Dairy Market Size

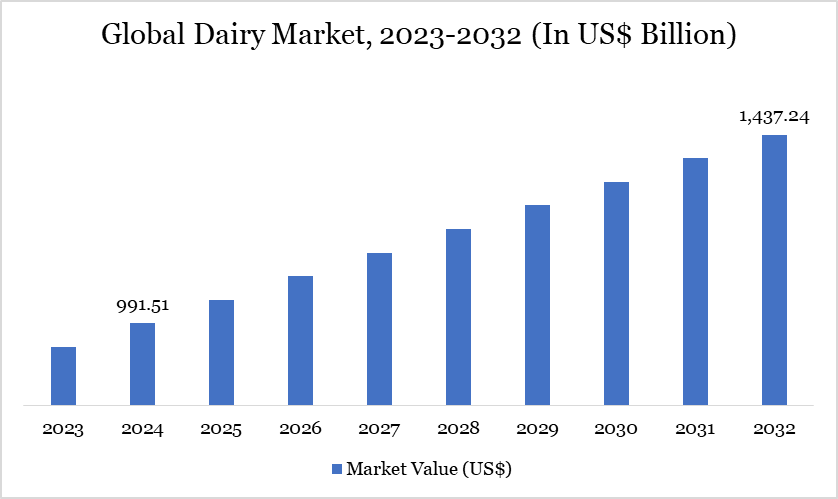

Dairy Market Size reached US$ 991.51 billion in 2024 and is expected to reach US$ 1,437.24 billion by 2032, growing with a CAGR of 4.75% during the forecast period 2025-2032.

The global dairy sector is transforming significantly, driven by five key trends shaping market dynamics and growth opportunities. Firstly, cultured dairy products, such as yogurt, kefir, and fermented milk drinks, are gaining traction due to their probiotic content and associated health benefits, particularly in enhancing gut health and boosting immunity. This trend, amplified by a post-pandemic focus on wellness, underscores the growing consumer preference for functional foods. Secondly, the surge in plant-based dairy alternatives, including almond milk, soy yogurt, and innovative options like oat and flaxseed milk, reflects a shift towards environmentally friendly and inclusive dietary choices. This segment is expanding rapidly as consumers seek sustainable and lactose-free options, driving substantial market growth.

Dairy Market Trend

The rising global demand for high-protein foods has positioned dairy as a key player in consumer diets. A significant percentage of consumers across major markets—including China (36%), India (34%), Japan (28%), the US (27%), Canada (25%), Australia (22%), and the UK (17%) prioritize high-protein products when shopping. This trend is particularly prominent among consumers aged 32-45.

As dairy protein is valued for its comprehensive nutritional benefits, including all nine essential amino acids, support for muscle growth and recovery, and contributions to satiety and bone health, the increasing consumer interest in protein has led to innovative product offerings, such as protein-fortified snacks that shift the perception of traditional snacks towards a healthier image. New dairy protein products like Kudo Salty Sweet Kettle Korn Protein Popcorn and In Good Hands White Cheddar Protein Puffs exemplify this trend.

For more details on this report, Request for Sample

Market Scope

Metrics | Details |

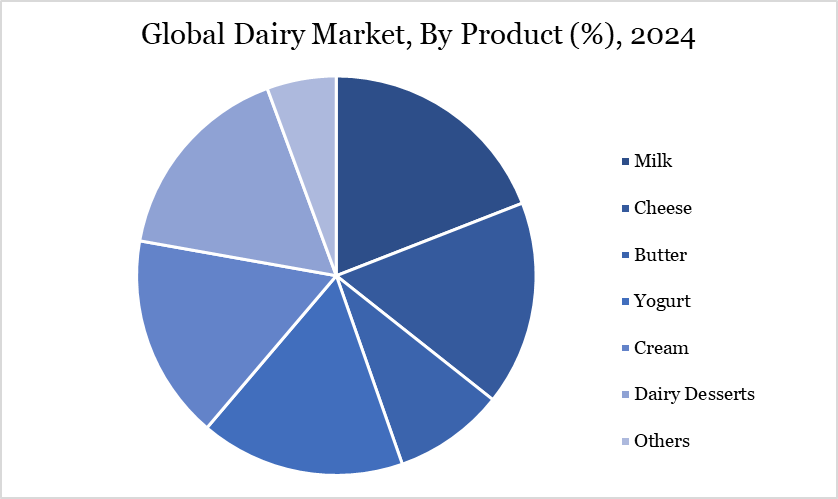

By Product | Milk, Cheese, Butter, Yogurt, Cream, Dairy Desserts, Others |

By End-User | Household, Food Service Industry, Industrial |

By Distribution Channel | Supermarkets and Hypermarkets, Specialty Stores, Direct Sales, Convenience Stores, E-Commerce, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dairy Market Dynamics

Rising Innovation in Dairy Products

Innovation in lactose-free dairy is expanding, with new products emerging across various subcategories such as coffee creamers, children’s ready-to-drink beverages, and yogurt. Lactose-free claims have become particularly prevalent, with 15% of yogurt launches in Europe and 7% in North America featuring this claim. With over a third of dairy alternative consumers opting for these products due to lactose intolerance, lactose-free dairy addresses this need while delivering the natural benefits of milk’s protein, minerals, and bioactives. The production of lactose-free milk typically involves the addition of lactase or membrane filtration to remove lactose, catering to consumer preferences for sweeter and more digestible products. Examples include Abbott PediaSure Grow & Gain Chocolate Shake and Darigold Belle Sweet Cream Flavored Coffee Creamer.

Glanbia Nutritionals is at the forefront of developing innovative dairy solutions to support the evolving needs of the dairy sector. Their offerings include clean-label functional dairy proteins, such as OptiSol1005 and 1007, which enhance product processing, flavor, and creaminess. Additionally, their UltraHi Protein Yogurt Technology enables brands to achieve up to 50 grams of protein per serving. Glanbia’s diverse product portfolio, including wellness cheeses and bioactive ingredients like Bioferrin lactoferrin, aligns with the growing consumer demand for functional health benefits in dairy products.

Fluctuating Raw Material Costs

In recent years, the dairy sector has been significantly impacted by volatile raw material costs, which have disrupted market stability and influenced production dynamics. Feed costs, constituting 40-60% of total milk production expenses, saw an extraordinary surge of 86% from mid-2020 to mid-2022, driven by increased demand and supply chain disruptions linked to geopolitical events such as Russia’s invasion of Ukraine.

Despite a subsequent reduction of 34% from peak levels, feed costs remain elevated compared to pre-pandemic figures, continuing to strain dairy farm profitability. Similarly, fertilizer costs, crucial for pasture-based systems in countries like New Zealand, rose by 174% during the same period due to fears of supply interruptions from key exporters. Although fertilizer prices have since decreased by 41%, they remain significantly higher than historical norms, impacting overall production costs.

This trend necessitates strategic adjustments such as reduced heifer rearing and increased calf sales to beef operations. In the EU, energy prices surged in 2022 due to reduced natural gas supplies from Russia. Although energy costs have somewhat eased, they remain well above pre-war levels, further burdening dairy processors and farmers. Additionally, interest rates have nearly tripled since the pandemic, particularly affecting New Zealand, where they represent 13-20% of production costs. This increased financial burden exacerbates operational challenges for dairy farmers.

Dairy Market Segment Analysis

The global dairy market is segmented based on product, end-user, distribution channel, and region.

The Surging Demand for Milk and Milk-Based Products

The global dairy sector is experiencing robust growth, driven by an unprecedented surge in demand for milk and milk-based products. This increased demand is primarily attributed to the increasing global population, urbanization, and rising disposable incomes. As urban areas expand and economic conditions improve, there is a noticeable shift towards higher consumption of dairy products, including milk, cheese, and yogurt. Additionally, growing awareness of the nutritional benefits of dairy, such as high-quality protein and essential vitamins, is further propelling consumer preference for these products.

In response to this rising demand, the dairy sector has significantly expanded its production capabilities. Over the past three decades, global milk production has surged by over 77%, from 524 million tonnes in 1992 to 930 million tonnes in 2022. Key regions, particularly South Asia, are at the forefront of this growth. India, the world’s largest milk producer, accounts for approximately 22% of global production. South Asia's expansion has been marked by increased dairy herd sizes and the adoption of advanced farming technologies. Investments in feed quality, animal health, and breeding practices are enhancing productivity and efficiency within the sector.

Dairy Market Geographical Share

Rising Demand for the Dairy Sector in Asia- Pacific

The dairy industry in Southeast Asia has witnessed significant recent developments, paving the way for an exciting market potential. With a growing population, increasing disposable income, and changing consumer preferences, the demand for dairy products in the region has soared. This surge in demand has led to advancements in production techniques, distribution strategies, and product innovation. The market potential for the dairy industry in Southeast Asia is promising, as key players focus on expanding their product portfolios, embracing new distribution channels, and catering to evolving consumer needs.

In March 2024, Mother Dairy committed US$ 88.11 (Rs 750 crore) towards substantial growth initiatives, including the development of a new dairy plant in Nagpur with a daily milk processing capacity of 600,000 liters, and a fruit processing facility in Karnataka under the Safal brand. This expansion strategy also includes a US$ 11.74 (Rs 100 crore) investment to scale up existing facilities. The competitive landscape is marked by significant investments in new product development and capacity expansion, underscoring the sector's positive growth trajectory and the evolving consumer preferences across the region.

Sustainability Analysis

The dairy market faces significant sustainability challenges due to its high greenhouse gas emissions, water usage, and land requirements. Methane from dairy cows is a major contributor to climate change, prompting a push for emission-reduction technologies and better manure management. In November 2024, Mars committed $1 billion to halve its dairy emissions by 2030, launching pilot net-zero farms in Germany and exploring methane-reducing seaweed feed additives.

Sustainable practices like rotational grazing, feed optimization, and renewable energy adoption are gaining traction. In October 2024, Arla Foods and Aldi partnered to invest over US$39 million in sustainable dairy farming practices, aiming to decarbonize production and enhance animal welfare. Consumer demand for organic, grass-fed, and locally sourced dairy is also influencing greener supply chains.

Dairy Market Major Players

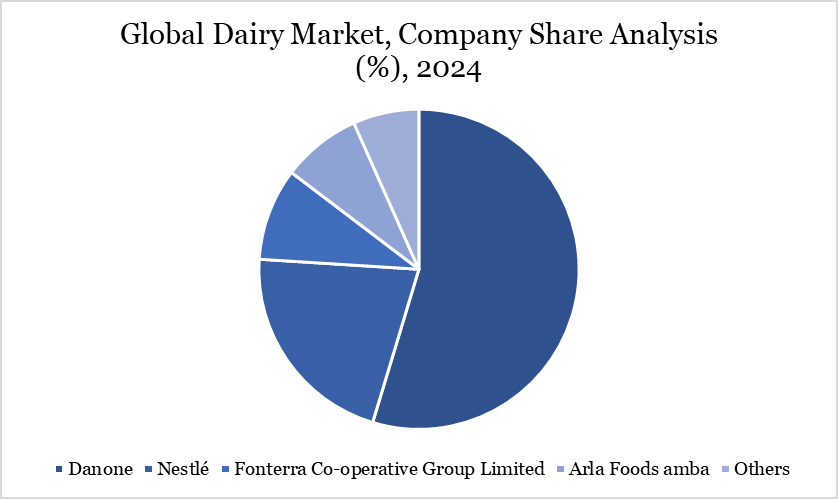

The major global players in the market include Danone, Arla Foods amba, Nestlé, Fonterra Co-operative Group Limited, LACTALIS, Dairy Farmers of America, Inc., Meiji Holdings Co., Ltd., FrieslandCampina, Schreiber Foods, and Gujarat Cooperative Milk Marketing Federation Limited and others.

Key Developments

In March 2025, Mother Dairy launched its 'Pro' portfolio, beginning with Promilk, a high-protein cow milk variant enriched with 30% more protein than standard milk. Each litre of Promilk contains 40 grams of protein, 4% fat, and 11.5% solids-not-fat (SNF), fortified with vitamins A and D.

In April 2025, Kwality Wall's launched "The Dairy Factory," a premium line of slow-churned ice creams designed to elevate the at-home dessert experience. Made with real dairy and crafted in small batches using a slow-churn technique, The Dairy Factory offers a creamier taste and smoother texture. Available in four popular flavors—Vanilla, Butterscotch, Mango, and Chocolate—the ice creams come in indulgent tubs and party packs.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies