Dental Implants and Prosthetics Market Size

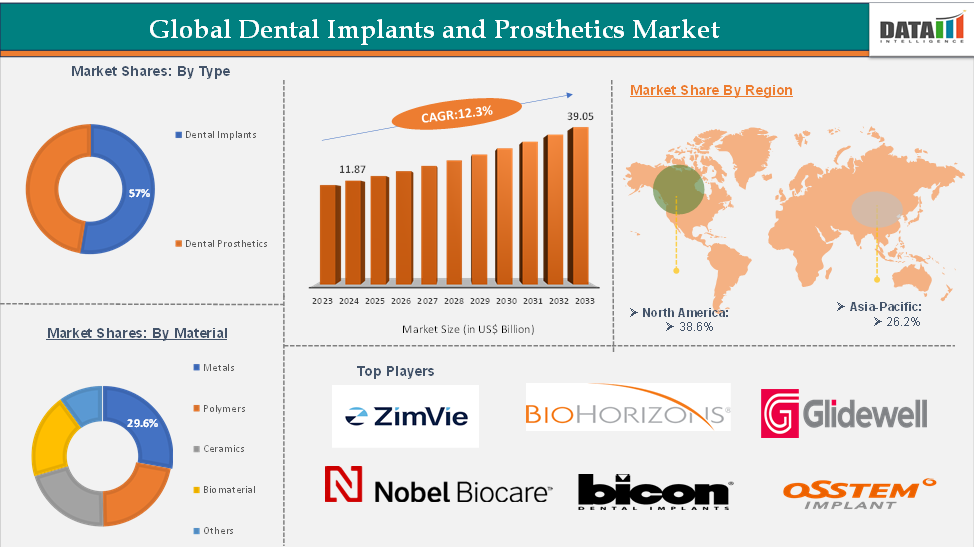

Dental Implants and Prosthetics Market reached US$ 11.87 billion in 2024 and is expected to reach US$ 39.05 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025-2033.

Dental Implants and Prosthetics Market Overview

The global dental implants and prosthetics market is witnessing robust growth, driven by rising demand for restorative dental procedures, an aging population, and increasing awareness of oral health and aesthetics. Valued at several billion USD, the market is projected to expand steadily over the coming years, supported by advancements in implant materials, CAD/CAM technologies, and minimally invasive surgical techniques.

Executive Summary

For more details on this report – Request for Sample

Dental Implants and Prosthetics Market Dynamics: Drivers & Restraints

The increasing prevalence of oral problems is significantly driving the dental implants and prosthetics market growth

The increased prevalence of oral problems is significantly driving the dental implants and prosthetics market. The rise in dental disorders, such as dental caries and periodontal disease, significantly impacts the need for dental implants and prosthetics. As these disorders cause tooth loss, patients are increasingly seeking restorative options to maintain oral function and aesthetics. For instance, the World Health Organization in 2024 stated that severe periodontal conditions are estimated to impact approximately 19% of the global adult population, totaling more than 1 billion cases worldwide. Poor dental hygiene and tobacco use are the most significant risk factors for periodontal disease.

The global population is aging, and older people are more prone to dental problems that require implants and prosthetics. Age-related tooth loss is widespread, increasing demand for dental restoration treatments. For instance, according to a study published by the National Institute of Health in 2024, Gum disease is a widespread oral health issue, affecting over 42% of adults aged 30 and older, with nearly 8% experiencing severe periodontal disease. The prevalence of gum disease rises significantly with age, impacting almost 60% of adults aged 65 and above.

It is also more common in men than women, affecting more than 50% of men compared to 35% of women. Lifestyle and health conditions play a significant role in its development. Over 60% of current smokers suffer from periodontal disease, and individuals with chronic conditions such as diabetes are particularly vulnerable, with nearly 60% of diabetics also affected by the condition.

High costs of dental procedures are expected to hamper the dental implants and prosthetics market growth.

The increasing rate of medical waste is expected to be a significant restraining factor for the pharma blister packaging market. This is due to increasing environmental concerns and regulatory pressures. Blister packaging, while effective in protecting medications and extending shelf life, is primarily composed of plastic and aluminum, which complicates disposal and recycling efforts.

The complexity of materials used in blister packs makes them challenging to recycle, resulting in a considerable amount of waste that often ends up in landfills or incinerators. This not only contributes to environmental degradation but also raises concerns among consumers and regulatory bodies regarding the sustainability of pharmaceutical packaging practices. Companies will need to innovate and adapt their packaging strategies to address these issues while complying with evolving regulations aimed at reducing waste and promoting sustainability.

Dental Implants and Prosthetics Market Segment Analysis

The global dental implants and prosthetics market is segmented based on type, material, end-user, and region.

The dental implants from the type segment are expected to hold 57.6% of the market share in 2024 in the dental implants and prosthetics market.

The dental implants segment is poised for dominance within the dental implants and prosthetics market due to a combination of rising dental disease prevalence, an aging population, technological advancements, increased aesthetic demands, and greater public awareness. For instance, according to the WHO Global Oral Health Status Report, oral diseases impact about 3.5 billion people globally, with middle-income nations accounting for 3 out of every 4. An estimated 2 billion people worldwide suffer from permanent tooth decay, while 514 million children have primary tooth decay. These factors collectively contribute to robust growth for the dental implants segment, positioning it in the dominant position in the global dental implants and prosthetics market.

Dental technological innovations, such as improved implant materials (such as titanium), enhanced imaging techniques, and computer-aided design/manufacturing (CAD/CAM), improve the effectiveness and acceptability of dental implants among patients and practitioners.

Companies are introducing advanced dental implant solutions in different regions. For instance, in March 2024, U Dental launched its advanced dental implant solution in Melbourne. With premium dental implants and skilled artisanal dentists, the team aims to provide patients with life-changing smiles and long-term oral health benefits. These innovations help to improve outcomes and promote patient satisfaction by contributing to the overall segment's growth.

Dental Implants and Prosthetics Market, Geographical Analysis

North America is expected to dominate the global dental implants and prosthetics market with a 38.6% share in 2024

North America is anticipated to maintain its leading position in the dental implants and prosthetics market, owing to several significant factors that contribute to its growth and dominance. The dominance of the region in the global market is contributed to by the rising incidence of dental diseases, an increasing number of dental prosthetic procedures, rising technological advancements in the field of dentistry, and the presence of major key players in the region.

There are large numbers of individuals in the region suffering from more than one dental disease each year. There is a growing number of incidences of serious dental conditions leading to the increasing demand for dental implantation and prosthetic restoration. For instance, according to the Centers for Disease Control and Prevention in 2024, 7 in 10 Mexican American children (70%) aged 6 to 9 years have had cavities in their primary (baby) or permanent teeth compared with 4 in 10 non-Hispanic White children (43%).

The companies are introducing advanced dental implants, which could contribute to the market’s growth. For instance, in February 2025, Dentsply Sirona announced the US market launch of MIS LYNX, a cost-effective dental implant solution designed by MIS Implants Technologies.

The growing emphasis on cosmetic improvements has resulted in a surge in demand for aesthetic dental treatments, including implants that have a natural appearance and feel, boosting the region's market expansion.

Asia-Pacific is growing at the fastest pace in the dental implants and prosthetics market, holding 26.2% of the market share.

The Asia-Pacific (APAC) region is witnessing the fastest growth rate in the dental implants and prosthetics market, owing to a combination of factors such as high illness burden, improved healthcare access, low-cost generic medications, and government initiatives. Several emerging markets, including India, China, and Southeast Asian countries, are driving this expansion, which is transforming global market dynamics.

There is a growing number of older populations in the region, which is one of the significant reasons for the rising dental diseases.

For instance, according to the report by the ESCAP (Economic and Social Commission for Asia and the Pacific) in 2022, one in seven people was aged 60 years or older. By 2050, this age group is expected to represent 1 in every 4 persons. The region is experiencing exceptional growth in the number of older people compared to other parts of the world.

Dental Implants and Prosthetics Market Major Players

The major global players in the dental implants and prosthetics market include Dentsply Sirona, ZimVie Inc., Bicon, OSSTEM IMPLANT CO., LTD., Nobel Biocare Services AG., Glidewell, Institut Straumann AG, BioHorizons, Ivoclar Vivadent, MEGA’GEN IMPLANT CO., LTD., among others.

Dental Implants and Prosthetics Market, Key Developments

In April 2025, ZimVie Inc., a medical technology and dental implant company headquartered in Palm Beach Gardens, Florida, announced the U.S. launch of its Immediate Molar Implant System. This innovative solution is specifically engineered to tackle the unique challenges involved in immediate molar replacement procedures.

In January 2025, Stratasys announced that its TrueDent-D resin is now available for purchase in Europe as a CE Mark Class I medical device. This achievement allows the company to market its TrueDent monolithic multi-shade digital denture solution across European countries that mandate CE certification.

Dental Implants and Prosthetics Market Scope

Metrics | Details | |

CAGR | 12.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Dental Implants, Dental Prosthetics |

Material | Metals, Polymers, Ceramics, Biomaterials, Others | |

End-User | Dental Hospitals, Dental Clinics, Academic Institutes | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global dental implants and prosthetics market report delivers a detailed analysis with 62 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.