Global Connectivity as a Service Market: Industry Outlook

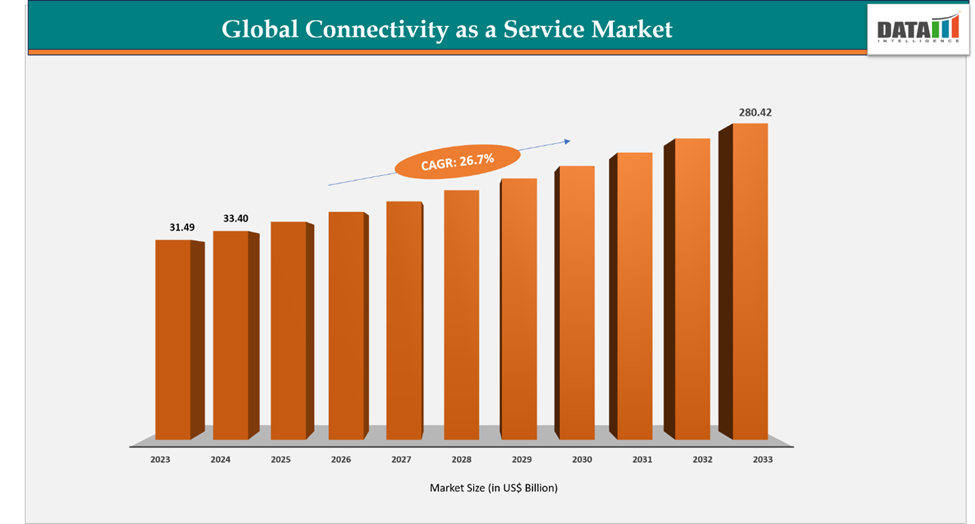

The global connectivity as a service market reached US$ 31.49 billion in 2023, with a rise to US$ 33.40 billion in 2024, and is expected to reach US$ 280.42 billion by 2033, growing at a CAGR of 26.7% during the forecast period 2025–2033. he global connectivity as a service market is expanding steadily, driven by rising demand for flexible, cloud-based connectivity solutions across industries. Enterprises are increasingly adopting CaaS to enable seamless hybrid cloud integration, global WAN connectivity, IoT device management, and secure access for distributed workforces.

Growth is further accelerated by technological advancements in 5G, SD-WAN, edge computing, and AI-driven network management, alongside rising investments in digital infrastructure such as subsea cables, satellites, and private 5G networks. Industry dynamics are also being reshaped by strategic partnerships between hyperscalers, telecom operators, and enterprises, as well as large-scale digital transformation initiatives worldwide..

The US and Japan stand as key frontrunners in the global connectivity as a service market, fueled by substantial infrastructure investments and rapid enterprise adoption. In the US, hyperscalers like Google, AWS, and Microsoft, together with telecom giants such as AT&T and Verizon, are accelerating advancements in cloud interconnectivity, secure WAN services, and private 5G networks.

A major milestone includes Google’s US$ 1 billion investment in the Proa and Taihei subsea cables, designed to boost digital links between Japan, CNMI, Guam, Hawaii, and the US, thereby strengthening cross-border cloud and data exchanges. Meanwhile, Japan is reinforcing its role as a CaaS hub through initiatives like NTT SmartConnect’s establishment of a new connection point for Megaport Japan at the Sonezaki Data Center in July 2025, offering enterprises greater access to agile global networking. Collectively, these initiatives position the US and Japan as pivotal leaders in building robust, high-speed, and cloud-driven connectivity ecosystems worldwide.

Key Market Trends & Insights

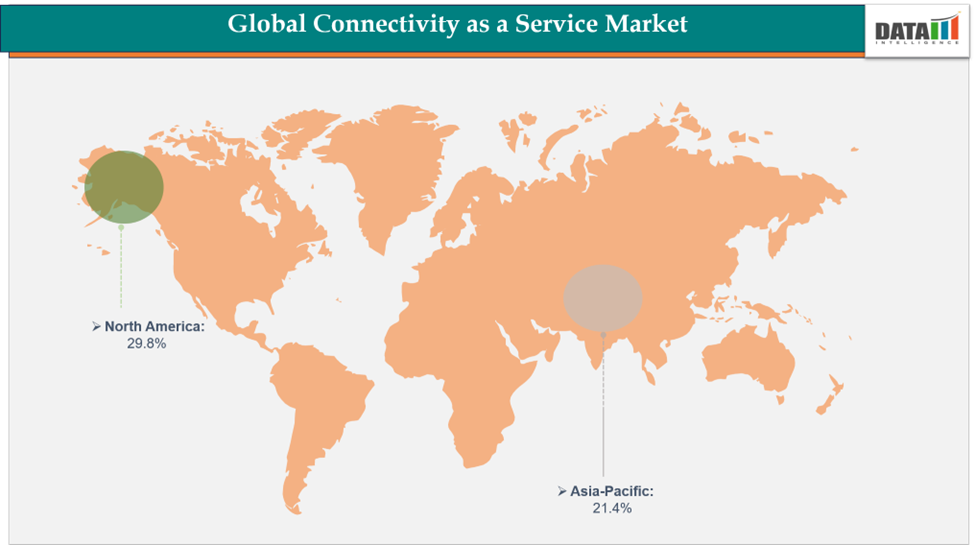

- North America held around 29.8% of the global connectivity as a service market in 2024 and is expected to maintain its lead during the forecast period. This dominance is fueled by the widespread adoption of multi-cloud strategies, rapid growth of edge data centers, and large-scale deployment of 5G enterprise solutions. For instance, AT&T’s collaboration with Microsoft Azure is enabling enterprises to integrate secure, on-demand connectivity with cloud applications, further strengthening North America’s position in the CaaS market.

- Asia-Pacific is set to register the fastest growth, supported by massive investments in digital infrastructure, government-led smart city programs, and the rising demand for IoT-driven services. Countries such as India and Singapore are playing a key role: India is rolling out nationwide 5G enterprise offerings, while Singapore is positioning itself as a hub for multi-cloud interconnection services. These initiatives are accelerating the adoption of CaaS across both enterprise and public sector ecosystems in the region.

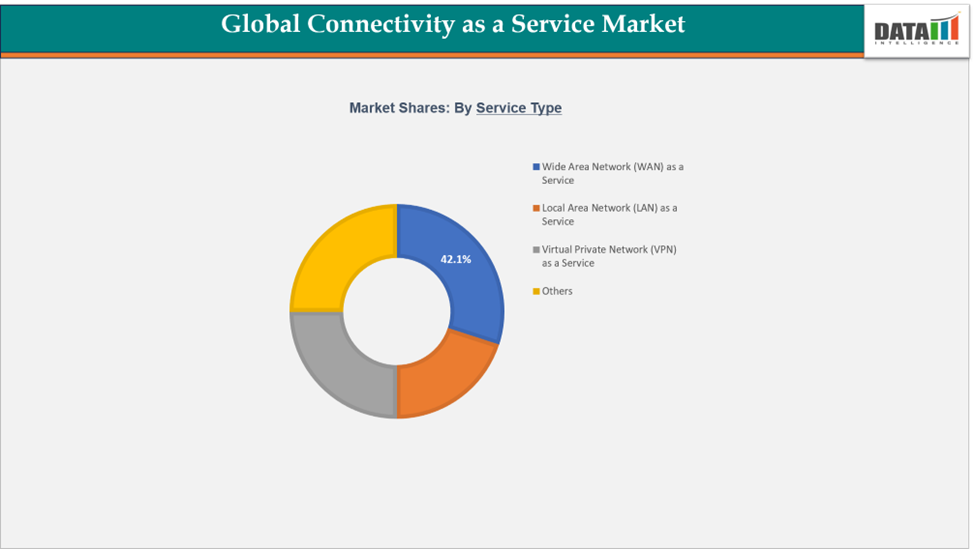

- Among service types, Wide Area Network (WAN) as a Service continues to dominate, given its importance in enabling hybrid workforce connectivity, cloud integration, and global data exchange. Its strong uptake in industries such as retail, BFSI, and healthcare underscores its relevance. For example, retail chains are increasingly adopting SD-WAN as a Service to securely link distributed store networks and ensure smooth access to cloud-based platforms, making it a critical element of modern enterprise connectivity.

Market Size & Forecast

- 2024 Market Size: US$ 33.40 Billion

- 2033 Projected Market Size: US$ 280.42 Billion

- CAGR (2025–2033): 26.7%

- North America: Largest market in 2024

- Asia-Pacific: Fastest-growing market

Global Connectivity as a service Market Dynamics: Drivers & Restraints

Driver: Growth of 5G and Edge Computing

The rapid adoption of 5G and edge computing is emerging as a key driver of the connectivity as a service market, as enterprises increasingly demand high-speed, low-latency, and reliable connectivity to support cloud-native applications, IoT deployments, and mission-critical workloads. By integrating 5G with edge technologies, CaaS providers are enabling real-time processing, seamless mobility, and localized data management, reducing reliance on centralized data centers and transforming traditional WAN and interconnect models into agile, cloud-centric networks. This shift enhances organizational agility and lowers the costs associated with legacy systems.

For instance, in 2024, Tata Communications introduced its global cloud-based 5G Roaming Laboratory, a platform that allows Mobile Network Operators to test standalone 5G use cases prior to full-scale rollout. By combining 5G with CaaS capabilities, the initiative delivers secure cross-border roaming, uninterrupted high-speed connectivity, and immersive digital services, underscoring how 5G and edge computing are reshaping CaaS into a high-performance connectivity backbone for the digital economy.

Restraint: Data Security and Compliance Risks

While CaaS provides scalability and global reach, it also brings significant data security and compliance challenges. Enterprises relying on third-party cloud and network providers face concerns around data sovereignty, cyberattacks, and the complexity of meeting international regulations such as GDPR in Europe, CCPA in the US, HIPAA in healthcare, and strict data localization laws across Asia-Pacific. Multi-cloud and hybrid deployments often involve cross-border transfers, which complicates compliance, while the growing frequency of cyber threats like ransomware, DDoS attacks, and insider breaches further heightens the risk. For highly regulated sectors such as healthcare, BFSI, and government, these vulnerabilities can slow or even limit adoption, as secure and compliant data exchange is mission-critical.

To mitigate these risks, enterprises increasingly demand advanced encryption, zero-trust security frameworks, and regulatory audit support from CaaS providers. For instance, in 2023, several multinational corporations were penalized under GDPR for non-compliant cross-border data transfers between Europe and the US, underscoring how regulatory missteps can lead to multi-million-dollar fines and reputational damage, thereby making organizations cautious in embracing global CaaS solutions.

For more details on this report, Request for Sample

Segmentation Analysis

The global connectivity as a service market is segmented based on service type, enterprise size, deployment mode, end-use and region.

Service Type: The Wide Area Network (WAN) as a Service segment accounts for an estimated 42.1% of the global connectivity as a service market.

Wide Area Network (WAN) as a Service plays a crucial role in the connectivity as a service (CaaS) ecosystem, offering enterprises secure, scalable, and high-performance network connectivity across distributed sites. Providers in this segment deliver managed WAN solutions that integrate SD-WAN, cloud networking, and advanced security capabilities, enabling automated network management, optimized application performance, and a seamless user experience.

The segment’s growth is fueled by rising demand for cloud adoption, remote work enablement, multi-cloud integration, and real-time application performance monitoring. Leading companies such as Cisco, VMware, Aryaka Networks, and Fortinet are at the forefront of the market. For example, in 2024, Cisco launched its new WAN edge platform, designed to accelerate cloud adoption and provide secure, automated connectivity across cloud, data centers, and edge environments, highlighting WANaaS’s strategic role in enterprise digital transformation. Meanwhile, newer entrants are innovating with AI-driven traffic optimization, lightweight deployment models, and flexible subscription-based offerings tailored for small and medium businesses.

Regionally, North America dominates due to robust infrastructure, high enterprise adoption, and strong cloud partnerships. Europe and APAC are seeing growing demand for cloud-optimized WAN solutions to support business digitization, while Latin America is gradually adopting WANaaS as enterprises modernize their networks.

Looking ahead, WAN as a Service is expected to retain its leading position in the CaaS market. Although challenges such as integration complexity and subscription costs persist, ongoing advancements in AI-based routing, zero-trust security, and edge connectivity are likely to drive sustained growth, helping enterprises efficiently meet evolving cloud and networking requirements.

Geographical Analysis

The North America connectivity as a service market was valued at 29.8% market share in 2024

The North America connectivity as a service market held 29.8% of the global market share in 2024, remaining the largest regional contributor. Growth in the region is driven by rising enterprise demand for flexible, secure, and cost-efficient connectivity, alongside strong adoption of cloud technologies and digital transformation initiatives. For instance, Cisco, a global technology leader, and NTT DATA, a leading digital business and IT services provider, announced an expanded partnership to enhance how enterprises access wireless connectivity. Their unified solution, supported by comprehensive services from both companies, addresses the need for secure network access beyond traditional office setups, leveraging technologies such as eSIM to deliver connectivity wherever required. North America’s robust infrastructure, advanced R&D capabilities, and extensive enterprise deployments continue to solidify its leadership in the global CaaS market.

The Asia-Pacific connectivity as a service market was valued at 21.4% market share in 2024

The Asia-Pacific connectivity as a service market accounted for 21.4% of the global market share in 2024 and is expected to be the fastest-growing region. Expansion is supported by increased investments in digital infrastructure, enterprise networking, and regional defense initiatives. For instance, Seraya AQX Pte Ltd (“AQX”), a digital infrastructure investment platform, signed a definitive agreement to acquire 100% of SPTel Pte Ltd (“SPTel”) from Singapore Technologies Engineering Ltd and Singapore Power Limited for an enterprise value of SGD 290 million (approximately USD 227 million). This acquisition highlights the region’s focus on consolidating digital connectivity assets to meet growing enterprise demand for reliable, scalable, and secure network services. Japan, China, and South Korea are key contributors, driving growth through initiatives in cloud networking, advanced digital infrastructure, and enterprise connectivity solutions. Combined government programs, regional partnerships, and private-sector investments continue to accelerate CaaS adoption across Asia-Pacific.

Competitive Landscape

The major players in the connectivity as a service market include Cisco Systems, Inc., AT&T Intellectual Property, Verizon, NTT DATA Inc., Vodafone Limited, BT, Tata Communications Limited, Lumen Technologies, Cloudflare, Inc, Telefónica Tech

Oceaneering International, Inc: Cisco Systems, Inc. is a global technology leader specializing in networking, cybersecurity, and cloud solutions. In the Connectivity as a Service (CaaS) market, Cisco offers advanced WAN, SD-WAN, and cloud-managed networking platforms that enable enterprises to securely connect distributed locations, cloud applications, and edge environments. The company focuses on delivering automated, flexible, and scalable connectivity solutions that support digital transformation, remote work, and multi-cloud adoption. Strategic partnerships, continuous R&D, and innovations such as eSIM-enabled networking and secure WAN edge platforms position Cisco as a key player driving enterprise connectivity globally.

Market Scope

| Metrics | Details | |

| CAGR | YY % | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Service Type | Wide Area Network (WAN) as a Service, Local Area Network (LAN) as a Service, Virtual Private Network (VPN) as a Service, Others |

| Enterprises Size | Large Enterprises, SMEs | |

| Deployment Mode | Public Cloud-based, Private Cloud-based, Hybrid Cloud | |

| End-Use | IT & Telecommunication, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Government, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global connectivity as a service market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions For Related Reports

For more connectivity as a service (CaaS)-related reports, please click here