Insulin Pen Market Size & Industry Outlook

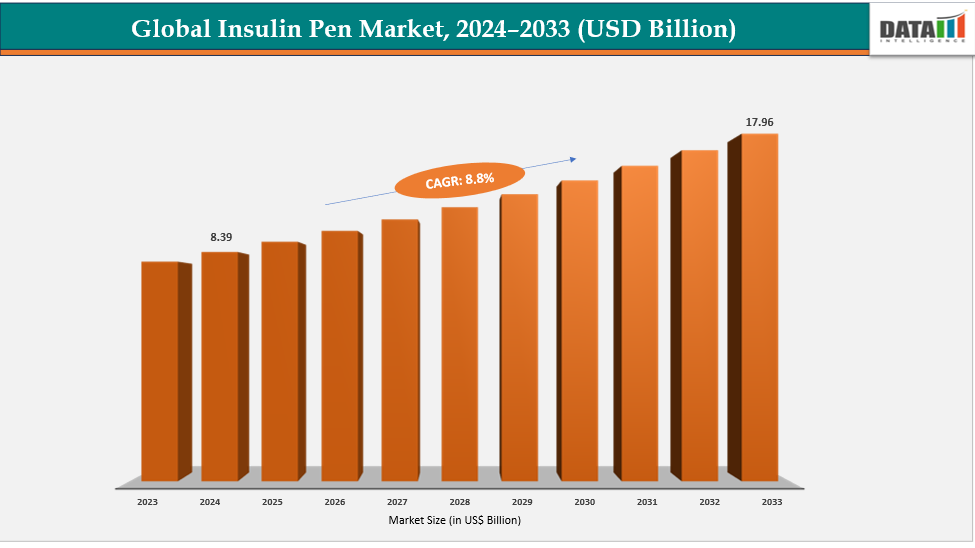

The global insulin pen market size was US$ 8.39 Billion in 2024 and is expected to reach US$ 17.96 Billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033.

The increasing demand for convenient, precise, and portable insulin delivery systems is propelling the growth of the insulin pen market, as both patients and healthcare professionals are leaning towards solutions that simplify the management of diabetes. Insulin pens minimize dosing mistakes, are lightweight, and facilitate discreet administration, which enhances adherence, particularly for individuals who need multiple injections each day. Furthermore, advancements in technology, such as smart insulin pens featuring digital tracking, Bluetooth capability, and compatibility with mobile applications or continuous glucose monitoring systems, are enhancing patient participation and fostering improved glycemic control. These developments offer real-time information, alerts, and personalized dosing assistance, which not only boost treatment results but also attract technology-oriented users, thereby accelerating global market growth and adoption.

Key Highlights

- North America is dominating the global insulin pen market with the largest revenue share of 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global insulin pen market, with a CAGR of 7.7% in 2024

- The type 2 diabetes segment is dominating the insulin pen market with a 61.8% share in 2024

- The prefilled insulin pens segment is dominating the insulin pen market with a 54.3% share in 2024

- Top companies in the insulin pen market are Eli Lilly and Company, Novo Nordisk, Sanofi, Biocon, Medtronic, Owen Mumford, BD, Gan & Lee Pharmaceuticals, Ypsomed, and Stevanato Group, among others.

Market Dynamics

Drivers: Rising prevalence of diabetes is accelerating the growth of the insulin pen market

The global surge in diabetes cases is significantly fueling the insulin pen market. With a growing number of individuals diagnosed with both type 1 and type 2 diabetes, there is an increasing need for convenient and precise insulin delivery methods. Insulin pens make self-injection easier compared to conventional vials and syringes, providing accurate dosing, portability, and user-friendliness, which enhances patient adherence. The rising count of patients needing multiple daily insulin doses further drives the popularity of insulin pens.

Owing to the factors like prevalence. For instance, according to WHO data published in 2024, an estimated 537 million adults globally had diabetes, with projections indicating a rise to 783 million by 2045.

Restraints: Competition and alternative delivery technologies are hampering the growth of the insulin pen market

The expansion of the insulin pen market is being influenced by competition and alternative delivery methods, as patients and healthcare professionals now have various choices for insulin delivery. Insulin pumps, patch pumps, and new forms of oral or inhaled insulin provide convenience, continuous dosing, and improved glucose management, potentially making standard pens less appealing.

Moreover, generic vials and syringes continue to serve as more affordable options, particularly in price-sensitive markets. Smart pens encounter rivalry from digital health platforms that are connected with pumps, providing enhanced monitoring and dosing information. These alternatives lead to market fragmentation and hinder the adoption of standard prefilled and reusable pens.

For more details on this report, see Request for Sample

Insulin Pen Market, Segmentation Analysis

The global insulin pen market is segmented based on pen type, indication, distribution channel, and region

By Pen Type: The prefilled insulin pens segment is dominating the insulin pen market with a 54.3% share in 2024

The global insulin pen market is primarily led by the csegment, which is favored for its user-friendliness, practicality, and accurate dosing. In contrast to reusable pens, prefilled versions eliminate the necessity of loading insulin cartridges, thereby decreasing the likelihood of user mistakes and promoting better patient adherence. They are compact and discreet, enabling patients to conveniently administer insulin while away from home. Additionally, prefilled pens reduce the risks of contamination and are designed for one-time use, ensuring hygiene and safety.

Moreover, drug manufacturers promote prefilled pens in conjunction with well-known insulin analogs, which enhances their uptake. For instance, in July 2025, Biocon Biologics Ltd. announced that the FDA had approved Kirsty (insulin aspart-xjhz) as the first interchangeable biosimilar to NovoLog, indicated for glycemic control in adults and pediatric patients. KIRSTY was made available as a single-patient-use prefilled pen for subcutaneous use.

By Indication: The type 2 diabetes segment is dominating the insulin pen market with a 61.8% share in 2024

The segment of type 2 diabetes leads the global insulin pen market due to the rapidly rising occurrence of type 2 diabetes globally. For example, as reported by WHO, over 95% of individuals with diabetes are affected by type 2 diabetes, largely attributed to sedentary lifestyles, obesity, and an aging population. People with type 2 diabetes typically require insulin treatment over time as oral medications become less effective, increasing the demand for user-friendly insulin delivery options such as pens. Insulin pens provide precise dosing, are user-friendly, portable, and cause less injection pain compared to standard syringes, making them especially attractive for ongoing self-administration.

In addition, increasing regulatory approvals, advancements in insulin pen technology, and the endorsement from regulatory agencies for insulin pumps are contributing to the segment's growing dominance. For instance, in March 2023, Sanofi India received marketing authorization from CDSCO for Soliqua pre-filled pens, a once-daily fixed-ratio combination of insulin glargine (100 U/mL) and lixisenatide, indicated for adults with obesity and Type 2 diabetes inadequately controlled on oral or injectable therapies.

Insulin Pen Market, Geographical Analysis

North America is dominating the global insulin pen market with 48.5% in 2024

North America dominates the insulin pen market due to its advanced healthcare system, swift acceptance of cutting-edge technologies, and rising rates of diabetes. The region's market leadership is bolstered by robust reimbursement policies, ongoing product innovations, a highly trained healthcare workforce, and stringent regulatory standards, all of which promote the widespread use of insulin pens.

The insulin pen market in the U.S. is expanding due to enhanced healthcare systems, regular introductions of new products, cutting-edge technologies, and supportive FDA approvals, which enhance diabetes management and patient care. For instance, in February 2025, the U.S. FDA approved Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar, for adult and pediatric diabetes patients, available as both a 3 mL single-patient-use prefilled pen and a 10 mL multiple-dose vial.

Europe is the second region after North America, which is expected to dominate the global insulin pen market with 34.5% in 2024

The market for insulin pens in Europe is growing as a result of improved healthcare systems, an aging population, and a rise in surgical procedures. Ongoing product introductions, supportive reimbursement policies, and EU/CE certifications promote innovation, improve patient safety, and facilitate regional market expansion within healthcare environments.

In addition, the market is also strengthened by increasing collaborations and partnerships among major companies in the insulin pen sector. For instance, in March 2023, Diabeloop, a France-based company, collaborated with Novo Nordisk to integrate its DBL-4pen algorithm with NovoPen 6 and NovoPen Echo Plus, initiating a clinical study to evaluate efficacy and benefits for type 2 diabetes patients using connected, reusable insulin pens.

The Asia Pacific region is the fastest-growing region in the global insulin pen market, with a CAGR of 7.7% in 2024

The market for insulin pens in the Asia-Pacific area, which encompasses India, China, Japan, and South Korea, is expanding rapidly due to the increasing incidence of diabetes, higher healthcare expenditures, improved medical infrastructure, supportive government policies, and a greater uptake of convenient insulin delivery devices in hospitals, clinics, and home-care environments.

In India, companies manufacturing insulin pens are introducing prefilled and reusable options that have received approval from CDSCO and are emphasizing patient education, digital monitoring, and self-administration to enhance diabetes management and care. Owing to factors like CDSCO-approved prefilled and reusable pens. For instance, in June 2025, Biocon Limited received CDSCO approval in India for its Liraglutide drug substance, and Biocon Pharma Limited obtained approval for the 6 mg/mL solution for injection in pre-filled pen and cartridge for the treatment of diabetes.

Insulin Pen Market Competitive Landscape

Top companies in the insulin pen market are Eli Lilly and Company, Novo Nordisk, Sanofi, Biocon, Medtronic, Owen Mumford, BD, Gan & Lee Pharmaceuticals, Ypsomed, and Stevanato Group, among others.

Eli Lilly and Company: Eli Lilly and Company, a global biopharmaceutical leader, is a major player in the insulin pen market, offering a range of prefilled pens like Humalog KwikPen and Admelog SoloStar. The company focuses on innovation, patient-centric design, and digital integration, providing accurate, convenient, and user-friendly insulin delivery solutions for both type 1 and type 2 diabetes worldwide.

Key Developments:

- In March 2025, South Africa’s competition authority investigated Novo Nordisk and Sanofi for potential anti-competitive practices in the human insulin pen market, examining whether their business strategies restricted competition and affected insulin accessibility.

- In February 2024, Ypsomed completed the sale of its pen needle and blood glucose monitoring business to Medical Technology and Devices S.p.A. (MTD), enabling Ypsomed to focus on commercializing and developing its innovative mylife Loop insulin pump solution.

- In September 2023, Abbott announced a definitive agreement to acquire Bigfoot Biomedical, a leader in smart insulin management systems, aiming to develop personalized, connected solutions for people living with diabetes.

Insulin Pen Market Scope

| Metrics | Details | |

| CAGR | 8.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Pen Type | Prefilled Insulin Pens, Reusable Insulin Pens, Smart Insulin Pens |

| By Indication | Type 2 Diabetes, Type 1 Diabetes | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global insulin pen market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here