Insulin Delivery Devices Market Size & Industry Outlook

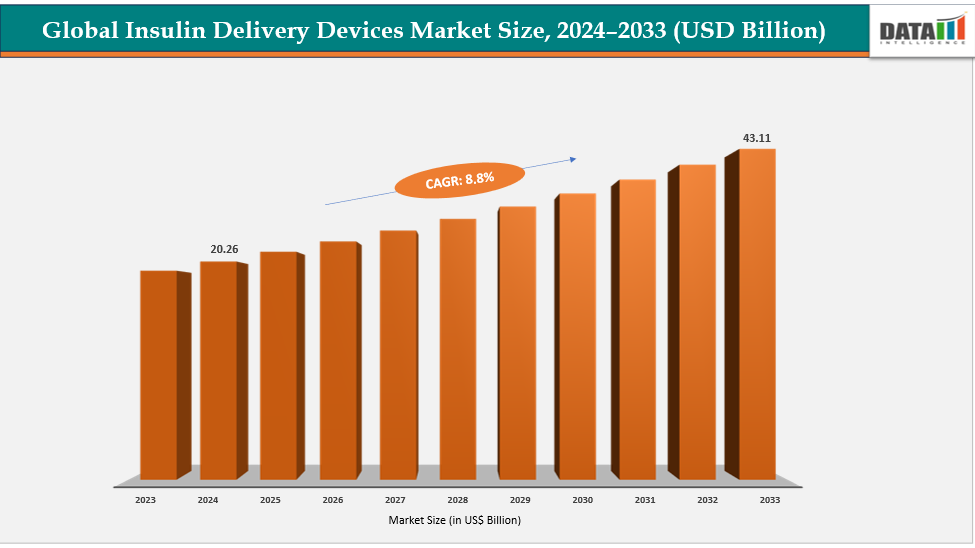

The global insulin delivery devices market size reached US$ 20.26 billion in 2024 is expected to reach US$ 43.11 billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033. A key emerging driver in the insulin delivery devices market is the growing shift toward patient-centric, minimally invasive diabetes management solutions. Users today demand convenience, comfort, and improved treatment adherence fueling innovation in wearable and discreet insulin delivery options. For instance, Insulet Corporation’s Omnipod 5 and Medtronic’s MiniMed 780G systems allow continuous insulin infusion without frequent needle insertions, improving patient compliance and glycemic control. Such user-friendly and automated systems are encouraging broader adoption among both newly diagnosed and existing diabetic patients, driving consistent market expansion.

Key Highlights

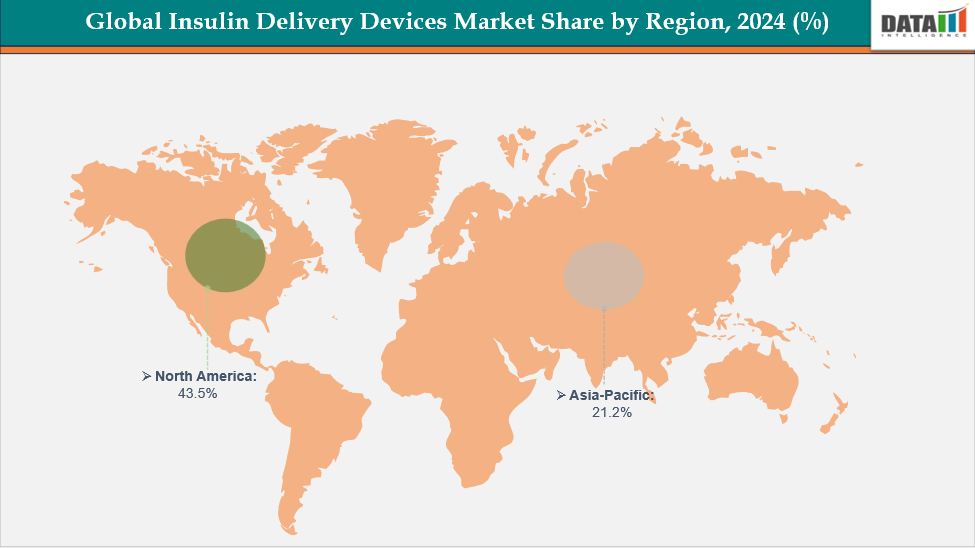

- North America dominates the insulin delivery devices market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

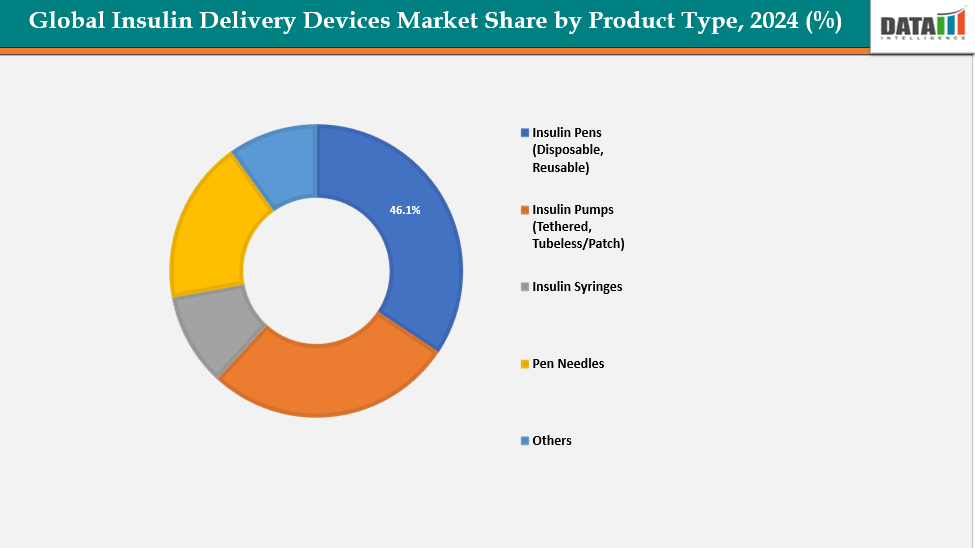

- Based on product type, insulin pens (Disposable, Reusable) segment led the market with the largest revenue share of 46.1% in 2024.

- The major market players in the insulin delivery devices market includes Medtronic, Insulet Corporation (Omnipod), Tandem Diabetes Care, Inc, Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Becton, Dickinson and Company (BD) / Embecta, Ypsomed Holding AG, Roche Diabetes Care, Terumo Corporation and among others.

Market Dynamics

Drivers: Rising prevalence of diabetes driving the insulin delivery devices market growth

One of the most significant driving factors for the global insulin delivery devices market is the rising prevalence of diabetes worldwide. The growing number of individuals diagnosed with Type 1 and Type 2 diabetes linked to sedentary lifestyles, obesity, poor nutrition, and an aging population has substantially increased the need for efficient and reliable insulin delivery methods.

For instance, according to the International Diabetes Federation (IDF), the global diabetic population is projected to reach nearly 640 million by 2030, reflecting an alarming surge in disease incidence. This escalating patient base is pushing healthcare providers and patients alike to adopt advanced insulin delivery systems that offer improved accuracy, comfort, and glycemic control compared to traditional syringes.

Restraints: High cost of advanced insulin-delivery devices are hampering the growth of the insulin delivery devices market

The high cost of advanced insulin delivery devices remains a major restraint in the global market, particularly affecting adoption in low- and middle-income regions. Modern technologies such as insulin pumps, continuous glucose monitoring (CGM)-integrated systems, and smart insulin pens offer superior accuracy and convenience but come at a substantial financial burden for patients. For instance, the average price of an insulin pump ranges from USD 4,000 to USD 7,000, while the annual cost of consumables and maintenance can add another USD 1,500–2,500. Similarly, smart insulin pens and patch systems may cost between USD 300 and USD 800, making them less affordable for large patient populations without comprehensive insurance or reimbursement coverage.

For more details on this report – Request for Sample

Insulin Delivery Devices Market, Segment Analysis

The global insulin delivery devices market is segmented based on product type, application, end user and region.

Product Type: The insulin pens segment from product type segment to dominate the insulin delivery devices market with a 46.1% share in 2024

Rising diabetes prevalence and the shift toward patient-centered care are the main drivers behind the insulin-pen segment’s growth. Pens combine ease-of-use, accurate dosing and portability, which improve adherence versus vial-and-syringe therapy especially for working adults and older patients who value discreet, simple administration. Continued innovation (pre-filled pens, finer dosing increments, memory/connected “smart” pens) plus expanding availability of pen-compatible insulin formulations and stronger reimbursement in many markets further push clinicians and payers to prefer pens. Together these factors raise patient satisfaction and reduce dosing errors, making pens a fast-growing share of the insulin-delivery devices market.

For instance, in August 2025, Trividia Health has introduced its new TRUEplus five-bevel insulin pen needle line in the UK, expanding its diabetes care portfolio. The product line offers healthcare providers a range of needle gauges and lengths (31G 5mm, 6mm, 8mm, and 32G 4mm) designed to enhance patient comfort and usability. With its five-bevel tip technology, the needle ensures smoother and less painful injections, improving the overall injection experience.

Application: The type 1 diabetes segment is estimated to have a 41.1% of the insulin delivery devices market share in 2024

The Type I Diabetes segment plays a pivotal role in driving the insulin delivery devices market, as insulin therapy remains the cornerstone of disease management for these patients. Since individuals with Type I Diabetes require lifelong insulin administration, there is consistent demand for advanced delivery systems such as pens, pumps, and smart injectors that ensure accurate and convenient dosing. The increasing prevalence of Type I Diabetes among children and young adults, coupled with the growing focus on self-management and glucose monitoring, further accelerates adoption of user-friendly and less invasive devices. Continuous technological innovations aimed at improving dosing precision, minimizing pain, and integrating with glucose monitoring systems are enhancing treatment outcomes, thereby sustaining strong market growth within this segment.

For instance, in August 2024, The U.S. Food and Drug Administration (FDA) has expanded the indications of Insulet’s SmartAdjust technology, an interoperable automated glycemic controller, to now include the management of type 2 diabetes in adults aged 18 years and older. Previously approved for individuals with type 1 diabetes aged two years and above, this update significantly broadens the device’s clinical applicability.

Insulin Delivery Devices Market, Geographical Analysis

North America dominates the global insulin delivery devices market with a 43.5% in 2024

North America remains the leading market due to the high prevalence of diabetes, advanced healthcare infrastructure, and early adoption of smart insulin delivery technologies such as connected pens and patch pumps. Strong presence of key players like Medtronic, Insulet, and Eli Lilly, along with supportive reimbursement frameworks, drives continued product innovation. Additionally, rising patient awareness about self-management and continuous glucose monitoring boosts demand for user-friendly, accurate devices.

The U.S. market is propelled by rapid technological advancements and growing adoption of automated insulin delivery systems, particularly among tech-savvy diabetic patients. The FDA’s supportive regulatory stance, as seen with recent approvals like Insulet’s SmartAdjust expansion, encourages innovation. A large diabetic population base, high disposable income, and increasing integration of AI-based glucose monitoring and insulin dosing systems further strengthen the market’s momentum.

For instance, in September 2025, Medtronic Diabetes launched a new continuous glucose monitor (CGM) named Instinct in the United States. This innovative sensor, produced by Abbott, is designed to enhance the functionality and options available for users of the MiniMed 780G insulin pump system, allowing for improved diabetes management for patients.

Europe is the second region after North America which is expected to dominate the global insulin delivery devices market with a 34.5% in 2024

In Europe, growth is driven by favorable healthcare policies, strong reimbursement coverage for insulin delivery devices, and the rising prevalence of Type 1 Diabetes among youth. The region’s focus on digital health integration and the adoption of smart insulin pens and hybrid closed-loop systems are accelerating the shift toward automated diabetes management. Local collaborations and initiatives promoting early diagnosis and disease management also support market expansion.

The UK market is witnessing steady growth owing to NHS-led diabetes management programs, which emphasize patient education and access to modern insulin delivery devices. Increasing preference for pen needles and connected insulin pens that offer comfort and accurate dosing is boosting usage.

For instance, in September 2025, Arecor Therapeutics has entered into a co-development agreement with Sequel Med Tech LLC to integrate its AT278 insulin formulation with Sequel's twiist Automated Insulin Delivery system. Additionally, Arecor has secured a royalty financing agreement with Ligand Pharmaceuticals, aimed at raising up to $11 million in non-dilutive capital.

The Asia Pacific region is the fastest-growing region in the global insulin delivery devices market, with a CAGR of 8.1% in 2024

The Asia-Pacific region is rapidly becoming the fastest-growing market for insulin delivery devices, influenced by increasing diabetes rates, healthcare spending, and the adoption of insulin pens and pumps. Factors such as urbanization, lifestyle changes, and government initiatives in countries like India, China, and South Korea are promoting early diagnosis and insulin therapy.

Japan's market growth is driven by its aging population, high diabetes burden, and advanced medical technology, with a focus on compact and efficient insulin delivery systems and digital health integration.

For instance, in 2024, Japan reported a total adult population of approximately 93.2 million, with an estimated 8.1% prevalence of diabetes among adults. This translates to around 8.97 million individuals living with diabetes across the country. The growing diabetic population is largely attributed to Japan’s aging demographic, sedentary lifestyle, and dietary transitions toward high-calorie consumption.

Competitive Landscape

Top companies in the insulin delivery devices market Medtronic, Insulet Corporation (Omnipod), Tandem Diabetes Care, Inc, Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Becton, Dickinson and Company (BD) / Embecta, Ypsomed Holding AG, Roche Diabetes Care, Terumo Corporation and among others.

Medtronic:- Medtronic plays a crucial role in driving the insulin delivery devices market through its strong portfolio of advanced insulin pumps and integrated diabetes management systems. The company’s focus on innovation—such as hybrid closed-loop technologies that automatically adjust insulin delivery based on glucose readings enhances treatment precision and patient convenience. Its flagship MiniMed insulin pump series and connected ecosystem with continuous glucose monitoring (CGM) devices have set benchmarks for smart diabetes care. Medtronic’s extensive global reach, robust clinical support programs, and collaborations aimed at expanding access to automated insulin delivery systems further strengthen its market position.

Market Scope

| Metrics | Details | |

| CAGR | 8.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Insulin Pens (Disposable, Reusable), Insulin Pumps (Tethered, Tubeless/Patch), Insulin Syringes, Pen Needles, Others |

| Application | Type I Diabetes, Type II Diabetes | |

| End User | Hospitals & Clinics, Homecare Settings, Ambulatory Care Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Insulin Delivery Devices market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.