Bronchodilators Market Size & Industry Outlook

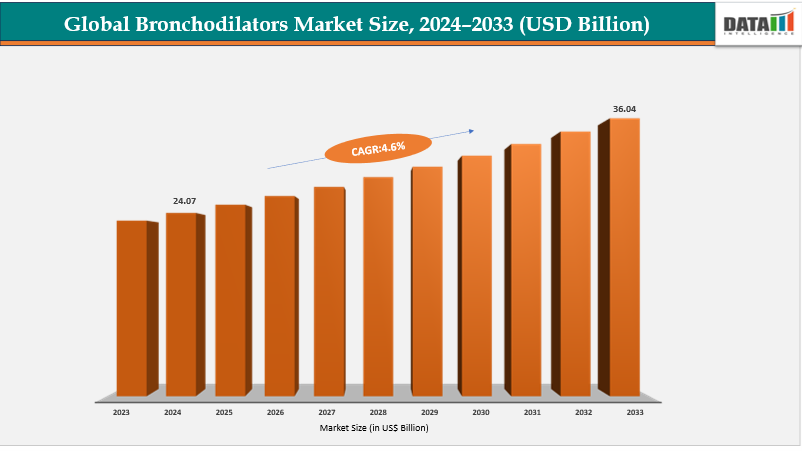

The global bronchodilators market size reached US$ 23.09 Billion with rise of US$ 24.07 Billion in 2024 is expected to reach US$ 36.04 Billion by 2033, growing at a CAGR of 4.6% during the forecast period 2025-2033.

The global bronchodilators market is experiencing significant growth due to the rise in respiratory disorders like asthma and COPD. The demand for fast-acting treatments is driving the adoption of inhalation-based therapies. Pharmaceutical companies are also developing advanced combination therapies and smart inhaler technologies to improve treatment outcomes and disease management. These innovations are expanding the market potential and catering to the growing healthcare needs of both developed and emerging economies.

The market for branded inhalers faces challenges like high costs and stringent regulatory approvals, limiting accessibility for lower-income patients. However, the rise of affordable generic bronchodilators in emerging markets presents strong opportunities.

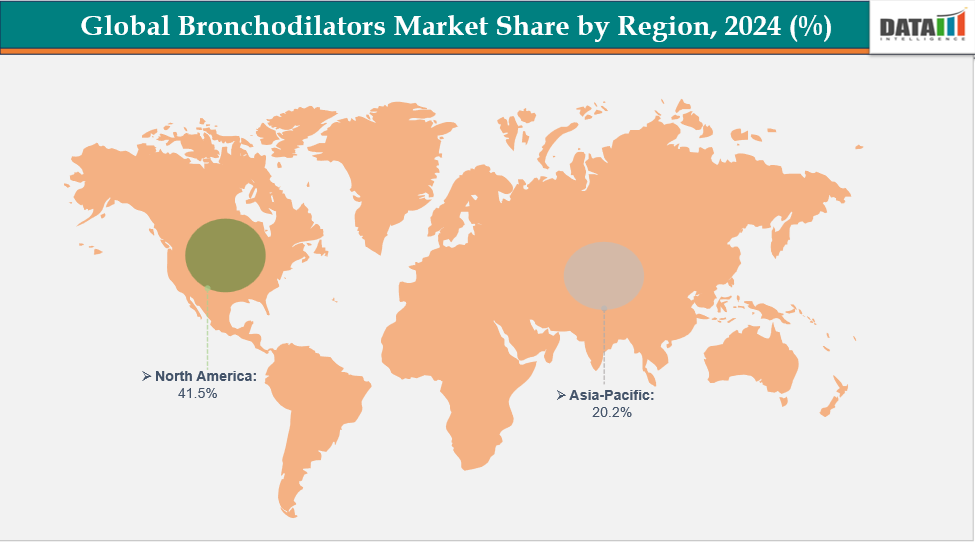

North America is expected to dominate the global bronchodilators market due to its high disease burden, robust healthcare infrastructure, respiratory care awareness, and leading pharmaceutical manufacturers. The region's emphasis on innovation, clinical research, and early adoption of advanced therapies drives global market expansion.

Key Market Trends & Insights

The global bronchodilators market is experiencing growth due to key trends such as a shift towards combination therapies, the adoption of smart inhalers and digital health solutions, rising demand for generic bronchodilators in emerging markets, and the emphasis on long-acting bronchodilators for chronic disease management.

These trends are driven by cost pressures and the need for affordable respiratory care. The market is transitioning from conventional inhalers to innovative, cost-effective, and technology-driven respiratory solutions, highlighting the need for innovative and cost-effective solutions.

North America is expected to dominate the bronchodilators market with the largest revenue share of 41.5% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 9.1% over the forecast period.

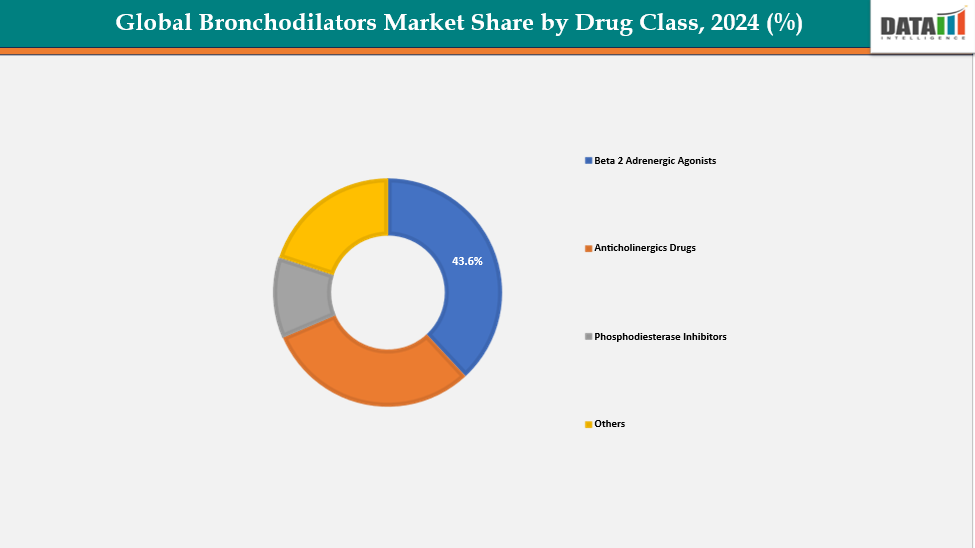

Based on drug class, the beta 2 adrenergic agonists segment led the market with the largest revenue share of 43.6% in 2024.

The major market players in the bronchodilators market are GlaxoSmithKline (GSK), AstraZeneca, Novartis, Boehringer Ingelheim, Teva Pharmaceuticals, Sunovion Pharmaceuticals, Viatris, Cipla, Lupin and among others.

Market Size & Forecast

2024 Market Size: US$ 24.07 Billion

2033 Projected Market Size: US$ 36.04 Billion

CAGR (2025–2033): 4.6%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

For more details on this report – Request for Sample

Market Dynamics

Drivers:

The rising prevalence of asthma and COPD is significantly driving the bronchodilators market growth

The global bronchodilators market is driven by the increasing prevalence of asthma and COPD, driven by environmental pollution, allergens, and lifestyle factors like smoking. This population is increasing demand for quick-relief medications like bronchodilators, which are essential for managing these conditions. The surge in cases, often involving multiple therapies, is contributing to higher prescription volumes and market growth. The need for advanced, patient-friendly inhalation devices and combination therapies is also accelerating innovation, making the bronchodilators market a key force in the industry.

For instance, Asthma is one of the most common chronic non-communicable diseases that affects over 260 million people and is responsible for over 450000 deaths each year worldwide, most of which are preventable.

Restraints:

High treatment costs associated with branded inhalers and devices are hampering the growth of the bronchodilators market

The global bronchodilators market faces significant restraint due to reimbursement and regulatory challenges. Obtaining regulatory approvals for new technologies is complex and costly, causing delays and limiting innovation speed. Reimbursement policies for advanced monitoring solutions vary across countries, making it difficult for healthcare providers and patients to adopt high-cost devices, especially in developing markets. Despite technological advancements, market penetration is hindered by uncertain regulatory pathways and inadequate reimbursement structures.

Bronchodilators Market Segment Analysis

The global bronchodilators market is segmented based on drug class, route of administration, indication, distribution channel, and region.

Drug Class:

The beta 2 adrenergic agonists segment is dominating the bronchodilators market with a 43.6% share in 2024

The beta-2 adrenergic agonists segment is a significant growth driver in the global bronchodilators market, used as first-line therapy for asthma and COPD. These drugs provide rapid bronchodilation by relaxing airway smooth muscles, offering immediate relief from symptoms like wheezing, breathlessness, and chest tightness. The increasing prevalence of asthma and COPD worldwide is driving demand for both short-acting and long-acting Beta-2 agonists. The growing preference for inhalation-based delivery systems and the development of combination therapies further enhance treatment effectiveness.

For instance, in 2024, the Beta-2 adrenergic agonists segment of the bronchodilator market witnessed significant developments, particularly with the launch of AIRSUPRA, a fixed-dose combination inhaler containing albuterol (a short-acting beta-2 agonist) and budesonide (an inhaled corticosteroid).

Market Geographical Analysis

North America is expected to dominate the global bronchodilators market with a 41.5% in 2024

The North America bronchodilators market is fueled by the high prevalence of respiratory disorders like asthma and COPD, strong healthcare infrastructure, and access to advanced therapies. The presence of leading pharmaceutical companies, patient awareness, and well-established reimbursement systems support market growth. The rapid adoption of innovative inhalation devices and digital health solutions enhances treatment adherence and outcomes, solidifying North America's position as a key revenue-generating region.

For instance, in June 2024, Verona Pharma has received FDA approval for Ohtuvayre, an inhaled product, for the maintenance treatment of chronic obstructive pulmonary disease (COPD) in adult patients. Ohtuvayre is the first inhaled product with a novel mechanism of action available for COPD maintenance treatment in over 20 years.

The Asia Pacific region is the fastest-growing region in the global bronchodilators market, with a CAGR of 9.1% in 2024

The Asia Pacific region is experiencing rapid market growth due to a growing asthma and COPD patient population, urbanization, air pollution, and lifestyle changes. Increased awareness about respiratory health, healthcare infrastructure expansion, and cost-effective generic bronchodilators are driving adoption. Government initiatives and modern inhaler technologies are also contributing to the region's rapid growth, making it one of the fastest-growing markets globally.

For instance, in May 2025, Nuance Pharma has announced the results of its Phase 3 ENHANCE-CHINA trial, which evaluated nebulized ensifentrine for chronic obstructive pulmonary disease maintenance treatment. The trial successfully met its primary endpoint and secondary endpoints, showing improvements in lung function. Ensifentrine, a selective dual inhibitor of phosphodiesterase 3 and 4, combines bronchodilator and non-steroidal anti-inflammatory effects in one molecule, delivered directly to the lungs through a standard jet nebulizer.

Bronchodilators Market Top Companies

Top companies in the bronchodilators market include GlaxoSmithKline (GSK), AstraZeneca, Novartis, Boehringer Ingelheim, Teva Pharmaceuticals, Sunovion Pharmaceuticals, Viatris, Cipla, Lupin and among others.

GlaxoSmithKline (GSK):

GlaxoSmithKline (GSK) is a leading innovator in the global bronchodilators market, offering a range of respiratory therapies including Ventolin, Serevent, and combination products like Advair/Seretide. With a strong presence in North America and Europe, extensive R&D capabilities, and a focus on patient-centric inhalation technologies, GSK drives market growth and sets treatment standards for asthma and COPD management. Its continuous innovation, including smart inhalers and digital adherence solutions, strengthens its leadership position and influence in the bronchodilators market.

Key Developments:

In August 2025, Insmed Incorporated, a global biopharmaceutical company, has received FDA approval for its first-in-class BRINSUPRI treatment for non-cystic fibrosis bronchiectasis (NCFB) in adults and children 12 years and older. This is the first and only FDA-approved treatment for NCFB, providing hundreds of thousands of patients and clinicians with an option to manage this chronic and progressive disease, which can lead to permanent lung damage and decline in lung function.

In January 2024, AstraZeneca has announced the commercial availability of AIRSUPRA® (albuterol/budesonide) in the US by prescription, which received FDA approval in January 2023 for treating asthma symptoms and preventing sudden severe breathing problems in individuals aged 18 and older.

Bronchodilators Market Scope

Metrics | Details | |

CAGR | 4.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | Beta 2 Adrenergic Agonists, Anticholinergics Drugs, Phosphodiesterase Inhibitors, Others |

Route of Administration | Oral, Injection, Inhalation | |

Indication | Asthma, Chronic Obstructive Pulmonary Disease (COPD), Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global bronchodilators market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.