Dopamine Agonists Market Size

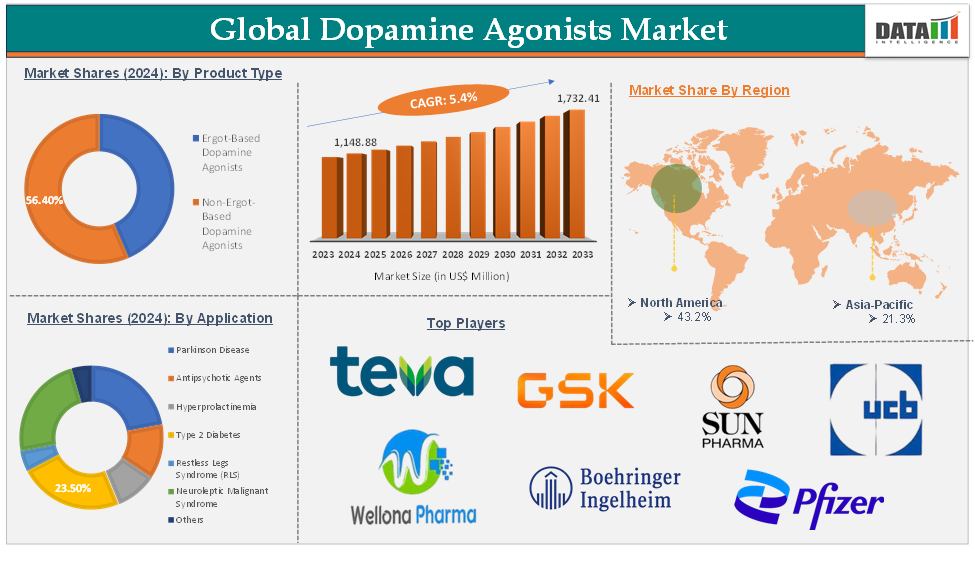

Dopamine Agonists Market reached US$ 1,148.88 Million in 2024 and is expected to reach US$ 1,732.41 Million by 2033, growing at a CAGR of 5.4 % during the forecast period 2025-2033.

Dopamine agonists are medications that activate specific dopamine receptors in the brain, playing a crucial role in treating movement disorders, particularly Parkinson's disease. Essentially, these drugs act like dopamine, a vital neurotransmitter responsible for various functions, including movement, mood regulation, and the experience of pleasure.

One of the key drivers of the market is the shift toward non-ergot dopamine agonists, such as pramipexole and ropinirole. Advancements in drug formulations, including the development of extended-release and transdermal options, increased awareness, and improved diagnostic rates for neurological conditions, are contributing to higher prescription rates and market growth.

Opportunities in the dopamine agonists market are significant, especially in the development of novel therapies with better safety and efficacy, as well as the expansion into emerging markets like Asia-Pacific and Latin America, where healthcare infrastructure and awareness are rapidly improving. Furthermore, strategic collaborations, research funding, and broader reimbursement coverage are supporting innovation and market penetration.

Current trends in the market include the dominance of oral formulations, although injectable and transdermal routes are gaining traction for their convenience and efficacy. The market is highly competitive, with major players investing in research and development to enhance their product offerings and maintain their positions in this expanding landscape.

Executive Summary

For more details on this report, Request for Sample

Dopamine Agonists Market Dynamics: Drivers

Increasing prevalence of Parkinson's disease

Parkinson's disease (PD) is a progressive neurodegenerative disorder that primarily affects movement and has significant implications for global health. Its prevalence is increasing worldwide, particularly among older adults, and it poses a growing burden on healthcare systems.

According to a ScienceDirect research publication in 2024, the Global Burden of Disease Study indicates that the number of individuals diagnosed with parkinson's disease is expected to double from approximately 6 million in 2015 to over 12 million by 2040. This increase is primarily attributed to the aging population, as the incidence of parkinson's disease rises significantly with age. For instance, individuals aged 80 and older exhibit much higher prevalence rates compared to younger age groups.

Research shows that parkinson's disease incidence increases dramatically with age. For instance, prevalence rates per 100,000 individuals rise from about 3 in those aged 30-39 to over 1,700 in those aged 80-89. Men are statistically more likely to develop parkinson's disease than women, with a ratio of approximately 1.5:1.

For instance, in September 2024, AbbVie announced the positive results from its Phase 3 clinical trial for tavapadon is a significant development in the dopamine agonist market, particularly for the treatment of Parkinson's disease (PD). Tavapadon, a selective D1/D5 dopamine receptor partial agonist, is designed to provide effective symptom relief while minimizing side effects commonly associated with traditional dopamine agonists.

Dopamine Agonists Market Dynamics: Restraints

Side effects associated with drugs

The side effects associated with drugs will hinder the growth of the global dopamine agonists market. Dopamine agonists can cause a range of side effects that may discourage some patients from using them. Furthermore, the necessity for long-term treatment can complicate medication regimens and lower adherence rates, especially among patients who encounter adverse effects or struggle to stick to a consistent dosing schedule.

Long-term use of dopamine agonists can lead to dystonic movements and psychiatric issues. Common psychiatric side effects include hallucinations, delusions, confusion, depression, and mania. Patients taking pramipexole and ropinirole may also experience irresistible sleep attacks, along with symptoms such as increased sedation, yawning, drowsiness, somnolence, and daytime sleepiness.

Additionally, cabergoline and pergolide have been associated with a heightened incidence of cardiac valve regurgitation; consequently, pergolide has been withdrawn from the U.S. market. Bromocriptine and cabergoline are not recommended for treating Parkinson’s disease due to the necessity for long-term use at higher doses compared to their use in treating hyperprolactinemia. Thus, the above factors could be limiting the global dopamine agonists market's potential growth.

Dopamine Agonists Market Segment Analysis

The global dopamine agonists market is segmented based on product type, route of administration, application, distribution channel, and region.

Product Type:

The non-ergot-based dopamine agonist segment is expected to hold 56.4% of the global dopamine agonists market in 2024

The non-ergot-based dopamine agonists (NEDAs) segment is an important and expanding area within the global dopamine agonists market, particularly for the treatment of Parkinson's disease (PD). These medications are primarily utilized either as standalone treatments for early-stage parkinson's disease or as supplementary therapy alongside levodopa in more advanced cases.

The non-ergot compounds commonly used for treating Parkinson's disease (PD) include apomorphine, rotigotine, pramipexole, ropinirole, and piribedil. Among these, rotigotine, ropinirole, and pramipexole have demonstrated comparable clinical effectiveness in alleviating motor symptoms of PD, whether used alone or in combination with levodopa.

Apomorphine is particularly recommended for patients with advanced PD who experience drug-resistant "OFF" periods and peak-dose dyskinesia that cannot be adequately managed with standard oral therapies. Piribedil has also shown effectiveness both as a standalone treatment and as an adjunct to levodopa for individuals with early, non-fluctuating PD.

Dopamine Agonists Market Geographical Share

North America is expected to hold 43.2% of the global dopamine agonists market in 2024

The aging population in North America significantly contributes to the increasing incidence of Parkinson's disease (PD). It is projected that the number of diagnosed cases will exceed 1.2 million by 2030, leading to a heightened demand for effective treatment options, including dopamine agonists.

Ongoing research and development activities are facilitating the emergence of innovative therapies. New drug formulations and delivery methods, such as transdermal patches and extended-release options, improve patient adherence and treatment effectiveness. These advancements play a crucial role in attracting both healthcare providers and patients to the use of dopamine agonists.

Moreover, in this region, a major number of key players' presence, well-advanced healthcare infrastructure, government initiatives & regulatory support, technological advancements, & investments, and product launches & approvals would propel the dopamine agonists market growth.

For instance, as per American Parkinson Disease Association news in February 2024, four dopamine agonists are currently approved by the Federal Drug Administration (FDA) for treating Parkinson's disease (PD) in the United States: Mirapex (pramipexole), Requip (ropinirole), Neupro (rotigotine), and Apokyn (apomorphine).

Both pramipexole and ropinirole are available in regular and extended-release formulations. Rotigotine is offered as a transdermal patch that is applied to the skin once a day. Apomorphine is administered via injection and is considered a "rescue" medication, acting quickly with an onset of action within approximately 10 minutes. Thus, the above factors are consolidating the region's position as a dominant force in the global dopamine agonists market.

Asia-Pacific is expected to hold 21.3% of the global dopamine agonists market in 2024

The increasing number of Parkinson's disease (PD) and other movement disorder cases in the Asia-Pacific region is a significant factor driving the dopamine agonists market growth. As more individuals receive diagnoses, the demand for effective treatment options, including dopamine agonists, continues to escalate. As the population ages, there is an increasing need for effective management of age-related conditions, driving up the demand for dopamine agonists.

Enhanced healthcare spending in emerging economies like China and India is improving access to medical treatments, including advanced therapies for neurological conditions. This investment in healthcare infrastructure supports the availability of dopamine agonists and improves patient access to essential medications.

There is a growing awareness of Parkinson's disease and its treatment options among both healthcare professionals and the general public. Educational campaigns and support groups are playing a vital role in informing patients about available therapies, which leads to increased demand for dopamine agonists. Continuous research and development efforts are resulting in the launch of new formulations and delivery systems for dopamine agonists. These innovative therapies enhance patient adherence and treatment effectiveness, further propelling the dopamine agonists market growth.

Favorable government initiatives aimed at improving healthcare access and promoting research into neurological disorders are contributing to the dopamine agonists market expansion. Policies that facilitate the development of new treatments can increase the availability of dopamine agonists. There is a rising demand for non-invasive treatment methods among patients with Parkinson's disease.

Dopamine Agonists Market Major Players

The major global players in the dopamine agonists market include Teva Pharmaceuticals USA, Inc., GSK plc, UCB S.A., Sun Pharmaceutical Industries Ltd., Pfizer Inc., Boehringer Ingelheim International GmbH, Wellona Pharma, Glenmark Pharmaceuticals Inc., AdvaCare Pharma, and Serum Institute of India Pvt. Ltd., among others.

Global Dopamine Agonists Market - Emerging Players

The emerging players in the global dopamine agonists market include Cerevel Therapeutics, Inhibikase Therapeutics, Inc., Neuraly Inc., and Peptron, among others.

Dopamine Agonists Market - Key Developments

In February 2025, ONAPGO (apomorphine hydrochloride) is a newly FDA-approved therapy from Supernus Pharmaceuticals designed for adults with advanced Parkinson’s disease who experience motor fluctuation periods known as “OFF” episodes, when symptoms such as tremor, slowness, and stiffness return because standard medications are no longer providing consistent relief.

In September 2024, Renata Ltd., a leading pharmaceutical company from Bangladesh, has recently received approval through the European Union Decentralised Procedure (EU DCP) to export its Cabergoline 0.5mg tablets to multiple European countries, including Ireland, France, Portugal, Italy, Denmark, Sweden, the Netherlands, Norway, and Spain.

In January 2024, UCB S.A. introduced the Neupro (rotigotine transdermal patch) is approved for treating the signs and symptoms of early-stage idiopathic Parkinson's disease in Europe. It can be used as a standalone therapy (monotherapy) without levodopa or in conjunction with levodopa.

Market Scope

Metrics | Details | |

CAGR | 5.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Ergot-Based Dopamine Agonists, Non-Ergot-Based Dopamine Agonists |

Route of Administration | Oral, Parenteral, Transdermal Patches | |

Application | Parkinson's Disease, Antipsychotic Agents, Hyperprolactinemia Type 2 Diabetes, Restless Legs Syndrome (RLS), Neuroleptic Malignant Syndrome, Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Hospitals, Ambulatory Surgical Centers (ASCs), Specialized Middle East & Africa | |

The global dopamine agonists market report delivers a detailed analysis with 70 key tables, more than 65 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.