Global Construction Drone Market: Industry Outlook

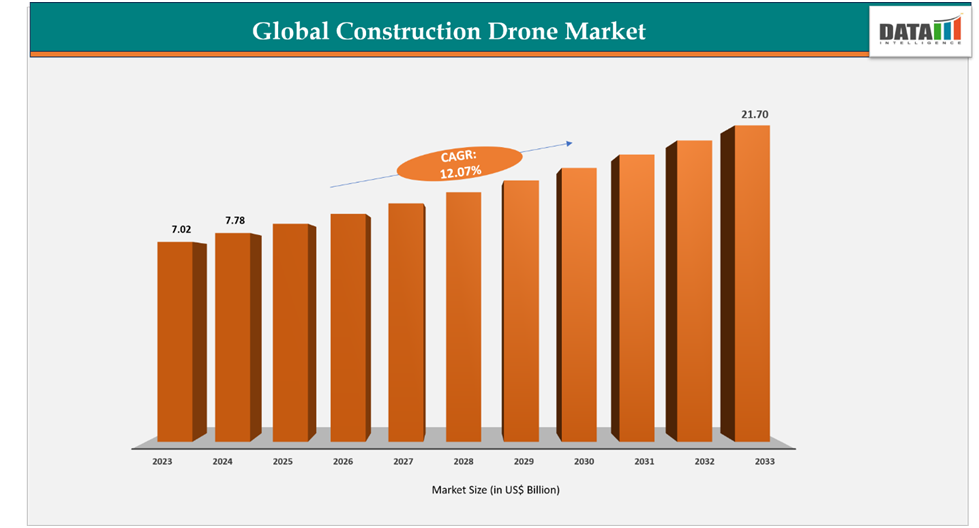

The global construction drone market reached US$ 7.02 billion in 2023, with a rise to US$ 7.78 billion in 2024, and is expected to reach US$ 21.70 billion by 2033, growing at a CAGR of 12.07% during the forecast period 2025–2033.

The global construction drone market is growing steadily, supported by increasing use in surveying, site monitoring, project tracking, and infrastructure inspection. Drones are becoming indispensable for improving construction quality, enhancing worker safety, and ensuring projects stay on schedule. This growth is further fueled by advancements in AI-driven analytics, autonomous flight systems, and real-time data capture, alongside rising investment in digital construction and smart infrastructure. Strategic partnerships between drone makers, software providers, and construction companies are also reshaping industry dynamics by offering integrated and scalable solutions.

The US holds a leading position in the construction drone market, driven by strong adoption in large-scale infrastructure and data center projects. In 2025, Drone Deploy secured nationwide US Beyond Visual Line of Sight (BVLOS) approval for critical infrastructure, reinforcing its leadership in reality capture and robotics for construction monitoring. More than 84% of its top 50 projects now focus on data center and infrastructure development worth US$35 billion, with its advanced platform helping contractors and developers boost efficiency, safety, and decision-making. Backed by technological innovation and extensive industry adoption, the US continues to set the pace for global market growth.

Japan is also emerging as a key market, where drones are being used for regular, minimally intrusive site surveys to detect issues early and keep projects on track. For instance, In 2024, NTT Communications Skydio’s business partner and a leading ICT solutions provider successfully applied Skydio’s drone and dock technology to monitor indoor construction progress. This highlights Japan’s growing focus on digital construction, precision monitoring, and proactive problem-solving to reduce delays and improve efficiency. With increasing partnerships and rapid adoption of drone-based solutions, Japan is strengthening its role as one of the fastest-growing construction drone markets in the region.

Key Market Trends & Insights

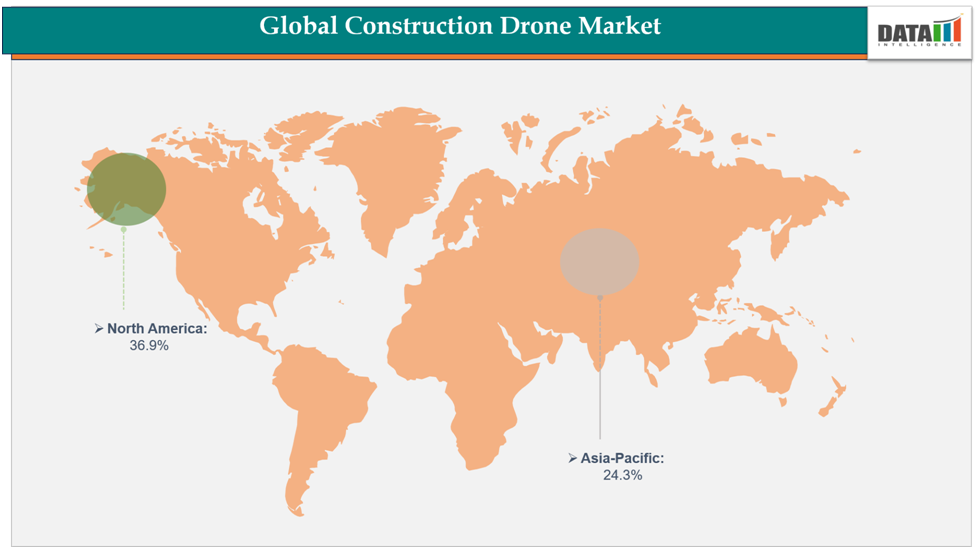

North America accounted for approximately 36.9% of the global construction drone market in 2024 and is expected to maintain its leading position throughout the forecast period. The region’s dominance is driven by strong adoption of drones in large-scale infrastructure, commercial construction, and critical projects. Widespread use of drones for real-time surveying, site progress tracking, and quality control reinforces North America’s leadership in the global market.

Asia-Pacific is projected to be the fastest-growing region, supported by increasing investments in urban infrastructure, industrial facilities, and large-scale construction projects. The adoption of drones for frequent, minimally-intrusive site surveys, progress monitoring, and early detection of construction issues is driving market growth. Rapid urbanization, government-backed infrastructure programs, and increasing digital construction practices continue to accelerate regional expansion in APAC.

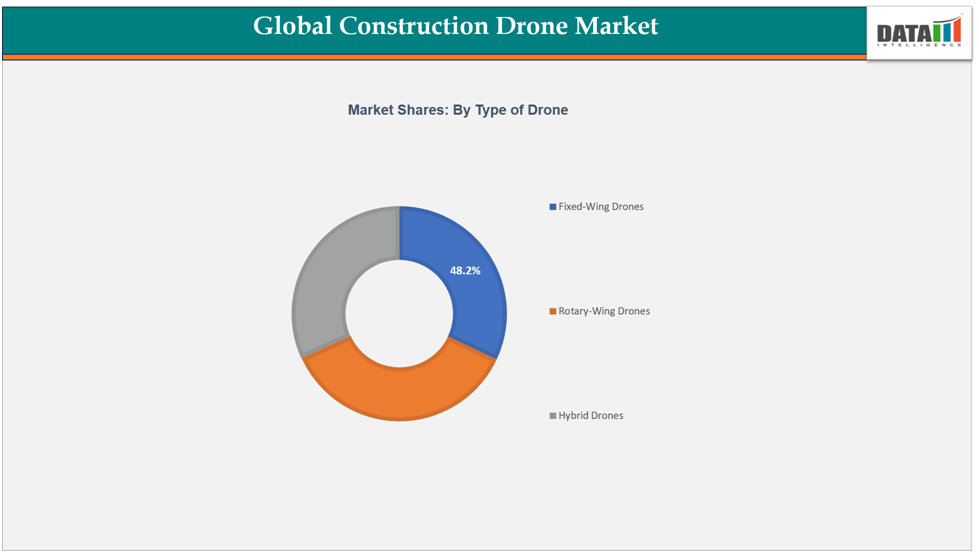

The Rotary-Wing Drones segment remains the dominant product category in the construction drone market due to its versatility, ease of use, and ability to perform precise site surveys and real-time monitoring. Their broad adoption across residential, commercial, and infrastructure projects highlights their role in enhancing construction efficiency, safety, and project management.

Market Size & Forecast

2024 Market Size: US$7.78 Billion

2033 Projected Market Size: US$21.70 Billion

CAGR (2025–2033): 12.07%

North America: Largest market in 2024

Asia-Pacific: Fastest-growing market

Drivers & Restraints

Driver: Advancements in Technology

The global construction drone market is being propelled by rapid technological innovations, including AI-driven analytics, autonomous flight capabilities, real-time data capture, and high-resolution imaging. These advancements enable construction professionals to efficiently conduct site surveys, monitor progress, detect potential issues early, and optimize project timelines with minimal manual intervention. Furthermore, drones are increasingly integrated with AI for structural safety and emergency management. For instance, the Delhi Police plan to monitor under-construction buildings using drones and create AI-based structural models to provide immediate assistance when required. This system not only identifies structural vulnerabilities but also allows for quick emergency response, highlighting the critical role of technology in enhancing both safety and operational efficiency.

Restraint: Regulatory and Airspace Restrictions

Construction drones face operational challenges due to strict regulations and airspace limitations. Rules on line-of-sight, flight permissions, altitude, and no-fly zones especially in urban areas or near critical infrastructure can restrict deployment. Compliance adds administrative burden, increases costs, and may delay projects. Privacy laws and inconsistent regional standards further limit large-scale adoption, making regulatory constraints a key barrier to market growth.

For more details on this report : Request for Sample

Segmentation Analysis

The global construction drone market is segmented based on type of drone type, technology, application and region.

Type of Drone: The rotary-wing drones segment accounts for an estimated 48.2% of the global construction drone market.

The rotary-wing drones segment dominates the market, accounting for an estimated xx% share. Rotary-wing drones are valued for their versatility, precision, and ability to hover, making them ideal for site surveys, real-time monitoring, and safety inspections. Manufacturers focus on producing lightweight, durable, and energy-efficient platforms equipped with advanced sensors, cameras, and autonomous navigation systems.

Market growth is driven by demand for accurate site mapping, progress tracking, volumetric calculations, and automated inspections across residential, commercial, and infrastructure projects. North America remains the largest regional market due to extensive infrastructure projects and technological adoption, while Asia-Pacific is the fastest-growing region, fueled by rapid urbanization and government-backed construction initiatives.

Rotary-wing drones are expected to maintain their leading position in the market, supported by continued innovations in autonomy, AI integration, and energy efficiency. Despite regulatory challenges and operational costs, their ability to enhance construction quality, productivity, and safety is projected to sustain strong growth for this segment.

Geographical Analysis

The North America construction drone market was valued at 36.9% market share in 2024

The North America construction drone market held approximately 36.9% of the global market share in 2024, making it the largest regional contributor. Growth in the region is driven by extensive use of drones in large-scale infrastructure, commercial construction, and critical projects. The adoption of advanced technologies such as AI-powered analytics, autonomous flight, and real-time site monitoring is enhancing project efficiency, safety, and quality. Strong R&D capabilities, technological expertise, and an established ecosystem for drone operations continue to reinforce North America’s leading position in the global market.

The Asia-Pacific needle vibrator market was valued at 24.3% market share in 2024

The Asia-Pacific construction drone market is expected to be the fastest-growing region, supported by rising investments in urban development, industrial facilities, and large infrastructure projects. Countries including Japan, China, and South Korea are driving regional growth by using drones for frequent site inspections, progress tracking, and early detection of construction issues. Government-led infrastructure programs, rapid urbanization, and growing adoption of digital construction practices are accelerating the region’s share in the global construction drone market.

Competitive Landscape

The major players in the construction drone market include EagleNXT, DJI, Parrot Drones SAS., Propeller, 3DR, Inc, AeroVironment, Inc., JOUAV, Skycatch, Inc., Microdrones, Quantum-Systems GmbH

EagleNXT :EagleNXT is a prominent player in the global construction drone market, specializing in advanced drone platforms and software solutions for site monitoring, surveying, and construction management. Its drones are equipped with high-resolution cameras, LiDAR sensors, and AI-powered analytics, enabling accurate mapping, real-time progress tracking, and structural inspections. With strong R&D capabilities and strategic collaborations with construction firms and technology partners, EagleNXT drives innovation in autonomous flight, data capture, and project management solutions, reinforcing its position as a key contributor to enhancing efficiency, safety, and productivity in construction projects worldwide.

Market Scope

Metrics | Details | |

CAGR | 12.07% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Drone Type | Fixed-Wing Drones, Rotary-Wing Drones, Hybrid Drones |

| Component | Software, Hardware, Services |

| Technology | LiDAR Drones, Thermal imaging Drones, Autonomous Drones, AI-Powered Drones |

| Application | Surveying & Mapping, Inspection & Monitoring, Material & Equipment Tracking, Safety & Security, Maintenance Planning, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global construction drone market report delivers a detailed analysis with 70 key tables, more than 66visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.