Cosmetic Surgery Market Size and Trends

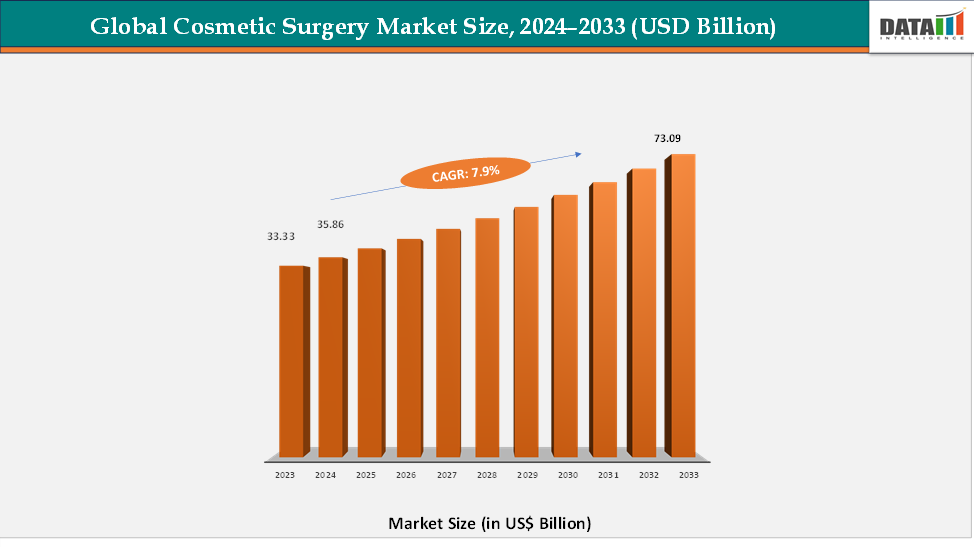

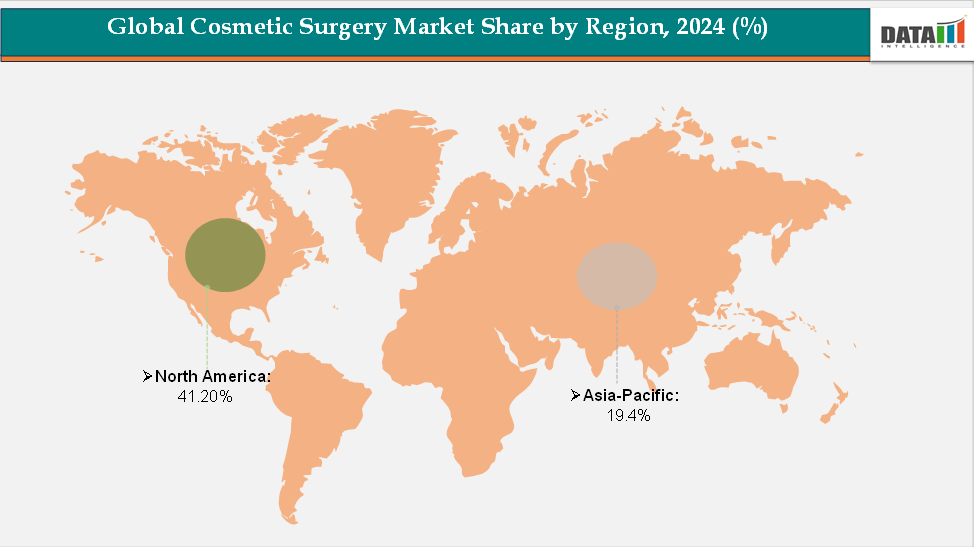

The global cosmetic surgery market size reached US$ 35.86 Billion in 2024 and is expected to reach US$ 73.09 Billion by 2033, growing at a CAGR of 7.9% during the forecast period 2025-2033. The global cosmetic surgery market is experiencing strong growth, driven by evolving beauty standards, technological advancements, and increasing accessibility of procedures. Minimally invasive treatments, such as injectables, laser therapies, and skin rejuvenation techniques, are gaining popularity due to their safety, shorter recovery times, and natural-looking results. North America remains the leading market, supported by advanced healthcare infrastructure and high consumer spending, while Asia-Pacific is emerging as the fastest-growing region owing to rising disposable incomes and growing medical tourism. Popular procedures include facelifts, breast augmentation, liposuction, and eyelid surgery, with male cosmetic procedures also on the rise. Continuous innovations, greater social acceptance, and improved affordability are expected to drive sustained growth in the cosmetic surgery market in the coming years.

Key Market highlights

- North America leads the cosmetic surgery market, accounting for approximately 41.2% of global revenue. The region’s dominance is supported by high consumer awareness, advanced healthcare infrastructure, and the strong presence of leading clinics and technology providers driving continuous innovation and adoption.

- Asia–Pacific is the fastest-growing regional market, holding around 19.4% of the share. Growth is fueled by rising disposable incomes, increasing medical tourism, and government initiatives to improve access to advanced aesthetic procedures across major economies such as China, India, Japan, and South Korea.

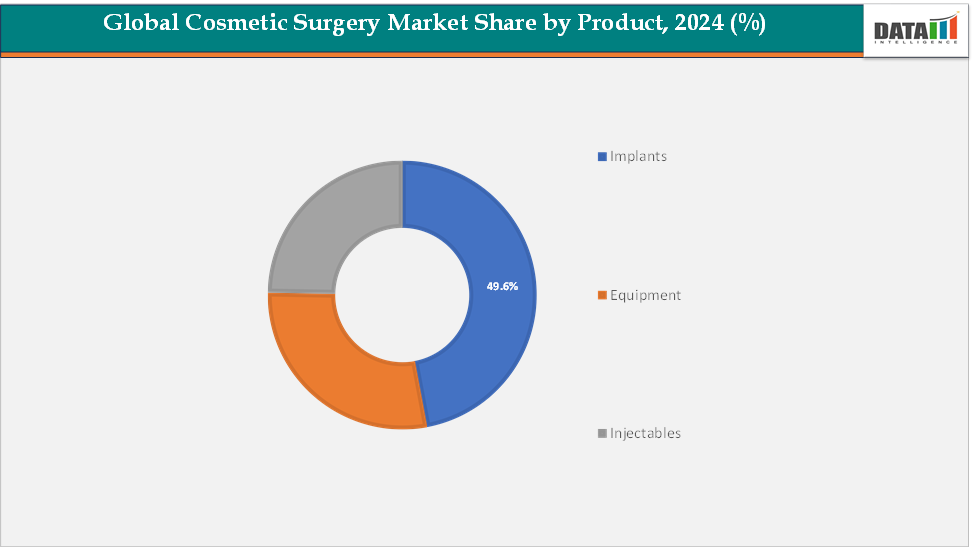

- Implants remain the dominant product segment, contributing approximately 49.6% of global revenue. Their widespread use is driven by favorable clinical outcomes, growing patient preference for long-lasting results, and continuous advancements in implant materials and techniques, making them a preferred choice among both physicians and patients.

Market Size & Forecast

- 2024 Market Size: US$ 35.86 billion

- 2033 Projected Market Size: US$ 73.09 billion

- CAGR (2025–2033): 7.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Rising Preference for Minimally Invasive Surgical Procedures

The cosmetic surgery market is experiencing robust growth, driven by the rising preference for minimally invasive surgical procedures and increasing demand across both younger and aging populations. According to the International Society of Aesthetic Plastic Surgery (ISAPS), more than 17.4 million surgical and 20.5 million non-surgical procedures were performed globally in 2024, reflecting a 42.5% rise over the past four years. This growth is being fueled by procedures that offer visible results with reduced recovery time, such as eyelid surgery, now the most performed surgical procedure with over 2.1 million cases and a 13.4% annual increase, alongside facial fat grafting, which surged by 19.2%. The younger demographic is increasingly turning to rhinoplasty, body contouring, and subtle enhancements driven by social media influence and aesthetic consciousness, while the aging population continues to seek anti-aging solutions like eyelid surgery and facial rejuvenation. As these two consumer segments converge in their pursuit of personalized, less invasive procedures, the market is witnessing a dynamic shift in treatment demand, technique innovation, and global adoption, making cosmetic surgery more mainstream and accessible than ever before.

Restraint: Clinical Risks & Post-Operation Complications

Clinical risks and post-operative complications are expected to significantly hinder the growth of the cosmetic surgery market. Despite advancements in techniques and materials, surgical procedures inherently carry risks such as infections, scarring, hematomas, implant ruptures, nerve damage, and unsatisfactory aesthetic outcomes. In some cases, patients require revision surgeries, which not only increase costs but also amplify health and psychological concerns.

For more details on this report, Request for Sample

Segmentation Analysis

The global cosmetic surgery market is segmented by drug category, route of administration, application, and distribution channel, and region.

Product: The implants segment is estimated to have 49.6% of the cosmetic surgery market share.

The implants segment continues to dominate the cosmetic surgery market due to the sustained popularity of procedures such as breast augmentation, facial implants, and gluteal enhancements. Breast augmentation remains one of the most frequently performed cosmetic surgeries worldwide, supported by evolving implant materials that improve safety, durability, and natural appearance. Patients are increasingly opting for advanced silicone gel implants and anatomically shaped devices that deliver more customized results. Recent developments, such as FDA approvals of next-generation cohesive gel breast implants in the U.S., have reinforced patient and surgeon confidence in implant-based procedures. This strong demand for long-lasting results ensures implants remain the leading segment in cosmetic surgery.

The equipment segment is estimated to have 26.8% of the Cosmetic Surgery market share.

The equipment segment is the fastest-growing category, driven by rising demand for minimally invasive and non-invasive procedures that rely on energy-based devices, lasers, radiofrequency systems, and ultrasound technologies. These tools are favored by patients seeking reduced downtime, lower risks, and natural outcomes compared to traditional surgery. Clinics are investing heavily in advanced platforms that combine multiple modalities. A recent example is the rapid adoption of multifunctional laser and radiofrequency systems in both North America and Asia–Pacific, reflecting the growing shift toward equipment-based treatments. This trend aligns with consumer preferences for safer, outpatient solutions and is expected to propel equipment as the fastest-expanding segment within cosmetic surgery.

Geographical Analysis

The North America cosmetic surgery market was valued at 43.2% market share in 2024

North America continues to hold a dominant position in the global cosmetic surgery market, driven by high procedural volumes, advanced medical infrastructure, and growing aesthetic awareness. According to Toronto Plastic Surgeons, over 4.38 million breast surgical procedures were performed in 2022 alone, with 2.17 million involving breast implants, highlighting the region’s strong demand for body enhancement procedures. Additionally, ISAPS data shows that approximately 224,900 procedures were performed in North America in 2024, accounting for 14% of all cosmetic procedures in the United States. Notably, chin augmentation made up the largest share of surgical procedures at 33%, followed by male breast reduction at 19%, signaling increasing demand from both male and female demographics. This regional performance is further supported by a strong base of board-certified plastic surgeons, widespread availability of advanced technologies, and a culture that embraces cosmetic enhancement, holding North America’s leadership in both surgical and non-surgical aesthetics.

The Europe cosmetic surgery market was valued at 20.9% market share in 2024

Europe maintains a significant position in the global cosmetic surgery landscape, with demand driven by an aging population seeking rejuvenation and a preference for minimally invasive procedures. The region is also influenced by cultural trends, with younger patients turning to subtle aesthetic enhancements inspired by social media. In the UK, for example, there has been a rise in facelifts among men and middle-aged patients, reflecting shifting beauty standards. At the same time, European regulators are tightening guidelines around advertising and patient safety, which is shaping how clinics market their services and manage outcomes. This balance of innovation with oversight underscores Europe’s steady and significant role in the market.

The Asia-Pacific cosmetic surgery market was valued at 17.1% market share in 2024

Asia–Pacific is projected to be the fastest-growing market for cosmetic surgery, fueled by rising medical tourism, increasing affordability, and a younger population with a strong interest in aesthetic enhancement. Countries such as South Korea and Thailand are recognized as global hubs, attracting international patients with advanced procedures and competitive pricing. For instance, South Korea recently reported significant growth in international medical visits, with plastic surgery being one of the most sought-after specialties. Thailand also continues to gain popularity for bundled cosmetic surgery packages that combine high-quality treatment with tourism services, reflecting the region’s strong global appeal.

Competitive Landscape

The major players in the cosmetic surgery market include Solta Medical Inc. (Bausch Health Companies), Candela Corporation, Cynosure Lutronic, Galderma, Johnson and Johnson, Tiger Aesthetics Medical, LLC, Sinclair, POLYTECH Health & Aesthetics GmbH, Implantech, Batavia Biosciences, among others.

Market Scope

| Metrics | Details | |

| CAGR | 7.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Category | Implants, Equipment, Injectables |

| Gender | Male, Female | |

| End-User | Hospitals & Specialty Clinics, Spas & Cosmetic Surgery Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cosmetic surgery market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here