Protein Market Size

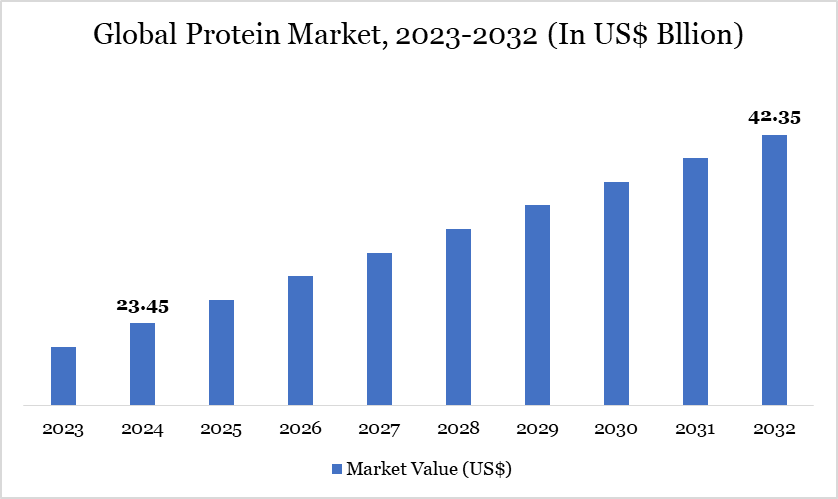

Global Protein Market size reached US$ 23.45 billion in 2024 and is expected to reach US$ 42.35 billion by 2032, growing with a CAGR of 7.67% during the forecast period 2025-2032.

The global protein market is experiencing rapid growth, driven by increasing consumer demand for healthier and functional nutrition options. According to the International Food Information Council's 2024 survey, the number of consumers actively trying to consume more protein has increased significantly, rising from 59% in 2022 to 71% in 2024. This growth reflects a stronger focus on protein intake among consumers in recent years. It highlights the continuing trend of prioritizing protein as an important part of a healthy diet.

As more people prioritize clean and effective ways to meet their nutritional needs, products offering high-quality, convenient and enjoyable consumption experiences are gaining traction. Health-conscious consumers are particularly drawn to protein-enriched snacks, beverages and non-traditional formats, such as ready-to-drink protein shakes.

Protein Market Trend

The evolving trend toward protein consumption has led to the diversification of the market, with innovations emerging to meet shifting dietary preferences and sustainability concerns. Key players are responding to this by introducing a variety of products designed to align with consumer demands. For example, in October 2023, Optimum Nutrition launched Clear Protein, a plant-based shake offering 20 grams of protein, zero sugar and refreshing flavors like lime sorbet and juicy peach.

For more details on this report, Request for Sample

Market Scope

Metrics | Details |

By Type | Animal-Based Proteins, Plant-Based Proteins, Insect-Based Proteins, Microbial Proteins |

By Form | Concentrates, Isolates, Hydrolysates, Blends |

By Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Pharmacies, E-Commerce, Others |

By Application | Food, Beverages, Animal Feed, Dietary Supplements, Cosmetics and Personal Care, Pharmaceuticals, Others |

By End-User | Athletes & Fitness Enthusiasts, General Consumers, Medical and Therapeutic, Others |

By Region | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Protein Market Dynamics

Rising Protein Deficiency Worldwide

Protein is an important part of a healthy diet, but an estimated one billion people worldwide suffer from protein deficiency. According to FAO, the problem is most severe in Central Africa and South Asia, where about 30 percent of children consume too little protein. Statistics reveal that 93% of the Indian population is unaware of the ideal daily protein requirement, with 97% of pregnant women, 96% of lactating mothers and 95% of adolescents unaware of their daily protein needs.

Protein deficiency leads to malnutrition, stunted growth and weakened immunity. Kwashiorkor, a severe form of protein malnutrition, is the most prevalent region, including Southeast Asia, Central America, Congo, Puerto Rico, Jamaica, South Africa and Uganda. The World Health Organization also highlights that 25% of children globally suffer from protein-energy malnutrition, underscoring the urgent need for accessible protein sources.

The growing protein deficiency is driving the increasing demand for protein-rich foods and supplements, contributing to the expansion of the global protein market. As awareness of the importance of protein intake spreads, both plant-based and animal-derived proteins are seeing rising consumption across diverse regions. This shift is fueling market growth as more consumers and governments prioritize protein in addressing malnutrition and health concerns.

Health Concerns of Some Protein Products

Health concerns are major obstacles to the global protein market, affecting both plant-based and animal-based products. Many consumers are wary of highly processed plant-based protein products, concerned about additives, preservatives and potential nutritional gaps. While plant-based proteins are often seen as a healthier, environmentally-friendly alternative, doubts persist about whether they provide all essential amino acids and nutrients found in animal proteins.

The uncertainty is fueled by information from organizations, contributes to hesitancy and slows the growth of both plant-based and animal-based protein markets. Harvard nutrition expert Kathy McManus warns against the indiscriminate use of protein powders, citing risks like digestive issues, added sugars and contaminants. She also points out the lack of strict FDA regulation, leaving consumers uncertain about the safety and accuracy of protein supplement labels.

Protein Market Segment Analysis

The global protein market is segmented based on type, form, distribution channel, application, end-user and region.

Increasing Vegan Population

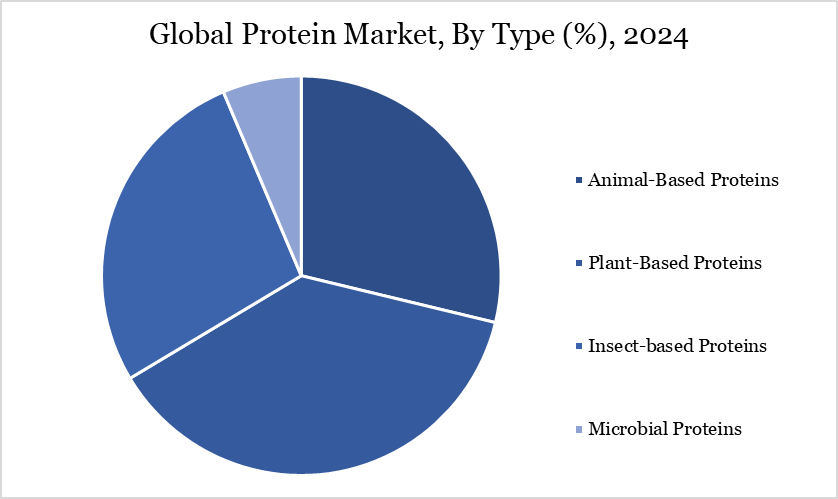

The global protein market is segmented based on type into plant-based, animal-based, insect-based and microbial. The plant-based protein segment is currently dominating the global protein market, driven by growing consumer demand for healthier and more sustainable alternatives to animal-based proteins. While animal products are considered the highest-quality sources of protein, research has increasingly linked the consumption of red meat to elevated risks of heart disease, stroke and premature death.

To avoid the health concerns related to animal-based products, people are highly preferring vegan options over animal-based products. With around 88 million vegans worldwide in 2022 as per Animal Health Foundation statistics, the shift towards plant-based diets is gaining significant momentum as individuals seek healthier, more environmentally friendly protein sources.

Various plant-based protein options such as soy protein, potato protein and pea protein have impressive protein content that can meet the protein needs. For instance, soy protein isolate typically has protein around 88.3 grams per 100 grams. Even everyday vegetables, such as potatoes, offer much lower protein content just 3 grams in a medium-sized, skin-on potato further highlighting the appeal of plant-based protein.

Protein Market Geographical Share

Asia-Pacific Holds a Significant Share in the Market Due to Rising Health Awareness and an Expanding Consumer Base

Asia-Pacific is rapidly dominating the global protein market, driven by a combination of health awareness and shifting dietary habits. In India, almost 80% of the population fails to meet their daily protein requirements, giving the country significant reliance on different protein sources to meet the need. This deficit is compounded by the fact that 90% of Indians are unaware of their daily protein needs, creating a massive opportunity for the protein industry to grow through education and product innovation.

Additionally, with 1 in 4 Indians being obese, as highlighted by the National Family Health Survey (NFHS-5), there is a clear demand for healthier, protein-rich alternatives to combat lifestyle diseases. Meanwhile, China showcases a contrast with an average protein intake of 124.61 grams per person, signaling a more advanced awareness of nutrition and protein's role in health.

As urban populations in both India and China continue to adopt more sedentary lifestyles, the need for protein-rich diets is increasing, especially as consumers seek solutions for weight management, muscle development and overall wellness. This rise in fitness culture across the region, combined with the growing awareness of the importance of protein, positions Asia-Pacific as a key player in the global protein market.

Sustainability Analysis

The shift towards clean and sustainable protein solutions is a key driver behind recent product innovations in the food and beverage industry, which is even driving the protein market. Companies like Arla Foods Ingredients are responding to consumer demand for high-protein, clean-label dairy products by launching campaigns to encourage the development of innovative, high-protein dairy solutions. The new product launches reflect a broader market trend toward healthier, functional protein solutions.

The priority is given to sustainability, clean labels and plant-based ingredients, meeting the needs of increasingly health-conscious and environmentally aware consumers, leading to such product launches. For instance, in July 2024, Alpino Health Foods introduced India’s first 100% peanut-based protein powder, offering a natural, lactose-free and highly digestible alternative with added BCAAs, catering to the growing fitness and plant-based market.

In the plant-based sector, in July 2024, Beyond Meat introduced its Sun Sausage made from whole ingredients like spinach and red lentils, marking a shift away from highly processed, meat-replicating products to simpler, cleaner plant-based options. This move aligns with consumer demand for more sustainable and natural protein sources. The new product introduction is expanding the product alignment to the customer needs and expanding the market reach.

Protein Market Major Players

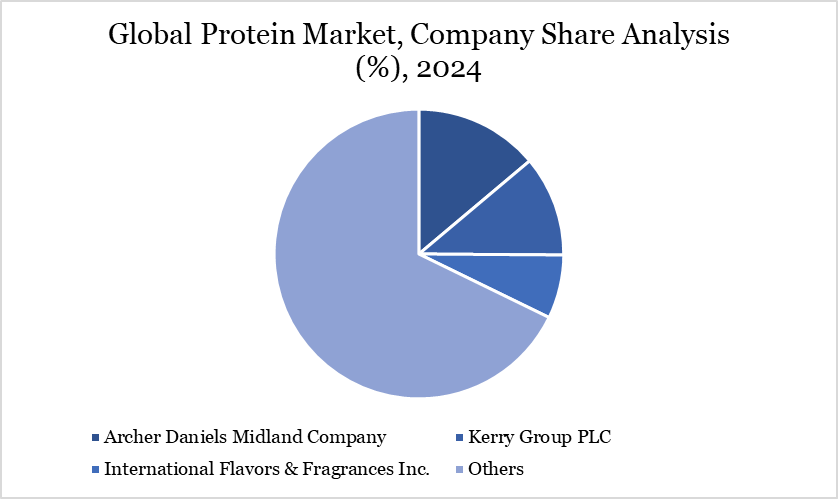

The major global players in the market include Archer Daniels Midland Company, Wilmar International Limited, Sonic Biochem Extractions Pvt. Ltd., Bunge Limited, Kerry Group PLC, Glanbia plc, International Flavors & Fragrances Inc., FrieslandCampina Ingredients, Fonterra Co-Operative Group Limited and Ingredion Incorporated.

Key Developments

In March 2025, GNC India, through its master franchisee Guardian Healthcare Pvt. Limited launched the country’s first whey protein with a cardio-protective formulation, GNC Pro Performance 100% Whey + Nitro Surge. This innovative supplement is designed to boost athletic performance while supporting cardiovascular health.

In March 2025, Eat Just, Inc. launched Just One protein, available nationwide at Whole Foods Market locations across the US Made from a single pure ingredient—mung bean protein—Just One offers the highest protein per serving on the market.

In March 2025, Dutch startup Vivici launched Vivitein BLG, a precision-fermented dairy protein, in the US market. Produced without animals, Vivitein BLG (beta-lactoglobulin) is self-affirmed GRAS and aims to meet growing consumer demand for high-quality protein in active lifestyles. The precision fermentation technology allows sustainable production of dairy protein, offering companies a novel ingredient to create innovative, animal-free nutrition products.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies