Electric Vehicle Battery Recycling Market Overview

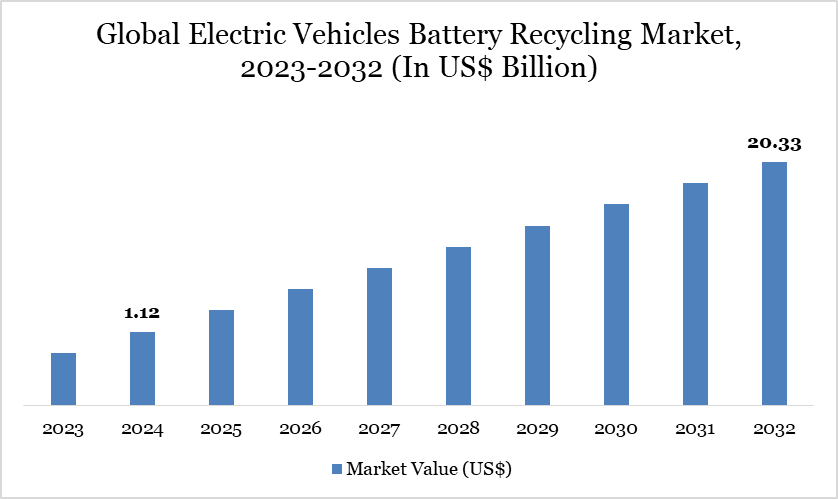

Global Electric Vehicle Battery Recycling Market reached US$ 1.12 billion in 2024 and is expected to reach US$ 20.33 billion by 2032, growing with a CAGR of 43.67% during the forecast period 2025-2032.

The global electric vehicle (EV) battery recycling market is witnessing significant growth, propelled by the rapid increase in EV adoption and heightened environmental awareness. In 2023, the International Energy Agency (IEA) reported that 20% of cars sold worldwide were electric, representing a 35% increase compared to the previous year and resulting in over 40 million electric vehicles on the roads.

The swift proliferation of the EV fleet is markedly elevating the demand for battery recycling solutions, as the volume of end-of-life batteries escalates and the necessity to reclaim valuable materials intensifies. Governments and OEMs are engaging in circular economy projects to decrease reliance on raw material extraction and alleviate hazards related to mineral supply chains. Sustainability objectives are concurrently driving the advancement of sophisticated recycling infrastructure. Despite ongoing obstacles in logistics and infrastructure, strategic alliances and increasing regulatory backing are positively influencing the global EV battery recycling industry.

Electric Vehicle Battery Recycling Market Trend

A significant development influencing the EV battery recycling market is the establishment of closed-loop recycling technologies designed to stabilize essential material supply chains. Leading OEMs are forming alliances with specialized recyclers to reclaim critical metals such lithium, nickel, and cobalt. Tesla and Ford have partnered with Redwood Materials in the US, whilst General Motors collaborates with Li-Cycle to ensure its Ultium platform supply chain.

This shift towards internalized recycling signifies a wider trend among OEMs to diminish reliance on raw materials and adhere to sustainability directives. The geographical concentration of minerals more than fifty percent of the world's nickel sourced from Indonesia and two-thirds of cobalt from the Democratic Republic of Congo has intensified the necessity for establishing in-house recycling capabilities. Researchers project that by 2040, almost 50% of lithium and nickel demand may be satisfied through recycling, emphasizing the strategic significance of these emerging trends.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Battery Type | Lithium Nickel Manganese Cobalt, Lithium Iron Phosphate, Lithium Titanate Oxide, Lithium Manganese Oxide, Lithium Nickel Cobalt Aluminum Oxide |

| By Vehicle Type | Passenger Cars, Commercial Vehicles, Two-Wheelers, Others |

| By Process | Hydrometallurgical, Pyrometallurgical, Mechanical, Others |

| By Application | Electric Vehicles, Energy Storage Systems, Consumer Electronics, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Electric Vehicle Battery Recycling Market Dynamics

Growing Demand for Sustainable Transportation Solutions

The market is significantly influenced by increasing consumer and industrial demand for eco-friendly automobiles. This transition is facilitated by fluctuating oil costs, heightened environmental consciousness, and the demand for fuel-efficient technologies. The IEA's 2023 estimate indicates a 35% annual increase in electric vehicle sales, which immediately results in a spike of used batteries necessitating end-of-life processing.

Moreover, investments from both government and the business sector are stimulating growth; for instance, the US Department of Energy declared a US$ 44.8 million investment in October 2024 to facilitate eight initiatives focused on decreasing battery recycling costs. Moreover, corporate behemoths such as Amazon are expediting fleet electrification, having declared a significant investment of US$ 974.8 million in October 2022 for electric vans and infrastructure in Europe. These initiatives demonstrate a convergence of legislative backing, business accountability, and public demand, creating a solid foundation for sustained growth in the EV battery recycling sector.

Deficiencies in Infrastructure Expansion

The EV battery recycling business encounters substantial limitations stemming from inadequate collection and recycling infrastructure. The absence of strong logistical networks for managing end-of-life batteries constrains the potential for extensive implementation of recycling solutions. In emerging markets, insufficient or absent battery collection mechanisms can result in incorrect disposal or prolonged storage, causing environmental risks and missed resource opportunities.

Even in developed economies like Europe, where regulatory frameworks are comparatively sophisticated, the recycling process continues to be fragmented and costly. A significant problem is the scarcity of accessible consumer drop-off sites and the elevated transportation expenses associated with centralized processing.

The systemic inefficiencies underscore the pressing necessity for infrastructure investment to accommodate the swiftly expanding EV fleet. Failure to address these gaps may result in the market falling behind, jeopardizing initiatives to create a circular economy and diminish reliance on raw materials.

Electric Vehicle Battery Recycling Market Segment Analysis

The global electric vehicle battery recycling market is segmented based on battery type, vehicle type, process, application, and region.

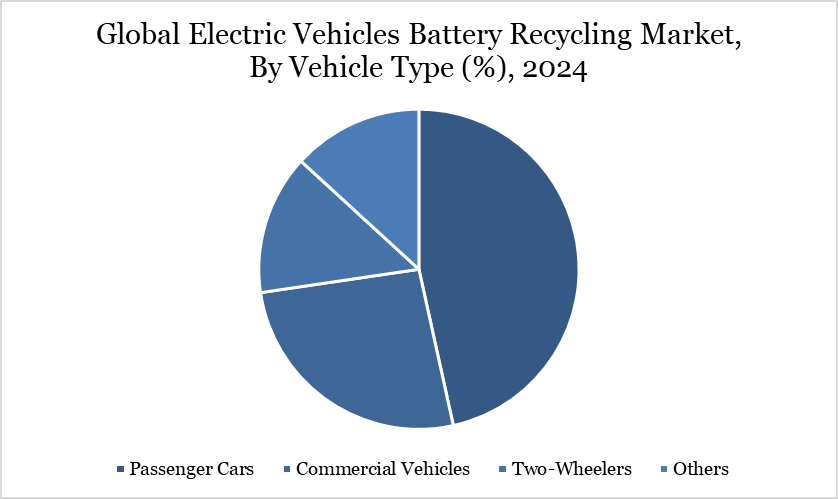

Preeminence of Passenger Vehicles in the Electric Vehicle Battery Recycling Sector

The passenger car category dominates the EV battery recycling industry, supported by the swift increase in electric vehicle usage. Stringent environmental restrictions and changing consumer preferences have prompted a significant shift from internal combustion engines to electric drivetrains.

Generally, electric vehicle batteries in passenger automobiles possess a lifespan of 8 to 12 years, leading to an increasing accumulation of depleted batteries necessitating organized recycling. Original Equipment Manufacturers are progressively forming partnerships with recyclers to tackle this issue and minimize waste.

In February 2024, Volkswagen Group United Kingdom Ltd. (VWG UK) entered into an arrangement with Ecobat, a global leader in recycling, to collect and recycle decommissioned EV batteries, thereby strengthening the closed-loop economic model. These partnerships guarantee sustainability while allowing manufacturers to obtain recycled raw materials, so reinforcing the segment's preeminence in the entire EV battery recycling ecosystem.

Electric Vehicle Battery Recycling Market Geographical Share

North America’s Strategic Race Toward Sustainable EV Materials

North America is becoming a crucial region in the EV battery recycling market due to its strong automotive industry and rigorous environmental regulations. The United States leads in electric vehicle manufacture and recycling, with substantial contributions from industry giants like General Motors and Ford.

The region is distinguished by significant technological investment, exemplified by the US$ 44.8 million grant from the US Department of Energy in 2024, intended to decrease recycling costs and promote sustainable car technologies. Moreover, collaborations with domestic recyclers, including Redwood Materials and Li-Cycle, are fortifying local supply networks and promoting closed-loop recycling frameworks.

Environmental issues and governmental measures additionally drive regional market expansion, coupled with increasing demand for automation and advanced transportation solutions. North America's strategy initiatives establish it as a frontrunner in achieving mineral autonomy and establishing worldwide benchmarks for battery lifetime management.

Sustainability Analysis

The EV battery recycling market is fundamentally driven by sustainability, addressing both environmental and strategic needs. Recycling substantially alleviates the ecological impact of raw material extraction, especially in areas such as the Democratic Republic of Congo and Indonesia, where mining frequently correlates with human rights abuses.

The transition to recycling promotes a circular economy, reducing waste and pollution. Original Equipment Manufacturers are progressively adopting closed-loop systems to reclaim and reutilize essential battery materials—measures that mitigate environmental consequences and bolster supply chain resilience. By 2040, studies project that more than 50% of the demand for lithium and nickel may be satisfied by recycling.

Companies such as Tesla and BMW are at the forefront of this shift, using recycled materials into their production processes. These activities also correspond with global ESG objectives and carbon neutrality aspirations. Battery recycling offers a sustainable solution to bolster the growing electric vehicle ecosystem while mitigating the environmental and social impacts of resource extraction.

Electric Vehicle Battery Recycling Market Major Players

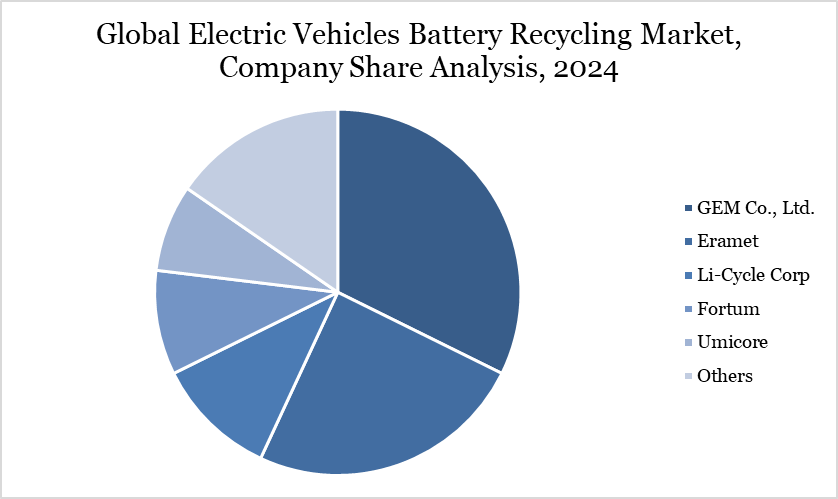

The major global players in the market include GEM Co., Ltd., Eramet, Li-Cycle Corp, Fortum, Umicore, Redwood Materials Inc., Shenzhen Highpower Technology Co., Ltd., ACE Green Recycling, Inc., Stena Metall AB, ACCUREC-Recycling GmbH.

Key Developments

In December 2024, Glencore collaborated with Li-Cycle Holdings Corp, a leading global lithium-ion battery resource recovery company, to assess the technical and economic viability of developing a new Hub facility in Portovesme, Italy, including a concept and pre-feasibility study.

In September 2024, SK Tes opened a lithium-ion and EV battery recycling facility in the Netherlands. The plant has been equipped to process up to 10,000 metric tons of battery materials annually

In July 2024, GEM Co subsidiaries, Fulan Qingmei Energy Materials Co., Ltd. (QM) and Wuhan Power Battery Recycling Technology Co, Ltd. (Power Battery Recycling), signed a cooperation agreement on Joint Development and Market Advancement of Graphene Lithium (Mariganese) fron Phosphate Material Industrialization Technology with Shenzhen Eigen Equation Graphene Technology Co, Ltd.

In June 2024, Fortum entered into a preliminary agreement and signed an MoU with Marubeni Corporation to jointly build a sustainable lithium-ion battery recycling chain, focusing on graphite recycling

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies