducing the need for patient visits to clinical sites. This shift has accelerated due to advancements in technology and the COVID-19 pandemic's impact on traditional trial models. Electronic Clinical Outcome Assessment (eCOA) solutions capture patient-reported outcomes, clinician assessments, and observer-reported outcomes digitally. Thus, market players are developing various eCOA solutions for clinical trials, which is accelerating the growth of the market.

For instance, in June 2025, Medable Inc. unveiled its new Partner Program, designed to empower contract research organizations (CROs) and other partners with generative AI-driven, self-service electronic clinical outcomes assessment (eCOA) build capabilities for digitally enabled clinical trials. Leveraging the Medable platform, the program eliminates traditional bottlenecks for CROs to accelerate timelines by 50% or more, while delivering administrative and financial benefits, including straightforward, up-front pricing.

Restraints:

Stringent regulatory and data privacy requirements are hampering the growth of the electronic clinical outcome assessment solutions market

To satisfy FDA’s 21 CFR Part 11 and EMA Annex 11, eCOA vendors must perform exhaustive system validation (IQ/OQ/PQ), maintain audit trails, and demonstrate data integrity. For instance, when Medidata’s Rave eCOA module was upgraded, the company spent an extra six months and several million dollars on re-validation activities before it could be used in pivotal Phase III trials. This extended timeline delays trial start-up and raises sponsors’ total trial costs.

Any integration of ePRO data with electronic health records requires end-to-end encryption, Business Associate Agreements, and breach-notification processes. A mid-sized biotech abandoned plans to roll out its own branded eCOA app after realizing the cost of establishing HIPAA-compliant cloud infrastructure and third-party audits would exceed its R&D budget.

For instance, according to the HIPAA Journal, in 2024, the protected health information of 276,775,457 individuals was exposed or stolen. On average, that is 758,288 records per day. In March 2025, 1,754,097 individuals had their protected health information exposed, stolen, or impermissibly disclosed in a healthcare data breach.

Opportunities:

AI and advanced analytics integration create a market opportunity for the electronic clinical outcome assessment solutions market

The integration of Artificial Intelligence (AI) and advanced analytics with eCOA solutions is revolutionizing how clinical outcome data is captured, processed, and interpreted. This technological advancement creates significant market opportunities by enhancing data quality, reducing trial costs, and accelerating decision-making. AI algorithms automatically detect inconsistencies, missing data, or outliers in real-time, improving the accuracy and reliability of patient-reported outcomes.

Additionally, AI-driven models predict patient dropout risks and engagement patterns, enabling proactive intervention to minimize missing data and improve trial retention. Advanced analytics convert large volumes of eCOA data into actionable insights quickly, speeding up clinical trial timelines and adaptive trial designs.

For more details on this report – Request for Sample

Electronic Clinical Outcome Assessment Solutions Market, Segment Analysis

The global electronic clinical outcome assessment solutions market is segmented based on type of solution, deployment mode, end-user, and region.

Cloud-based from the deployment mode segment is expected to hold 71.39% of the market share in 2024 in the electronic clinical outcome assessment solutions market

Cloud-based platforms allow patients, investigators, and sponsors to access and input data from anywhere in the world in real time. For instance, in a multi-country Phase III oncology trial sponsored by Novartis, Medidata’s Rave eCOA enabled real-time aggregation of patient-reported outcomes across 15 countries, something only possible with cloud-based infrastructure.

Web-based solutions can be deployed across thousands of trial sites without the need for local installation, reducing IT burden. For instance, IQVIA’s eCOA platform has supported global trials with over 50,000 participants using centralized cloud servers and real-time analytics dashboards. Cloud-based platforms are optimized for use on personal devices (smartphones, tablets), enabling broader patient participation and reducing provisioning costs. These advancements by the market players are further driving the segment growth.

For instance, in November 2024, Medable Inc. announced Medable AI, generative AI capabilities that help sponsors and clinical research organizations (CROs) build digital and decentralized trials faster with complete visibility and control over technology setup. Part of a broader AI strategy, Medable AI will initially deliver many new capabilities, such as automatically converting existing outcomes assessments into fully digital eCOAs in seconds. Users can also easily edit assessments with a simple ChatGPT-like integrated prompt interface and generate and scale assessments of varying complexity and logic.

Electronic Clinical Outcome Assessment Solutions Market, Geographical Analysis

North America is expected to dominate the global electronic clinical outcome assessment solutions market with a 43.94% share in 2024

The North America region, particularly the United States, is the dominant region in the electronic clinical outcome assessment solutions Market due to a combination of regulatory, technological, and biopharmaceutical leadership factors. North America houses the world’s largest concentration of clinical trial sponsors, including Pfizer, Merck, Johnson & Johnson, and Moderna, who are early adopters of digital tools to improve R&D efficiency.

For instance, Merck chose Medidata’s eCOA offerings to help run their studies more efficiently by keeping measures standard and designed for each therapeutic area and using them for multiple studies. Medidata eCOA is built on Rave EDC, eliminating the time and cost of merging disparate data sets.

The FDA’s guidance on Patient-Focused Drug Development (PFDD) and 21 CFR Part 11 has encouraged the widespread use of electronic PROs (ePROs) and digital endpoints in clinical trials. For instance, the FDA’s 2020 digital health framework specifically encouraged sponsors to leverage tools like eCOA for improved patient-centricity and regulatory submission quality.

North America is the leading region for decentralized clinical trials, where eCOA is essential for remote patient data capture. Many top eCOA solution providers, such as Signant Health (U.S.), YPrime (U.S.), and Clario (U.S.), are headquartered or have major operations in North America, driving innovation and regional dominance.

Asia-Pacific is growing at the fastest pace in the electronic clinical outcome assessment solutions market, holding 20.14% of the market share

APAC countries like China, India, Japan, and South Korea are becoming preferred destinations for clinical trials due to large patient pools, lower operational costs, and growing healthcare infrastructure. This drives demand for efficient digital tools like eCOA to manage patient data. Increasing smartphone penetration, improved internet connectivity, and government initiatives promoting digital health accelerate eCOA adoption in the region.

Companies like Parexel and Medidata are investing in APAC-specific eCOA platforms tailored to local languages and cultural contexts, boosting adoption. Sponsors and CROs operating in APAC are emphasizing patient-centric approaches, making electronic patient-reported outcome tools critical for capturing accurate data remotely.

Electronic Clinical Outcome Assessment Solutions Market Competitive Landscape

Top companies in the electronic clinical outcome assessment solutions market include IQVIA, Oracle, Dassault Systèmes, Parexel International Corporation, IBM Corporation, Signant Health, Clario, eClinical Solutions LLC, Castor, ICON plc, uMotif Limited, and YPrime, among others.

Electronic Clinical Outcome Assessment Solutions Market, Key Developments

In May 2025, Clario, a leading provider of digital endpoint data solutions to the clinical trial industry, announced the completion of its acquisition of WCG's electronic clinical outcome assessment (eCOA) business. This strategic move enhances Clario's ability to provide best-in-class data collection and analysis solutions for neuroscience drug development, reinforcing its commitment to delivering high-quality, reliable data across all therapeutic areas.

In April 2025, Clinical Ink launched the AI-powered, fully integrated analytics dashboard, TrialLens, designed to transform the visualisation, querying, and interpretation of trial electronic clinical outcome assessment (eCOA) data. The dashboard is designed to provide real-time insights into operations, subject behaviour, and metrics of digital biomarkers in hybrid and decentralised trials.

In February 2025, YPrime, the leading pioneer in clinical trial technology, announced the launch of its groundbreaking electronic clinical outcome assessment (eCOA) Automated Data Change Form (DCF). This innovative solution, integrated into YPrime’s latest eCOA 7.x release, transforms how clinical trial sites manage and control their data, offering unprecedented efficiency and accuracy.

In October 2024, Medidata, in partnership with Cogstate, reshaped clinical trials and outcomes measurement for central nervous system (CNS) diseases. Together, the companies will deliver an improved experience, supported by Medidata eCOA (electronic clinical outcome assessment) that empowers customers through faster trial starts and optimal rater experiences.

Electronic Clinical Outcome Assessment Solutions Market Scope

Metrics | Details | |

CAGR | 17.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type of Solution | ePRO (Electronic Patient-Reported Outcomes), ClinRO (Clinician-Reported Outcomes), ObsRO (Observer-Reported Outcomes), PerfO (Performance Outcomes), Hybrid Solutions, and Others |

Deployment Mode | Cloud-based and On-Premise | |

End-User | Pharmaceutical & Biopharmaceutical Companies, Contract Research Organizations (CROs), Academic & Research Institutions, Hospitals and Healthcare Providers, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global electronic clinical outcome assessment solutions market report delivers a detailed analysis with 68 key tables, more than 58 visually impactful figures, and 165 pages of expert insights, providing a complete view of the market landscape.