Global Deep Learning Chips Market: Industry Outlook

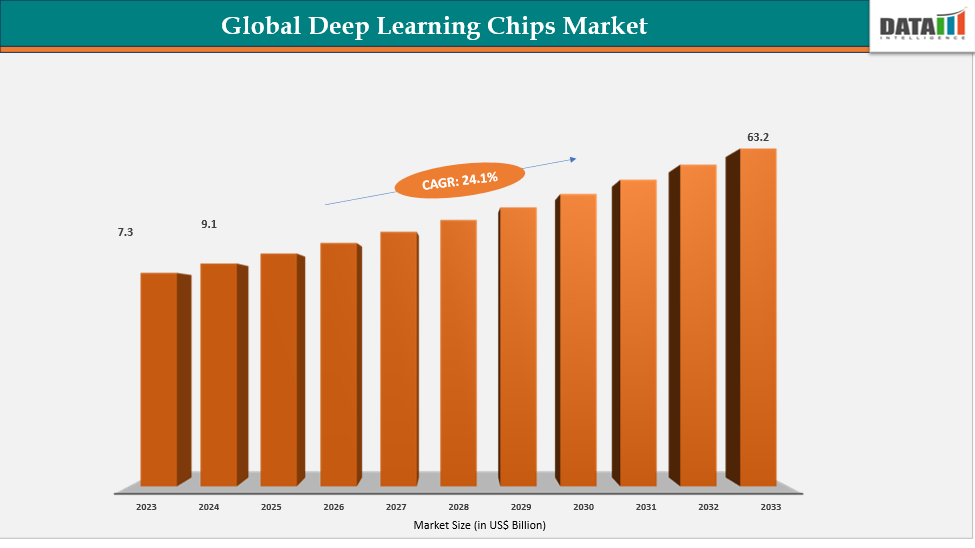

The global deep learning chips market reached US$ 7.3 billion in 2023, with a rise to US$ 9.1 billion in 2024, and is expected to reach US$ 63.2 billion by 2033, growing at a CAGR of 24.1% during the forecast period 2025–2033. The global deep learning chips market is experiencing robust expansion, driven by surging demand for artificial intelligence (AI) applications across industries such as cloud computing, autonomous vehicles, healthcare, robotics, and smart consumer devices. Deep learning chips, including GPUs, ASICs, FPGAs, and NPUs, are designed to accelerate complex neural network computations with high speed and energy efficiency, making them essential for training and inference tasks. This growth is supported by rising adoption of AI-driven solutions in cloud datacenters and the shift toward edge AI, where chips embedded in devices such as smartphones, IoT systems, and autonomous vehicles enable faster, real-time processing without relying solely on cloud connectivity.

The increasing importance of deep learning chips is also reflected in their role in emerging technologies such as natural language processing, predictive analytics, precision healthcare, and Industry 4.0 automation. For example, deep learning accelerators are vital for applications like medical imaging diagnostics, fraud detection in finance, and real-time video analytics in security systems. Edge applications are gaining momentum, from voice assistants in smartphones to computer vision in autonomous vehicles, driving demand for low-power, high-performance chips. In the U.S., adoption is particularly strong due to its concentration of AI startups, tech giants, and research institutions. With expanding AI use cases in cloud, defense, automotive, and healthcare, the U.S. is expected to maintain a leading position in both innovation and consumption of deep learning chip technologies. 2,132 data centers are operating in the U.S. (as of the period Sept 2023-Aug 2024), as analyzed in terms of their environmental footprint.

Key Market Trends & Insights

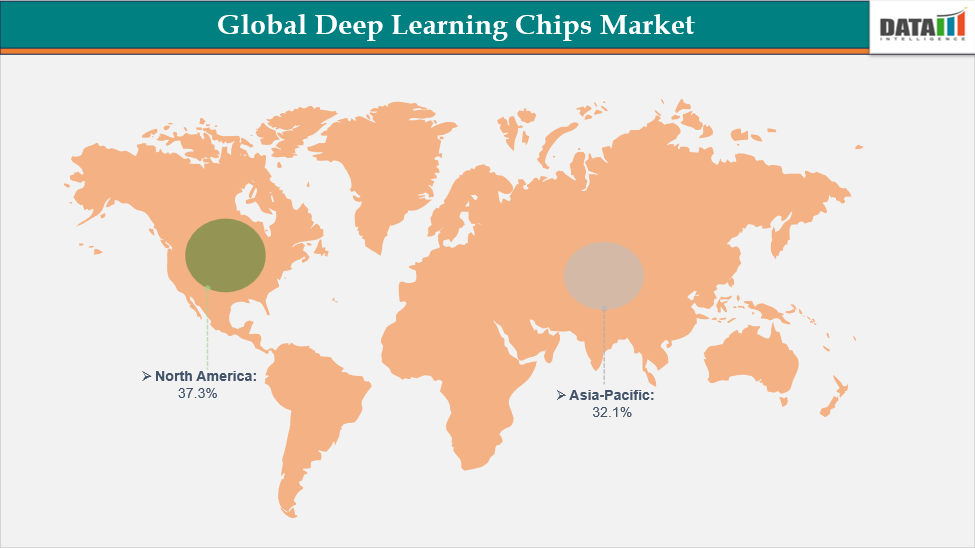

- North America holds the largest market share supported by the gowing adoption of AI chips in cloud datacenters, which is driving demand, with U.S. hyperscalers such as AWS, Google, and Microsoft accounting for over 60% of global hyperscale data center capacity in 2024.

- Asia Pacific is the fastest-growing region, witnessing rapid deployment of AI chips in 5G-enabled IoT devices, with China’s AI chip industry fueled by government-backed semiconductor initiatives.

- In Europe, the market is propelled by the EU investment of EUR 1 billion annually in AI research under Horizon programs, boosting demand for deep learning accelerators.

Market Size & Forecast

- 2024 Market Size: US$ 9.1 billion

- 2033 Projected Market Size: US$ 63.2 billion

- CAGR (2025–2033): 24.1%

- North America: Largest market in 2024

- Asia-Pacific: Fastest-growing market

Market Dynamics:

Driver: Explosive Growth of Generative AI End-Uses

The exponential rise of generative AI applications requires enormous computational power for training and inference. Generative models like OpenAI’s GPT, Google’s Gemini, and Stability AI’s diffusion models rely on billions of parameters, demanding highly specialized processors for efficiency. AI, including generative AI is expected to contribute US$ 15.7 trillion to the global economy by 2030, intensifying demand for deep learning accelerators. This surge pushes chipmakers such as NVIDIA, AMD, and Intel to optimize GPUs and AI-specific chips to meet the rising workloads.

A clear example of this demand can be seen in NVIDIA’s data center revenues, which skyrocketed by over 200% year-over-year in 2024, largely fueled by generative AI adoption across enterprises. Training large-scale AI models requires thousands of GPUs working in parallel, creating a supply-demand imbalance for deep learning chips. Similarly, cloud service providers like Microsoft Azure and Amazon Web Services are investing heavily in custom AI chips, such as AWS’s Trainium and Inferentia, to reduce dependence on third-party GPU shortages. These advancements highlight how deep learning hardware has become the backbone of AI-driven business strategies.

The impact extends beyond cloud datacenters to real-world applications across industries. In healthcare, AI-driven drug discovery is speeding up trials by nearly 50%, enabled by deep learning chips that process massive biological datasets. In media and entertainment, generative AI is transforming content creation, with companies using AI models to generate hyper-realistic images, video, and audio in real time. This unprecedented growth of generative AI is fueling sustained demand for high-performance chips globally, ensuring the deep learning chip market expands firmly, cementing its role as the enabler of next-generation AI applications.

Restraint: High Cost and Supply Chain Constraints

A major restraint for the deep learning chips market is the high cost of design, manufacturing, and deployment, which limits accessibility for smaller enterprises. Advanced AI processors, such as GPUs and custom ASICs, can cost thousands of dollars per unit, with training large models often running into billions in hardware expenses. Additionally, ongoing semiconductor supply chain disruptions and dependency on advanced fabs in Taiwan and South Korea have created shortages, slowing adoption. These challenges hinder scalability across industries, especially for startups and mid-sized firms, thereby restraining the overall growth potential of the global deep learning chips market.

For more details on this report, Request for Sample

Global Deep Learning Chips Market Segment Analysis

The global deep learning chips market is segmented based on chip type, processing type, deployment mode, end-use industry, and region.

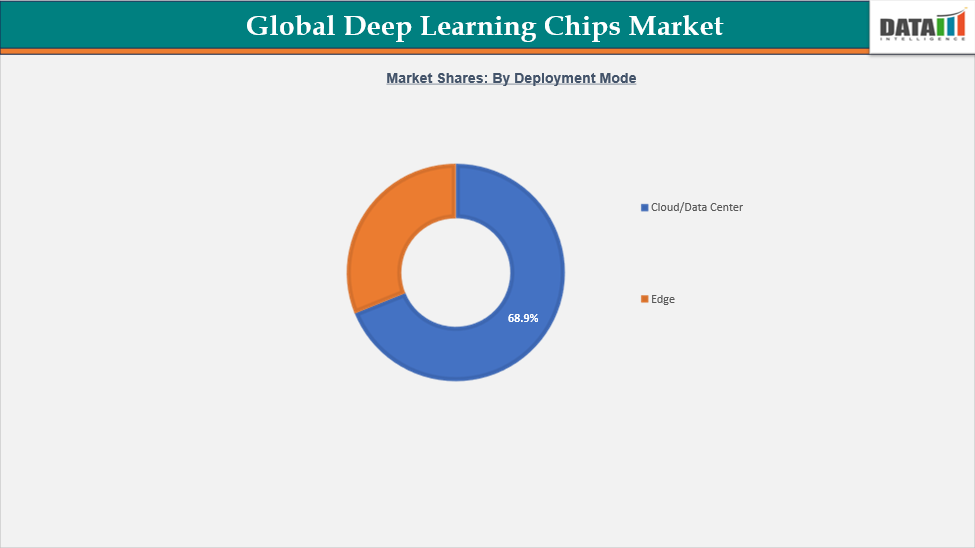

Deployment Mode: The cloud/data center segment is estimated to have 68.9% of the deep learning chips market share.

The cloud/data center segment represents the largest application area for deep learning chips, driven by the exponential growth of AI workloads and large-scale data processing needs. With organizations shifting toward digital-first operations, hyperscale cloud providers are investing billions in infrastructure to support AI-driven services. Global hyperscale data center capacity exceeded 900 facilities in 2024, with a significant share of them equipped with GPU clusters and AI accelerators. This rapid expansion highlights how deep learning chips have become indispensable for scaling cloud services and enabling advanced analytics.

Microsoft has integrated thousands of NVIDIA H100 GPUs into its Azure data centers to support AI services such as OpenAI’s models, significantly boosting AI-as-a-Service adoption. Similarly, Amazon Web Services has developed custom chips, Trainium for training and Inferentia for inference, which have improved cost-performance ratios for enterprise customers by up to 40%. Google Cloud also leverages its proprietary TPU (Tensor Processing Unit) infrastructure, which enables faster training of models for applications in healthcare, finance, and retail. These developments demonstrate how cloud platforms rely on specialized AI chips to differentiate their offerings in a competitive market.

The increasing demand for AI-driven business intelligence, predictive analytics, and generative AI tools is accelerating the growth of this segment. Enterprises are increasingly opting for cloud-based AI services rather than building costly on-premise infrastructure, fueling steady consumption of deep learning chips within data centers. With the surge of generative AI adoption across industries, the cloud/data center segment will remain the dominant revenue contributor to the deep learning chips market, underscoring its pivotal role in powering the AI revolution.

Geographical Analysis

The North America Deep Learning Chips market was valued at 37.3% market share in 2024

North America holds a commanding position in the global deep learning chips market, supported by its advanced digital infrastructure, strong presence of technology giants, and early adoption of AI. The region benefits from high levels of R&D spending, with the U.S. alone investing over US$ 100 billion annually in AI-related technologies. This ecosystem fosters innovation across industries such as cloud computing, defense, autonomous vehicles, and healthcare, where demand for deep learning accelerators continues to expand rapidly. Strong government initiatives also support semiconductor development, ensuring a robust environment for market growth.

Leading companies headquartered in North America, including NVIDIA, Intel, AMD, Qualcomm, and Google, have established themselves as global pioneers in AI chip development. For instance, NVIDIA’s dominance in GPU-based AI chips has positioned the company as a backbone provider for generative AI applications, while Google’s Tensor Processing Units (TPUs) are widely deployed across its own cloud ecosystem. Case studies show that Tesla uses custom Dojo chips to enhance AI training for autonomous driving, underscoring the region’s leadership in applying deep learning hardware to cutting-edge technologies. These corporate initiatives solidify North America as the innovation hub of AI hardware.

Sectors such as healthcare are seeing transformative applications, such as AI-enabled imaging diagnostics, where hospitals deploy GPU clusters for faster patient outcomes. Meanwhile, defense programs funded by DARPA continue to integrate AI chips for next-generation military systems. With its unique blend of government support, private sector innovation, and high adoption rates.

The Asia-Pacific deep learning chips market was valued at 32.1% market share in 2024

The Asia-Pacific region is emerging as the fastest-growing market for deep learning chips, propelled by strong government support, rapid industrial digitization, and expanding consumer demand for AI-enabled devices. Countries such as China, Japan, South Korea, and India are making heavy investments in AI infrastructure and semiconductor innovation. This momentum is creating vast opportunities for chipmakers targeting cloud, edge, and embedded AI applications in the region.

China remains a cornerstone of growth, with companies like Huawei and Cambricon developing domestic AI processors to reduce reliance on foreign technologies. Huawei’s Ascend series chips, for example, are being deployed in smart city projects and healthcare AI platforms across the country. Similarly, Japan is leveraging AI chips for robotics and industrial automation, while South Korea focuses on applying AI accelerators in 5G and smart manufacturing. In India, rising adoption of AI in fintech and healthcare has spurred demand for affordable AI-enabled processors, opening opportunities for both global and local players. These case studies illustrate the diverse and fast-expanding use cases across the region.

The consumer electronics sector provides another strong growth driver in the Asia-Pacific region. With smartphone penetration exceeding 80% in markets such as China and South Korea, AI-enabled processors are increasingly integrated into mobile devices for applications such as voice recognition, gaming, and augmented reality. Additionally, governments are prioritizing semiconductor self-sufficiency, with China’s five-year plan allocating billions toward local chip production. Combined with strong industrial and consumer demand, the Asia-Pacific region is on track to become the largest contributor to incremental growth in the global deep learning chips market over the next decade.

Competitive Landscape

The global deep learning chips market features several prominent players, including NVIDIA Corporation, Intel Corporation, Advanced Micro Devices Inc, Qualcomm Incorporated, Apple Inc., Alphabet Inc., Amazon Web Services, Inc., Microsoft Corporation, Alibaba Group, Cerebras Systems, among others.

NVIDIA Corporation: NVIDIA is the global leader in deep learning chips, dominating with its GPU architecture optimized for AI training and inference. Its flagship A100 and H100 Tensor Core GPUs power data centers worldwide, enabling generative AI, natural language processing, and computer vision. In 2023, NVIDIA’s data center revenue surged over 200% year-over-year, largely fueled by AI adoption. The company also develops specialized platforms like DGX systems and CUDA software, strengthening its ecosystem. With its GPUs widely deployed by hyperscalers such as AWS, Microsoft Azure, and Google Cloud, NVIDIA remains the backbone of the deep learning chips market globally.

Market Scope

| Metrics | Details | |

| CAGR | 24.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Chip Type | Graphics Processing Units (GPUs), Application-Specific Integrated Circuits (ASICs), Central Processing Units (CPUs), Field-Programmable Gate Arrays (FPGAs) and Others |

| Processing Type | Training and Inference | |

| Deployment Mode | Cloud/Data Center and Edge | |

| End-Use | Datacenters & Telecommunication, BFSI, Healthcare & Life Sciences, Automotive & Transportation, Retail & E-commerce, Industrial Manufacturing, Consumer Electronics and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global deep learning chips market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 231 pages of expert insights, providing a complete view of the market landscape.

Table of Contents

Suggestions for Related Report

For more related reports, please click here