Market Overview

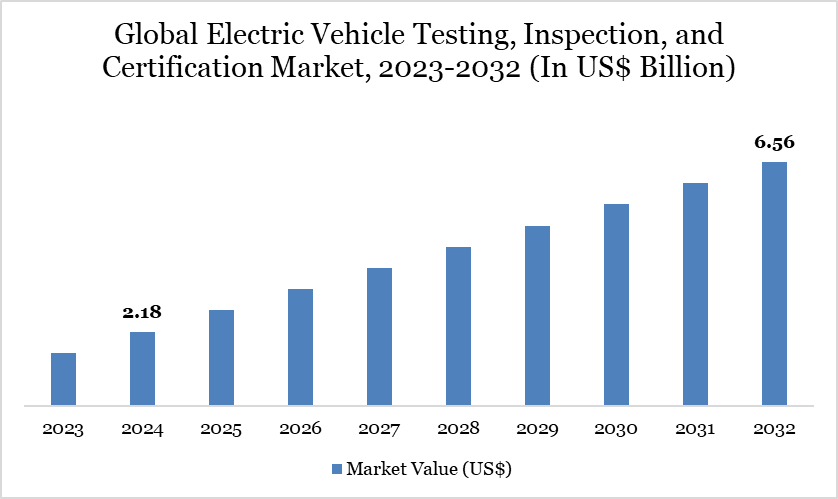

Global Electric Vehicle Testing, Inspection and Certification (EV TIC) Market reached US$ 2.18 billion in 2024 and is expected to reach US$ 5.87 billion by 2032, growing with a CAGR of 15.2% during the forecast period 2025-2032.

The global electric vehicle testing, inspection, and certification market is growing steadily due to rising adoption of electric vehicles, stricter safety rules, and the need for reliable quality checks. Governments are enforcing compliance for EV batteries, charging stations, and vehicle performance, which increases demand for testing, inspection, and certification services.

The growing complexity of EV technologies such as advanced batteries, driver-assistance systems, and connected platforms also supports this trend. In addition, fast-charging expansion and sustainability goals are driving the market, while digital tools and automation improve efficiency and accuracy.

Global Electric Vehicle Testing, Inspection, And Certification Market Trend

One of the most prominent trends in the global electric vehicle testing, inspection, and certification market is the growing focus on testing and certification of advanced driver-assistance systems (ADAS) and connected platforms. As features like adaptive cruise control, lane-keeping assistance, and vehicle-to-grid connectivity become more common, they require strict validation to ensure safety, cybersecurity, and smooth operation across different regions.

Another trend is the increased outsourcing of testing, inspection, and certification services to specialized third-party providers. While some OEMs still conduct in-house testing, the high cost and complexity of advanced EV technologies are leading many to partner with global testing, inspection, and certification companies such as TÜV SÜD, SGS, and Intertek. This approach helps reduce costs, improve expertise access, and speed up product launches.

The market is also witnessing a stronger push toward sustainability and green compliance standards. Governments and industries are now requiring certifications for eco-friendly materials, battery recycling practices, and carbon-neutral supply chains. This shift ensures EVs are not only safe and efficient but also aligned with long-term environmental goals.

Market Scope

Metrics | Details |

By Service Type | Testing, Inspection, Certification |

By Source Type | In-Housing, Outsourced |

By Propulsion | Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Hybrid Electric Vehicle, Others |

By Application | Safety & Security, Communication, Connectors, EV Charging |

By End-use | Automotive, Aeroscapce and Defense, Manufacturer |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growth in EV Charging Infrastructure

The rapid expansion of EV charging infrastructure is a key driver of the global electric vehicle testing, inspection, and certification market, as governments and private players invest heavily in building reliable and safe charging networks. For instance, under the FAME II scheme, the Government of India allocated $120 Million to support the deployment of EV charging stations across the country.

The Department of Heavy Industry (DHI) sanctioned 2,636 charging stations across 62 cities in 24 States and Union Territories, along with 1,544 stations on highways. These large-scale initiatives not only accelerate EV adoption but also create significant demand for testing, inspection, and certification of charging equipment, grid integration, and safety compliance.

Similarly, Europe, China, and the United States are witnessing large-scale public and private investments in fast-charging networks, reinforcing the need for standardized TIC services to ensure interoperability, safety, and quality. This steady growth in charging infrastructure worldwide is directly fueling the expansion of the EV TIC market.

High Testing and Certification Costs

High costs of EV testing and certification are a major restraint for the global electric vehicle testing, inspection, and certification market, as these processes require advanced equipment, skilled experts, and specialized laboratories. Safety and performance testing for large batteries, ADAS features, and fast-charging systems often involve complex simulations, crash tests, and long-duration endurance checks.

These requirements increase the overall development and production cost of EVs, especially for small and medium-sized manufacturers. The financial burden can restrict their ability to expand into new markets or scale production. Moreover, varying regional regulations lead to duplicate certifications and additional administrative fees, further slowing adoption and commercialization.

Segment Analysis

The global electric vehicle testing, inspection, and certification market is segmented based on service type, sourcing type, propulsion, application, end-use and region.

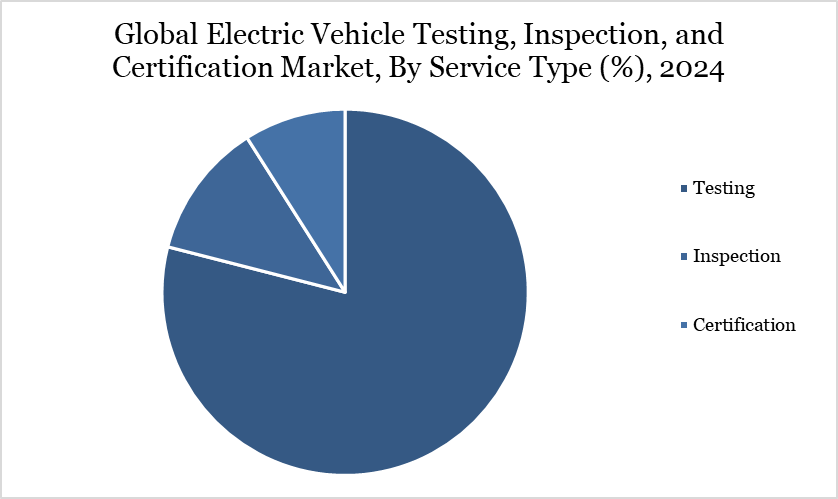

Testing of EV Components and Advanced Validation Processes in Electric Mobility

The testing segment leads the global electric vehicle testing, inspection, and certification market, driven by the growing need to validate the safety, durability, and performance of critical EV components such as batteries, motors, power electronics, and charging systems. This segment benefits from rising investments in advanced testing facilities, simulation platforms, and endurance labs to ensure compliance with stringent international safety and performance standards.

For instance, TÜV SÜD has expanded its battery testing laboratories in Germany to conduct high-voltage and thermal safety tests, supporting OEMs in meeting EU regulatory requirements. Similarly, in 2024, Intertek launched a state-of-the-art EV testing center in the U.S. to validate fast-charging interoperability, battery efficiency, and ADAS integration, accelerating the commercialization of next-generation electric vehicles.

Geographical Penetration

Expanding EV Production and Regulatory Compliance Driving Asia-Pacific Market Growth

The Asia-Pacific region holds a leading position in the global electric vehicle testing, inspection, and certification market, driven by rapid EV production, supportive government policies, and growing consumer adoption of electric mobility. Key markets such as China, Japan, South Korea, and India are making significant investments in testing facilities, battery safety frameworks, and fast-charging certification to meet both domestic demand and international standards.

In 2024, China expanded its EV testing infrastructure through the China Automotive Technology and Research Center (CATARC) to strengthen compliance with GB/T standards for batteries and charging systems, reaffirming its global dominance in EV manufacturing. Likewise, in 2025, Japan implemented updated safety guidelines for high-voltage EV batteries, ensuring strict validation for emerging solid-state technologies. These initiatives underline Asia-Pacific’s focus on regulatory consistency, advanced testing, and large-scale EV deployment, positioning the region as a central hub for global EV TIC market growth.

Technological Analysis

The technological landscape of the global electric vehicle testing, inspection, and certification (TIC) market is evolving quickly, supported by advances in digital testing platforms, simulation tools, and automation that improve accuracy, efficiency, and speed. Current EV testing involves advanced battery validation systems, crash simulation software, and high-voltage endurance testing to meet strict safety and performance standards.

New technologies such as digital twins and data-driven simulations allow virtual testing of EV components, helping reduce costs and shorten development timelines. At the same time, integrating cybersecurity measures into TIC processes has become essential, as connected vehicles and ADAS features must be protected against software risks. Additionally, progress in wireless charging validation, solid-state battery testing, and fast-charging interoperability certification is driving the next phase of market growth, ensuring EVs are safe, reliable, and globally compliant.

Competitive Landscape

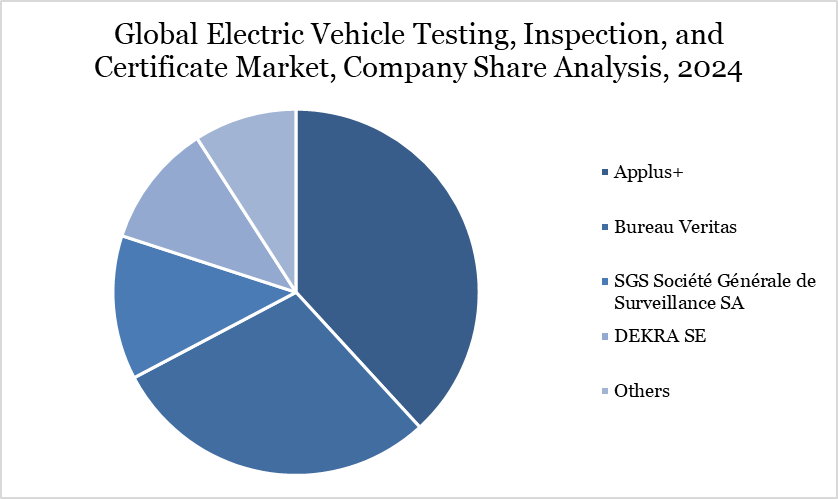

The major global players in the market include Applus+, Bureau Veritas, SGS Société Générale de Surveillance SA, DEKRA SE, Intertek Group plc, TÜV SÜD, iASYS Technology Solutions, UL LLC, TUV Rheinland, Eurofins Scientific, Materials Technology and among others.

Key Developments

In 2025, TÜV SÜD and NATRAX have signed an MoU to strengthen automotive testing in India. The partnership will enhance capabilities in EVs, connected systems, and autonomous technologies by combining TÜV SÜD’s global TIC expertise with NATRAX’s advanced infrastructure, supporting the development of safe, compliant vehicles and boosting India’s role as an automotive innovation hub.

In 2023, Element Materials Technology has acquired NTS Technical Systems, a provider of environmental simulation testing, inspection, and certification services. The acquisition enhances Element’s capabilities in key growth areas such as connected cars, medical devices, and battery testing, while also strengthening its presence in the North American market.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies