Organ-On-Chip Market Size

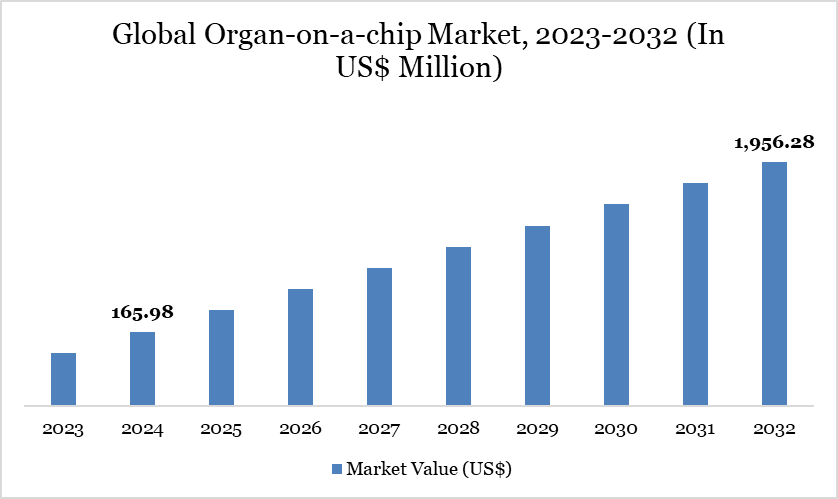

Global Organ-on-a-chip Market size reached US$ 165.98 million in 2024 and is expected to reach US$ 1,956.28 million by 2032, growing with a CAGR of 36.12% during the forecast period 2025-2032.

Organs-on-chips (Organ-on-a-chips) are microfluidic platforms that incorporate biological tissues produced in vitro to imitate the physiological activities of human organs. These systems utilize advanced tissue engineering and microfabrication to reproduce dynamic microenvironments, making them valuable for preclinical drug testing and disease modeling.

For more details on this report – Request for Sample

Organ-on-a-chips bridge the gap between traditional in vitro approaches and in vivo studies by delivering a more human-relevant model. Their ability to imitate organ-level operations allows researchers to study drug responses in real time with better accuracy. Organ-on-a-chip systems are increasingly utilized in the preliminary phases of pharmaceutical discovery, especially when human-specific drug metabolism or toxicity profiles are critical. The global growth in need for realistic preclinical models, driven by the limits of animal testing, is growing the role of Organ-on-a-chips. Notably, the passing of the FDA Modernization Act 2.0 in December 2022 has boosted interest in Organ-on-a-chips as verified, ethical alternatives to animal-based research.

Organ-on-a-chip Market Trend

One of the most significant trends in the organ-on-a-chip sector is the paradigm shift in drug research prompted by the failure of conventional preclinical models. Over 80% of medication candidates fail during clinical trials, with 30% due to toxicity and 60% due to inefficacy, highlighting the inadequacies of old cell cultures and animal models.

Organ-on-a-chips offer greater accuracy in forecasting human outcomes, minimizing the chance of late-stage medication failure. This tendency has been further pushed by regulatory progress: the FDA Modernization Act 2.0, passed by the US House in December 2022, authorizes data from non-animal research to support investigational new drug applications.

Another trend is the integration of artificial intelligence (AI), machine learning (ML), and computer vision to evaluate complicated biological data supplied by Organ-on-a-chip systems. These tools boost predictive modeling, speed drug discovery, and enable real-time evaluation of drug reactions, transforming Organ-on-a-chips into a high-throughput analytical platform.

Market Scope

Metrics | Details |

By Products & Services | Products (Instrument, Devices), Services |

By End-user | Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Others |

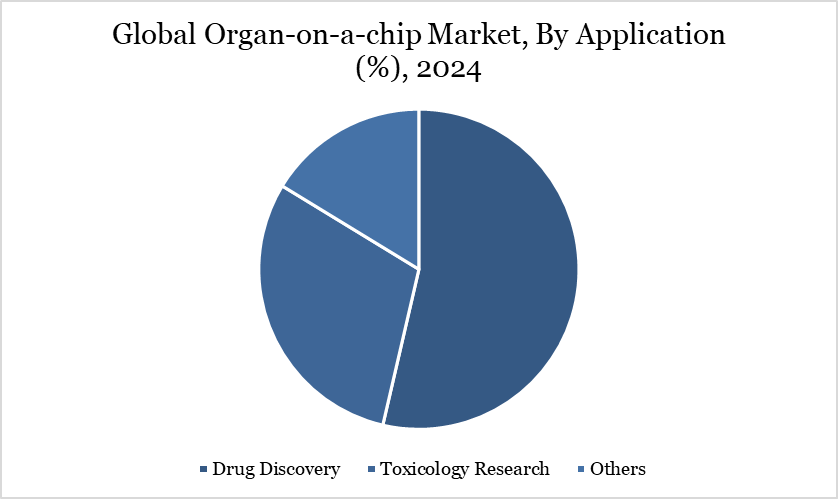

By Application | Drug Discovery, Toxicology Research, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Organ-On-Chip Market Dynamics

Regulatory backing and ethical demand fuel organ-on-chip growth

A primary driver of the organ-on-chip market is the expanding global movement toward animal-free drug testing supported by regulatory reforms and institutional funding. Ethical issues and high attrition rates in animal-based models have prompted alternatives such as Organ-on-a-chips. The 2013 European prohibition on animal testing for cosmetics launched this change, and it was further reinforced in 2023 when the US FDA passed the Modernization Act 2.0, enabling non-animal-based data for drug development.

Several government and private collaborations have verified Organ-on-a-chips as effective alternatives. For instance, CN Bio Innovation Ltd cooperated with the US FDA to boost drug bioavailability testing using multi-organ systems. In 2023, MIMETAS B.V. extended its agreement with Astellas Pharma Inc. to generate tumor models for cancer research. These initiatives indicate significant institutional confidence in Organ-on-a-chips, placing the technology as a cornerstone in future drug development pipelines by lowering reliance on animal testing and enhancing translational efficacy.

Scaling challenges and clinical transition bottlenecks

Despite the promise of organ-on-chip technology, its application remains primarily confined to the preclinical phase of drug development. A significant restraint is the restricted scalability and clinical application due to technical and biological constraints. Access to renewable, constant cell sources remains a barrier, and employing complicated cell types like iPSCs presents ethical and reproducibility concerns.

Current Organ-on-a-chip systems struggle to match the complete structural and functional complexity of human organs, notably vascularization, making biological scaling into clinical stages problematic. Moreover, low throughput lowers efficiency for large-scale compound screening. To tackle this, technologies such as High-Throughput Organ-on-a-Chip (HT-OOC) are under development.

An example is Emulate Inc.’s June 2023 launch of the Chip-A1 Accessible Chip, a membrane-free blood-brain barrier model that offers advanced imaging capabilities for testing neuroinflammatory treatments. However, the overall adoption in clinical workflows remains limited until these technical obstacles are overcome at scale.

Organ-On-Chip Market Segment Analysis

The global organ-on-a-chip market is segmented based on products & services, end-user, application, and region.

The expanding impact of organ-on-a-chip (ooc) technology in drug discovery and beyond

Organ-on-a-chip models provide phenotypic screening of chemical libraries, helping to identify weak candidates early, hence decreasing costs and shortening trial timelines. Chip-based testing aids hit-to-lead refining and better understanding of molecular mechanisms. Disease modeling, although a smaller segment, is rising at a good CAGR through 2030 due to its ability to recreate complicated diseases such as non-alcoholic steatohepatitis and inflammatory bowel disease under dynamic perfusion settings.

ADME and toxicology tests use liver, kidney, and gut chips to determine bioavailability, clearance, and toxicity, with increasing regulatory acceptance. CN Bio’s new bioavailability kit correlates with FDA data on drug-induced liver injury, increasing the legitimacy of chip-based PK studies. Though relatively rare, precision medicine applications are emerging, especially in oncology, where tumor-specific Organ-on-a-chip systems are used for individualized therapy selection in refractory situations.

Organ-On-Chip Market Geographical Share

Legislative support and r&d investments fuel north america's organ-on-a-chip market growth

North America dominates the global organ-on-a-chip market, with the US leading because to strong legislative support and increased R&D investments. The passing of the FDA Modernization Act 2.0 in December 2022 has advanced the market by permitting drug developers to submit non-animal testing data for clinical trials, directly encouraging Organ-on-a-chip adoption.

In Canada and the US, collaborative research involving government agencies and commercial enterprises has expanded the validation of Organ-on-a-chip models. The US FDA has collaborated with CN Bio to enhance multi-organ system testing for bioavailability. North America also benefits from a rich biotechnology ecosystem, academic-industry links, and early integration of artificial intelligence to interpret Organ-on-a-chip data. These elements collectively assure North America stays the vanguard innovator in establishing ethical, predictive, and human-relevant testing systems. Moreover, the 2023 MIMETAS-Astellas partnership also involves North American clinical inputs for oncology medication development.

Sustainability Analysis

Organ-on-a-chip technology is organically connected with the concepts of sustainable and ethical research. By greatly reducing the need for animal testing, it solves fundamental ethical concerns while supporting the 3Rs—Replacement, Reduction, and Refinement—of animal use in scientific research.

The 2023 debut of Emulate Inc.’s Chip-A1 Blood-Brain Barrier model signifies a breakthrough in sustainable in-vitro modeling. With membrane-free design and enhanced imaging, it offers a reusable, scalable, and precise method for testing drug permeability and neurotoxicity. In Europe, France and Germany are actively funding OOC technologies to eliminate animal models from pharmacological research.

The UK’s £7 million grant to Queen Mary University in March 2024 for creating an EPSRC Centre for Doctoral Training further demonstrates institutional commitment. Such advancements ensure that Organ-on-a-chips are not only more precise but also environmentally responsible, decreasing biohazard waste and linking medication development with sustainable scientific procedures.

Organ-On-Chip Market Major Players

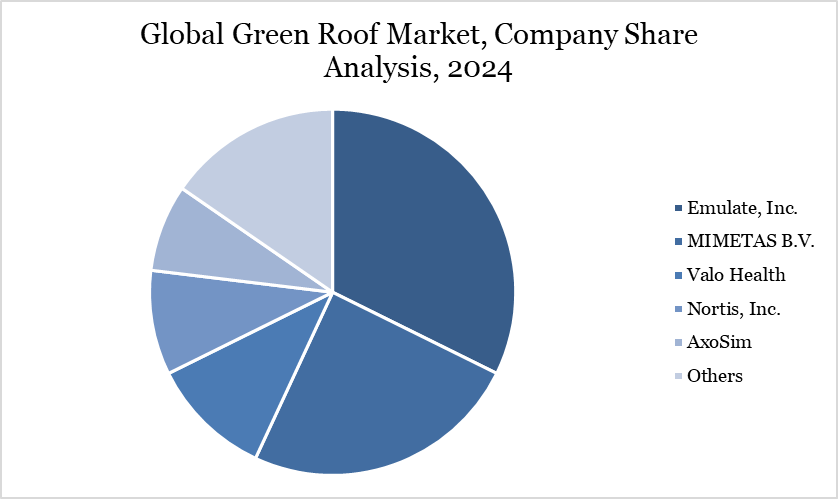

The major global players in the market include Emulate, Inc., MIMETAS B.V., Valo Health, Nortis, Inc., AxoSim, BICO - THE BIO CONVERGENCE COMPANY, CN Bio Innovations Ltd, The Charles Stark Draper Laboratory, Inc., SynVivo, Inc., AlveoliX AG.

Key Developments

In April 2024, CN Bio secured US$ 21 million in Series B funding from Bayland Capital and CN Innovations Holdings Ltd to expand its product development & scaling, meeting the rising demand for organ on a chip solutions and driven by improved drug R&D efficiency and legislative changes like the US FDA Modernization Act 2.0.

In March 2024, MIMETAS joined the Centre for Animal-Free Biomedical Translation (CPBT), which received US$134.78 million from the Dutch National Growth Fund to advance animal-free biomedical innovations.

In October 2023, AxoSim acquired Stemonix’s microBrain technology, expanding its human organoid platforms for neurological drug discovery, and integrating the microBrain platform with existing NerveSim and BrainSim technologies to enhance research capabilities in neurological disorders.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies