Biochips Market Size & Industry Outlook

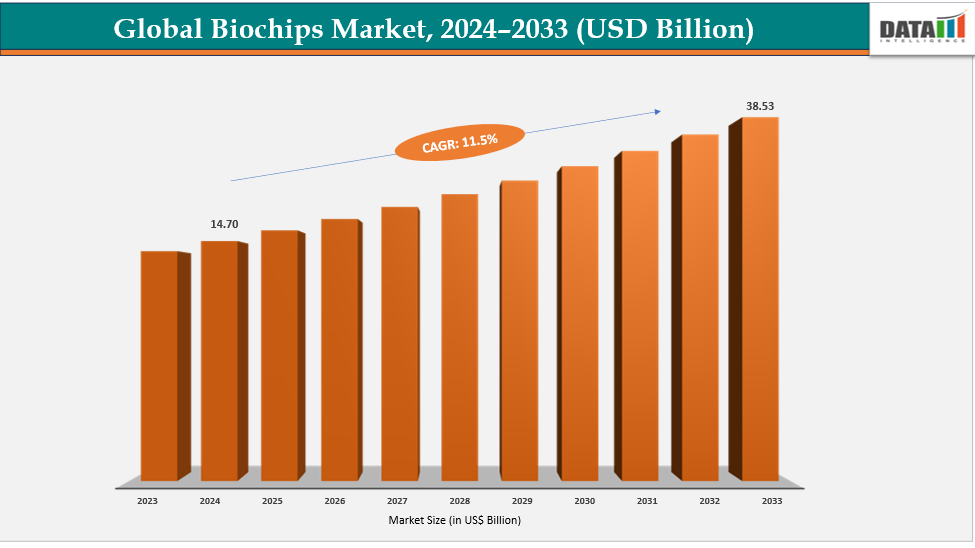

The global biochips market size was US$ 14.70 Billion in 2024 and is expected to reach US$ 38.53 Billion by 2033, growing at a CAGR of 11.3% during the forecast period 2025-2033.

Technological advancements are propelling rapid growth in the biochips market by improving the precision, efficiency, and scalability of biological analysis. Microfluidics, nanotechnology, and lab-on-chip devices have enabled high-throughput screening and single-cell analysis, saving time and money in research and diagnostics. Integration with artificial intelligence and automation enhances data accuracy and prediction capacities, hence facilitating customized medicine and drug development. Advances in manufacturing processes, like as 3D printing and photolithography, make complicated chip designs more affordable, increasing accessibility. Furthermore, better materials and sensor technologies improve sensitivity and reliability, allowing for point-of-care diagnostics.

Key Highlights

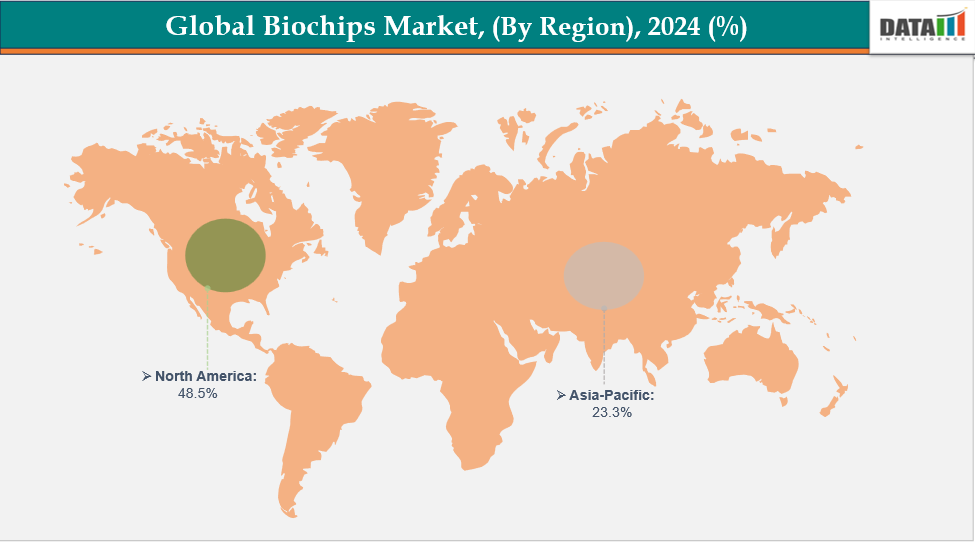

- North America is dominating the Global Biochips Market with the largest revenue share of 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the Global Biochips Market, with a CAGR of 7.7% in 2024

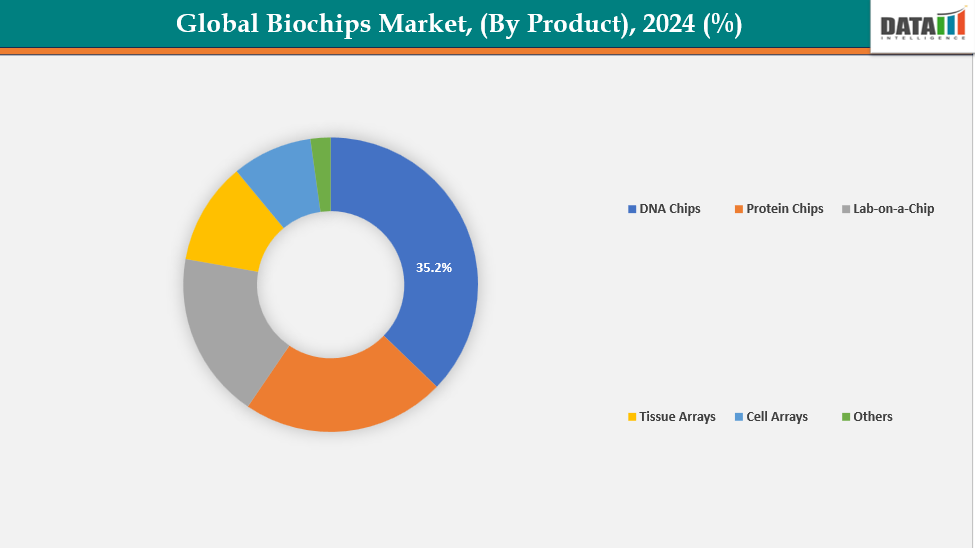

- The DNA chips segment is dominating the biochips market with a 35.2% share in 2024

- The microarrays segment is dominating the biochips market with a 55.3% share in 2024

- Top companies in the biochips market include Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., Veredus Laboratories Pte Ltd., Mimetas, TruDiagnostic, CapitalBiotech Co., Ltd., Standard BioTools Inc., Axela Biosensors, and Dynamic Biosensors, among others.

Market Dynamics

Drivers: Rising research and development and biotech and pharma spending are accelerating the growth of the biochips market

Rising R&D activity, combined with increased biotech and pharmaceutical investment, is fueling the expansion of the biochips market by raising the need for high-throughput, data-rich analytical tools. Biochips provide quick gene expression research, biomarker identification, target validation, and toxicity screening, allowing businesses to shorten development schedules and cut R&D expenditures. As drug pipelines become more sophisticated and customized treatment progresses, pharmaceutical and biotech companies increasingly rely on microarrays, protein chips, and organ-on-chip platforms to produce deep molecular insights.

Owing to the factors like funding and spending. For instance, in April 2024, CN Bio secured $21 million in the first close of its Series B round, with $10 million from Bayland Capital and $5.5 million from CN Innovations Holdings Ltd. The funding accelerated product development and scaled operations to meet growing global demand for organ-on-a-chip solutions.

Restraints: High costs of research and development, instruments, and consumables are expected to hamper the growth of the biochips market

The high cost of research and development, equipment, and consumables is likely to stifle biochip industry growth by making it inaccessible to small and medium-sized biotech enterprises and university laboratories. Advanced biochip platforms, such as DNA microarrays, protein chips, and organ-on-chip systems, need large capital investments for equipment, specific reagents, and upkeep. High per-test costs may inhibit normal use in cost-sensitive sectors or large-scale investigations.

Furthermore, continual updates to stay up with technology improvements raise the cost strain. These costs may hinder the adoption of biochip technologies in emerging regions and smaller research institutions, limiting overall market growth despite rising demand for drug development, diagnostics, and personalized medicine.

For more details on this report, see Request for Sample

Biochips Market, Segment Analysis

The global biochips market is segmented based on product type, technology, application, end-user, and region

By Product Type: The DNA chips segment is dominating the biochips market with a 35.2% share in 2024

The DNA chips category dominates the worldwide biochips market due to its broad use in genomics, personalized medicine, and clinical diagnostics. DNA microarrays can perform high-throughput gene expression analysis, SNP genotyping, and mutation detection, making them valuable tools in drug development and biomarker identification. Their capacity to handle hundreds of samples at once saves time and labor compared to traditional procedures, enhancing efficiency.

Furthermore, advances in array design, probe sensitivity, and data analysis software have improved accuracy and dependability, resulting in increased use.

By Technology: The microarrays segment is dominating the biochips market with a 55.3% share in 2024

The microarray sector dominates the biochips market due to its broad use in genetics, diagnostics, and drug development. Microarray biochips allow for high-throughput DNA, RNA, and protein analysis, examining hundreds of genes or biomarkers at the same time. Their capacity to generate fast, accurate, and multiplexed data makes them indispensable for biomarker identification, pharmacogenomics, and personalized treatment.

Additionally, continuous technological advancements have improved sensitivity, reproducibility, and scalability, increasing adoption across academic, clinical, and pharmaceutical laboratories. For instance, in August 2023, Thermo Fisher Scientific launched the Applied Biosystems CytoScan HD Accel chromosomal microarray, offering the fastest two-day turnaround in the industry. It analyzed the whole human genome, enhanced coverage of over 5,000 critical regions, and improved lab productivity for prenatal, postnatal, and oncology research.

Biochips Market, Geographical Analysis

North America is dominating the global biochips market with 48.5% in 2024

North America accounted for a sizable portion of the global biochips market, owing to advanced healthcare infrastructure, a high prevalence of chronic diseases, leading biotech and pharmaceutical companies, significant R&D investments, supportive regulations, early adoption of biochip technologies, and growing awareness of precision and personalized medicine applications.

In the United States, the biochips market expanded due to rising R&D investments, research grants, funding for biochips, growing prevalence of cancer and chronic diseases, and new product launches like advanced microarrays and organ-on-chip platforms. For instance, in April 2024, Boston Micro Fabrication launched BMF Biotechnology Inc. in San Diego to advance 3D biochips and organ-on-a-chip platforms, enabling large-scale in vitro tissue cultivation and accelerating pharmaceutical and cosmetic research and development.

Europe is the second region after North America, which is expected to dominate the global biochips market with 34.5% in 2024

The biochips market in Europe expanded significantly as a result of increased cancer and chronic illness prevalence, large research funding, and a strong innovation environment. Favorable legislation, biologics advancements, and smart biotech-pharma alliances have fueled product development, clinical applications, and regional market growth.

Furthermore, the continuous funding support from the government for research and development initiatives is anticipated to lead to substantial growth in the worldwide biochips market. For instance, in December 2024, Cherry Biotech, specializing in organ-on-chip and organoid technologies, was selected for the EIC Accelerator program, securing €2.5 million in grants and up to €15 million in equity to advance commercialization and growth of its biochip platforms.

The Asia Pacific region is the fastest-growing region in the global biochips market, with a CAGR of 7.7% in 2024

The Asia-Pacific biochips market has expanded significantly as a result of increased biotechnology investments, growing cancer and chronic illness rates, and supporting government healthcare programs. Advances in research, demand for targeted medicines, regional distribution, and strategic cooperation among pharmaceutical and biotech companies in China, Japan, India, and South Korea all contributed to market expansion.

Owing to the factors like regional distributions. For instance, in April 2025, Sphere Bio expanded its APAC distributor network, marking a key milestone in its global commercial strategy. The operational scale-up enhanced regional access and technical support, accelerating the company’s worldwide growth and meeting rising demand for its next-generation single-cell analysis platforms.

Biochips Market Competitive Landscape

Top companies in the biochips market include Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., Veredus Laboratories Pte Ltd., Mimetas, TruDiagnostic, CapitalBiotech Co., Ltd., Standard BioTools Inc., Axela Biosensors, and Dynamic Biosensors, among others.

Thermo Fisher Scientific Inc.: Thermo Fisher Scientific Inc. is a global leader in life sciences, offering advanced biochip technologies for genomics, proteomics, and molecular diagnostics. Its portfolio includes DNA microarrays, protein chips, and organ-on-chip platforms, enabling high-throughput analysis, biomarker discovery, and precision medicine applications, supporting research, clinical diagnostics, and pharmaceutical development worldwide.

Key Developments:

- In September 2025, Fluidic Sciences Ltd acquired the business and assets of Sphere Bio Ltd, creating a complementary technology suite that integrated Fluidic Sciences’ Microfluidic Diffusional Sizing (MDS) with Sphere Bio’s picodroplet microfluidic platforms, Cyto‑Mine Chroma, and high-throughput assays, accelerating single-cell and protein interaction research from cells to molecules.

- In April 2025, Sphere Bio, a leading provider of innovative microfluidics-based solutions for single-cell analysis and isolation, was named Best Droplet Microfluidic Technology Company 2025 at the Biotechnology & Life Sciences Awards by Global Health & Pharma (GHP), recognizing its excellence in single-cell microfluidics.

Market Scope

| Metrics | Details | |

| CAGR | 11.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product Type | DNA Chips, Protein Chips, Lab-on-a-Chip, Tissue Arrays, Cell Arrays, Others |

| By Technology | Microarrays, Microfluidics | |

| By Application | Drug Discovery and Development, Disease Diagnostics, Genomics, Proteomics, Others | |

| By End User | Biotechnology and Pharmaceutical Companies, Academic and Research Institutes, Hospitals and Diagnostic Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global biochips market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here