Dairy Products Market Size

Dairy Products Market reached USD million in 2022 and is projected to witness lucrative growth by reaching up to USD million by 2031. The market is expected to exhibit a CAGR of 3.2% during the forecast period (2024-2031).

The significant factors driving the expansion of the dairy products market are the rising consumption of dairy products and the shift in consumer preference from meat to dairy products for protein augmentation.

Due to modern retail facilities and cold chain logistics, dairy products are easily accessible, which contributes to the market's growth. Companies in the dairy products market invest heavily in research and development to create new and innovative products and optimize their supply chain management to remain competitive.

Market Summary

| Metrics | Details |

| CAGR | 3.2% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know more insights Download Sample

Dairy Products Market Dynamics

Increasing consumer demand for convenient and healthy food options drives the market growth

Consumers are looking for food options that are easy to prepare and consume while also providing the essential nutrients their bodies need. This trend has been particularly prominent in the dairy industry, where consumers are increasingly looking for dairy products that are high in protein, low in sugar, and free from additives and preservatives. As a result, the dairy products market is experiencing significant growth as consumers seek out convenient and healthy food options that fit their busy lifestyles.

Growing population and rising disposable income drives the market growth

There is an increased demand for food and beverage products, including dairy products, due to an increase in population and income, which is increasing the demand for the dairy products market. Dairy products are a staple food item in many cultures and cuisines around the world, making them an essential part of the global food industry. The rise in disposable income is driving the growth of the dairy products market as consumers are willing to pay more for high-quality dairy products that are perceived to be healthier and of higher nutritional value.

Dairy Products Market Segment Analysis

The global dairy products market is segmented based on type, distribution channel, and region.

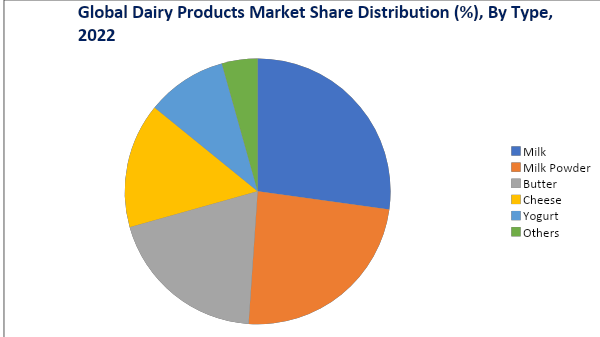

Increased production of milk

The milk segment is the largest and most dominant segment in the dairy products market, accounting for a significant share of more than 40% of the market revenue. Global milk production has been increasing steadily over the past few decades, driven by population growth, rising incomes, and changing dietary habits in many parts of the world. The Food and Agriculture Organisation of the United Nations predicts that global milk production will reach 930 million tons in 2023, an increase of 0.6% from 2022. This increase is primarily due to volume expansions in Asia, with a small gain in Central America and the Caribbean, offsetting a significant decline anticipated in Europe.

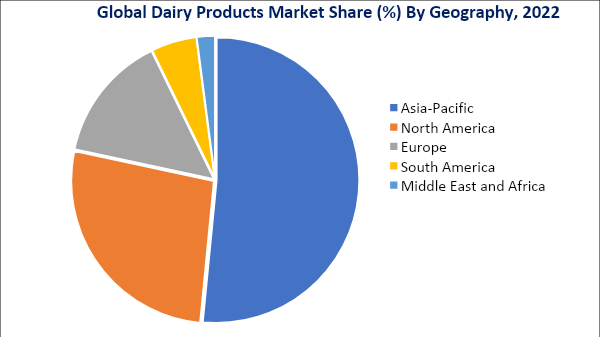

Dairy Products Market Geographical Share

Changing consumer preferences impacted the dairy products

The Asia-Pacific region has emerged as the largest and most dominant market for dairy products globally, with a share of more than 45%. The region's large and diverse population, with different cultural and dietary preferences, creates opportunities for companies in the dairy products market to expand their product offerings and cater to changing consumer preferences.

For instance, on April 12, 2023, the top manufacturer of milk and milk products in India, Mother Dairy Fruit and Vegetable Pvt. Ltd., recently revealed its updated lineup, which includes over 15 new products for the summer of 2023. These brand-new products were created based on in-depth consumer research with the intention of capturing the indulgence and convenience markets as well as the changing consumption occasions.

Dairy Products Companies

The major global players include Danone S.A., Nestlé S.A., Fonterra Co-operative Group Limited, Royal FrieslandCampina N.V., Lactalis International, Dairy Farmers of America Inc., Arla Foods amba, Saputo Inc., Yili Group, and Amul.

COVID-19 Impact on Market

The pandemic led to disruptions in the supply chain and logistics, which caused a temporary shortage of dairy products in some regions. However, despite the initial disruptions, the demand for dairy products remained resilient during the pandemic due to their essential nature and high nutritional value. Moreover, the increasing health awareness among consumers during the pandemic led to a surge in demand for dairy products that are perceived to boost immunity and overall health.

Ukraine-Russia War Impact Analysis

The ongoing Ukraine-Russia war has had a significant impact on the global dairy products market, particularly in the European region. The conflict has led to trade restrictions and sanctions, affecting the supply and demand of dairy products between the two countries and their trading partners. Companies in the dairy products market are adapting to the changing market conditions and exploring new opportunities to mitigate the risks posed by the conflict and other geopolitical factors.

Artificial Intelligence Impact Analysis

Artificial intelligence (AI) is being increasingly used in various aspects of the dairy industry, from optimizing milk production to improving the quality and safety of dairy products. One area where AI is particularly relevant is in the production of cheese, as it involves a complex process of fermentation, ripening, and texture development. AI can be used to monitor and control these processes, ensuring consistent quality and reducing waste.

Key Developments

- On April 11, 2022, Mother Dairy Fruit & Vegetable Pvt. Ltd., a wholly-owned subsidiary of the National Dairy Development Board (NDDB) and a well-known dairy major in Delhi, announced that it entered the state of West Bengal with the goal of expanding its portfolio of value-added dairy products.

- In March 2022, Danone's Activia Brand debuted Activia+ in the United States and other North American markets. The yogurt beverage is offered in strawberry, peach, and raspberry flavors.

- In February 2022, Chobani LLC, based in New Berlin, New York, introduced two brand-new dairy products, which are ultra-filtered milk, lactose-free, protein-packed ultra-filtered milk, and half-and-half, to increase its presence on the refrigerated shelf. These items are packaged in widely recyclable paper, much like many of the company's other new products. They are produced with locally produced milk.

Why Purchase the Report?

- To visualize the global dairy products market segmentation based on type, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of dairy products market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global dairy products market report would provide approximately 53 tables, 49 figures and 102 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies