Dystrophin Gene Therapy Market Overview

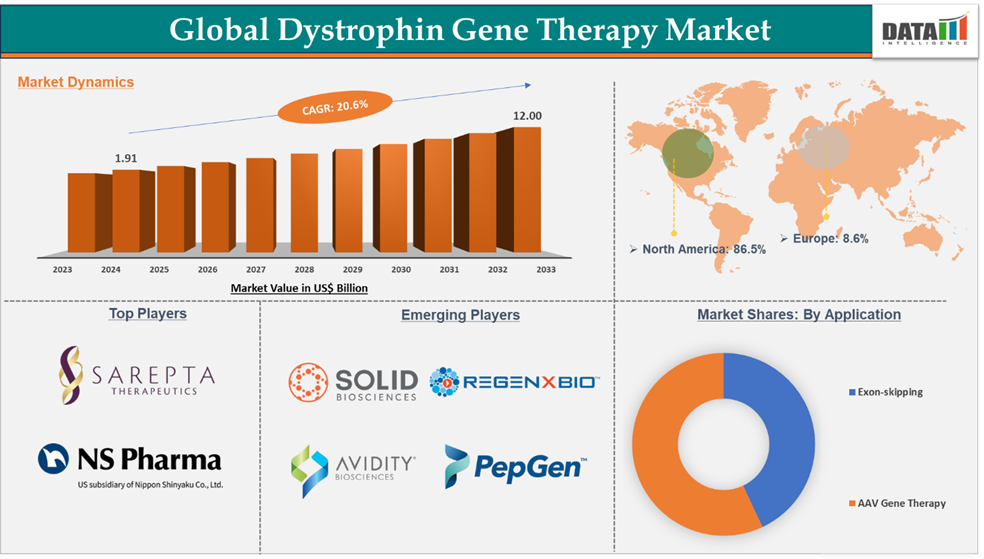

Dystrophin Gene Therapy Market reached US$ 1.91 billion in 2024 and is expected to reach US$ 12.00 billion by 2033, growing at a CAGR of 20.6% during the forecast period 2025-2033.

The Dystrophin Gene Therapy market is experiencing significant growth due to the rising development of advanced gene therapies and a growing number of patients with high unmet needs. However, the high cost of dystrophin gene therapies and the complexity in conducting clinical trials can significantly hinder their adoption. The strategic partnerships and collaborations are a key opportunity for market expansion in the forecast period.

Executive Summary

For more details on this report – Request for Sample

Dystrophin Gene Therapy Market Dynamics: Drivers & Restraints

The rising development of advanced gene therapies is driving the market growth

With the introduction of exon skipping therapies and AAV gene therapy, the DMD treatment landscape has been experiencing significant growth. Several companies are investing in developing advanced gene therapies that can address the DMD population with high unmet needs. There are several gene therapies, which are currently in clinical development, that are expected to make market entry in the forecast period and drive the overall market growth.

For instance, REGENXBIO's RGX-202, an investigational gene therapy for Duchenne muscular dystrophy, has shown consistent and robust microdystrophin expression in two new patients. The treatment showed 122.3% and 31.5% more expression in patients aged 3-7, respectively. RGX-202 was localized to the sarcolemma and was well-tolerated, with no serious adverse events or special interest (AESI) reported. The company plans to share more phase 1/2 functional data in 2025.

In November 2024, REGENXBIO announced that the first patient had been dosed in the pivotal phase 3 portion of AFFINITY DUCHENNE, and the company plans to submit a Biologics License Application (BLA) by mid-2026.

In the forecast period, several such novel gene therapies are expected to be launched commercially and boost the overall market growth.

High cost of dystrophin gene therapies may restrain the market growth

Although gene therapies have revolutionized the Duchenne muscular dystrophy treatment landscape, their high cost can be a significant restraining factor for their adoption. For instance, the cost of Elevidys, a revolutionary AAV vector-based gene therapy for DMD, can cost up to US$ 3.2 million per single dose administration, making it one of the most expensive treatments on the market.

Patients who are living in low-income countries or middle-class families, and those who don’t have proper insurance coverage, may not have access to these advanced therapies. More often, due to their higher cost, payers may employ stringent eligibility criteria to get access. This economic challenge poses a significant restraint on the growth of dystrophin gene therapies globally.

Dystrophin Gene Therapy Market Segment Analysis

The global dystrophin gene therapy market is segmented based on therapeutic approach, therapy, and region.

Exon-skipping in the therapeutic approach segment accounted for 57.0% of the market share in 2024 in the global dystrophin gene therapy market

Mutations in the dystrophin gene cause DMD by preventing the dystrophin protein from functioning properly. Exon-skipping therapies target these genetic alterations by using antisense oligonucleotides (ASOs) to "skip" defective exons in the dystrophin gene transcript. This process restores the gene's reading frame, resulting in the creation of a truncated but functional dystrophin protein. Such improvements indicate a fundamental shift in DMD therapy strategies, putting exon-skipping at the forefront of the market.

For instance, the approval of many exon-skipping medicines by regulatory agencies, including Eteplirsen (Exondys 51), Golodirsen (Vyondys 53), Casimersen (Amondys 45), and viltolarsen (viltepso), has strengthened the segment's position. These medicines are intended to address certain mutations, exons 51, 53, and 45, that affect approximately 30% of DMD patients with susceptible mutations. All these therapies combinedly generated US$ 1.09 billion in revenue in 2024, which is approximately 57% of the overall market share.

The good clinical outcomes associated with this therapy, such as enhanced dystrophin synthesis in muscle fibers and prospective improvements in muscular function, have attracted the attention of both healthcare providers and patients. As additional medicines are approved and introduced into the market, the dependence on exon-skipping techniques is projected to increase, propelling the market growth.

Dystrophin Gene Therapy Market Geographical Analysis

North America dominated the dystrophin gene therapy market with the highest share of 86.5% in 2024

North America’s dominance is contributed to by various factors, including the rising prevalence of DMD, recent approvals, advanced healthcare infrastructure, strong research and development (R&D) capabilities, and a favorable regulatory environment.

Furthermore, North America's regulatory landscape plays a crucial role in its market dominance. The United States Food and Drug Administration (FDA) has launched steps to speed up the approval process for novel medicines, particularly those tackling uncommon diseases such as DMD. The FDA's Orphan Drug Designation program incentivizes firms to explore medicines for uncommon illnesses, allowing new therapies to reach the market more quickly.

The prevalence of DMD is increasing day by day. For instance, according to the National Institute of Health, the estimated incidence is one per 3600 male live-born newborns. Some studies suggest that DMD affects 2 out of every 10,000 people in the United States.

The increasing number of approvals also contributes the largest market share in this region. For instance, in June 2024, the FDA announced the accelerated approval of ELEVIDYS (delandistrogene moxeparvovec-rokl), an adeno-associated virus-based gene therapy, for the treatment of ambulatory pediatric patients aged 4 to 5 years with Duchenne muscular dystrophy (DMD) and a confirmed mutation in the DMD gene.

This indication is authorized under rapid approval, based on the expression of ELEVIDYS micro-dystrophin seen in patients treated with ELEVIDYS.

Moreover, the majority of approved gene therapies are readily available in the U.S. market, and the manufacturers generate a major portion of the product revenue from the country, which is a significant contributing factor to North America’s dominance.

Dystrophin Gene Therapy Market Major Players

The major players in the dystrophin gene therapy market are Sarepta Therapeutics, Inc., and NS Pharma, Inc.

Dystrophin Gene Therapy Market Emerging Players

The major players in the dystrophin gene therapy market are REGENXBIO Inc., Solid Biosciences Inc., PepGen Inc., and Avidity Biosciences, among others

Key Development

In May 2025, Sarepta Therapeutics, Inc. announced that the Japanese Ministry of Health, Labour, and Welfare (MHLW) had approved ELEVIDYS (delandistrogene moxeparvovec) for the treatment of Duchenne muscular dystrophy (DMD) under the conditional and time-limited approval pathway in Japan.

Market Scope

Metrics | Details | |

CAGR | 20.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Therapeutic Approach | Exon-skipping, AAV Gene Therapy |

Therapy | Elevidys, Exondys 51, Amondys 45, Viltepso, Vyondys 53 | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |