Cystic Fibrosis (CF) Therapeutics Market Size and Trends

The global cystic fibrosis (CF) therapeutics market reached US$ 9.22 billion in 2023, with a rise to US$ 10.60 billion in 2024, and is expected to reach US$ 35.09 billion by 2033, growing at a CAGR of 14.2% during the forecast period 2025–2033. The global cystic fibrosis (CF) therapeutics market is experiencing steady growth, driven by the increasing prevalence of cystic fibrosis worldwide and growing emphasis on targeted and personalized treatment approaches. The market is being fueled by the expanding use of CFTR modulators, which directly address the underlying genetic defects rather than just managing symptoms. Continuous advancements in gene-based therapies, inhalation technologies, and combination drug regimens are improving treatment efficacy, quality of life, and life expectancy for patients.

In addition, the rising awareness of early diagnosis, along with expanded newborn screening programs and enhanced genetic testing capabilities, is increasing the number of identified CF patients eligible for advanced treatments. Pharmaceutical companies are investing heavily in R&D and clinical trials to develop next-generation modulators, gene editing solutions, and anti-infective therapies targeting resistant bacterial strains.

Supportive government policies, patient advocacy initiatives, and favorable reimbursement frameworks in developed countries continue to strengthen market growth. As healthcare systems in emerging economies expand access to advanced therapies, the global cystic fibrosis therapeutics market is expected to witness sustained expansion over the coming years.

Key Market highlights

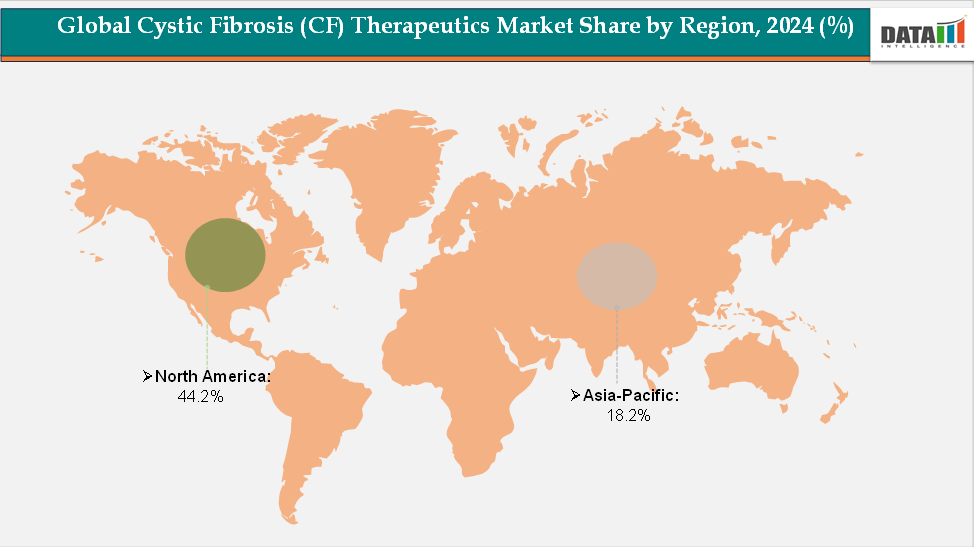

- North America accounted for approximately 44.2% of the global cystic fibrosis (CF) therapeutics market in 2024 and is expected to maintain its dominant position throughout the forecast period. The region’s leadership is driven by the strong presence of key biopharmaceutical companies, high diagnosis and treatment rates, and widespread adoption of advanced CF therapies.

- The Asia-Pacific region accounted for approximately 18.2% of the global CF therapeutics market in 2024 and is projected to be the fastest-growing region during the forecast period. Growth is supported by rising disease awareness, increasing adoption of genetic testing, and expanding access to innovative treatment options.

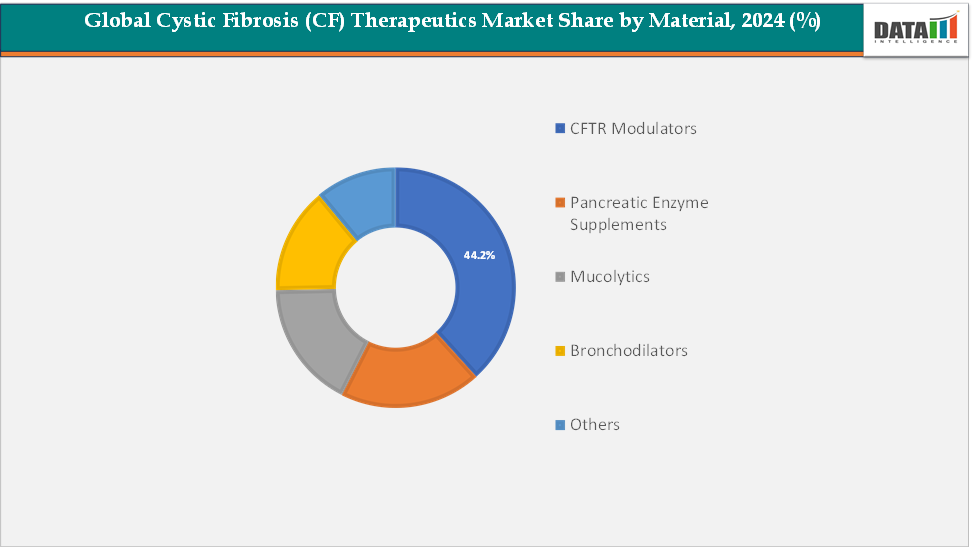

- By drug class, CFTR modulators dominated the global cystic fibrosis therapeutics market, accounting for approximately 48.5% of total revenue in 2024. This dominance is attributed to their proven ability to address the underlying genetic cause of the disease by restoring the function of the defective CFTR protein. The growing clinical success of combination therapies such as elexacaftor/tezacaftor/ivacaftor and the ongoing development of next-generation modulators for rare mutations are further fueling this segment’s strong growth.

Market Size & Forecast

- 2024 Market Size: US$10.60 billion

- 2033 Projected Market Size: US$35.09 billion

- CAGR (2025–2033): 14.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Global Cystic Fibrosis (CF) Therapeutics Market: Executive Summary

Market Dynamics:

Global Cystic Fibrosis (CF) Therapeutics Market Dynamics: Drivers & Restraints

Driver: Rising Adoption of CFTR Modulators

The rising adoption of CFTR modulators is one of the primary factors driving the growth of the cystic fibrosis (CF) therapeutics market. These innovative drugs, which target the root genetic cause of cystic fibrosis by restoring the function of the defective CFTR protein, have transformed the disease’s treatment paradigm from symptom management to precision therapy. The growing availability of combination regimens has significantly improved lung function, reduced pulmonary exacerbations, and enhanced overall quality of life for patients. Increasing clinical evidence supporting the long-term efficacy of these therapies, along with their expanding approval for younger age groups and broader mutation coverage, is accelerating global adoption.

Furthermore, rising awareness among clinicians, supportive regulatory initiatives, and favorable reimbursement policies in major markets like the United States and Europe are driving higher treatment uptake. As more pharmaceutical companies invest in next-generation modulators and combination therapies with enhanced efficacy and safety profiles, the CFTR modulator segment is expected to remain the key growth engine of the cystic fibrosis therapeutics market in the coming years.

Restraint: High Cost of CFTR Modulator Therapies

The high cost of CFTR modulator therapies is a significant factor expected to hamper the growth of the cystic fibrosis (CF) therapeutics market. While these therapies have revolutionized treatment outcomes by targeting the root cause of the disease, their extremely high pricing poses a major barrier to accessibility, particularly in low- and middle-income countries.

For more details on this report, Request for Sample

Global Cystic Fibrosis (CF) Therapeutics Market Segment Analysis

The global cystic fibrosis (CF) therapeutics market is segmented by drug class, route of administration, distribution channel, and region.

Drug Class: The CFTR modulators segment is estimated to have 44.2% of the cystic fibrosis (CF) therapeutics market share.

CFTR modulators dominate the global cystic fibrosis therapeutics market. This dominance is attributed to their ability to target the root cause of the disease by correcting or enhancing the function of the defective CFTR protein, rather than merely alleviating symptoms. The approval and widespread adoption of highly effective combination therapies such as Trikafta (elexacaftor/tezacaftor/ivacaftor), Orkambi (lumacaftor/ivacaftor), and Symdeko (tezacaftor/ivacaftor) have revolutionized cystic fibrosis treatment.

These therapies have demonstrated substantial clinical benefits, including improved lung function, reduced pulmonary exacerbations, and enhanced life expectancy. Furthermore, ongoing expansion of drug indications to cover additional CFTR mutations and pediatric populations continues to strengthen this segment’s market leadership..

The bronchodilators segment is estimated to have 26.2% of the cystic fibrosis (CF) therapeutics market share.

The bronchodilators segment is projected to be the fastest-growing category in the cystic fibrosis therapeutics market over the forecast period. Growth in this segment is driven by the increasing use of short- and long-acting bronchodilators, such as albuterol and salmeterol, to manage airway obstruction and improve breathing efficiency in CF patients. Rising awareness of combination therapies, where bronchodilators are used alongside CFTR modulators and mucolytics to enhance drug delivery and treatment efficacy, is further fueling adoption.

Additionally, advancements in inhalation delivery technologies and the availability of portable nebulizers are making bronchodilator administration more convenient, particularly for pediatric and home-based care settings, supporting strong segmental growth momentum.

Global Cystic Fibrosis (CF) Therapeutics Market - Geographical Analysis

The North America cystic fibrosis (CF) therapeutics market was valued at 44.2% market share in 2024

North America remains the largest and most dominant region in the global cystic fibrosis therapeutics market. The region’s leadership is driven by the high disease prevalence, early and accurate diagnostic capabilities, and broad access to advanced CFTR modulator therapies. The United States represents the core of market expansion, with strong clinical adoption of triple combination regimens such as elexacaftor/tezacaftor/ivacaftor (Trikafta), which have revolutionized CF management by targeting the root genetic defect.

The presence of leading pharmaceutical innovators such as Vertex Pharmaceuticals, combined with ongoing R&D collaborations and favorable reimbursement frameworks, further strengthens regional dominance. Additionally, the existence of comprehensive patient registries like the Cystic Fibrosis Foundation Patient Registry (CFFPR), well-structured care networks, and continuous clinical trial activity accelerates therapeutic uptake. The growing emphasis on personalized medicine and access to next-generation modulators ensures North America’s sustained leadership in the global market.

The European cystic fibrosis (CF) therapeutics market was valued at 20.8% market share in 2024

Europe holds a significant position in the cystic fibrosis therapeutics landscape, supported by strong healthcare systems, early disease screening, and increasing regulatory approvals for advanced therapies. Countries such as the United Kingdom, Germany, and France are at the forefront due to extensive newborn screening programs and the widespread integration of CFTR modulator therapies within national health services. The European Medicines Agency (EMA) has been proactive in approving modulator therapies, driving treatment accessibility across EU nations.

Moreover, rising patient awareness, structured CF care centers, and government-supported reimbursement models ensure consistent therapy adoption. The presence of research-intensive institutions and patient advocacy organizations also contributes to high participation in multinational clinical trials. Although pricing constraints and varied reimbursement timelines across countries pose minor challenges, Europe remains a key region for long-term therapeutic adoption and innovation.

The Asia-Pacific Cystic Fibrosis (CF) Therapeutics market was valued at 18.2% market share in 2024

The Asia-Pacific region is emerging as the fastest-growing market for cystic fibrosis therapeutics. Market growth is driven by rising disease awareness, improved diagnostic capabilities, and the gradual inclusion of CFTR modulators in treatment guidelines. Historically, cystic fibrosis has been underdiagnosed in Asian populations, but advances in genetic screening, molecular testing, and data from population-specific registries are changing the landscape.

Countries such as China, Japan, India, and South Korea are witnessing expanding access to targeted therapies and an increase in clinical trials evaluating the efficacy of CFTR modulators in diverse genetic backgrounds. Governments are also investing in strengthening rare disease programs, which include cystic fibrosis management and drug access initiatives. With increasing healthcare expenditure, collaboration with Western biopharma companies, and growing awareness among clinicians, the Asia-Pacific is expected to register the highest CAGR in the global cystic fibrosis therapeutics market over the forecast period.

Global Cystic Fibrosis (CF) Therapeutics Market – Competitive Landscape

The major players in the cystic fibrosis (CF) therapeutics market include Vertex Pharmaceuticals Incorporated, F. Hoffmann-La Roche Ltd, Novartis Pharmaceuticals Corporation, Teva Pharmaceuticals USA, Inc., Gilead Sciences, Inc., Alcresta Therapeutics, Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 14.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Class | CFTR Modulators, Pancreatic Enzyme Supplements, Mucolytics, Bronchodilators, Others |

| Route of Administration | Oral, Inhaled, Parenteral | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cystic fibrosis (CF) therapeutics market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here